Understanding the SEC and Its Role in the Crypto Industry

The recent actions of the SEC have once again caused a stir in the crypto industry, as they have recently classified 68 crypto assets as securities. As a result, two major exchanges were sued for violating the law on securities. What exactly is the role of the SEC, and why has it been in contact with the crypto industry lately? Find out the full answer through the following article.

Article Summary

- 🏦 The SEC, or US Securities and Exchange Commission, is a United States federal government agency tasked with regulating and overseeing the securities market.

- 🚨 The SEC believes that at least 68 crypto assets meet the criteria as securities. Inevitably, the SEC feels it has a role to oversee and enforce SEC regulations on crypto assets and exchanges.

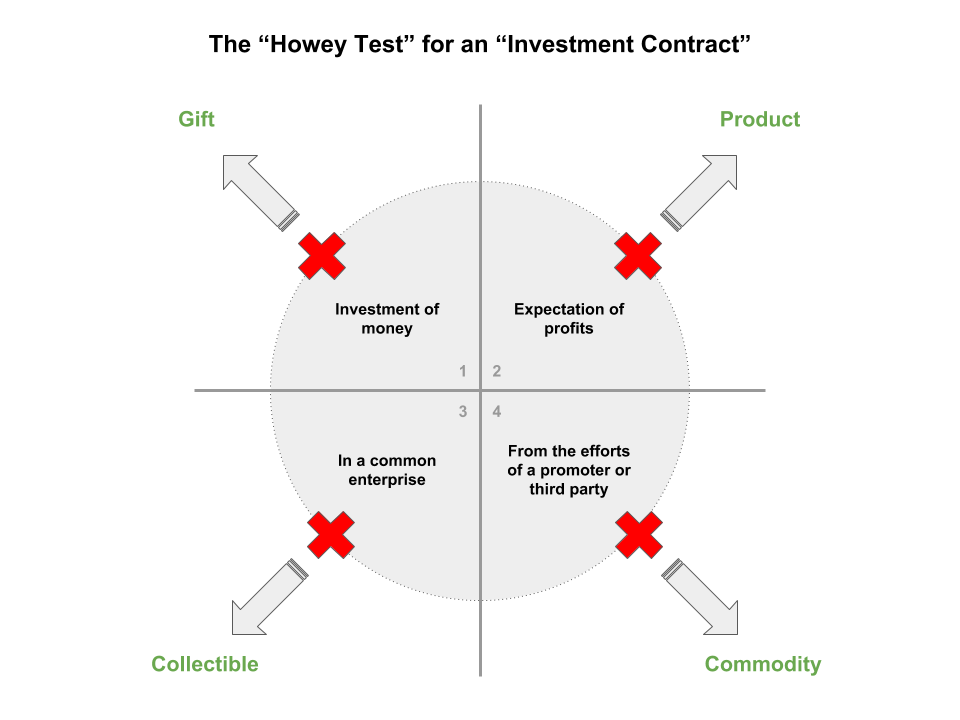

- 👁️ Crypto is considered a security because it meets the four criteria of the “Howey Test” used by the SEC. The four criteria are (1) an investment in money, (2) a public entity, (3) an expectation of profit, and (4) the profit comes from another identifiable party.

- ❌ However, many believe that the fourth criterion of the Howey Test cannot be applied to crypto assets. This is because of its decentralized nature, making it difficult to identify the third party that allows profits to be made.

