Features

Trading

Learn

ACADEMY CLASS

New to Crypto?

We’re here to help! Master everything about crypto, step by step with our Class.

More

Features

Trading

Learn

ACADEMY CLASS

New to Crypto?

We’re here to help! Master everything about crypto, step by step with our Class.

What is A Crypto Flash Crash and How to Avoid It?

Crypto is a very volatile high-risk asset. In 24 hours, a crypto asset can rise 100% only to fall 50% in the next day. This kind of volatility in crypto is prevalent because of various reasons. It’s also why news and narrative trading is popular. However, there are some extreme cases where volatility is so high but short-lived. This is commonly known as a flash crash. So, what is a flash crash and how can you manage your risk during one? We will discuss it in detail.

Article Summary

- 📉 What is a Crypto Flash Crash: A crypto flash crash is a sudden, dramatic drop in asset prices within a short timeframe, often triggering liquidations among leveraged traders. Although markets may quickly recover, such crashes can erase millions in value and are especially common in crypto.

- 🔎 Causes of Flash Crashes: Flash crashes in crypto are triggered by a combination of factors, such as black swan events (e.g., Terra Luna collapse, SEC announcements), liquidation cascades, and occasional technical glitches on exchanges.

- ⚠️ Managing Allocation and Risk: Given the unpredictability of flash crashes, traders are advised to carefully manage their allocation and set specific risk parameters, including stop-losses and target prices, especially for leveraged positions.

- 💥 Utilizing Stop-Loss Orders: Stop-loss orders can help mitigate losses during flash crashes by automatically selling positions at a pre-set price, though they are not guaranteed to execute under extreme volatility conditions. They are essential in both spot and futures trading to minimize exposure.

- 💸 Margin Maintenance: During a flash crash, maintaining your margin can prevent liquidation. Adding funds to your position can be profitable if you believe the crash is temporary, though this requires conviction and additional capital.

What is Crypto Flash Crash?

A crypto flash crash is an event where assets suffer from a sudden and dramatic drop in prices within a short timeframe. Flash crashes usually erase millions of market value and trigger a chain reaction of liquidation from leverage traders. Depending on the reason for the crash, the market can quickly recover within hours of said events or slowly climb up into the price prior to the flash crash.

Flash crashes are common in all industries, but cryptocurrencies are especially prone to this. Some assets have thin liquidity and a flash crash can easily happen once traders simultaneously sell a huge amount. Other flash crashes are triggered by events. The FTX collapse is one example of one of the most extreme flash crashes in recent years.

Why Does Crypto Flash Crash Happen?

A variety of reasons trigger a crypto flash crash. These reasons can come from internal and external things.

like liquidation cascade, thin liquidity, and market manipulation. On the other hand, external events such as the Terra Luna collapse, COVID-19, and inflation reports can trigger flash crashes.

- Black Swan events: One of the most common causes of flash crashes in crypto is Black Swan events. The Terra Luna collapse, COVID-19, the SEC crypto announcement, and the Israel-Iran conflict are some of the recent events that triggered a flash crash.

- Liquidation Cascade: Liquidation cascade can be both the cause and the after-effect of another initial event in a flash crash. Nevertheless, in both instances, the market experienced further sell-off from leverage traders getting wiped out by the sudden move.

- Technical and Algorithm Glitches: Technical errors such as liquidation engine or order book glitches on cryptocurrency exchange can also trigger isolated price crashes. However, this is less likely to happen with the advancement of technology in crypto exchanges.

