Q4 2024 Crypto Insights

In the middle of the bull market, Bitcoin shows that it will not be as easy as it seems. In the last 3 months, Bitcoin has seen wild volatility, going as high as $70k and as low as $49k. As a result, altcoins are decimated and many reach a new yearly low. Despite all that, September closes green for BTC. This crypto market analysis will discuss what happened in Q3 2024 for crypto and the potential narratives and predictions for Q4 2024.

Article Summary

- Bitcoin’s Volatility in Q3 2024: Bitcoin experienced significant volatility in Q3 2024, with prices fluctuating between $49k and $70k. Despite this, September closed positively for Bitcoin but altcoins struggled, with many reaching new yearly lows.

- Memecoins and Sector Strength: Memecoins like POPCAT and emerging sectors such as the Ton ecosystem, AI, and alt L1 blockchains demonstrated resilience despite broader market declines.

- Q4 2024 Outlook: Historically, Q4 is a bullish period for Bitcoin, with expectations of overcoming resistance levels at $64k-$66k. Both Bitcoin and altcoins are facing strong resistance, yet signs point to a potential upside due to increasing global liquidity.

- Key Narratives for Q4 2024: Memecoins continue to drive market attention, L1 ecosystems remain competitive with new launches, and the AI sector is gaining momentum, led by Bittensor .

What Happened in Q3 2024?

Q3 was a very volatile month for Bitcoin. As you can see above, the price swings wildly from $56k to $70k, only to come back down to make a new low of $49k. From early August to early September, it rallied to $64k and crashed to retest the $49k support. BTC then rallied to $66k and now sits at around the $60-$62k range, holding the 200-day EMA (yellow line).

In light of Bitcoin’s volatility, altcoins are much worse. Many altcoins made their new yearly lows around early August. SEI, SUI, NEAR, and RUNE are some of the altcoins falling to new lows amid Bitcoin’s volatility.

The ETF launch around early July can’t prevent ETH from the market’s downturn. Throughout Q3, Solana memecoins such as POPCAT is leading the market while most VC altcoins crashed. Besides memecoins, several sectors such as Ton ecosystem, AI, and alt L1s (Fantom and Sui) show considerable strength amidst market weakness.

Bitcoin and Altcoins Prospect in Q4 2024

Q4 historically has been one of the most bullish quarters for Bitcoin along with Q1. Additionally, when September closes green for BTC, October also closes green. However, BTC has been stagnant since rallying to $64k in early October. Bitcoin currently faces heavy resistance at around $64-$66k range.

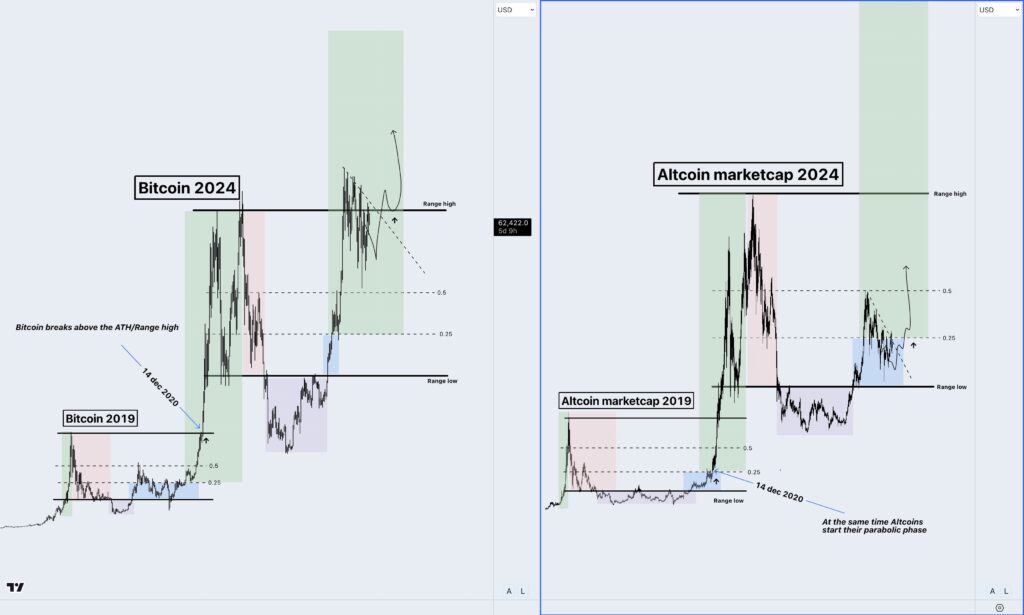

As seen with the last 3 months, most altcoins will get decimated whenever BTC nukes. An interesting chart from @damskotrades shows how both altcoins and BTC need to overcome a heavy resistance to resume the uptrend—The altcoin market is correcting near the range low. Additionally, the charts also show that what happened now is normal and doesn’t mean the bull market is finished.

Furthermore, the global liquidity (M2) supply (blue line) has been increasing since the start of 2024 (blue graph). Since the last few years, BTC price has been following the M2 supply closely. Currently, there is a divergence between both. This could be interpreted as a potential upside for BTC.