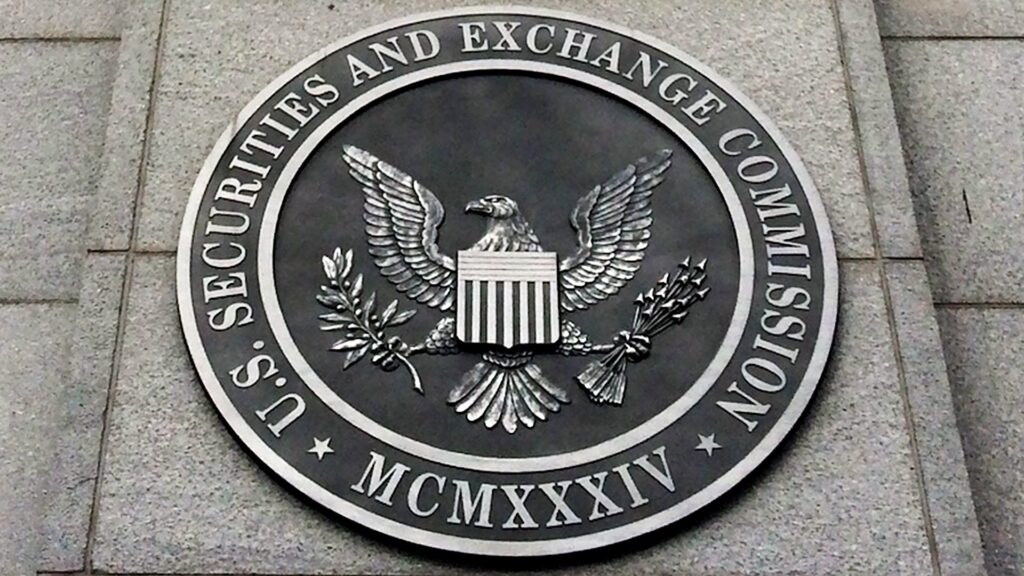

What is SEC?

The SEC or US Securities and Exchange Commission is an agency of the United States federal government that regulates and supervises securities markets such as stocks and bonds. The SEC was established in response to the US stock market crash in 1929 that kicked off “The Great Depression”. The main objectives of the SEC are to protect investors, maintain market fairness and efficiency, and facilitate capital formation.

However, the SEC has also begun actively overseeing the crypto industry in the last decade. The ultimate goal is to provide crypto investors with the same protections as they would for stock or bond investors.

SEC’s Role in The Crypto Industry

As previously stated, the SEC has taken on a more proactive role in regulating the crypto industry. One outcome of the SEC’s involvement in the crypto industry is the introduction of guidelines for Initial Coin Offerings (ICOs). The reason for the SEC issuing guidelines related to ICOs is the assumption that the new token offering can be classified as a securities offering. This makes the SEC feel that it has the jurisdictional authority to oversee and apply securities-related rules to ICO activities. Now the SEC also considers the majority of crypto assets classified as securities.

On the one hand, crypto industry players or the crypto community consider that crypto assets do not fall into the category of securities. They argue that crypto assets are more suitable as commodities. In this case, the SEC does not have the authority to supervise. Instead, they believe that the Commodity Futures Trading Commission (CFTC) should be responsible for regulating them as commodities.

This difference in views is often the cause of disputes between the SEC and crypto industry players. Most recently, the SEC has filed lawsuits against Binance and Coinbase, where it has identified up to 68 crypto assets as securities. Some crypto assets called securities have a large capitalization, including BNB, SOL, ADA, MATIC, ATOM, SAND, MANA, AXS, BUSD, and many more. Considering that The SEC’s legal actions against these major crypto exchanges, Binance and Coinbase, inevitably caused an uproar in the crypto industry.

Besides the SEC, the Fed’s policies could also impact the crypto industry. Check out the explanation here.

Are Crypto Assets Classified as Securities?

SEC Chairman Gary Gensler said that apart from Bitcoin, all other crypto assets are securities in an interview with NY Magazine in February. It’s important to note that Gary’s statement does not hold any legal authority, as the final determination lies with the jury during the trial. However, the precedent shows the attitude of Gary and the SEC, which seems unwilling to accommodate the crypto industry. The lawsuit against Binance and Coinbase seems to confirm this assumption.

At least 68 crypto assets are classified as securities for the SEC itself. The SEC uses the “Howey Test” method to determine whether an asset is classified as securities. In the Howey Test, there are four criteria, namely (1) investment in money, (2) a public entity, (3) there is an expectation of profit, and (4) profits are obtained from other parties that can be identified. The SEC will categorize the asset as securities if these four criteria are met.

For example, the following are reasons the SEC considers Solana tokens to be securities. First, SOL tokens have been sold through several ICO opportunities. Second, Solana Labs was allotted SOL tokens in the ICO process. Third, Solana Labs has made various statements suggesting profit opportunities for anyone who invests in SOL tokens. Fourth, SOL tokens can be staked, and any transaction fees from those profits will be burned. Fifth, the burn mechanism makes SOL tokens deflationary, so it is considered a profit expectation.

