3 On-Chain Indicators That Indicate Bitcoin Whales Have Started Buying Assets

Jakarta, Pintu News – Widespread speculation about massive accumulation by Bitcoin (BTC) whales appears to have been exaggerated. According to onchain data from CryptoQuant, the market structure of this digital asset has not undergone any significant material changes. Further analysis shows that the activity perceived as accumulation by whales is actually influenced more by exchange activity than true investor behavior.

Data Distortion by Exchange Activity

Julio Moreno, head of research at CryptoQuant, revealed that much of the publicly shared whale accumulation data is actually distorted by exchange activity. Crypto exchanges often consolidate funds from many small wallets into a few large wallets for operational and regulatory reasons.

This process artificially increases the number of wallets holding large balances, which are then misclassified as accumulation by the whales. When these exchange-related distortions are filtered out, the data shows that large holders are actually still distributing Bitcoin (BTC) rather than accumulating it. This indicates that whales’ overall balances continue to decline, with the same trend also seen for addresses holding 100 to 1,000 BTC.

Also read: RWA Momentum Strengthens, Solana Starts 2026 with Positive Sentiment!

Effect of ETFs and Market Structure

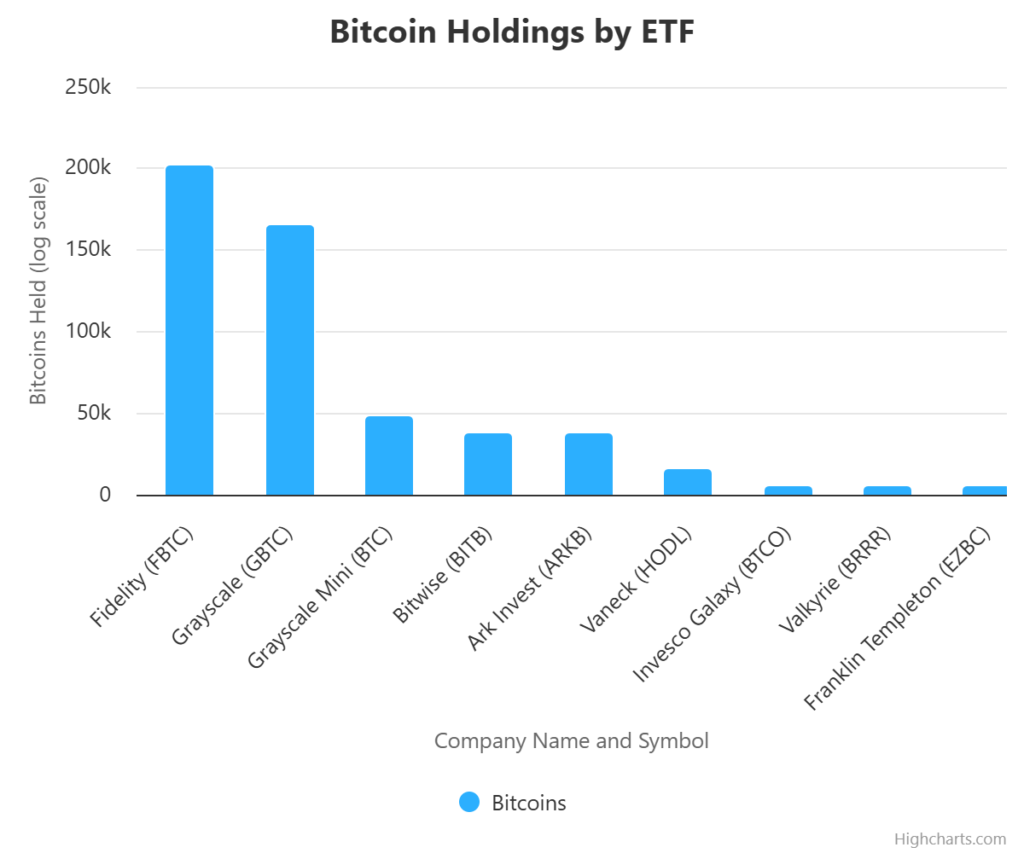

Since the launch of spot Bitcoin (BTC) ETFs in the US in early 2024, the market structure has undergone a shift. These ETFs have emerged as major digital asset holders, changing market dynamics. While large transactions by whales often influence market prices and volatility, recent data suggests that they no longer act as net accumulators.

The drop in balances among addresses with 100 to 1,000 BTC also indicates an outflow from exchange-traded funds. This indicates a significant change in the way these digital assets are held and managed at scale.

Also read: MiCA Regulation 2026: What is the Fate of Bitcoin (BTC) and DeFi?

Role of the Long-Term Holder

On the other hand, onchain data shows a more constructive shift among long-term holders of Bitcoin (BTC). Matthew Sigel, head of digital asset research at VanEck, stated that long-term holders have become net accumulators over the past 30 days. This follows the largest selling event by this group since 2019.

This change suggests that one of the biggest sources of selling pressure against Bitcoin (BTC) recently may be starting to ease. Although the price of Bitcoin (BTC) is yet to show a sustained recovery, the asset has also managed to avoid retesting the low below $80,000 that occurred in November.

Conclusion

While the popular narrative of massive accumulation by Bitcoin (BTC) whales has attracted much attention, more in-depth onchain data shows a different picture. A more accurate understanding of this activity is essential for interpreting the current market dynamics and potential future direction of Bitcoin (BTC).

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cointelegraph. Bitcoin whale accumulation overstated, long-term holders buy. Accessed on January 11, 2026

- Featured Image: Generated by AI