Bitcoin (BTC) Nears $100,000 — Is a New All-Time High Coming? Tom Lee Weighs In

Jakarta, Pintu News – Bitcoin is finally showing a continuation of positive movement. The price has broken above the $95,000 zone and is still holding at that level as of this report, up about 3.8% on January 14 and about 6.5% in the last 30 days. This strength is starting to change market sentiment.

As momentum builds and important resistance levels approach, Tom Lee’s January prediction of a new record high begins to look less like speculation and more like technical analysis. However, there are still risks to be aware of!

Cup-and-Handle Pattern Breakout Aligns with Favorable On-Chain Supply

Bitcoin has confirmed the breakout from the cup-and-handle pattern, breaking the resistance level around $94,800 with strong transaction volume. This volume is important as it shows there is real demand supporting the breakout, not just thin liquidity pushing the price up. The measured movement of this pattern leads to the first upside target around $106,600.

Read also: Bitcoin Price Rises to $97,000 Today: Whales Are Accumulating, BTC Could Reach $100,000 Again?

However, before it can make any further upward projections, BTC needs to first reclaim the psychological level of $100,000 ($100,200 to be exact based on the chart). If this level is successfully crossed, Tom Lee’s predictions for the end of January could be back on track.

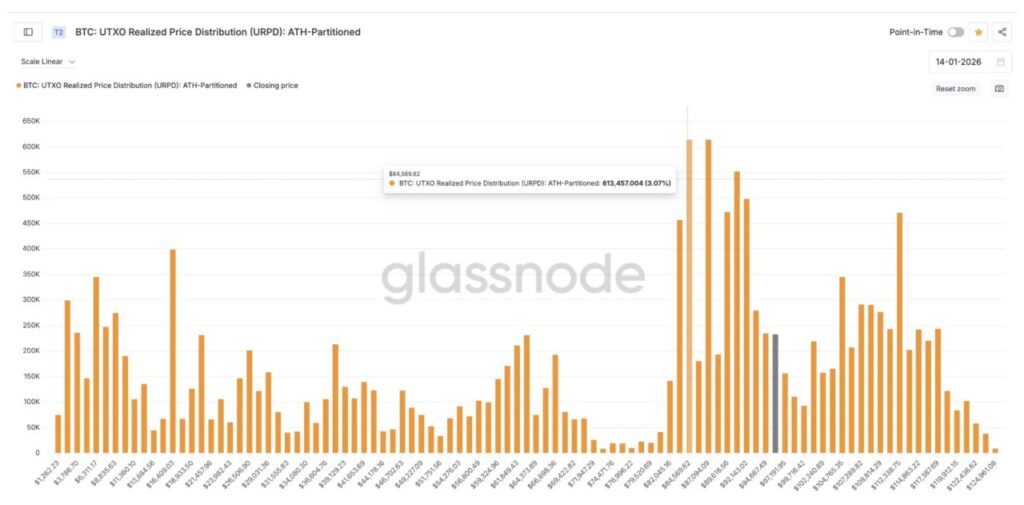

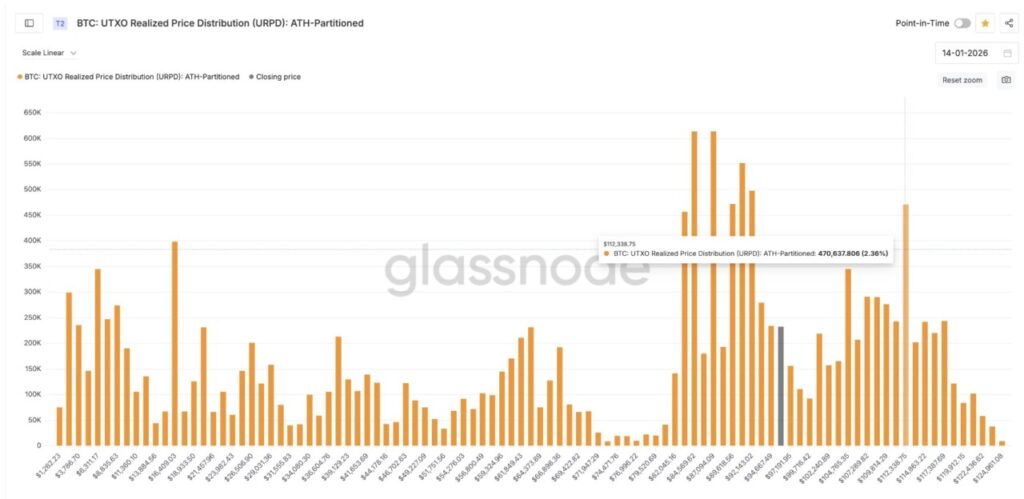

On-chain supply data further reinforces this scenario. The highest realized price cluster is currently below the current Bitcoin price, which means most BTC holders bought at a lower price and are now enjoying profits. This reduces selling pressure in the short term.

The combination of a bullish technical pattern and supportive on-chain data suggests that a price increase is not just a possibility, but rather reflects the strong market position of the players.

