What is WOO Network (WOO)?

Have you ever imagined a protocol that combines CeFi and DeFi services? Well, that’s exactly what WOO Network is achieving to ensure deep liquidity. With deep liquidity, WOO Network can offer competitive trading fees, even free. Want to know more about WOO Network? Read the full article below!

Article Summary

- 🌐 WOO Network is a protocol that combines CeFi and DeFi services to provide deeper liquidity for traders and exchanges.

- 🏦 The main products of the WOO Network are WOO X (exchange), WOOFi (DeFi platform), and WooTrade (specialized platform for institutions).

- 🪄 WOO Network’s advantages include abundant liquidity, Zero Fee Zone, high yielding Supercharger Vault, and diversified products.

- 🪙 WOO is the native token of WOO Network and is essential to their ecosystem. It is also used to access various services and participate in the governance of WOO Network.

What is WOO Network?

WOO Network is a protocol that has Centralized Finance (CeFi) and Decentralized Finance services to provide deep liquidity. Through the WOO Network, traders, institutional investors, exchanges, and DeFi platforms can easily access ample liquidity and trade at a low cost.

Kronos Research, a firm specializing in liquidity, is behind the birth of the WOO Network. Kronos Research co-founders Jack Tan and Mark Pimentel started developing WOO Network in 2019.

Besides providing liquidity access, WOO Network provides spot or futures trading services with various features. WOO Network’s main products are an exchange called WOO X, a DeFi platform called WOOFi, and WOOTrade, a specialized platform for institutions. WOO Network works with major institutions and protocols, such as NEAR, Binance, 1Inch, Dodo, and Oneboat Capital.

Learn more about the differences between CeFi and DeFi through this Pintu Academy article.

How WOO Network Works

WOO Network aggregates liquidity from various sources, including CEX, DEX, and market makers. It works with Kronos Research to perform quantitative trading and hedging tactics in aggregating and combining liquidity. This is what gives them its deep liquidity pool.

Quantitative trading is a trading algorithm that uses mathematical and statistical models to identify trading opportunities. After entering mathematical computations and specific parameters, they develop a computer program that applies the model to historical market data. The model is then backtested and optimized.

Every transaction and order on CeFi or DeFi will be routed back to the WOO Network to execute existing orders. Users can get the most competitive prices for their trades by always being connected to a deep liquidity pool. As for institutions or exchanges, it allows them to improve the depth of their order book and reduce their trading costs.

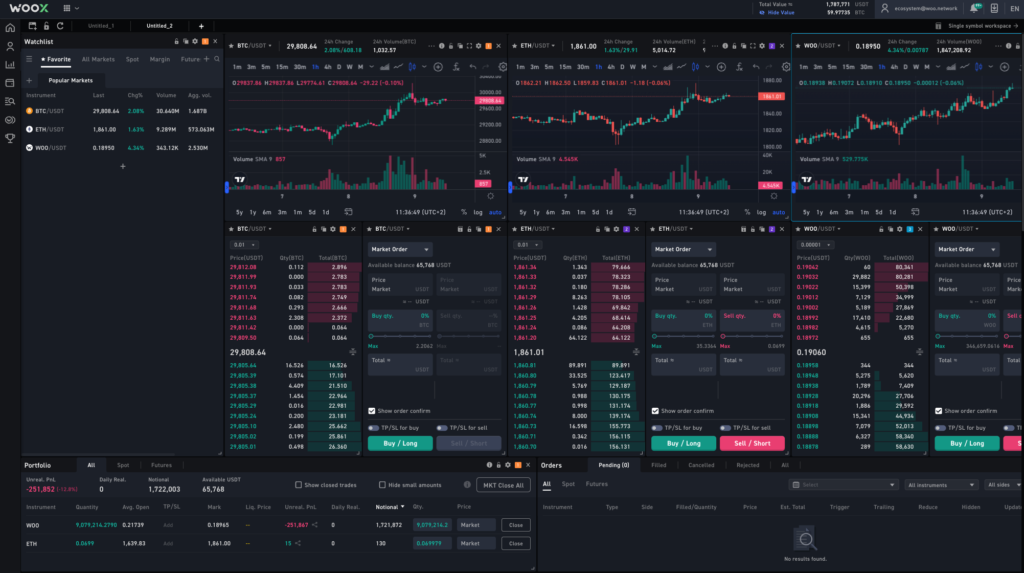

WOO X

WOO X is a centralized exchange (CEX) platform that provides deep liquidity and optimal trade execution. In addition to spot trading, users can also do margin and futures trading. Another advantage of WOO X is that the user workspace is customizable and can be modified.