Potential Narratives in Q4 2024

1. Memecoins Continue to Perform

Memecoins has so far been the top performer in this bull market. WIF, POPCAT, BRETT, and PEPE reached a $1 billion market cap. Recently, memecoins such as MOODENG, NOT, DOGS, and SPX rose to hundreds of millions of dollars within a few weeks. This has been the prevailing trend as every month some new memecoins reach $100 million, regardless of market condition.

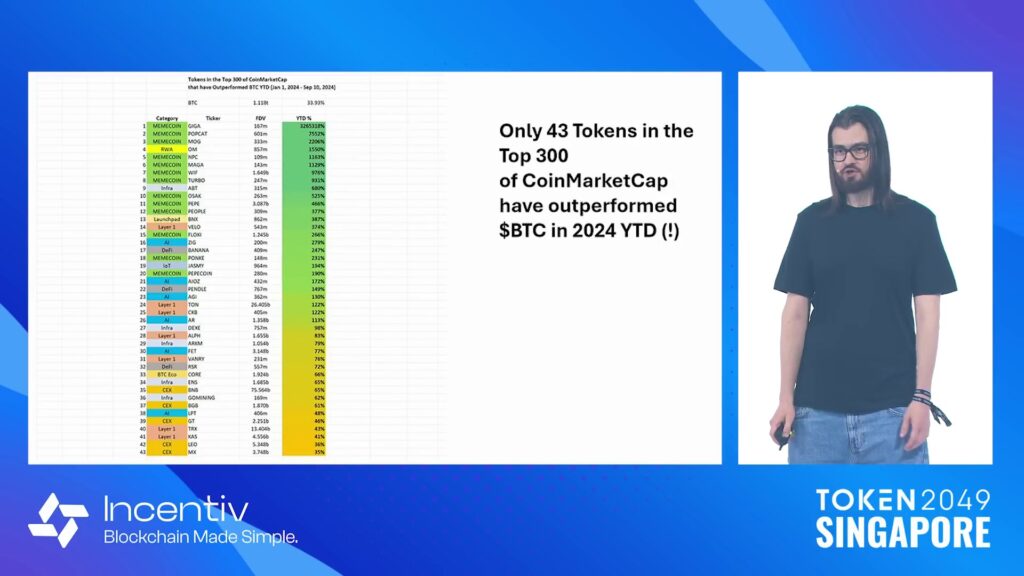

One of the most attention-grabbing catalysts for memecoins was a speech by Murad in Token2049. Murad explained his thesis and reasoning for calling the market a memecoin supercycle. Interestingly, out of the top 300 cryptocurrencies, only 43 outperformed BTC in 2024. Out of 43, 13 memecoins managed to perform BTC including GIGA, POPCAT, MOG, WIF, and PEPE.

However, as we’ve seen in the last 3 months, most memecoins will fall the hardest when BTC is in correction. So, timing is one of the most important things when it comes to buying memecoins. Don’t buy memecoin at ATH or peak attention.

2. L1 Competition is Still Alive

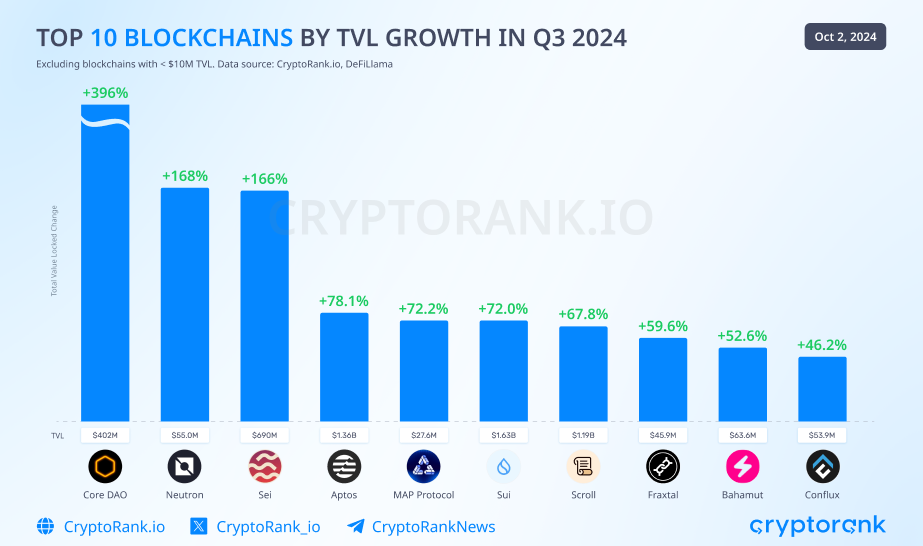

Non-EVM blockchains such as Ton, Sui, and Aptos have been some of the biggest winners in September. The TVL of Sui and Aptos rise by 72% and 78%, respectively. Ton’s TVL went parabolic from $100 to $755 million within 2 months. However, Solana is still dominating various metrics, including volume, TVL, and mindshare in the crypto community.

