5 Strategies to Invest in Cryptocurrency

Investing is easy, but doing it properly is difficult. When investing in cryptocurrencies, investors should not make decisions by just following the current trend. Implementing a crypto investment strategy is important because it will help investors to achieve their investment goals and reduce potential risk. This article will walk you through the many investment strategies you can learn before investing in crypto.

Article Summary

- 📝 Planning out your crypto investment strategies is crucial as it will help you reach your financial objectives while reducing the risk.

- 💰 The types of crypto investment strategies that are commonly used are dollar cost averaging, buy the dip, diversification, staking, and choosing blue chip crypto.

- 🔎In addition to preparing a crypto investment strategy, investors also must know the crypto investment risk, which is high volatility, the existence of FOMO and FUD, and too late to take profits.

The Importance of Having Crypto Investment Strategies

When starting an investment, most people are confused about taking the first step. Questions like, “Where do I begin? What assets should I buy? How much money should I put in?”, always first thing that comes to mind when considering investing. If it’s not followed by investment knowledge, it’s possible that the decisions will only follow the current trend or simply follow any suggestions blindly.

Therefore, by having a strategy, investors will know which assets are the most suitable, when the right time to buy, how to optimize the potential returns, and minimize the potential of crypto investment risk.

💡 But keep in mind, each individual’s strategy are different. There are long term crypto investment strategies and short term crypto investment strategies. So, you should choose a strategy that suits your characteristics and investment goals.

When choosing to invest in cryptocurrency, you can use a variety of strategies, including the following:

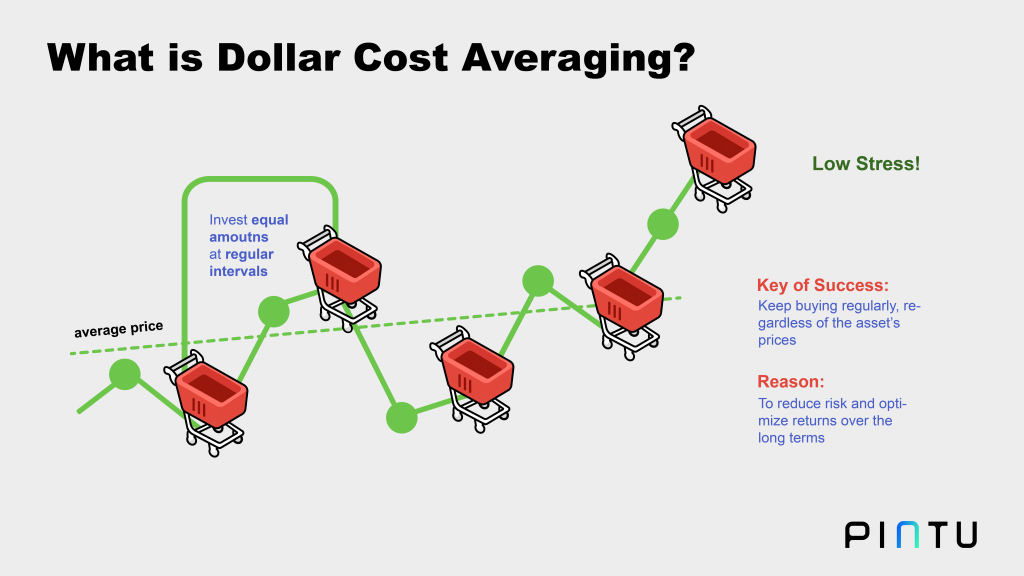

1. Dollar Cost Averaging (DCA)

Dollar Cost Averaging (DCA) is an investment method that invests a certain amount of funds periodically regardless of the asset’s prices. This means investing at set intervals, despite rising or declining asset price. DCA is typically used as a long-term investment strategy, and can also be applied on other assets, such as stocks, bonds, or gold.

Through DCA, investors can minimize the crypto investment risk from the fluctuations in asset prices as investors are buying at different intervals. As a result, investors are investing at an average buying price instead of investing one time at one price.

DCA investment strategies is very suitable for both beginner investors or those who invest in the long term. In addition to being able to get lower average price, through DCA, investors will be calmer when facing highly volatile crypto market movements. By using DCA, investors can minimize the risk of buying assets at the wrong time.

Furthermore, DCA investment strategy will help you to be more disciplined in carrying out investment because the amount and the time of buying are regular. This method also eliminates the risk of investing because of emotions.

2. Buy The Dip (BTD)

The next crypto investment strategies is buy the dip (BTD). Actually, BTD is a common phrase that is often used by crypto investors after an asset has declined in price. After an asset’s price drops and considered at the lowest point, it’s viewed as a “discounted” price because its price is expected to rise again in the future.

By doing BTD strategy, investors can buy or add existing positions at lower prices. Sometimes, BTD is also combined with DCA strategy. Usually, investors who are at a loss position will increase their positions by using BTD. This step was taken to make the average prices of the assets much lower.

However BTD is not risk-free. Because no one can predict the future. Thus, no one will know where the lowest point to do BTD. Furthermore, there is no guarantee whenever an asset reaches the lowest point, it will rebound. In fact, the price could go down deeper and won’t strengthen any time soon.

3. Asset Diversification

Like investing in general, one strategy for investing in cryptocurrencies is to “don’t put all of your eggs in one basket.” Asset diversification is one thing you should do if you want to adopt long-term crypto investments. Asset diversification is primarily used to reduce the risk of investment losses when the assets are underperforming.

