Bitcoin Falls to $86,000 — Is a Recovery on the Horizon?

Jakarta, Pintu News – Bitcoin (BTC) hovered around $89,800 on Dec. 15, while traders evaluated the market’s still-ranging conditions and new signals from companies.

This recovery came after prices dipped below $88,000, where buyers stepped in and absorbed liquidity, pushing prices back into balance.

Even so, the overall market is still showing a consolidation pattern, rather than a widespread trend movement. Therefore, market participants are keeping their eyes on specific price levels and derivative activities for clues as to the next direction.

Then, how will the Bitcoin price move today?

Bitcoin Price Drops 2.04% in 24 Hours

On December 16, 2025, Bitcoin was trading at $86,020, or approximately IDR 1,437,806,422 — marking a 2.04% drop over the past 24 hours. During this time, BTC hit a low of IDR 1,426,572,523 and reached a high of IDR 1,502,910,323.

At the time of writing, Bitcoin’s market capitalization is around IDR 28,611 trillion, while its 24-hour trading volume has declined by 8% to IDR 858.89 trillion.

Read also: Crypto Whale Buys Ethereum Massively, Signaling Asset Shift away from Bitcoin?

Range Structure Determines Direction in the Near Future

On the four-hour chart (15/12), Bitcoin is still moving in a wide horizontal range. The price bounced after touching the liquidity area below $88,000, indicating short-term demand strength.

However, this bounce was held below the descending upper trend line and the resistance area in the middle of the range. Thus, the momentum is not strong enough to move into an impulsive movement phase.

The nearest support is in the range of $89,000 to $89,300, which currently acts as a balance zone. If the price drops below this area, the $87,600 level becomes the next important point as it aligns with the 0.5 Fibonacci retracement and becomes the foundation of the range structure.

Missing this level could weaken the market formation and open up a potential drop to $85,950. Moreover, $83.880 is still the main defense on the downside for the bulls.

Meanwhile, resistance is layered above the current price. The $90,400 to $90,800 area is the zone where there is a tight cluster of EMAs and is the upper limit for any rally. Furthermore, the $92,700 level is the top of the range as well as the previous rejection zone.

In the event of a consistent four-hour candle close above that area, the market focus will likely shift towards the supply zone at $94,600.

Derivatives Data Shows Engagement, Not Excessive Euphoria

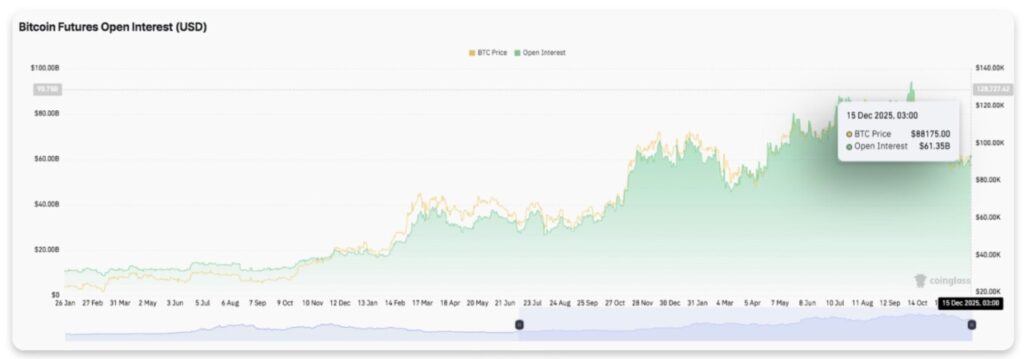

Open interest in Bitcoin futures contracts has continued to show an upward trend over time, reflecting deepening participation in the derivatives market. In the initial phase, the growth of open interest went hand in hand with the price increase, indicating a restrained use of leverage.

As Bitcoin enters higher price levels, open interest increases faster – signaling the formation of new positions, not massive exits.

During the correction phase, open interest briefly dropped, which reflected a leverage flush rather than signaling a trend break. More recently, open interest has held above $60 billion, while prices have stabilized around $88,000.

As such, traders appear to remain active but do not show excessive aggressiveness. High open interest without a sharp drop indicates balanced exposure and an increasing level of market maturity.

Read also: Spot XRP ETF Raises Nearly $1 Billion as Bitcoin and Ethereum ETFs Bleed!

Spot Flow and Corporate Signals Provide Contrast

Spot flow data showed a more cautious picture. Net exchange flows remained largely negative, with outflows consistently outpacing inflows. The short-term surge in inflows was short-lived, indicating that buying has not been done with high conviction.

This means that traders tend to focus more on managing risk near resistance areas, rather than making massive accumulations.

In addition, corporate activity is back in the spotlight after Strategy’s Chairman, Michael Saylor, shared an update regarding Bitcoin accumulation. Market participants widely regard signals like this as confirmation that buying has been completed.

Currently, Strategy is known to own around 660,000 Bitcoins, with a value close to $59 billion and an average purchase price of around $74,700.

Technical Outlook of Bitcoin Price

Key levels are still evident as Bitcoin moves in a broad consolidation pattern ahead of the next trading session.

On the upside (resistance), the $90,400-$90,800 area becomes the initial resistance cluster, followed by $92,700 as the upper limit of the range. In the event of a confirmed breakout above $92,700, the price movement could potentially continue towards the supply zone in the range of $94,600-$94,700.

Meanwhile, on the downside (support), the $89,000-$89,300 area serves as short-term balance support. If this level is broken, $87,600 becomes the critical level to defend. Failure to maintain this level could open up the potential for further weakness to $85,950 and $83,880.

Technically, the price structure suggests that Bitcoin is undergoing range compression, which could be an early signal of volatility expansion. The momentum indicator is currently neutral, reflecting a lack of conviction on the part of both buyers and sellers.

Will Bitcoin Price Rise?

The outlook for Bitcoin’s price movement depends on whether buyers are able to defend the $87,600 level and reclaim $92,700. If the buying strength continues and the price is able to hold above the resistance, bullish momentum could return, pushing the price to the upper limit of the range.

However, if the $87,600 level fails to hold, Bitcoin risks a deeper drop to the lower support zone. For now, Bitcoin is at a tipping point, and its next direction will likely be determined by a breakout from the current range.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinEdition. Bitcoin Price Prediction: BTC Consolidates Near $90,000 as Traders Await Directional Break. Accessed on December 16, 2025