What is Market Cap in Cryptocurrency?

The cryptocurrency market is currently worth almost $1 trillion US dollars. In this figure, there are various sectors with various crypto projects that have different functions and roles. Moreover, there are now thousands of crypto assets in the industry. Market cap is one way for investors to measure each crypto asset and see its position in the industry. This article will explain the definition of market cap, its function, and also its classification.

Article Summary

- ️⚖️ Crypto market cap is a measure to see a crypto project’s value and valuation. It counts the number of tokens currently in circulation and the price of each token (the price of tokens X the number of tokens in circulation).

- 🪙 Market capitalization is used as an indicator of the dominance and popularity of a crypto asset. In general, the higher the market capitalization of a cryptocurrency, the more dominant the asset is in the market.

- ️🗒️ The crypto market cap is divided into several classifications, namely low-cap, mid-cap, and large-cap which are divided based on the number of each crypto project.

- 🧠 Various investors make use of market cap classification to create investment strategies in crypto. This strategy utilizes the characteristics of assets in each market cap category to balance potential profit and risk

What is Market Cap?

Crypto market cap is a measure to see a crypto project’s value and valuation. It calculates the number of tokens currently in circulation and the price of each token (the price of tokens X number of tokens in circulation).

Market capitalization is used as an indicator of the dominance and popularity of a crypto asset. In general, the higher the market capitalization of a cryptocurrency, the more dominant it is in the market.

The calculation of market capitalization in cryptocurrencies is different from the market capitalization in the equities market. In equities, the market capitalization of a company is calculated by multiplying the market price of shares by the total number of shares outstanding. So, market capitalization is the price at which a company can be fully purchased.

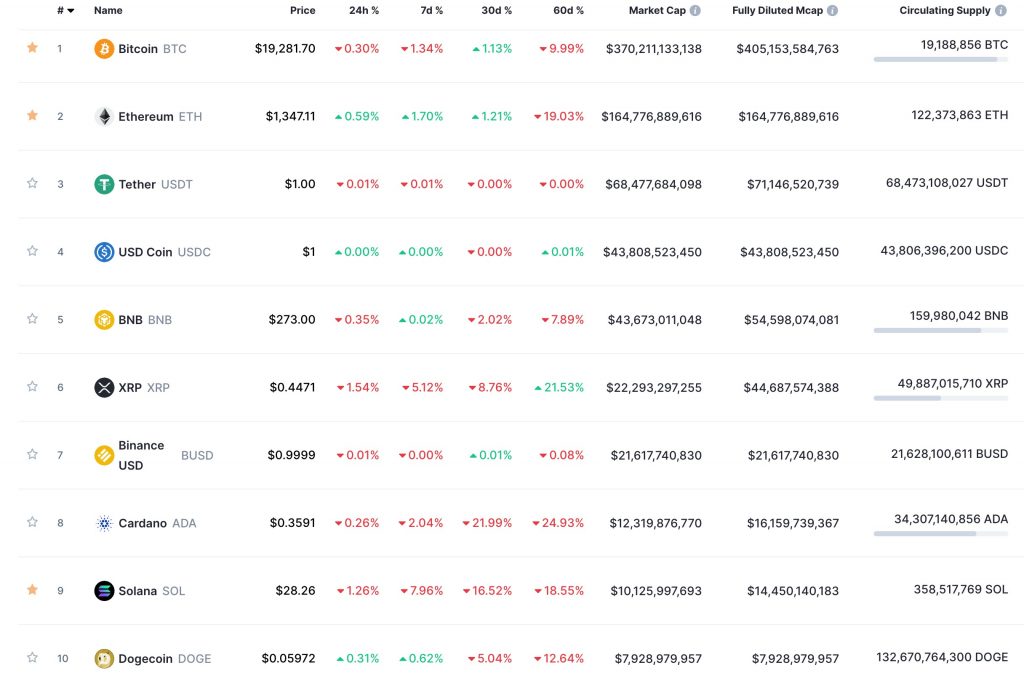

Currently, Bitcoin and Ethereum are the two crypto projects with the largest market caps of $370 billion and $164 billion US dollars. The market cap also reflects the price of both tokens at around $19k for BTC and $1.3k for ETH.