If you didn’t diversify your asset and put all your capital in one asset, there is a risk that when the asset underperforms, your losses will be huge. But, if you diversify your crypto asset, when one asset underperforms, there will be another asset to offset the losses. In fact, when all of your assets are doing well, there is a chance your profit will be much bigger than having one asset.

Even so, don’t let yourself get stuck with too much diversification. This can make investors hold too many assets, which can lead to more assets potentially underperformed and ultimately lead to bigger losses.

As for the ideal number of crypto assets and the size of each portion, it must be adjusted to the risk profile of each investor.

In this article, Pintu Academy has explained how to diversify crypto assets

4. Staking

Another crypto investment strategies that can be used to gain profit is staking. Crypto staking is a way to lock coins into the network that uses a proof of stakes (PoS) to ensure all transactions are verified and secured. In staking, you don’t need any extra tools like when you do mining.

In a simple way, the concept of staking works like a deposit, which means, an asset that is owned by investors will be locked for a certain period of time. However, some staking allowed investors to withdraw their assets at any time. By staking their asset, investors will get a reward in the form of interest from the locked asset everyday. As for the amount of reward, it may depend on each asset.

If you are interested in staking, keep in mind, the assets that offer this service are limited to blockchain that use PoS based networks, such as Solana, Cardano, or Cosmos. When you want to try staking, don’t forget to do your own research.

💡 If you are interested in staking, Pintu has PTU Staking feature that allows users to earn various reward by locking their PTU at Pintu. The bigger the number of PTU staked, the greater the rewards will be. For example, if you stake 100 PTU tokens, you will get an APR of 7% which you will receive everyday.

Even though it seems easy and profitable, it doesn’t mean that staking is risk-free. As the crypto price is very volatile, there is a possibility that the price will drop significantly. If this happens, it’s very possible your reward will not cover the losses. Not to mention, some coins will be locked on certain period of time, so you can’t do anything in that timespan

Don’t forget to read this article if you want to know about how crypto staking works

5. Blue Chip

Last but not least, having a crypto blue chip is the other crypto investment strategies. Actually, the term blue chip was already popular in the stock market. This term refers to stocks that are highly worthy because they come from large companies, are financially stable, and have been proven from time to time. As a result, this stock was picked by many retail and institutional investors.

In crypto assets, the term blue chip still has the same meaning. Usually, a token with a big market cap can be referred to as blue chip crypto. Not only having a big capitalization, most blue chip crypto also has a long track record, great reputation from their founders, have solid fundamentals such as project development, and ample liquidity. On the other hand, being picked by institutional investors such as MicroStrategy, Galaxy Digital Holdings, Voyager Digital Ltd, Tesla, Block, etc, affirm it as a crypto blue chip. Bitcoin and Ethereum are seen as crypto blue chips among the other crypto assets.

By investing in crypto bluechip, one thing that can be expected is that the movement is less volatile than most crypto assets. This makes investing in crypto blue chips in terms of risk much more measurable. Plus, with the big liquidity, making it easy to sell at any time. On the other hand, with a solid and reputable background from crypto bluechip, the risk of scam and rug pull is also less likely.

Crypto Investment Risk

After knowing all about crypto investment strategies, you should also be aware of several crypto investment risk. The main risk of crypto investment is the price volatility. Your profit can go up by 50% within a day, but on the other day, you can also lose more than 50%. So, by implementing all those crypto investment strategy, you can mitigate your risk better. However, there are some things that you should avoid when investing in crypto assets.

1. FOMO and FUD

FOMO or fear of missing out is the fear of missing out on trend. FOMO can make your investment decision compromised and become just following a trend. Investment decisions that do not go through research, thoroughness, and prudence can lead to losses.

While FUD (fear, uncertainty, and doubt) is the term for misinformation tactics to keep investors from buying an asset. FUD makes you scared and confused because of negative information about an asset whereas the information actually can be incorrect and make you miss the opportunity to buy.

FOMO and FUD are very easy to avoid, the best trick is to gather information from multiple sources. The more information you can get, the more neutral and objective your decision will be.

2. Too Late To Take Profit

In addition to avoiding FOMO and FUD, you should also avoid taking profit too late. This principle is very useful, especially for short or medium-term investors because of the volatility of crypto assets movement.

Take advantage of the rising momentum of the crypto market by taking some profit from your investment. This is especially important in a bull market. Don’t lose all your crypto assets because you are waiting for higher prices.

Determine what percentage you will take from your total profit or take all the initial capital you have invested.

Learn Crypto Investment at Pintu

After knowing all the crypto investment strategies, you can start learn crypto investment and choose crypto for investment such as BTC, ETH, and other crypto currencies at Pintu. Through Pintu, you can invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Besides making transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

- Christian Voos, What is dollar-cost averaging (DCA) and how does it work? Coin Telegraph, accessed on 19 September 2022.

- Cory Mitchell, Buy The Dips, Investopedia, accessed on 19 September 2022.

- Anupam Varshney, Seven common mistakes crypto investors and traders make, Coin Telegraph, accessed on 19 September 2022

- Andrey Sergeenkov, The Importance Of Crypto Portfolio Diversification, Coin Market Cap, accessed on 19 September 2022

- Coinbase Learn, What is Staking?, Coinbase, accessed on 19 September 2022

- Bybit Learn, What Are Blue Chip Cryptos: Are They Safe Bear Market Options?, Bybit, accessed on 19 September 2022

- Stephen Graves, The 10 Public Companies With the Biggest Bitcoin Portfolios, Decrypt, accessed on 20 September 2022

Share