In terms of features, WOO X presents a transparency dashboard that displays proof of reserves and liabilities in real-time. Thus, users can know where the funds are stored. There is also an execution quality analytics dashboard that allows users to compare trading fees from different platforms.

WOO X has very low trading fees. It can even be free for some crypto asset pairs when users stake their WOO tokens.

WOOFi

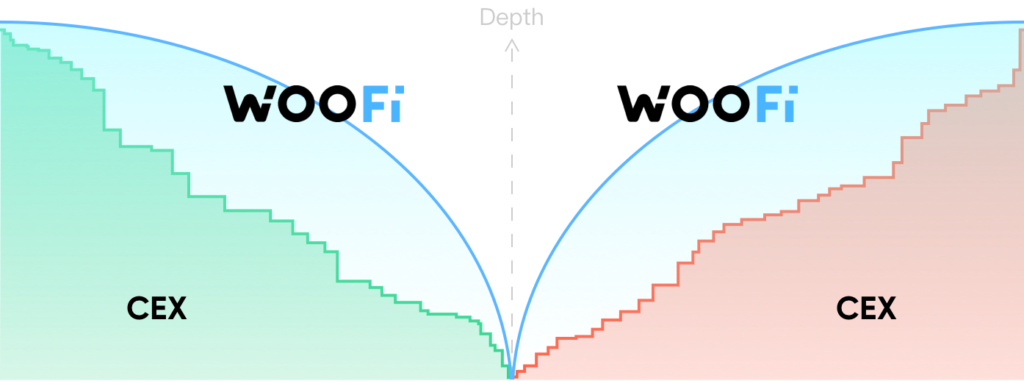

WOOFi is a decentralized exchange (DEX) platform that bridges the deep liquidity of CEX through on-chain. This enables DeFi traders to swap large amounts and maximize profits through the lowest swap fees and minimal slippage. It also supports cross-chain swaps so users can move their assets quickly and cheaply across ten supported chains.

The swap mechanism in WooFi uses a market-making algorithm called Synthetic Proactive Market Making (sPMM). In simple terms, the algorithm enables the simulation of CEX order books on DEX liquidity pools. With sPMM, market makers can simulate the price, spread, and depth of the order book on CEX's on-chain.

Other features WOOFi offers include revenue sharing of 80% of swap fees through WOO staking. Despite being a DEX, WOOFi also has a perpetual trading feature. This means users can enjoy the CeFi trading experience while still having control over their funds, as WOOFi is non-custodial.

Cross-Chain Swaps

WOO Network also has a cross-chain swaps feature that allows users to switch chains with just one click. This is done by integrating LayerZero’s cross-chain messaging and Stargate’s liquidity. WOOFi cross-swap router contracts will wrap multiple cross-chain swaps into one. As a result, the entire process is abstracted away from the user.

The cross-chain swap transaction on the WOO Network is as follows:

- Swap asset A in the user’s wallet to asset B in WOOFi on the source chain

- Bridge asset B to asset C on the destination chain via Stargate (asset B and asset C are of the same value)

- Swap asset C to asset D in WOOFi on the destination chain and send it to the wallet instructed by the user

Users only need to initiate and sign one transaction on the source chain (the chain the input token is on). Then, the output token will be delivered to the address designated by the user automatically. Users only need to pay the gas fee on the source chain once, which will cover the gas fee of the operations on the destination chain.

Pintu Academy has prepared a guide article on how to bridge crypto assets in the following article.

