Five Trading Tips for a Sideways Market

While bullish markets are popular for their potential for gains, and bearish markets often deter traders, sideways markets can be surprisingly tricky. Instead of sitting things out, traders often fall into the trap of overtrading. Why does overtrading happen? What should one do in a sideways market? Find out the answers in the following article.

Article Summary

- 📊 At the beginning of 2024, the cryptocurrency market showed significant gains. However, entering the second quarter, Bitcoin started to go sideways, and many altcoins experienced drastic declines.

- ↔️ Those conditions make the crypto market sideways or choppy. This trend is expected to continue into the third quarter. Many predicted asset prices would fluctuate but not show significant movement.

- 💡 Sideways trading tips: avoiding overtrading, range trading using limit orders, creating an altcoin watchlist, and setting price alerts.

- 🚀 Amidst the volatile conditions, historical data shows that the market still has a strong structure to turn bullish again.

Challenges of Sideways Trading

Early 2024 saw a surge in the cryptocurrency market, with Bitcoin reaching an all-time high . However, the second quarter brought a shift. Bitcoin entered a sideways trend, and many altcoins experienced significant declines. Many altcoins plunged by over 60% from their peak levels, settling into a narrow trading range following the correction.

As we enter the third quarter of 2024, this sideways or choppy trend is expected to continue. Experts anticipate that the market will continue to exhibit choppy behavior. In such a market environment, trading becomes more challenging due to the lack of significant price movements.

A choppy market occurs when buyers and sellers are in balance, or when buyers and sellers are in a fierce fight but there isn't an overall winner. Prices are moving up and down—slowly or quickly and in large moves or small moves—but the price isn't making headway higher or lower overall.

5 Trading Tips on Sideways Market

Navigating a sideways market can be tricky, but you can reap opportunities with the right approach. Here are five tips to help you maximize your trading results in such market conditions:

1. Don’t Overtrade

Sideways markets, with their lack of clear direction, can tempt traders into overtrading – a frequent culprit of portfolio decline. It can stem from both gains and losses.

Overtrading driven by gains. When traders experience a string of successful trades, they may become overly confident. It leads them to engage in excessive transactions without proper analysis or adherence to their trading plan. This can result in subsequent losses that erase the hard-earned profits.

Overtrading driven by losses. Overtrading often emerges as a form of revenge or an attempt to “recoup” losses. After experiencing setbacks, traders may rush into new positions, hoping to offset their losses. In such situations, emotions often take over, leading to riskier and less calculated actions.

2. How to Avoid Overtrading

While avoiding overtrading might seem simple, it can be challenging to execute in practice. Here are some effective strategies to curb overtrading tendencies:

- 📝 Reevaluate Your Trading Plan.

After experiencing profitable or losing trades, take a break to reassess your trading plan. If you’ve incurred losses, adjust your trading parameters and strategies. If you’ve made significant gains, evaluate whether to reinvest the profits or allocate them elsewhere.

Pausing your trading activities can also help you manage your emotions, whether greed from profits or a desire for revenge after losses. Emotions can cloud judgment and lead to suboptimal trading decisions.

- 🔏 Implement Disciplined Risk Management.

A well-defined trading plan is meaningless without disciplined risk management. Establish clear stop-loss orders for each trade aligned with your risk tolerance. Adhere to these orders and exit positions when losses reach your predetermined limit.

Additionally, set a maximum capital allocation for each trade to prevent overextending yourself beyond your prepared funds.

- 👀 Avoid Constant Chart Monitoring.

Fixating on charts can induce stress. When price movements deviate from your expectations, anxiety can arise, disrupting your trading plan and leading to overtrading. Limit your chart monitoring to essential tasks, such as conducting analysis or checking prices near target levels.

- 🏁 Focus on Long-Term Goals.

Embracing a long-term investment approach can effectively deter overtrading. With a longer time horizon, current price volatility becomes less concerning.

These five tips will further enhance your trading performance if the market shifts to a bullish trend.