However, there is some debate about whether market capitalization can be used for all crypto projects. This occurs due to different factors in the fully diluted market cap (total value of crypto at today’s price assuming all its token is in circulation), the circulating supply in the market, projects with unlimited tokens, and tokens in treasury. So, some analysts argue that market capitalization calculations are sometimes imprecise.

How to Calculate Market Cap?

As previously mentioned, how to calculate the market cap is to multiply the price and the number of tokens in circulation. The formula for calculating the crypto market capitalization is token price X circulating supply.

💡 For example, the current price of Bitcoin is $19,283k and the circulating supply is 19,188,925. So, to find out the market cap of Bitcoin we have to calculate $19,283k X 19,188,925.

Most crypto exchanges like Pintu will provide market capitalization figures for each asset. You can also see them on sites like Coinmarketcap and CoinGecko.

Difference between Fully Diluted Value and Market Capitalization

Fully Diluted Value or FDV is the total value of a crypto project assuming all of its tokens are in circulation. It shows the maximum value of crypto. FDV is the Maximum supply of tokens X token price. FDV is very useful to see the value of a project if all of its tokens are in circulation.

The difference between market cap and FDV is related to time and potential. The market capitalization shows the current value and valuation of a project. Meanwhile, FDV is a future valuation of a project when all its tokens are in circulation (without considering demand).

Why Market Cap is Important?

- ️⚖️ Measuring the value and valuation of a crypto project: Market cap is important to see if the fundamental value of a project matches the indicated market cap. This valuation is also related to the usability, user activity, and adoption of a crypto project.

- 💰 Investment strategy: Market cap calculation is also useful for investment strategy. Investors will usually differentiate crypto projects based on the size of their market capitalization and invest in each category.

- 🧠 Comparing profit potential: Market cap is important because it relates to the potential profit you can get with a crypto asset. Crypto assets with a small market capitalization have greater potential than assets with a high market capitalization.

Market Cap Classification in Crypto

Low-Cap

Low-cap is a term for crypto assets with a fairly small market cap. Although there is no standard figure for determining market capitalization classification, a common reference for determining low-cap assets is if it’s below $1 billion US dollars. Projects in this category are usually less popular altcoins and rank below 50 in the rank.

Then, why do many people choose to invest in low-cap assets? The reason for investing in low-cap assets focuses on the potential profit to find the next Ethereum or Solana killer. Solana itself is ranked 112 with a market cap of $100 million dollars in January 2021 and now it sits as the 9th largest crypto. However, the risk of a low-cap asset is that it has high volatility and its price fluctuates greatly. In addition, there is also the high risk of failure (not all projects can become Solana).

Examples of small-cap crypto assets are GALA, RUNE, FTM, and LDO.

Most assets in a low-cap category are altcoins. Find out what is an altcoin in this article!

