Bitwise’s Chainlink ETF Officially Debuts on NYSE Arca, Unlocking New Upside Potential

Jakarta, Pintu News – Crypto asset manager Bitwise has obtained approval to list its Chainlink ETF on NYSE Arca under the trading code “CLNK”.

The spot-based Chainlink ETF will provide investors with direct exposure to LINK assets, with the launch expected to take place this week. In the past week, the price of Chainlink has risen by more than 11%.

Bitwise’s Chainlink Spot ETF Officially Gets Approval

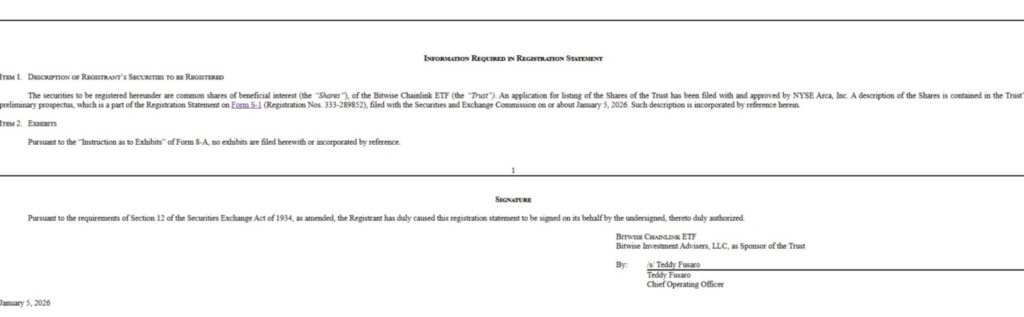

Crypto asset manager with around $15 billion under management, Bitwise, has filed a Form 8-A for the Chainlink Spot ETF with the US Securities and Exchange Commission (SEC) on January 5. In the latest filing, Bitwise has also obtained approval from the NYSE Arca exchange to list the Chainlink ETF under the trading code CLNK.

Read also: Top 3 Crypto Price Predictions: Dogecoin, Cardano, and Chainlink Ready for a Big Jump?

In addition, Bitwise extended the management fee waiver period for total assets of up to $500 million, from one month to three months. Bitwise Investment Manager LLC was appointed to purchase $2.5 million worth of initial units of the ETF, equivalent to 100,000 shares at $25 per share.

Bitwise also mentions LINK staking as a secondary investment objective, although implementation details are yet to be announced. If the staking feature is enabled in the future, this ETF expresses a preference for Attestant Ltd as the staking agent.

The Chainlink Bitwise ETF has a management fee of 0.34%. Coinbase Custody will serve as the custodian of crypto assets, while BNY Mellon is appointed as the cash custodian.

LINK Price Strengthens as Grayscale ETF Inflows

On Monday (Jan 5), Grayscale’s Chainlink ETF (GLNK) recorded an inflow of $2.24 million. Cumulatively, total inflows have reached $62.22 million, with total assets under management (AUM) exceeding $87 million.

Read also: Grayscale Shares Ethereum Staking Yield Amid Positive Crypto ETF Inflows

Grayscale also previously implemented a management fee waiver of 0.35% for three months until AUM hits $1 billion. On the other hand, the launch of the Chainlink ETF from Bitwise is considered to have the potential to provide an additional boost to the price of LINK.

As of January 6, LINK’s price rose by more than 2% and extended its weekly gain to more than 11%. On Tuesday, LINK briefly traded in the range of $13.86, with a daily low of $13.41 and a high of $14.11.

In addition to price movements, LINK’s trading volume surged by nearly 45% in the past 24 hours, reflecting increased trader interest amid the overall positive sentiment of the crypto market.

Data from CoinGlass also shows increased buying activity in the derivatives market. The total open interest of LINK futures contracts rose by almost 2% to $665.46 million in the last 24 hours (6/1).

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Bitwise Spot Chainlink ETF Gains Approval to List CLNK on NYSE Arca. Accessed on January 7, 2026

- Coinpedia. Bitwise Chainlink ETF Approved for NYSE Arca Listing Under CLNK Ticker. Accessed on January 7, 2026