Ripple (XRP) has a chance to reach US$5? Here’s the Price and Risk Analysis!

Jakarta, Pintu News – Ripple is back in the spotlight of the cryptocurrency market after successfully moving above an important support level and showing the potential for a continuation of the bullish trend. This price movement triggered the attention of market participants who considered XRP to be in a crucial technical phase to determine its next direction.

Ripple (XRP) Price Analysis

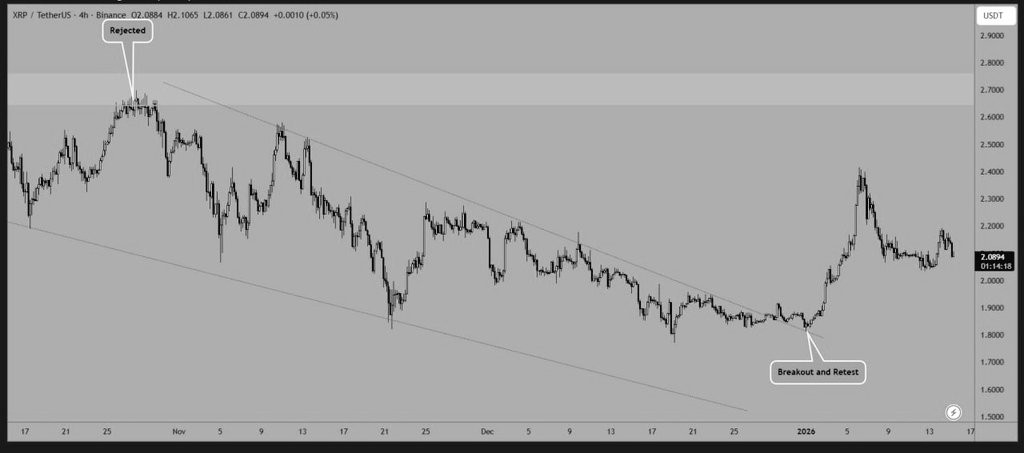

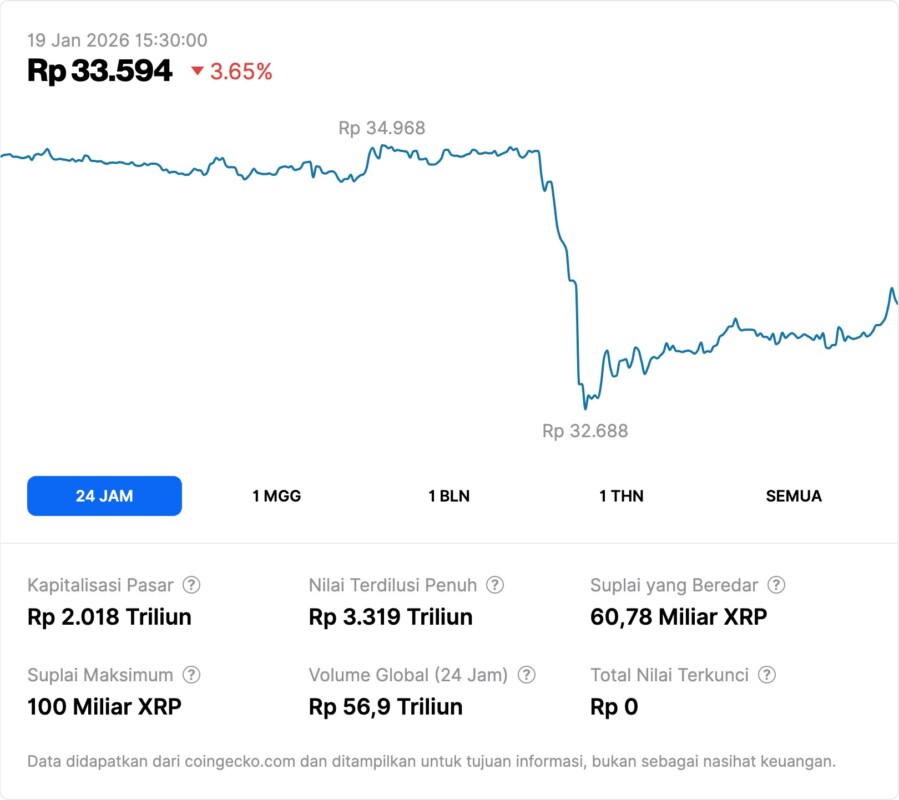

Ripple (XRP) recently broke out of its previous trading zone, signaling a strengthening buying momentum. Technically, the price structure shows a higher low pattern which is often associated with a medium-term uptrend. This condition opens up opportunities for XRP to continue rising if buying pressure is maintained.

If Ripple (XRP) is able to break and stay above the resistance level of around US$2.21, technical analysts think the room for improvement is still wide open. The next target is in the area of US$5, which represents a potential increase of about 126% from current levels. In that scenario, a US$1,000 investment could theoretically grow to around US$2,260, depending on market conditions and each investor’s risk management.

Also Read: 5 Realistic Ways to Earn 2 Million in a Day, Here’s the Secret!

Factors Supporting XRP Movement

One of the main factors underpinning the movement of Ripple (XRP) is the growing market interest in crypto assets with cross-border payment utility. Ripple is known as a project that focuses on the efficiency of global transactions, so it is often positioned as a utility-based asset, not just speculation.

Additionally, the broader crypto market sentiment also plays a role in XRP’s movement. When Bitcoin and Ethereum stabilize or rally, large altcoins like XRP tend to get a spillover of positive sentiment. Nevertheless, volatility remains a key characteristic of the cryptocurrency market to keep an eye on.

Risks and Alternative Scenarios

Although the technical outlook looks positive, the risk of a correction remains open if XRP fails to defend nearby support levels. A rejection at the resistance area could trigger short-term profit-taking, potentially bringing the price back to the previous consolidation zone.

External factors such as global macroeconomic conditions, crypto regulations and overall market sentiment can also affect the direction of price movements. Therefore, technical analysis needs to be combined with monitoring news and fundamental data for more balanced decision-making.

Conclusion

Ripple (XRP) is currently at an important phase in its price movement cycle, with significant upside opportunities if it is able to break through key resistance levels. While the upside potential looks attractive, the dynamics of the cryptocurrency market still demands caution and understanding of risks.

For market participants, the movement of XRP can be used as a reference to observe how large-cap crypto assets respond to a combination of technical sentiment and global market conditions in periods of high volatility.

Also Read: 10 Ways to Make Money from Games Quickly but Realistically (Online & Mobile)

Follow us on Google News to get the latest information about crypto and blockchain technology. Check Bitcoin price today, Solana price today, Pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Cryptopolitan. Analysts say Ripple (XRP) could hit $5 while this new crypto could explode 50x. Accessed January 19, 2026.