Mid-Cap

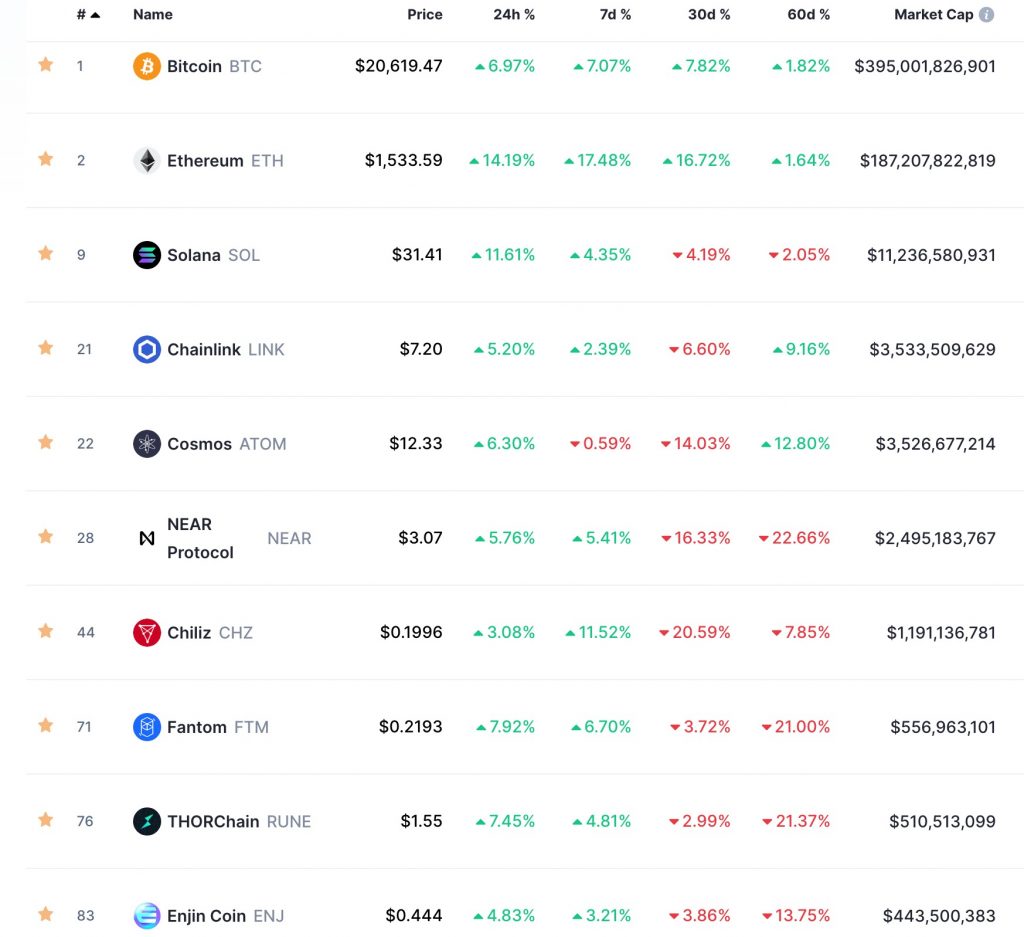

Mid-caps are crypto that has a medium market cap, between $1-10 billion US dollars. In market capitalization leaderboards, assets in this category usually rank between 11-50. Mid-cap assets are usually altcoins that are already quite popular among the crypto community. However, outside the crypto community, it is not widely known.

Many investors choose to invest in mid-cap crypto because it has the right balance in terms of potential profit and risk. Mid-cap assets typically experience more significant price increases than assets like Bitcoin. In a bull market, assets of this category can increase by hundreds of percent.

However, as with low-caps, there is a high risk of fluctuation in this category of altcoins (though not as high as low-caps). Examples of mid-cap crypto assets are MATIC, NEAR, ATOM, and LINK.

Large-Cap

Large-cap is a category of crypto with a high market capitalization, above $10 billion US dollars. Assets in this category usually rank in the top 10 by market capitalization. Large-cap crypto projects have usually been around for a long time (except Solana). Apart from that, they are already very popular among the crypto community and even with the general public.

Investing in large-cap crypto projects is highly recommended for novice investors because it has the lowest risk compared to the other categories (but still higher than other investment assets). Not only that, many institutional investors choose crypto in this category because it can provide more consistent returns in the long run.

Some crypto assets in this category can also be called blue-chip cryptos because they have such a huge dominance in the industry. These two blue-chip assets are BTC and ETH. Other examples of large-cap crypto assets are BNB, XRP, ADA, and SOL.

Using Market Cap To Determine Crypto Investment Strategy

First, you can use the Coinmarketcap and Coingecko sites as a reference for looking for market caps. Both sites are quite accurate and verify the token supply in circulation and the maximum number of tokens for a crypto project. In addition, Pintu’s market page also has complete information about the market cap of all assets registered at Pintu.

