Liquid Staking: A New Era of Flexibility and Liquidity for Staked Tokens

As the cryptocurrency market evolves, new use cases for blockchain technology are emerging. And staking has emerged as a promising way for investors to earn rewards while supporting the network’s security and efficiency.

With the highly anticipated Ethereum Shanghai upgrade scheduled to take place in April 2023, liquid staking derivatives (LSD) platforms are currently gaining momentum, as investors seek to maximize their returns by participating in staking activities. In this article, we’ll explore the growing trend of liquid staking derivatives and their potential impact on the cryptocurrency market.

Article Summary

- 🔗 Liquid Staking Derivatives (LSDs) is a protocol that allows users to derive liquidity from the assets they stake, so that they can be leveraged on other DeFi applications.

- 💡 The Shanghai Update on blockchain Ethereum scheduled for April this year is expected to further drive the development of the LSD platform.

- 🚀 LSD on Ethereum is growing very fast and already recorded a TVL of 12.6 billion USD as of March 2023, or about 20% of the total TVL in DeFi.

What is Liquid Staking?

Liquid Staking Derivatives (LSDs) are protocols that allow users to acquire liquidity on staked assets and utilize staked assets as collateral in decentralized financial applications through by tokenizing them.

By depositing their ETH into a smart contract, users receive a token that represents the staked ETH and increases in value based on network rewards.

By offering investors a new way to earn passive income on their digital assets, LSD have taken the cryptocurrency world by storm over the past few months. According to recent data, the total value locked in liquid staking derivatives has surpassed $4 billion, signaling growing interest in this innovative financial product.

What are the differences between Liquid Staking Derivatives and Regular Staking?

Understanding the differences between regular staking and liquid staking derivatives can help investors choose the option that best suits their needs. Below are the differences.

| Regular Staking | Liquid Staking Derivatives |

|---|---|

| Coins are locked up for a specific period | Coins can be traded and used while still earning staking rewards |

| No ability to use staked coins until the staking period is over | More flexibility in managing cryptocurrency holdings |

| Users manage their own staked coins | Staking service provider manages the staked coins on behalf of the users |

| Less liquidity and ability to profit from price movements | Additional liquidity and ability to profit from price movements through trading derivative tokens on decentralized exchanges |

The Current State of LSD

The development of liquid staking derivatives platforms cannot be separated from the development of the Ethereum blockchain, which last September has transitioned from a proof-of-work (PoW) to proof-of-stake (PoS) mechanism. Validators wishing to participate in securing the network must stake a certain amount of ETH.

At present, staking ETH involves a one-way transaction without any option to unstake or withdraw, unlike other Proof-of-Stake (PoS) chains. Those who staked their ETH when the beacon chain was launched in December 2020 took a risk, hoping they would be able to withdraw their funds eventually. Although the risk of staking has decreased significantly after The Merge, withdrawals are still not possible.

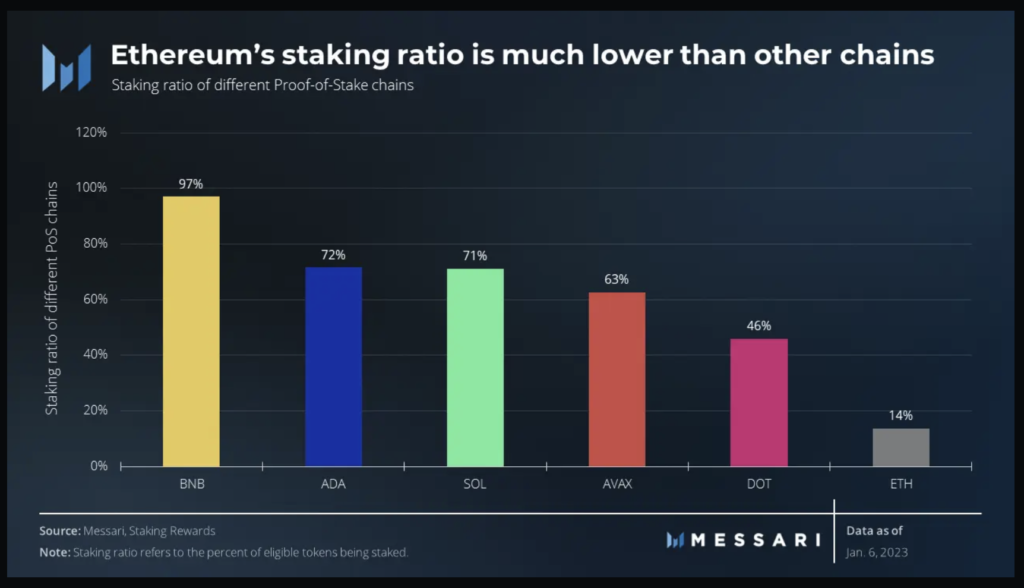

As seen in the data from Messari below, this makes the ETH staking ratio still relatively low compared to other PoS blockchains such as Solana and Avalanche.

The upcoming Ethereum’s Shanghai Upgrade will allow withdrawals from the staking contract. This withdrawal feature is likely to decrease the risks associated with ETH staking and could potentially result in a rise in the overall amount of ETH that is staked.

There are two conditions that make ETH staking less attractive to many ETH holders. Namely, a minimum deposit of 32 ETH as well as non-withdrawable assets until the Shanghai update is complete. The liquid staking protocol overcomes the first problem by pooling ETH from multiple holders, so that investors with less than 32 ETH can also participate and get staking rewards. Not only that, the liquid staking platform provides its users with derivative tokens (LSD) that can be used on various DeFi platforms so that users can multiply the benefits of their assets.