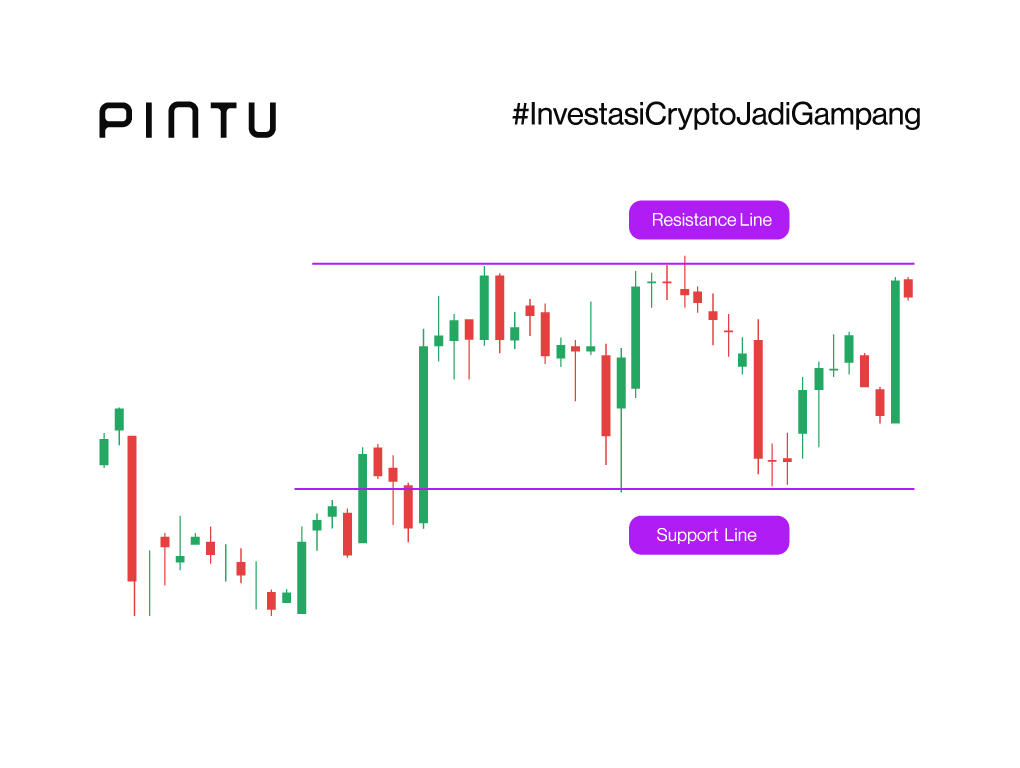

3. Using Limit Order

When the market is in a sideways trend, range trading using limit orders can effectively prevent overtrading. This strategy involves placing buy-limit orders at support and sell-limit orders at resistance levels.

As the market continues its sideways movement, the asset’s price is expected to fluctuate within these established ranges. While individual profit margins may be smaller, traders can generate recurring gains through consistent buying and selling at predefined price targets.

This disciplined approach to trading helps prevent overtrading by ensuring that transactions adhere to predetermined price levels.

Click here to learn more about implementing range trading and strategies to optimize results.

4. Creating an Altcoin Watchlist

Creating an altcoin watchlist can be valuable when the market enters a sideways phase rather than actively trading. A sideways market provides an opportunity to observe various protocols’ performance under reduced token demand, which can serve as a benchmark to assess project quality and token potential.

Constructing an altcoin watchlist involves several considerations. One approach is identifying projects with narratives that could gain traction during the next bull run. For instance, in the current cycle, many anticipate the Artificial Intelligence and Real World Asset (RWA) sectors to dominate the narrative.

Additionally, consider including market leaders within specific sectors or promising new altcoins that have the potential to challenge established protocols.

Why monitor Altcoins? Altcoins undergoing consolidation often harbor significant breakout potential when a bull run commences. Maintaining a watchlist facilitates focused and organized monitoring, enabling timely position entry during breakout events.

Unsure whether to prioritize established or new altcoins? Explore selection strategies here.

5. Set the Alert

After compiling an altcoin watchlist, the next step is establishing price alerts for each. These alerts notify traders when the specified price levels are reached, prompting them to conduct further chart analysis and determine potential entry points.

Price alert settings can vary among traders based on their preferred indicators. In this example, we’ll utilize the Fibonacci retracement indicator on SOL.

Currently, SOL’s price is trading below the 61.80% level. The 50% level is often considered a strong support or resistance zone in Fibonacci retracement. The 50% level or $154.28 for SOL, is a significant resistance barrier. If SOL surpasses this level, it indicates a continuation of its upward trend, presenting an ideal entry point during a breakout.

Therefore, traders can set a price alert at $153. Upon reaching this level, traders can closely monitor SOL’s price action. Then, they can determine whether it successfully breaks out or fails and retraces.

Find out how to use fibonacci indicators in trading in the following article.

What Happens After a Sideways Market?

Recent market conditions may make many people pessimistic about BTC’s and the broader cryptocurrency market’s future trajectory. Some have even speculated that BTC has reached its peak.

However, renowned trader Damskotrades refutes this assumption. According to him, the current market structure still looks solid. Based on BTC’s weekly time frame, the current structure is still bullish, as it contains higher highs and higher lows. In other words, despite the correction, BTC will not undergo a bearish trend as feared.

Furthermore, Damskotrades mentioned that historically, BTC has also always experienced a chopping movement accompanied by a correction in the first 50 days after the halving. Then, BTC will start the second phase of the bull run after 50 days of halving. At its peak, BTC will record upside for 300-500 days after halving.

Renowned crypto trader Bob Loukas acknowledges the sideways movement as an anticipated development, considering BTC’s near-doubling in value since its January 2024 lows. He projects that this choppy phase will likely persist until at least September 2024. Bob said that extended periods of sideways often pave the way for more robust and sustainable price action in the bull run.

The Glassnode chart above can also be used as a reference to confirm these traders’ historical data and analysis. After the halving, the price of BTC went sideways, followed by a correction. However, as the third-month post-halving approaches, BTC tends to embark on an upward trajectory, marking the beginning of its bull run.

Conlusion

While sideways markets are a natural part of trading, their limited price movements can be tricky. Without a solid strategy, traders can get caught overtrading, chasing losses, or forcing gains.

When the market is sideways, a trader needs to avoid overtrading. This can be done by setting a trading plan, having strict risk management, avoiding charts constantly, and focusing on the long term. If you still want to make a profit during a sideways market, then range trading is the optimal choice. Meanwhile, wait-and-see traders can create an altcoin watchlist and set price alerts.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Damskotrades, Market Overview in This Market Chop, X, accessed on 26 June 2024.

- Distilled Crypto, When Will The Chop End? X, accessed on 26 June 2024.

- James Chen, Overtrading: Definition, Causes, Types, and Ways to Avoid, Investopedia, accessed on 26 June 2024.

- Cory Mitchell, Choppy Market: Overview and Examples of Trendless Trading, Investopedia, accessed on 26 June 2024.

Share

Related Article

See Assets in This Article

AI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-