What Is Liquity (LQTY)?

In the Web2 world, online loan platforms are prevalent. In the realm of Web3, we encounter a game-changing presence in Decentralized Finance , with Liquity as a notable example. Through Liquity, borrowers and lenders can interact in a decentralized manner without third party presence. Let’s delve deeper into what LQTY is and its advantages in the following article.

Market Analysis Summary

- 💸 Liquity is a decentralized lending protocol operating on the Ethereum blockchain, using Ethereum as collateral to lend LUSD. These loans are interest-free and require a minimum collateral ratio of 110%.

- ⛓️ Liquity’s Trove allows users to manage loans with ETH as collateral and LUSD as debt, while the Stability Pool enhances the protocol’s stability by absorbing debt from liquidated Troves, rewarding LUSD providers with LQTY tokens, and incentivizing Frontend Operators to facilitate user interaction with the Liquity ecosystem.

- ♻️ LQTY serves as a secondary token for the Liquity protocol. LQTY has a maximum supply of 100 million coins, with a current circulation of about 94,588,299.

What Is LQTY?

Liquity is a decentralized lending protocol that allows users to borrow at 0% interest using ether as collateral. Loans are issued in the form of LUSD stablecoins pegged to the USD and require a minimum collateral ratio of only 110%.

LQTY operates in a decentralized manner, with loans secured not only by the underlying collateral but also by the stability pool, which consists of LUSD and other borrowers. Liquity is an unsupervised, immutable protocol with no central authority, ensuring its decentralized nature.

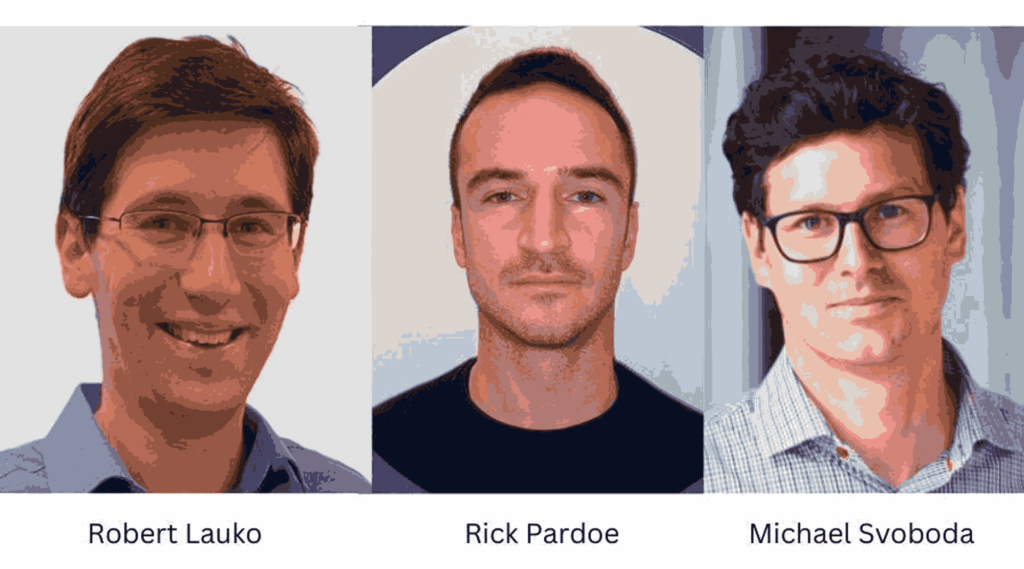

Who Are the Founders of LQTY?

LQTY was founded in 2019 by Robert Lauko and Rick Pardoe. Robert, who currently serves as the head of research at LQTY, is a researcher at DFINITY. With a background in physics and economics, Pardoe specializes in blockchain development for ETHDevs.com and currently holds the position of Lead Engineer at LQTY. Eighteen months after its launch, LQTY secured $8.4 million in funding in three rounds led by Pantera Capital and Polychain.

Currently, Liquity is led by CEO Michael Svoboda, who previously served as chief operating officer and managing director at several blockchain companies. Svoboda holds a Ph.D. in computer science and economics.

