Here are 3 Altcoins That Could Face Major Liquidations This Week

Jakarta, Pintu News – The altcoin market in December is no longer recording large losses as it did last month. Currently, the market movement is starting to enter the consolidation phase or move flat.

A number of altcoins with special triggers and positive news flow have prompted many derivatives traders to take positions that tend to be one-way.

However, this week will also be characterized by several important macroeconomic events. These events could increase the risk of significant liquidation of positions.

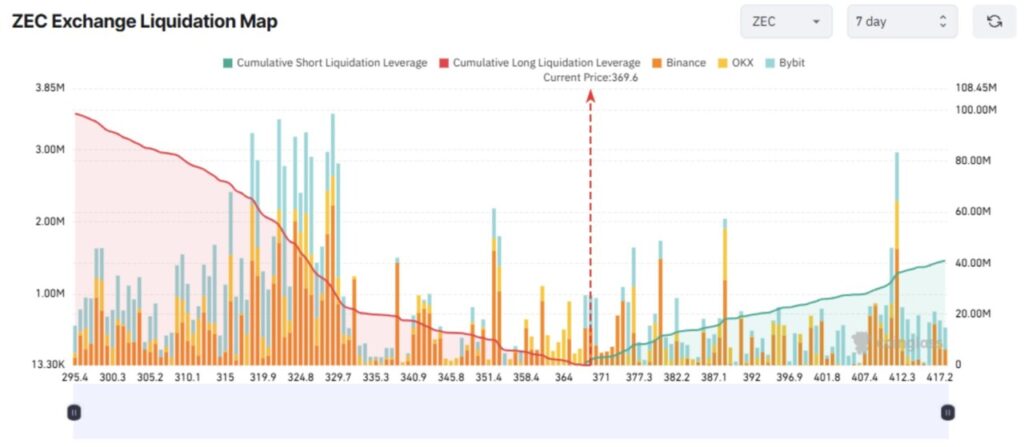

Zcash (ZEC)

Since hitting an all-time high of $748 last month, the price of Zcash (ZEC) has dropped by 50%. Sharp declines like this often attract investors who feel they missed out on previous opportunities.

Read also: Real World Assets (RWA) Tokenization Narrative Potentially the Main Driver in 2026

This sentiment prompted derivatives traders to speculate on a price bounce in December. As a result, the volume of liquidation of long positions increased sharply.

Traders also have an additional reason to go long. Zcash founder Zooko Wilcox is scheduled to attend a discussion hosted by the SEC on December 15, which will cover the topics of crypto, financial oversight, and privacy. Investors expect his presence to strengthen support for privacy coins like ZEC.

However, if long positions are taken without a clear stop-loss strategy and overconfidence, long traders risk liquidation of up to $98 million if ZEC prices fall close to $295 this week.

Analysis from the BeInCrypto page shows that ZEC is still in a long-term downtrend after previously experiencing a price surge due to FOMO. Technically, the current ZEC price movement still resembles a bubble pattern.

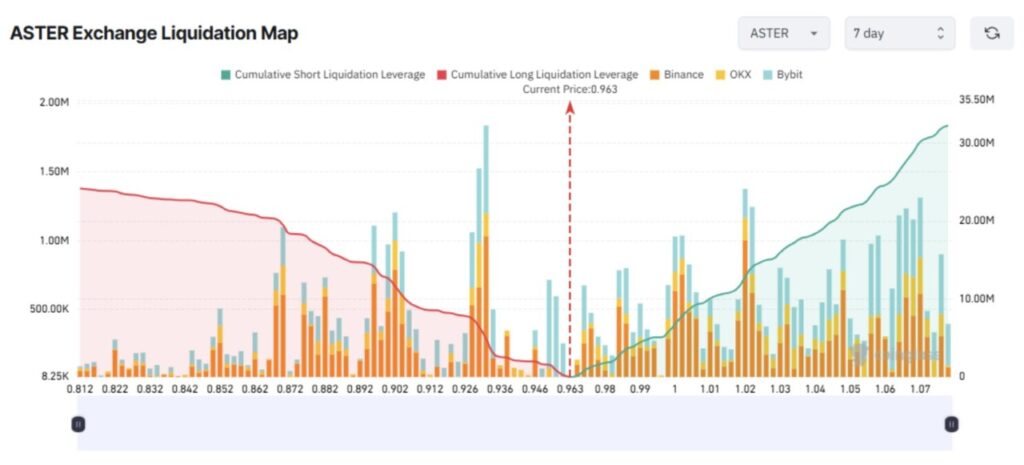

Aster (ASTER)

Aster (ASTER), one of the leading DEX derivatives on the BNB Chain network, enjoyed a surge in trading activity during the Perpetual DEX boom in September. But since then, the price of ASTER has fallen by more than 60% and is now moving below the $1 level.

