What is Staking?

Staking is an option for crypto investors to earn passive income amidst the market’s lack of movement. Investors will get rewards by locking the tokens owned for a certain period. How does crypto staking work? How to calculate the rewards that will be obtained? Find out more in the following article!

Article Summary

- 💻 Crypto staking is a way to lock coins into the network that uses a proof of stakes (PoS) to ensure all transactions are verified and secured.

- 🔗 Several blockchains that use a proof-of-stake mechanism include Solana, Cardano, Fantom, and Terra.

- 🌀 Joining a staking pool can be an alternative for retail investors. This is because some staking services require relatively large and expensive capital.

- 💰 Staking can be one of the ways to get passive income for long-term investors.

What is staking?

Staking is a way to lock coins into the network that uses a proof of stakes (PoS) to ensure all transactions are verified and secured. In staking, you don’t need any extra tools like when you do mining.

In a simple way, the concept of staking works like a deposit, which means, an asset that is owned by investors will be locked for a certain period of time. However, some staking allowed investors to withdraw their assets at any time. By staking their asset, investors will get a reward in the form of interest from the locked asset every day. As for the amount of reward, it may depend on each asset.

By staking, you are essentially locking up your crypto assets to participate in the running of the blockchain and ensure its safety. This can be done on blockchains that use proof-of-stake consensus mechanisms, such as Ethereum, Solana, Cardano and Cosmos.

If you want to learn more about PoS, Pintu Academy has prepared an article here.

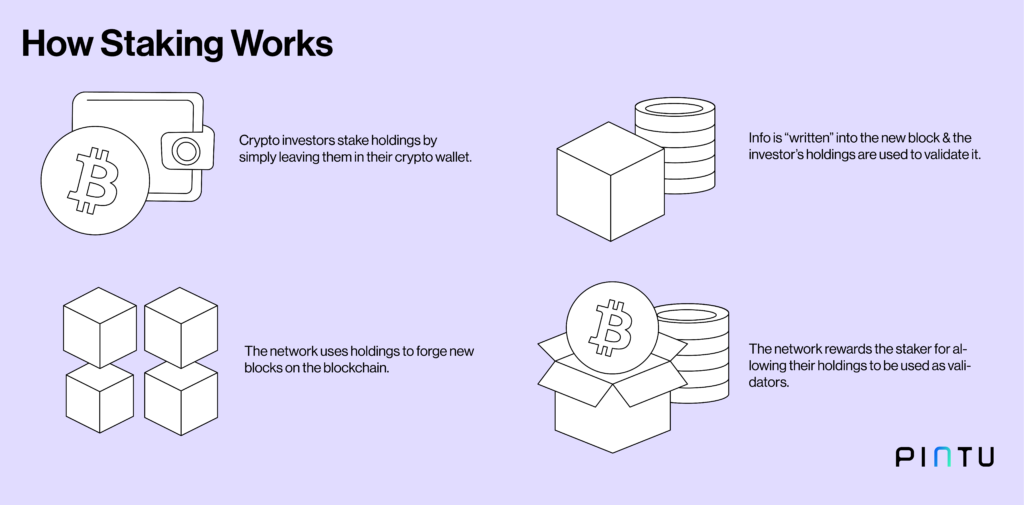

How does staking work?

As we discussed earlier, blockchain with a proof-of-work mechanism requires energy to add new blocks to the blockchain. Meanwhile, proof-of-stake generates or validates new blocks through the staking process.

Staking requires validators to lock their tokens and they will be randomly selected by the protocol at certain intervals to create new blocks. Usually the stakeholders who stake their coins in a larger amount have a higher chance of being selected as a validator. In contrast to proof-of-work where everyone can mine coins as long as they have a mining machine and the machine can run the hashing process.

The proof-of-stake validator is selected based on the number of coins staked. The stake (stake) is that if the validator fails to maintain network security, the validator has the risk of losing the amount of coins that have been staked. However, if the validator manages to maintain network security, the validator will receive a token as a reward.

If you are interested in staking, Pintu has PTU Staking feature that allows users to earn various rewards by locking their PTU at Pintu. The bigger the number of PTU staked, the greater the rewards will be. For example, if you stake 100 PTU tokens, you will get an APR of 7% which you will receive every day.

How to calculate staking rewards?

Each blockchain has a different way of calculating staking rewards. Some blockchains use the method on a block-by-block basis. However, in general, there are several factors that we can consider in calculating staking rewards, including:

- How many tokens are staked by the validator

- How long the validator has been actively staking his tokens.

- How many tokens are staked on the network in total.

- Inflation rate.

For some other networks, the staking reward is determined by a fixed percentage. These rewards are distributed to validators and as the coins add up it will encourage users to spend their coins instead of keeping them.

The staking reward schedule is also predictable because the determination of the validator can also be predicted based on probabilistic odds. For example in the Cardano network, staking rewards will be obtained at the end of each epoch which usually lasts 5 days.