Whales Continue to Accumulate, Retailers Begin to Enter, but Leverage Risk Still Exists

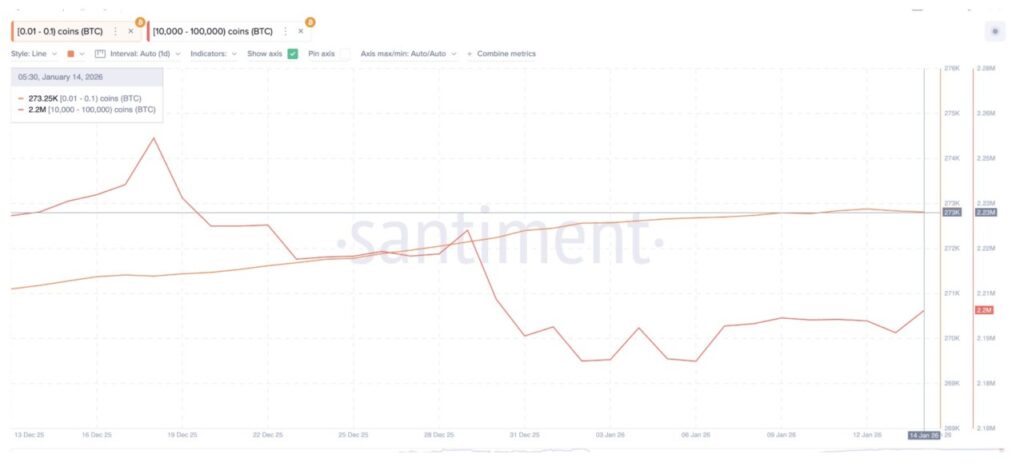

The current behavior of Bitcoin holders still supports the potential for price increases. Wallets holding between 10,000 and 100,000 BTC have continued to add to their holdings since January 2, rising from around 2.18 million BTC to around 2.20 million BTC. This silent accumulation shows the confidence of the whales.

What has changed recently is the behavior of retail investors. BTC’s rally in early January is likely to fizzle out as retailers sell when prices are strong.

But this time, retail wallets are starting to show positive signals. Since January 5, BTC holdings by small wallets (between 0.01 to 0.1 BTC) increased slightly, from around 273,080 BTC to 273,250 BTC. Although the increase is small, the direction of the movement is important – retailers are no longer selling as the price rises, which was previously the main obstacle to the price increase.

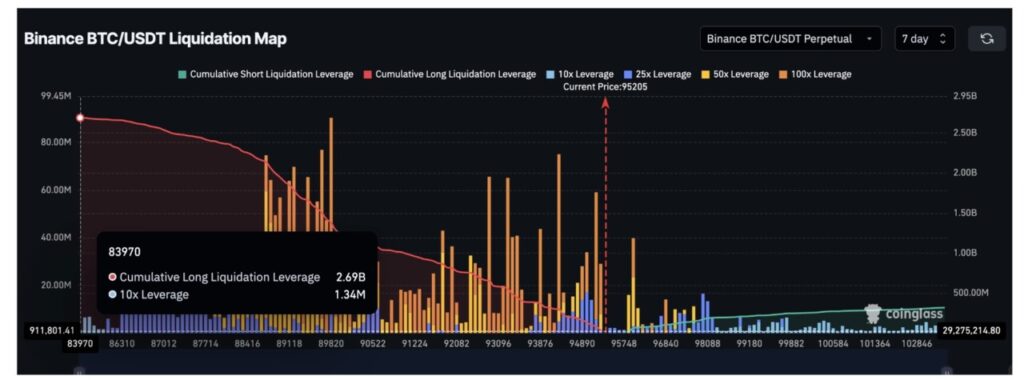

However, the main risk now comes from derivative positions. Exposure to long positions is still overwhelmingly dominant, with a long capitalization of around $2.69 billion, far exceeding short positions of only around $320 million. This imbalance of up to 9x creates potential vulnerability if BTC prices drop back below the breakout zone of the cup-and-handle pattern.

If BTC falls below $94,800, there could be a liquidation of long positions, which could push the price down to the low $90,000 range.

Read also: Solana Overtakes Ethereum in Perpetual Futures Volume – Is SOL Ready for $190?

Nevertheless, strong spot buying near the support level suggests that buyers are likely to come back in before the selling pressure due to leverage actually pushes the prices down further.

Bitcoin price levels that determine whether a new record will be reached

From this point, the structure of Bitcoin’s movement is quite clear. Keeping the price above the $94,500-$94,800 range (which is the breakout area of the cup-and-handle pattern) is crucial to maintaining this bullish pattern.

Ahead, there is the psychological level of $100,200, but the more important technical target remains at $106,600, which is the projection of the cup-and-handle pattern – this being the first major target.

If BTC prices can break that level and absorb selling pressure above $112,000 (a strong supply zone in the short term), the market will enter into a region with minimal historical resistance.

This is where accelerating towards the previous record high, around $126,200, becomes more realistic than theoretical.

Bitcoin doesn’t need perfect market conditions to keep rising. All it needs is to keep the breakout intact and continue to attract spot demand. If that happens, Tom Lee’s prediction of a new record at the end of January no longer looks bold, but rather a logical outcome of the current market structure.

Above the current level, the most significant supply zone is above $112,000. Once past this area, the realized supply is drastically reduced, making the path to the previous highs structurally smoother.

Conversely, if BTC drops below $94,500, the bullish structure could weaken. And if it falls below $91,600, selling pressure from the bearish market could return.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Price Prediction by Tom Lee for January. Accessed on January 15, 2026