What is Bitcoin Cash (BCH)? The Peer-to-Peer Electronic Cash

In the last few weeks of June 2023, the price of Bitcoin Cash spiked by over 150%! This significant increase can be attributed, in part, to BCH being included among the four cryptocurrency assets traded on the newly launched EDX Markets crypto exchange, which Fidelity backs. Along with Bitcoin , Ethereum , and Litecoin , Bitcoin Cash (BCH) has shown its position as a major player in the crypto market. Let’s check out this article to learn more about Bitcoin Cash (BCH), how it differs from Bitcoin, and what it does!

Article Summary

- 🪙 Bitcoin Cash (BCH) is a crypto asset created as a hard fork of Bitcoin in 2017.

- 🍴 As a fork of Bitcoin, Bitcoin Cash has a separate blockchain, miners, and community from Bitcoin. However, it still uses a proof of work (PoW) consensus mechanism like Bitcoin.

- 💰 Bitcoin Cash aims to be a peer-to-peer (P2P) electronic cash that is fast, affordable, efficient, and can be used for day-to-day transactions.

- 🪄 On May 15, 2023, Bitcoin Cash successfully upgraded the protocol known as Chiptokens CHIP. Chiptokens CHIP allows the BCH network to implement smart contracts based on on-chain UTXO and decentralized applications (dApps).

What is Bitcoin Cash (BCH)?

Bitcoin Cash (BCH) is a crypto asset created as a hard fork of Bitcoin in 2017. A hard fork is a blockchain split into two with separate miners and communities.

The hard fork entitles holders of coins on the original blockchain (BTC) to receive the same amount of new coins on the newly created blockchain (BCH).

Bitcoin Cash addresses the issues of high fees and scalability limitations that Bitcoin faces. Bitcoin Cash sees itself as an upgraded version of Bitcoin, with a focus on scalability and day-to-day usage.

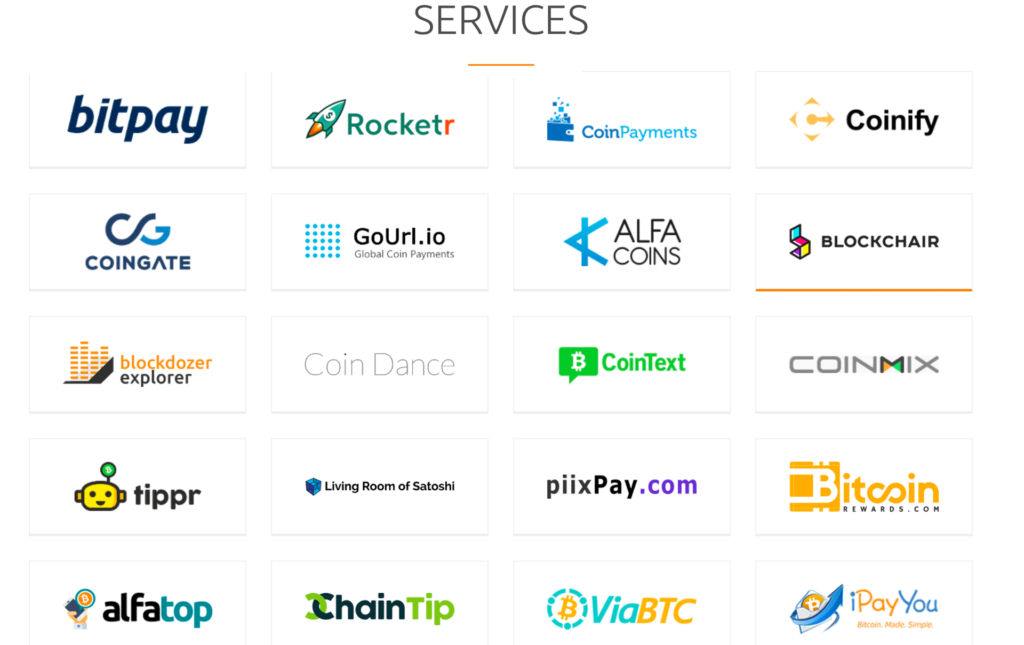

As a P2P electronic cash, BCH has partnered with several parties to expand the adoption of BCH. Among them are wallet service providers that support the Bitcoin Cash system in providing fast transactions and secure storage. You can see the projects, services, and exchanges that support the Bitcoin Cash network at bitcoincash.org.

Since June 21, 2023, BCH has increased about 165% from 110 US dollars to 298 US dollars as of July 3, 2023. One of the reasons is the launch of EDX Markets, a crypto asset exchange backed by Wall Streets veterans such as Charles Schwab, Citadel Securities, and Fidelity Digital Assets. EDX announced that it supports the trading of four crypto assets, which are Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

In addition, according to data from Watcher Guru, BCH experienced a massive increase in trading volume on South Korea’s largest exchange, Upbit. The BCH/KRW (Korean Won) pair has traded for over 350 million US dollars. This volume represents 23,58% of the total trading volume for BCH and is three times higher than the BTC/KRW trading volume on Upbit.

The History of Bitcoin Cash (BCH)

BCH, the token name of Bitcoin Cash, results from a difference of opinion within the Bitcoin community. This disagreement primarily revolved around the challenges of high transaction fees and limited scalability that Bitcoin encountered in 2017.

The core of the dispute was centered on finding a solution to enhance Bitcoin’s block capacity. Certain community members advocated for increasing the block size to 8MB or even 32MB, which would enable the processing of a greater number of transactions within a single block. However, this proposal faced opposition from other members of the Bitcoin community.

Some Bitcoin community members argued that implementing Segregated Witness (SegWit) and the Lightning Network could address Bitcoin’s scalability. Therefore, increasing the block size is optional.