How to Manage Risks During Crypto Flash Crash

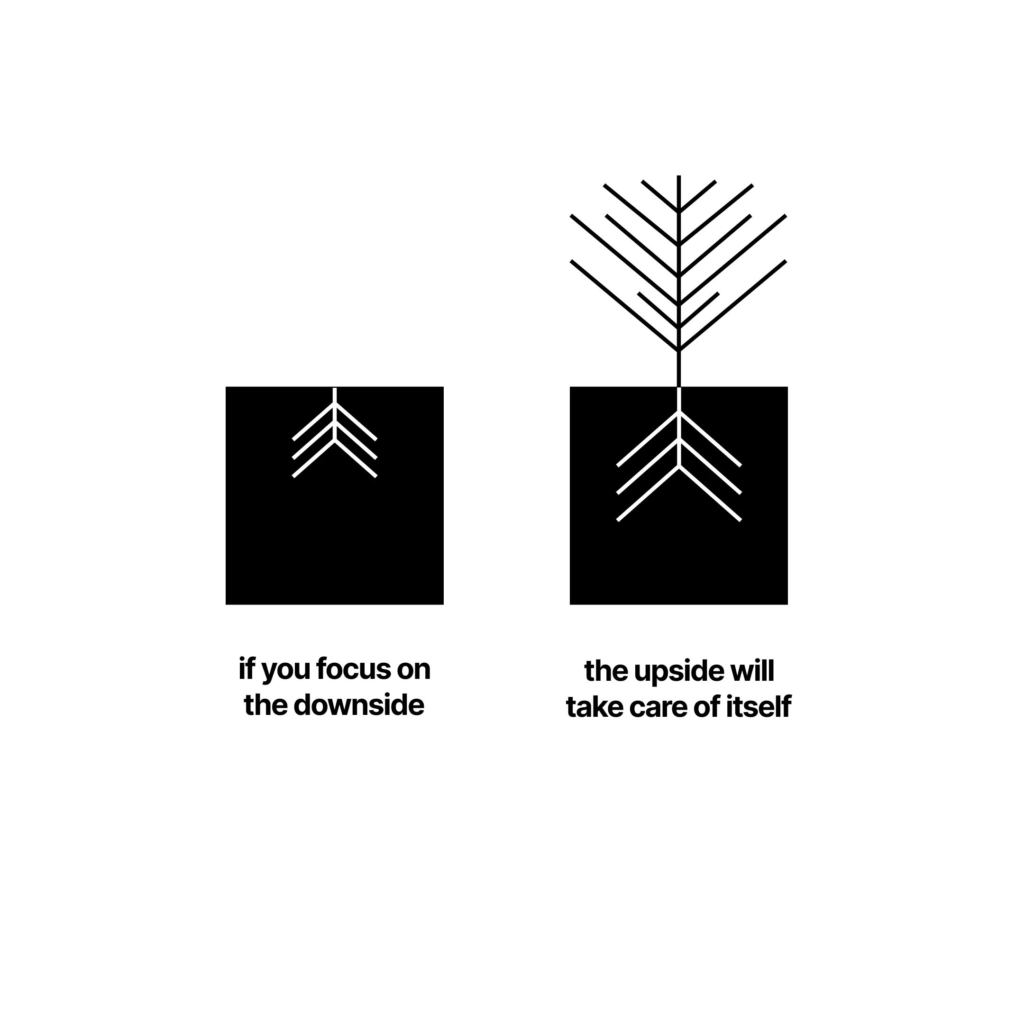

1. Managing Allocation and Risk

Flash crashes can come out of the blue, leaving many leverage traders liquidated. Even on normal days, leverage wipes are one of the most common occurrences (such as in early October). This is why you always need to be mindful of your allocation and risk/return ratio each time you open a leveraged position.

Each opened leverage position represents a far higher risk than the buying spot. This is why most veteran leverage traders have a specific system before opening up a short or long trade—They set specific stop loss, target price, invalidation price, etc.

2. Utilizing Stop-Loss

Stop-loss orders are essential for mitigating losses during a flash crash. With Stop-loss, You can set a predetermined price to sell your position automatically. Stop-loss removes the stress of needing to make quick decisions during a market panic.

Furthermore, stop-loss is even more important when it comes to futures trading. A well-placed stop-loss order can be the difference between losing 100% of your position or taking a 5% loss on a trade. In spot trading, set your stop-loss price according to your risk tolerance (ideally between 5%-10% from entry).

A stop-loss order isn’t 100% guaranteed to be executed. On days of extreme volatility and volumes, some stop-loss orders can be missed, especially on round numbers where it is crowded.

Meanwhile, flash crashes are the bane of all future traders. Leverage flush is a common occurrence in the crypto market where the funding rates get overheated and prices move in the opposite direction. This usually results in traders suffering losses and millions of dollars getting liquidated. So, in futures trading, make sure to set your stop order above your liquidation price (mark price) and avoid round numbers (such as $20k, $2k, etc.).

3. Margin Maintenance

In 2024, several market-moving events triggered a flash crash. One of them is the image above from May 1st when the Fed announced worsening economic conditions. BTC tumbled 12% on the day of the Fed meeting but quickly erased the dump two days later.

Margin Maintenance is crucial if you want to keep your trade open and avoid being liquidated. In the event of a flash crash, you will get a margin call on your position with the option to keep your position by adding funds to your account. If you have the conviction that the flash crash is temporary, adding funds to your position can be more profitable than closing your position.

Conclusion

Flash crashes are an inherent risk in the volatile crypto market, often occurring unexpectedly and leaving traders vulnerable to sudden losses. By understanding the causes of flash crashes and employing risk management tools like stop-loss orders, cautious allocation, and maintaining margin, traders can better navigate these events and potentially protect their positions. While these strategies cannot eliminate risk, they provide a structured approach to managing it in a high-stakes environment.

References

- “What are crypto flash crashes: how to survive any flash crash”, OKX, accessed on 7 November 2024.

- Benedict George, “Crypto Flash Crashes: What You Need to Know”, CoinDesk, accessed on 7 November 2024.

- “Flash Crash”, Coinmarketcap, accessed on 8 November 2024.

- “Bitcoin Flash Crashes,” River Learn, accessed on 11 November 2024.

- Dennis Mugambi, “Navigating Crypto Flash Crashes: Strategies, Analysis, and Insights for Investors,” DroomDroom, accessed on 11 November 2024.

- Riley Asak, “Bitcoin Flash Crashes: What’s Causing Them and What to Do?,” Coinpaper, accessed on 12 November 2024.

Rate this article

Share