The purpose of creating Liquity was to provide a low-cost, interest-free smart contract in the form of loans to crypto users while providing LQTY incentives to those operating the system to ensure its effective functioning.

How Does LQTY work?

The operation of the LQTY platform is based on two token functions: LUSD and LQTY. The platform uses liability positions known as “troves”. Users can deposit LUSD into the stability pool, which is used to absorb debt from liquidations. When troves are liquidated, holders of LUSD in the stability pool receive a portion of the locked ETH as collateral, which can be redeemed. It’s important to note that there is a minimum debt of 2,000 LUSD to prevent spam of many small troves that could lead to increased gas fees.

LUSD – Stablecoin

LUSD is a stablecoin that can be exchanged for Ethereum at any time and in any amount. This stablecoin uses a soft peg mechanism to ensure USD parity, thus maintaining balance throughout the protocol, including the cost of borrowing for new debt. For example, when LUSD falls below the $1 target, it creates arbitrage opportunities as LUSD can be exchanged for $1 worth of ETH. An increase in redemptions lowers the loan rate, helping to moderate the supply of LUSD.

Liquity Token (LQTY)

The LQTY token is used to reward stability providers and incentivize front-end developers and early adopters. Users can earn rewards or a share of loan origination and redemption fees after depositing a certain amount of LUSD into the stability pool. LQTY does not require a minimum lock-up period and rewards are distributed on a pro-rata basis.

Features of LQTY

Borrowing

Users can borrow by opening a Trove and receive an interest-free loan. Borrowers pay only a one-time fee set by Liquity’s algorithm at a base rate plus 0.5%. The current base rate is 0.5%, although this may change over time. However, the total cost of the loan will never exceed 5%.

For example, if a borrower opens a Trove and deposits 5 ETH as collateral, they will receive a loan of 5,000 LUSD. It’s important to note that they will also be responsible for a one-time loan fee, currently estimated at 1%. This fee would be 50 LUSD. Finally, a liquidation reserve of 200 LUSD is added, bringing the total debt to 5,250 LUSD. However, since the $200 is just a reserve, the borrower only has to repay $5,050.

Stability Pool and Liquidation

The Stability Pool in LQTY ensures that the protocol remains stable and operates at peak efficiency. Its primary use is to cover debts incurred by liquidated accounts. The required amount of LUSD is removed from the pool to pay off the debt, and then the locked Ethereum is distributed proportionally to the stakers in the pool, known as “liquidation gains”.

Liquidation takes place in two scenarios: First, if a trove falls below the minimum collateral ratio of 110%. Second, when the system is in recovery mode. Owners of liquidated troves are allowed to keep the LUSD they borrowed, but they will suffer a loss because they won’t get their collateral back.

💡 The recovery mode ensures that the Liquity protocol works properly by requiring the supply of Ethereum collateral to be above 150% of the total network debt. If it falls below this amount, the system enters recovery mode.

Once the loans are repaid from the Stability Pool funds, the liquidation profits are distributed to the pool providers. Next, the tokens used to cover the Stability Pool debt are burned. Finally, the pool providers receive liquidation profits to offset the cost of the burned tokens.

Redemption and LUSD Price Stability

A unique feature of Liquity is that LUSD token holders can exchange their LUSD stablecoins for Ethereum. For example, $10 in LUSD can be exchanged for the equivalent of $10 in ETH. This exchange system involves a fee, which can vary but is generally around 1%. To provide the necessary ETH, the Liquity protocol uses LUSD tokens to pay troves with the lowest collateral ratios.

The LUSD itself is priced between $1 and $1.10. If it goes above this range, LUSD holders can exchange it for ETH, which helps drive the price back toward $1. Conversely, if the LUSD price falls below $1, users can also arbitrage for a profit. This system ensures that the price consistently moves towards $1 without needing a hard peg.