The liquidation map shows that the volume of active liquidation of Short positions is greater than that of Long positions. Even so, Short sellers remain at significant risk this week.

Recently, Aster announced an accelerated buyback program, starting on December 8, 2025. The daily buyback pace has now increased to approximately $4 million per day, up from $3 million previously.

This development could be a positive catalyst for ASTER’s price increase in the near future. If the price rises to $1.07, the total liquidation volume of Short positions is expected to exceed $32 million.

Technically, the analysts also noted that ASTER’s price has touched a strong support zone and managed to break the downtrend line of the past one month.

Read also: 10 Best Cloud Mining Sites in 2025

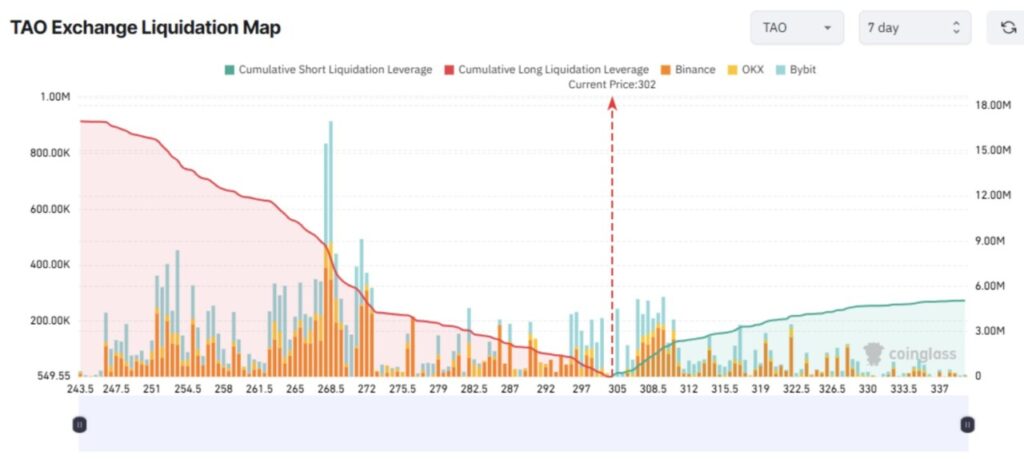

Bittensor (TAO)

The liquidation map for Bittensor (TAO) shows a significant imbalance. The volume of potential liquidations from Long positions is much larger than from the Short side.

If TAO’s price drops to $243.50, Long traders could incur losses of nearly $17 million. Conversely, if the price rises to $340, Short traders risk liquidation of around $5 million.

So, why do many traders go long? The majority of them anticipate a price increase ahead of the first halving of TAO.

According to the BeInCrypto page, around December 14, Bittensor will undergo its first halving, which will reduce the daily issuance amount from 7,200 TAO to 3,600, after the total supply reaches 10.5 million TAO.

“This reduction in supply will reduce emissions to network participants and increase TAO scarcity. Looking at Bitcoin’s history, supply reductions like this tend to strengthen the value of the network, even if rewards are reduced. In the previous four halvings, Bitcoin’s security and market value have steadily increased. Similarly, Bittensor’s first halving was an important milestone in the network maturing towards its total cap of 21 million tokens.” – Explanation from Grayscale.

This report from Grayscale also reinforced the bullish sentiment among long traders. However, without a disciplined stop-loss strategy, the “sell-the-news” effect could potentially trigger mass liquidation.

In addition, the second week of December also coincides with the interest rate announcement by the Federal Reserve. Historically, these decisions have a much greater impact on the markets than internal news from the crypto world.

Even if traders can guess the Fed’s policy direction, they are still at risk of extreme volatility that could trigger liquidation of both long and short positions.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. 3 Altcoins Face Major Liquidation Risks in the 2nd Week of December. Accessed on December 12, 2025