Also, read What is SegWit (Segregated Witness) in Bitcoin?

Some other members of the Bitcoin community who were in favor of increasing the block size decided to fork the Bitcoin network. The fork resulted in two separate crypto assets, Bitcoin (BTC), which continues to use a 1MB block size, and Bitcoin Cash (BCH), with a larger block size.

Since the fork, Bitcoin Cash has continued to develop its ecosystem with an active community and dedicated developers.

In November 2018, Bitcoin Cash forked and split into Bitcoin Cash ABC and Bitcoin Cash SV (Satoshi Vision). In 2021, Bitcoin Cash ABC changed its name to eCash (XEC).

How Does Bitcoin Cash (BCH) Work?

Technically, Bitcoin Cash works the same as Bitcoin. Miners confirm and add transactions to the blockchain by using cryptography to solve complex equations. They then receive BCH tokens as a reward for their work.

In addition, Bitcoin Cash and Bitcoin have the same maximum supply of 21 million coins. It means that, at most, 21 million Bitcoin Cash or Bitcoin will circulate worldwide.

In addition, Bitcoin Cash also uses a proof-of-work (PoW) consensus mechanism to validate transactions and reach agreements within the network.

You can learn more about Bitcoin and how it works in this article.

Bitcoin vs. Bitcoin Cash

The differences between Bitcoin and Bitcoin Cash continue to grow as developers working on each network have different goals. The following are some of the differences between the two of them:

Block size difference

Bitcoin has a fixed block size of 1 megabyte (MB), which limits the number of transactions that can be processed in a block. On the other hand, Bitcoin Cash has a block size of 32 MB, allowing more transactions to be included in a single block.

Transaction fees

Due to block size limitations, Bitcoin transaction fees can be high, especially when the network is busy. On the contrary, Bitcoin Cash offers lower transaction fees compared to Bitcoin. With a larger block size, Bitcoin Cash can process more transactions at a lower cost. That is one of the advantages of Bitcoin Cash.

The focus of use cases

Bitcoin is generally considered as a digital asset or “digital gold” more suitable as a store of value or investment tool. In comparison, Bitcoin Cash focuses on being used as P2P electronic cash that can be used daily.

Token project issuance

To issue tokens on top of the Bitcoin blockchain, developers can use the Omni Layer, a platform for creating and trading specialized digital assets and currencies. However, the adoption of this layer is more focused on stablecoins. Meanwhile, Bitcoin Cash has a Simple Ledger Protocol that allows developers to issue tokens on top of BCH, similar to Ethereum blockchain tokens. However, the adoption of both still needs to be improved.

With Ordinals, NFT creation becomes possible on the Bitcoin network. You can read more about Ordinals and its technology in this article. On the other hand, through its system upgrade, Bitcoin Cash now supports smart contracts comparable to Ethereum.

Roadmap dan Protocol Upgrade of Bitcoin Cash

The Bitcoin Cash development team is gradually improving the technical system to achieve its purpose. They will maximize this peer-to-peer electronic cash with optimizations and protocol improvements.

Bitcoin.com mentions that the following three categories can define technical improvements:

- Enabling Bitcoin Cash to scale from 100 TPS to more than 5,000,000 TPS.

- Improving the payment experience to ensure that payments are instant and reliable. Transactions should be secure within three seconds.

- Making Bitcoin Cash extensible.

On May 15, 2023, Bitcoin Cash successfully upgraded the protocol known as Chiptokens CHIP or Bitcoin Cash Improvement Proposal (CHIP).

Chiptokens CHIP allows the BCH network to implement UTXO-based on-chain smart contracts and decentralized applications (dApps) with this upgrade.

Bitcoin Cash developer Jason Dreyzehner said that the upgrade allows dApps on Bitcoin Cash to be comparable to Ethereum and has an efficiency advantage of more than 1000x in transactions and block validation.

Previously, in June 2021, Bitcoin Cash also launched SmartBCH, which functions as the sidechain of the Bitcoin Cash network.

Conclusion

With the evolution of crypto assets, Bitcoin (BTC) and Bitcoin Cash (BCH) serve different purposes. BTC functions as a “digital gold” and primarily serves as a store of asset value, whereas BCH aims to function as “digital money” and focuses on being a payment method. This distinction is widely recognized by users who support the development of both BTC and BCH.

Through protocol upgrades, the Bitcoin Cash network has gained enhanced flexibility, enabling it to support smart contracts similar to Ethereum’s capabilities. This expansion in functionality further solidifies the position of Bitcoin Cash as a versatile blockchain network.

How to Buy BCH on Pintu?

You can start investing in BCH by buying it on the Pintu app. Here’s how to buy BCH on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- Click the deposit button on the homepage and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for BCH.

- Click buy and fill in the amount you want.

- Now you have BCH as an asset!

In addition, the Pintu application is compatible with various popular digital wallets, such as Metamask to facilitate your transactions. Download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles updated weekly! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Cointelegraph team, What is Bitcoin Cash, and how does BCH work? A beginner’s guide, Cointelegraph, accessed 30 Juni 2023.

- Cryptopedia Staff, Bitcoin Cash (BCH): There’s More Than One Bitcoin? Cryptopedia, accessed 30 Juni 2023.

- Graham Smith, Bitcoin Cash Smart Contracts ‘Comparable to Those on Ethereum’ Possible via May Upgrade, ‘1000x Efficiency Advantage’: Dev Jason Dreyzehner, Bitcoin.com, accessed 30 Juni 2023.

- Sahana Kiran, Bitcoin Cash Is up by 113%: Why? Watcher Guru, accessed 30 Juni 2023.

- Cointelegraph team, Bitcoin vs. Bitcoin Cash: What’s the difference between BTC and BCH? Cointelegraph, accessed 30 Juni 2023.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-