Yield farming is another way to earn passive income. Find out how it differs from staking in the following article.

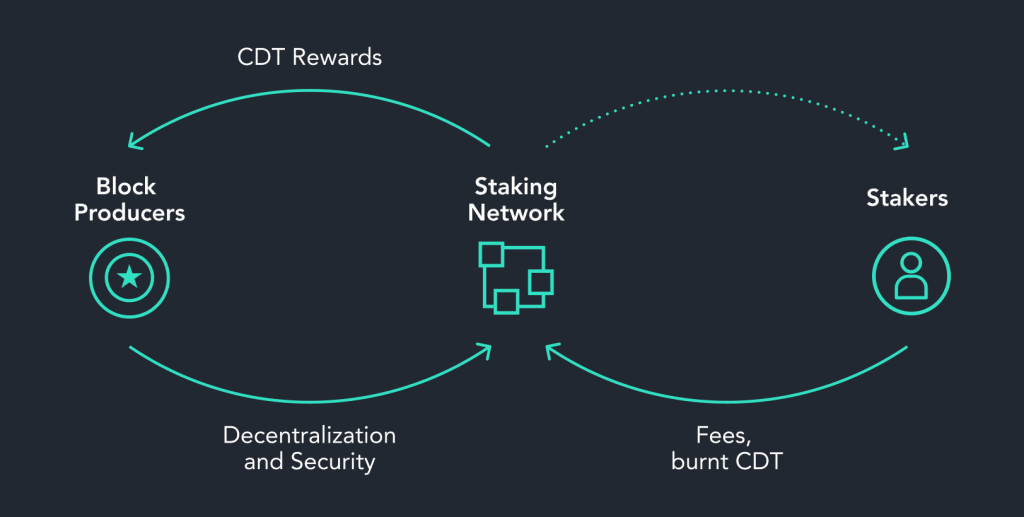

What is Staking Pool?

A staking pool is a group of token holders who combine their bets to increase their chances of validating blocks and receiving rewards. They combine the power of their bets and distribute the prizes proportionately based on their contribution. Staking pools are more useful for new users who do not have sufficient funds or sufficient resources.

For example, it takes 32 ETH to become an ETH validator. For most retail investors, having 32 ETH is too expensive. By joining a staking pool, retail investors can still stake and get rewarded with ETH, but at a lower amount. Ultimately, staking pools provide flexibility to stakers.

Like most staking, staking pools also enforce a system of locking tokens for a specific time. In addition, staking pools also have protocol-defined times when stakes can be withdrawn or released.

However, joining a staking pool is not free. This is in line with the staking pool operator incurring various operational costs related to maintenance, server operating costs, website hosting and hardware. So if you join a staking pool, then there is a fee that you have to pay a fee to the operator. The percentage of fees paid to these operators is referred to as stake pool fees.

How to do Staking?

To start staking, you must first have the tokens to be staked. Most major exchange platforms now provide staking services, making it easier to try staking. Meanwhile, if you’re just starting and don’t have a lot of funds, joining a staking pool is highly recommended.

To start a staking pool, you first need to download a wallet that will allow you to Staking. As an example:

- Solana uses SolFlare

- Cardano using Daedalus Wallet

You will be asked to transfer a certain amount of tokens into the wallet. Then you can choose a validator to delegate your tokens. Before selecting a validator, do some research to choose the best validator according to your needs. You can consider various aspects such as operator fees, staking pool ranking & performance, transparency, and so on.

However, if you want to become a validator, learn more in the following article.

What are the Advantages of Staking?

The main advantage of staking is to earn additional rewards. Staking can be a way to earn passive income for investors in the long run. Moreover, when staking, investors do not need to do anything. All they need to do is select a network; the returns will follow. Regarding rewards, the APY offered by staking is also quite attractive. For example, the APY of SOL token staking is around 6.3%.

In addition, staking also contributes to the security and efficiency of the blockchain projects you support. By staking your tokens, you make the blockchain more resistant to attacks and strengthen its ability to process transactions.

The Risks Behind Staking

The main risk of staking is if the blockchain network is hacked. If this happens, then the hacker can steal all the assets that are being staked. The next risk is the price volatility of crypto assets. When the price of the staked asset drops deeply, the value of the token’s yield also drops with market fluctuations. On the one hand, locking the asset for a certain period prevents investors from cutting losses when the price falls sharply.

Buy Crypto Assets in Pintu

Before you start staking, you can buy a variety of token assets such as ETH, SOL, ADA, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Coinbase Learn, What is Staking?, Coinbase, accessed on 22 June 2023.

Kriztian Sandor, Crypto Staking 101: What is Staking? Coindesk, accessed on 22 June 2023.

Murtuza Merchant, Understanding staking pools: The pros and cons of staking cryptocurrency, Coin Telegraph, accessed on 22 June 2023.

Lyle Daly, What Is Proof of Stake (PoS) in Crypto? The Motley Fool, accessed on 22 June 2023.

Share