LQTY Tokenomics

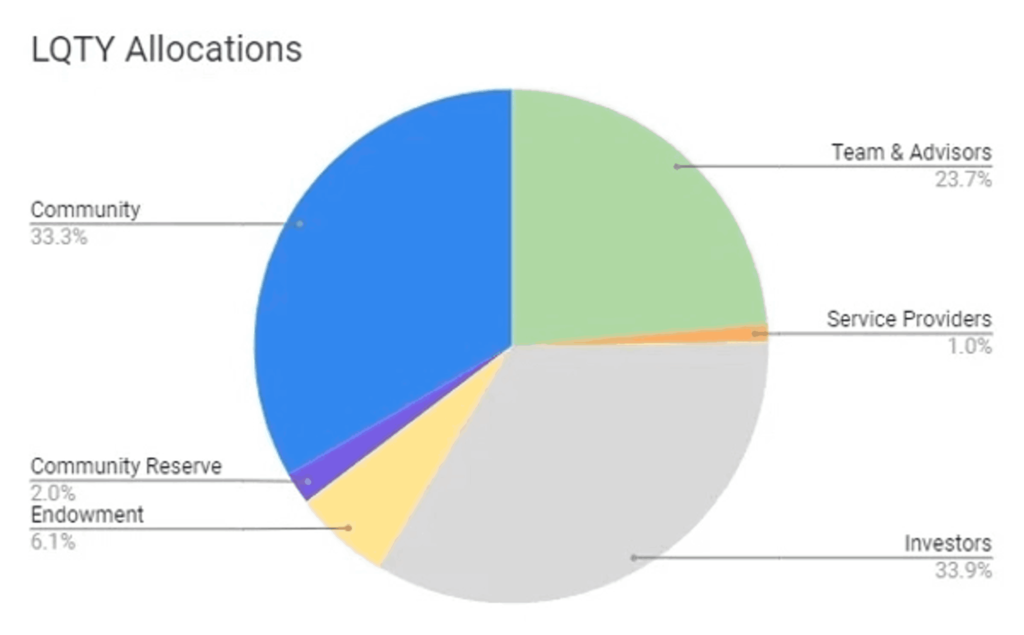

LQTY serves as a secondary token for the Liquity protocol. It has a maximum supply of 100 million coins, with a current circulation of approximately 94,588,299. LQTY’s price reached its all-time high of $146.94 on its launch date, April 5, 2021. At its launch, approximately 33.9% of the total LQTY tokens were distributed to investors, 33.3% to the community, approximately 23.7% to the team and advisors, 6.1% to the Liquity AG Endowment, 2% to the Community Reserve, and 1% to service providers. The LQTY tokens distributed to the community were an exception, as all remaining LQTY tokens had to be locked for one year.

Conclusion

Liquity (LQTY) was founded by Robert Lauko and Rick Pardoe in 2019 as a decentralized lending protocol. The protocol enables users to borrow LUSD, a stablecoin pegged to the USD, by using Ethereum as collateral with a minimum collateral ratio of 110%. No interest is charged for these loans. Users can also participate in the Stability Pool to absorb debt created by liquidated accounts and earn rewards in ETH. Serving as the protocol’s token, LQTY incentivizes stability providers and front-end developers with a proportionally distributed reward system. LQTY is distinguished by its offering of interest-free loans, its redemption feature that helps maintain LUSD price stability, and its fully decentralized, censorship-resistant protocol. Currently led by CEO Michael Svoboda, the protocol has received significant funding, highlighting its potential within the blockchain and decentralized finance ecosystems.

How to Buy LQTY on Pintu

You can start investing in LQTY by buying it on the Pintu app. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for LQTY.

- Click buy and fill in the amount you want.

- Now you have LQTY!

In addition to LQTY, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate transactions. Download the Pintu app on the Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- LinG, What is Liquity? Everything you need to know about LQTY, coin98, accessed on 13 December 2023.

- Liquity, Meet the team, accessed on 13 December 2023.

- Bybit, Liquity (LQTY): The Rising Decentralized Borrowing Protocol, learn.bybit, accessed on 13 December 2023.

- Coincdx, What is Liquity Token?, accessed on 13 December 2023.

Share

Related Article

See Assets in This Article

ETH Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-