Bitcoin Drops to $92,000 — Is This a New Buying Opportunity for BTC?

Jakarta, Pintu News – Bitcoin price has shown mild bearish pressure in recent sessions along with global market uncertainty and traders’ caution. BTC is struggling to establish strong upward momentum, but its price decline is still manageable.

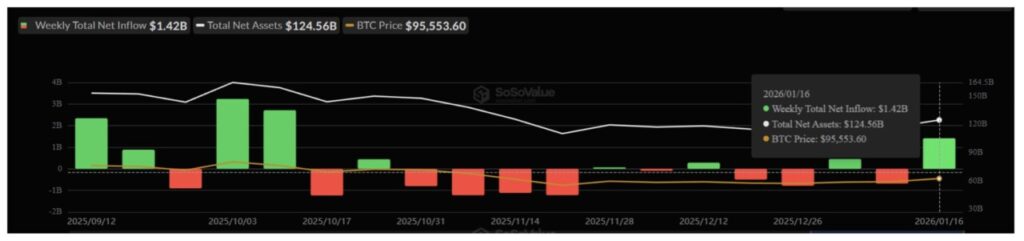

Interestingly, the high demand for spot Bitcoin ETFs indicates that investors’ positions may be shifting to a more positive outlook. So, how will Bitcoin price move today?

Bitcoin Price Drops 2.45% in 24 Hours

On January 19, 2026, Bitcoin was trading at $92,662, or approximately IDR 1,571,935,372 — marking a 2.45% decline over the past 24 hours. During this time, BTC hit a low of IDR 1,567,877,194 and a high of IDR 1,618,726,686.

At the time of writing, Bitcoin’s market capitalization is around IDR 31,262 trillion, while its 24-hour trading volume has surged by 89% to reach IDR 578.81 trillion.

Read also: Bitcoin Price Breaks $95,000, 3 Altcoins Draw Market Attention for Potential Rally

Bitcoin Shows Buy Signals

Bitcoin spot ETFs recorded inflows of $1.42 billion over the past week, the highest weekly total in three months. The spike reflects renewed institutional interest amid flat price movements. The last time there was a similar surge was in October 2025, when the ETF attracted $2.71 billion.

Such inflows often signal rising investor confidence. Capital going into ETFs usually reflects a long-term strategy, rather than short-term speculation. Current trends suggest that market participants are anticipating a rise in Bitcoin prices, reinforcing bullish sentiment despite short-term volatility and mixed macroeconomic signals.

Macro indicators also support a positive outlook. The Pi Cycle Top indicator, a historical tool to measure overheated Bitcoin market conditions, is currently showing a diverging pattern. It compares the 111-day simple moving average (SMA) with the 2×365-day SMA to identify cycle tops.

Currently, the two averages are moving further apart instead of closer together. This separation indicates that the market is not yetoverheated.

Historically, these conditions usually occur in the early to mid phase of a bull market with relatively low risk. This signal contrasts sharply with the market conditions when the sell signal appears, thus reinforcing the presence of an active buy signal.

BTC Price May Not Correct

Bitcoin price traded at around $95,173 on January 18, staying above the important $95,000 level. This zone has proven to be a strong support despite being tested several times, indicating that buying interest is still active.

Continued ETF inflows could provide the demand boost needed to lift prices from the current consolidation phase.

Read also: 3 Altcoins Targeted by Whales as Crypto Market Booms Again

If the bullish conviction continues, BTC could potentially climb back towards $98,000. This rise would also allow Bitcoin to reclaim its 200-day exponential moving average (200-EMA) which is around $95,986.

Breaking this level will restore bullish momentum and strengthen the chances of breaking the psychological threshold at $100,000.

However, risks remain. If investor sentiment changes or spot ETFs start registering fund outflows, this bullish structure could weaken. In that scenario, Bitcoin could lose support at $95,000. In the event of a decline, BTC risks dropping towards $93,471, which would mark renewed bearish pressure.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin ETFs Note $1.4 Billion Inflows This Week As Indicator Flashes Buy Signal. Accessed on January 19, 2026