Ethereum, Sui, Fantom, Aptos, Ton, and Tron all got the spotlight at some point in 2024. This shows that L1 ecosystems are still the center of cryptoeconomic activity.

Moreover, Q4 is filled with exciting launches or rebranding in the L1 sectors. Berachain, one of the most popular L1 alongside Monad, is planning to launch in Q4 2024 or Q1 2025. The full migration of Fantom to Sonic is also expected to be done in Q4. MakerDAO, one of DeFi’s oldest protocols, is also building an L1 ecosystem called Sky Ecosystem.

3. Bittensor the King of AI

The AI narrative is one of the newest ones in crypto. Despite that, it is already one of the most popular sectors in crypto. In Coingecko’s ranking, the market cap of the AI sector is still 30th at $26 billion.

The leaders of the AI sector are Bittensor (TAO), Near Protocol , and Artificial Superintelligence Alliance . Bittensor’s TAO is one of the best-performing AI coins in the last quarter. From its low of $150, TAO reached a peak of $679 in early October. As usual, this price increase brought back the hype in the AI sector.

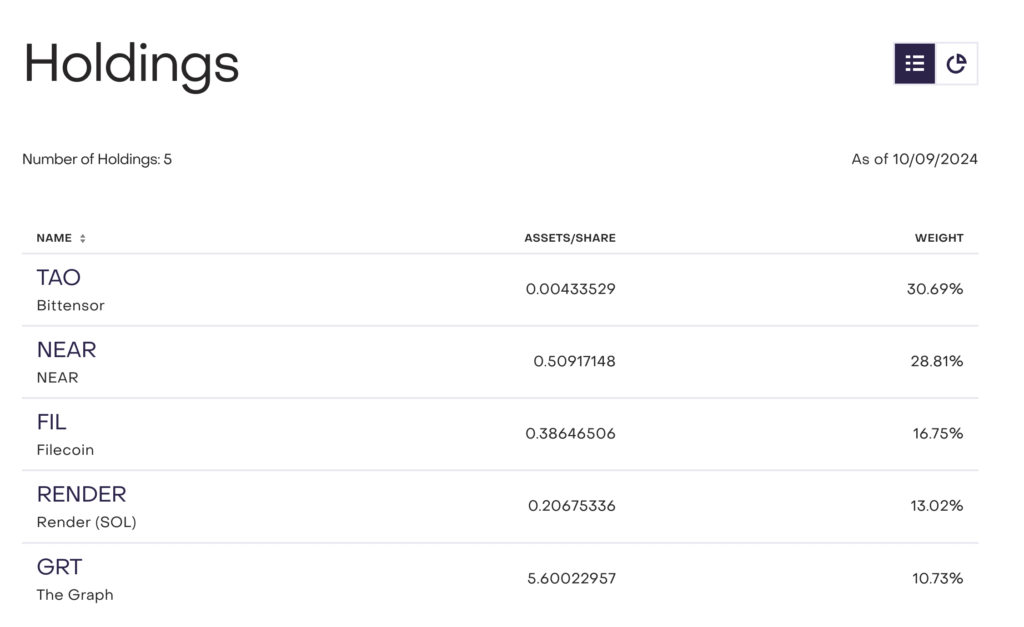

Institutional investors Grayscale even created a decentralized AI fund. As can be seen above, TAO is the largest asset in Grayscale’s DeAI fund. However, as it stands currently, the crypto AI sector hasn’t created a convincing product-market fit and remains mostly a speculative asset. Projects like Bittensor, Near, and Akash are important in creating a viable demand for decentralized AI.

Conclusion

Q3 2024 saw substantial market volatility, particularly for Bitcoin and altcoins. Certain narratives like memecoins, L1 blockchains, and AI maintained strength. As Q4 unfolds, historical trends suggest a bullish period for Bitcoin, while altcoins, L1 blockchains, and AI projects will continue to play a significant role in shaping market trends. Caution is advised as speculative assets like memecoins and AI remain volatile, emphasizing the need for strategic timing and careful market analysis.

References

- CMC Research, “According to CMC 2024 Q3,” CoinMarketCap, accessed on 8 October 2024.

- @milesdeutscher, “Murad’s recent speech at TOKEN2049 has ignited a memecoin frenzy. It will change your ENTIRE outlook on crypto (and could net you huge gains),” X, accessed on 8 October 2024.

- @milesdeutscher, “The stars are aligning for a monumental crypto rally, and altcoins look ready to rip,” X, accessed on 9 October 2024.

- @cprinze_, “To navigate Q4-2025 successfully in DeFi, here are the key insights you need,” X, accessed on 9 October 2024.

- Grayscale, “Grayscale Research Insights: Crypto Sectors in Q4 2024,” accessed on 10 October 2024.

- Crypto Distilled, “Q4 Rally Likely, But Don’t Expect Wild Gains,” Substack, accessed on 10 October 2024.

Share

Related Article

See Assets in This Article

NEAR Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-