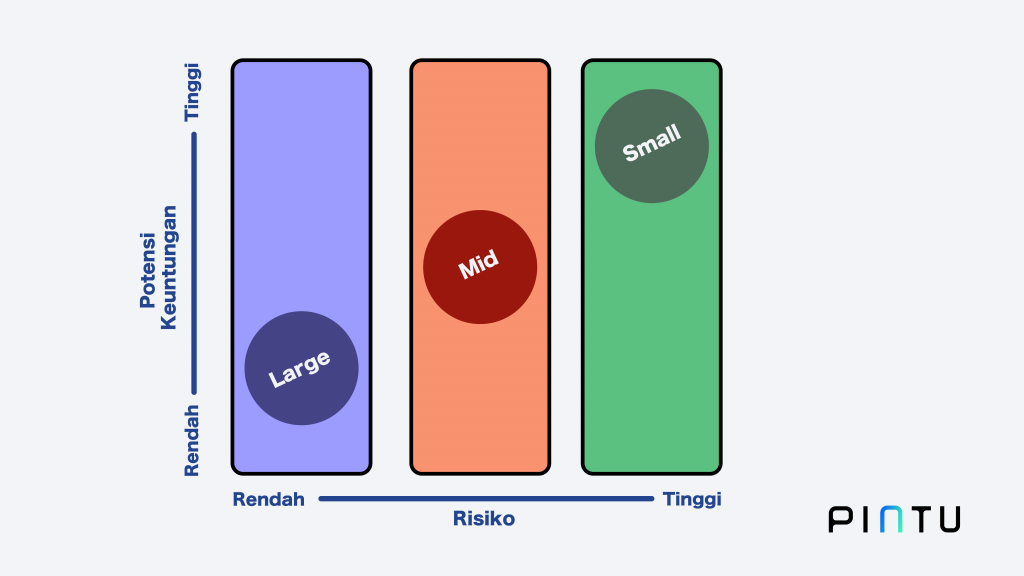

As explained in the previous section, market capitalization can be used for investment strategies by dividing by the market capitalization category. The image above gives us information about how market cap intersects with risk and potential profit. The bigger the market cap of a project, the smaller the potential profit. On the other hand, investment risk is inversely proportional to the market cap of an asset.

💡 Several altcoins experienced drastic gains in the 2021 bull market and managed to gain more than 1000%. Some of these assets are FTM, LUNA (RIP), SOL, SAND, and MATIC.

Basically, your profit potential is closely related to the market cap. For example, Bitcoin would have to hit a market cap of over 1 trillion (and find investors worth $700 billion dollars) for you to be able to make a profit of around 300% from the current price. This is something that is difficult to do. Meanwhile, achieving a 300% increase for a project with a market cap of $300 million dollars won’t be that difficult.

Lastly, we also need to consider the dynamics of the bull market and the bear market. In a bear market, assets with large market caps such as Ethereum and Bitcoin have less potential for losses because their price fluctuations will not be as large as altcoins with small market caps. This also applies vice versa, in a bull market assets with a large market cap will not increase as much as an altcoin with a small market cap.

How to Buy Cryptocurrencies at Pintu

You can start investing in cryptocurrencies by buying them in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto assets.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Rahul Nambiampurath, What Is Cryptocurrency Market Cap?, The Defiant, accessed on 20 October 2022.

- Kunal Goel, Analyst Note: Market Cap and FDV, Messari, accessed on 21 October 2022.

- Joel Agbo, What Is Fully Diluted Valuation (FDV) In Crypto?, CoinGecko, accessed on 25 October 2022.

- Daniel Phillips, Fully Diluted Valuation (FDV) — The Great Dilution Dilemma | Alexandria, Coinmarketcap, accessed on 26 October 2022.

- What are Large cap, Mid cap & Small cap coins in cryptocurrency?, Coin Guides, accessed on 26 October 2022.

Share