WOO Network Advantages

- Zero Fee Zone

WOO X offers a zero fee zone feature where users can buy or sell more than 60 mainstream tokens without any trading fees. This feature can be enjoyed for spot and spot margin (up to 5x leverage). Users can have unlimited access by staking 1800 WOO or more.

WOO X still has very competitive trading fees for users who cannot access the zero fee zone. For the spot market, trading fees for makers and takers start at 0.05%. While for perpetual swaps, fees start at 0.02% (maker) and 0.03% (taker).

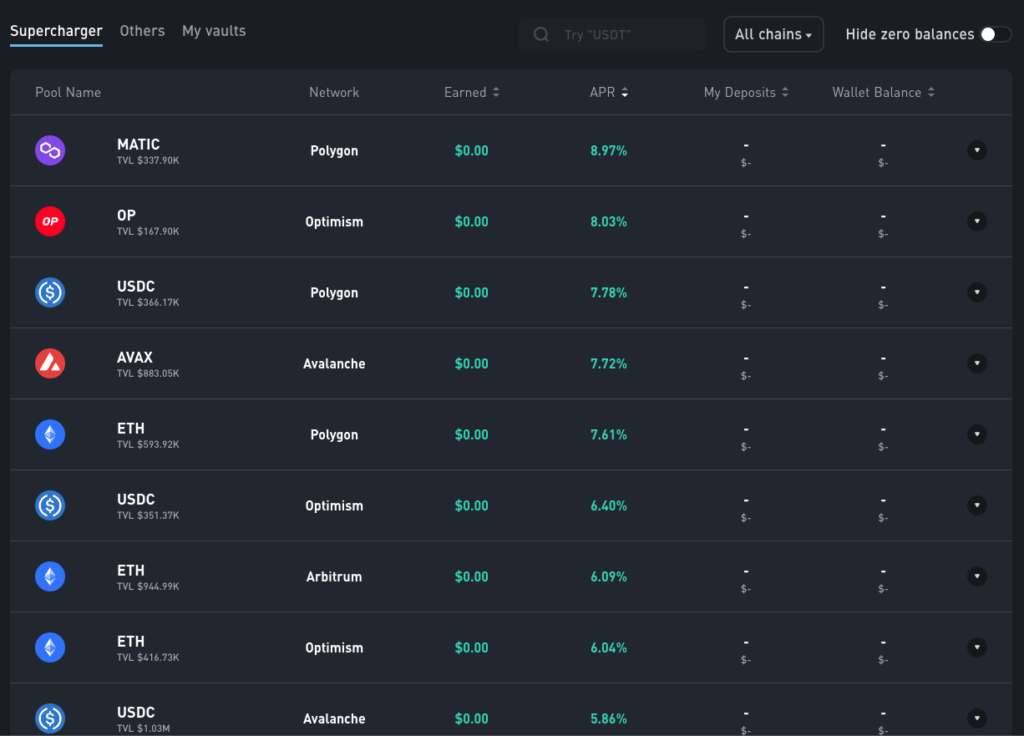

- WOOFi Supercharger Vault

WOOFi Supercharger vault is a product of WOOFi Earn, which provides large yields to users who become liquidity providers for WOOFi. By doing so, users will delegate liquidity management to the sPMM pool manager. As a result, users keep the exposure only to the tokens they deposit without worrying about impermanent loss.

Users will get rewards in the form of USDC or WOO. They can also get additional WOO by staking WOO tokens obtained from the WOOFi Supercharger vault.

Product and Service Diversification

WOO Network offers various products and services beyond spot trading and staking. These range from perpetual trading cross-chain swaps to specialized platforms for institutional services. This creates a rich ecosystem that meets the needs of traders, exchanges, and institutional investors.