Learn more about Solana and its technology in this Pintu Academy article.

Responses from Crypto Industry Players

In light of the SEC’s claims, the Solana Foundation emphasized that SOLs are not securities. They welcome further engagement from the SEC to achieve legal clarity in the digital asset space.

"The Solana Foundation firmly believes that SOL is not securities. SOL is the native token of the Solana blockchain, a robust, open-source, community-based software project that relies on the decentralized user and developer engagement to thrive," the Solana Foundation said in a tweet on June 11, 2023.

Similarly, Input Output Global (IOG), one of the teams behind the creation of Cardano, emphasized that the SEC report contains various factual inaccuracies. They said that under no circumstances ADA is a security under US securities laws. Instead, IOG opened the door for relevant parties to collaborate to maintain the possibility of future blockchain innovation while still protecting consumers.

"This SEC lawsuit shows we still have a long way to go. Regulation through enforcement actions does not provide the clarity or certainty that the blockchain industry and consumers are entitled to," IOG said in its official statement.

The decision of the SEC to classify certain crypto assets as securities has raised concerns and skepticism within the crypto community. They question the SEC’s justification and reasoning behind this classification. They believed the fourth criteria in the Howey Test cannot be applied to crypto assets. This is because of the decentralized nature of crypto assets, making it difficult to identify third parties that allow profits to occur. In addition, they also assessed that the SEC’s regulations regarding digital assets seem unclear and inconsistent. This is believed to be unhelpful to crypto industry players and makes it difficult for them to seek guidance.

Crypto Industry Future

So what is the fate of the crypto industry going forward with this aggressive stance from the SEC? In the short term, the United States crypto industry landscape is the most affected. It is possible that there will be more delisting of tokens that are considered securities by the SEC. This step has already been taken by Robinhood which delisted SOL, ADA, and MATIC tokens. Meanwhile, crypto.com decided to close its institutional services in the US.

Given that the crypto industry is global, this move by the SEC will not affect the crypto industry landscape in other parts of the world. In fact, Hong Kong has recently continued to show its support for the development of the crypto industry. Most recently, one of Hong Kong’s legislators invited Coinbase to open their services in the country amid the problems with the SEC.

Actually, a similar lawsuit has also been filed by the SEC before. In 2020, the SEC sued Ripple Labs Inc for selling XRP tokens without registering them as securities. The SEC considers Ripple Labs to be raising money by selling XRP to investors and betting that the price will rise. As of this writing, the case is still continuing in court. This means that the latest lawsuit by the SEC has the same potential to drag on without clarity

In the long term, regardless of the trial’s outcome, at least there will be more transparent rules regarding the crypto industry. Therefore, it is hoped that the current dispute will be constructive for the development of the crypto industry in the future. Ultimately, transparency and clearer rules can make investors more confident in the crypto industry.

Pintu Academy has written an article about the future of crypto in Indonesia.

Conclusion

Looking at the SEC’s policy direction under the leadership of Gary Gensler, aggressive measures such as lawsuits are likely to continue. Crypto industry players in the United States will undoubtedly feel the real impact. Given the large crypto share in the United States, the global crypto industry will also feel the effect. However, this dispute is necessary to create a better crypto industry landscape in the future. In that case, we can remain optimistic and hope that a positive resolution will soon emerge from the conflict between the SEC and US crypto industry players, bringing about favorable outcomes for all parties involved.

Buy Crypto Aset Crypto in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Jody Godoy, What Makes a Crypto Asset a Security in The U.S.? Reuters, accessed on 12 June 2023.

Lydia Beyoud, Why the Crypto World Flinches When the SEC Calls Coins Securities, The Washington Post, accessed on 12 June 2023.

Rakesh Sharma, How SEC Regs Will Change Cryptocurrency Markets, Investopedia, accessed on 12 June 2023.

Katherine Ross, The SEC Allegations Against Binance: How Bad Is It? Blockworks, accessed on 12 June 2023.

Jesse Coghlan, SEC Lawsuits: 68 Cryptocurrencies are Now Seen as Securities by The SEC, accessed on 12 June 2023.

Andre Beganski, Solana, Cardano, Polygon Push Back Against SEC ‘Security’ Label, Decrypt, accessed on 12 June 2023.

Share

Related Article

See Assets in This Article

SOL Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-