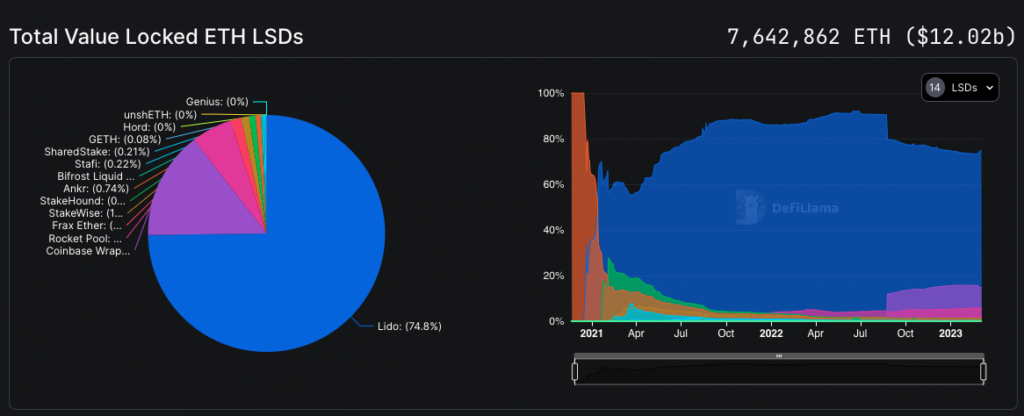

LSD on Ethereum is growing very rapidly and has recorded a TVL of 12.6 billion US dollars, or about 20% of the total TVL in DeFi.

LSD Platforms

Lido

Lido is the biggest staking provider at the moment, with a market share reaching 29%. As of March 2023, Lido also dominates the liquid staking market with a market share of 74.84%.

This Shanghai renewal plan causes an increase in the platform’s original token value liquid staking, an example is Lido Finance. Over the past month, Lido’s LDO token has increased by 118%.

Rocket Pool

Rocket Pool is currently the second largest decentralized liquid staking protocol after Lido. What makes it different from other liquid staking platforms, to become a validator in the Rocket Pool, users only need to stake 16 ETH, instead of 32 ETH as required by the Ethereum Beacon Chain. Based on the price chart, the RPL token has experienced a positive rally throughout early 2023. The completion of The Merge and the Shangai renewal plan are one of the driving factors.

Frax Ether

Frax Finance, a decentralized finance (DeFi) application, is gaining popularity among investors due to its strong product lineup as liquid staking derivatives (LSD) heat up ahead of Ethereum’s Shanghai upgrade.

Frax protocol is a two-token system consisting of a stablecoin called FRAX, partly collateralized by USD coin , and a governance token called frax shares (FXS). Frax’s staked ether product, which was launched in October, allows users to deposit ether and receive the Frax ether token (frxETH), which is backed 1:1 with ether.

The frxETH token can be traded or staked on other DeFi applications or on Curve’s liquidity pools, where stakers can earn up to 10% annualized.

How will LSD impact cryptocurrency market?

The emergence of Liquid Staking Derivatives (LSDs) platforms offers a new way for investors to earn passive income from their cryptocurrency holdings, by staking their assets and receiving rewards without locking them up for a long period of time. This could result in increased participation in staking activities, which could, in turn, increase the security and efficiency of the underlying blockchain network.

Furthermore, the tokenization of staked assets could provide increased liquidity to the cryptocurrency market, as users can now use their staked assets as collateral in decentralized finance (DeFi) applications. This could open up new avenues for lending, borrowing, and trading, further increasing the market’s liquidity and volume.

According to a report by Messari, the total value locked (TVL) in staking has increased significantly in recent years, with over $120 billion worth of assets staked as of February 2022. With the upcoming Ethereum Shanghai hard fork, which will introduce a new staking mechanism, LSD platforms are expected to gain even more momentum.

However, it’s worth noting that LSD platforms are a relatively new concept and may face challenges, such as regulatory issues and potential risks associated with tokenization. Therefore, it’s essential to conduct thorough research and due diligence before investing in any LSD platform.

In conclusion, the emergence of LSD platforms could potentially have a significant impact on the cryptocurrency market, increasing participation in staking activities and providing increased liquidity to the market. However, it’s crucial to approach these platforms with caution and conduct proper research before investing.

Buy LSD Tokens on Pintu App

You can start investing in LSD tokens such as LDO and RPL by buying it in the Pintu App. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for LDO token.

- Click buy and fill in the amount you want.

- Now you have LDO token as an asset!

Besides LSD tokens, you can also invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for educational purposes, not financial advice.

References

- Michiel Milanovic, DeFi Market Commentary | January 2023, Consensys Cryptoeconomic Research, accessed on February 25, 2023

- Anatol Hooper, DeFi’s Next Big Thing: Liquid Staking Derivatives, Cointelegraph, accessed on February 25, 2023

- Kunal Goel, New Highs for Liquid Staking Derivatives, Messari, accessed on February 27, 2023

- Leeor Shimron, Ethereum’s Centralized And Decentralized Liquid Staking Providers Battle For Dominance, Forbes, accessed on February 27, 2023

- Chase Devens, DeFi Sector Brief: Frax Enters the Liquid Staking Arena, Messari, accessed on February 27, 2023

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-