Token WOO Network (WOO)

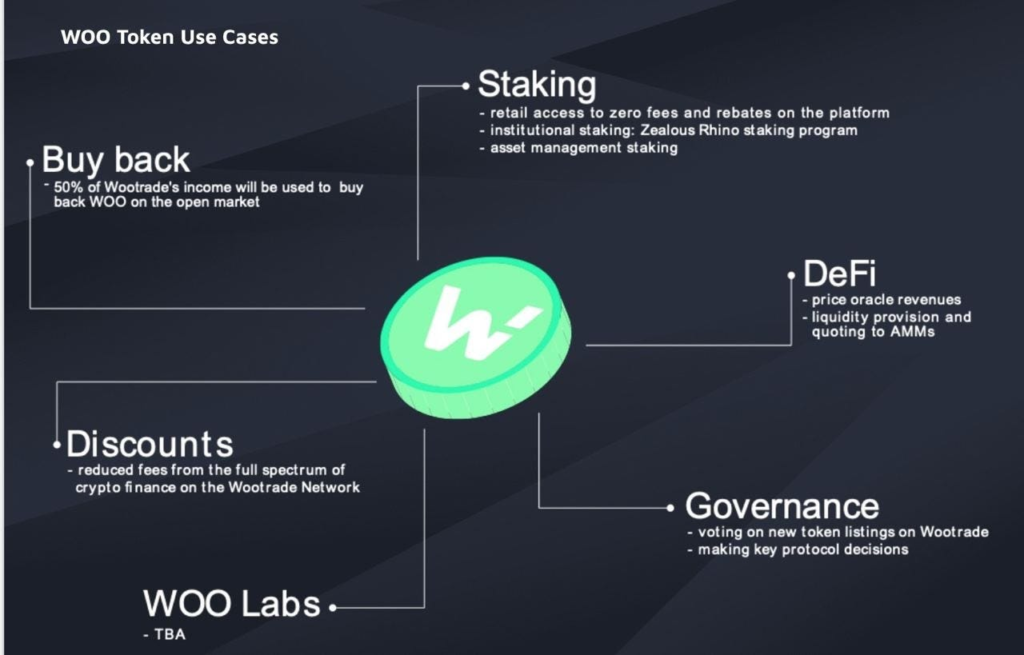

WOO is WOO Network’s native token that plays an important role in the their ecosystem. It serves to unite businesses and access all services on WOO Network’s CeFi and DeFi.

The WOO token has a supply of 3 billion, continuously decreasing monthly through the burns mechanism. The process will continue until the maximum supply is reduced by half. The total supply of WOO in circulation at the end of semester I-2023 was 1.71 billion WOO, equivalent to 76.7% of the total supply.

Users can stake WOO tokens to get various features such as Zero Free Zone, discounts on APIs and perpetual trading, and withdrawal bonuses. In addition, users can also participate in the governance of the WOO DAO. WOO token returns from staking can also be integrated with WOO Network’s DeFi to earn additional returns through yield farming, lending and borrowing.

Want to know the difference between yield farming and staking? Find out the answer here.

Conclusion

WOO Network is a protocol that provides CeFi and DeFi services focusing on providing deep liquidity. Through partnerships with major entities such as NEAR, Binance, and others, WOO Network combines liquidity from various sources such as CEX, DEX, and market makers. This ensures that users get the most competitive prices for their trades.

WOO Network’s main products are WOO X (exchange platform), WOOFi (DeFi platform), and WooTrade (for institutions). Some of it advantages are the zero fee zone and the WOOFi Supercharger Vault, which provides high yields for liquidity providers. WOO, the native token of WOO Network, has an important role in their ecosystem, allowing users to access various services and participate in governance.

How to Buy WOO Token on Pintu

You can start investing in WOO by buying it on the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for WOO.

- Click buy and fill in the amount you want.

- Now you have WOO as an asset!

You can safely and conveniently purchase other cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Woo Network, Introduction to WOO Network, accessed on 18 August 2023.

- Woo Network, Introducing the WOO X Zero Fee Zone, accessed on 18 August 2023.

- Blockchain Council, Everything You Need To Know About WOO Network (WOO), accessed on 18 August 2023.

- Rakesh Sharma, What Is Quantitative Trading? Definition, Examples, and Profit, Investopedia, accessed on 18 August 2023.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-