Bitcoin Runes: Potential and How to Buy

Bitcoin is undergoing its most significant phase of innovation in the past year. Satoshi’s design for security and decentralization meant that Bitcoin had a limited capability as a payment network. However, during the past year, many innovations such as on-chain NFTs through Ordinals and Bitcoin’s L2 ecosystem have grown. Runes was a protocol launched on the recent halving. Runes is currently dominating the Bitcoin network. This article will give you a full explanation of Bitcoin Runes, how they work, and how to buy Runes.

Article Summary

- 💎 What is Runes: Runes is a new protocol that creates a fungible token standard on the Bitcoin network. Created by Casey Rodarmor, Runes is designed to be simpler, less burdensome on the network, and cheaper than its predecessors Ordinals and BRC20.

- ⚖️ How Runes Work: Runes works by utilizing the UTXO system and the

OP_RETURNfunction, making it smaller and easier to move. The Runes minting system is flexible and composable with many digital wallets, making it more efficient than Ordinals. - ⚖️ Buy and Sell Runes: The process of buying Runes is quite simple through platforms like Magic Eden using digital wallets. However, there is currently a high minimum purchase threshold, which limits access for small investors.

- 📈 Potential of Runes: Runes have the potential to become the most widely used token standard in Bitcoin. With the development of L2 in Bitcoin, Runes can be integrated into many new ecosystems.

What is Runes?

Runes is a new protocol that creates a new fungible token standard in Bitcoin. Runes is a follow-up innovation from Casey Rodarmor who last year created Ordinals and Inscriptions on the Bitcoin network. At the time, @domodata modified Ordinals to create BRC20, the first functional fungible token in Bitcoin. Rodarmor then decided to create a new token standard that was easier to run, less taxing on the Bitcoin network, and cheaper.

You can also read Casey Rodarmor's blog about Runes to read about the details: Runes - Casey Rodarmor's Blog.

Rodarmor created the Runes protocol as an alternative to BRC20 and Ordinals, which caused controversy due to their burden on the Bitcoin network. Runes officially launched on the Bitcoin network at block 840,000, coinciding with the 2024 halving.

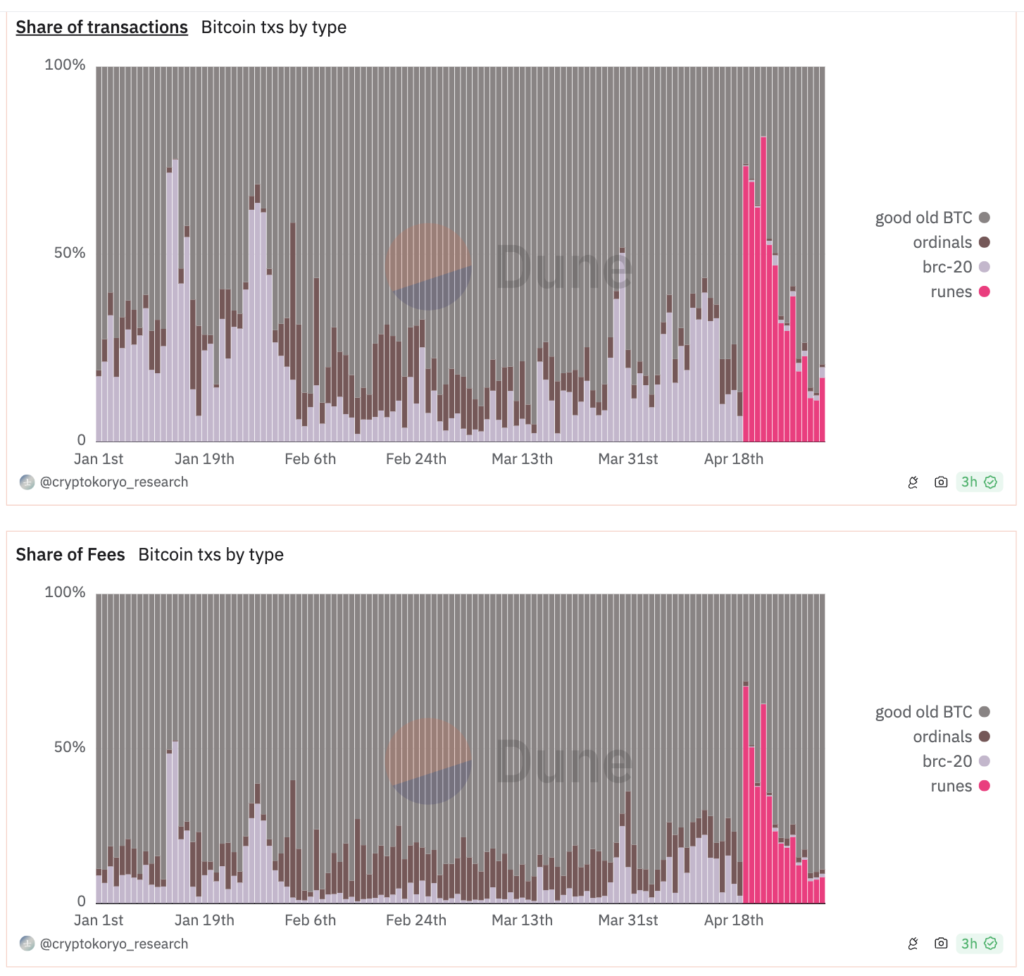

Since its launch on 19 April 2024, Runes has become the most widely used protocol in Bitcoin, beating Ordinals and BRC20. Total Runes transactions have reached 4.4 million with total transaction fees incurred worth 2,286 BTC. Runes DOG-GO-TO-THE-MOON is the Runes token with the highest market capitalization of $280 million.

Advantages and How Runes Works

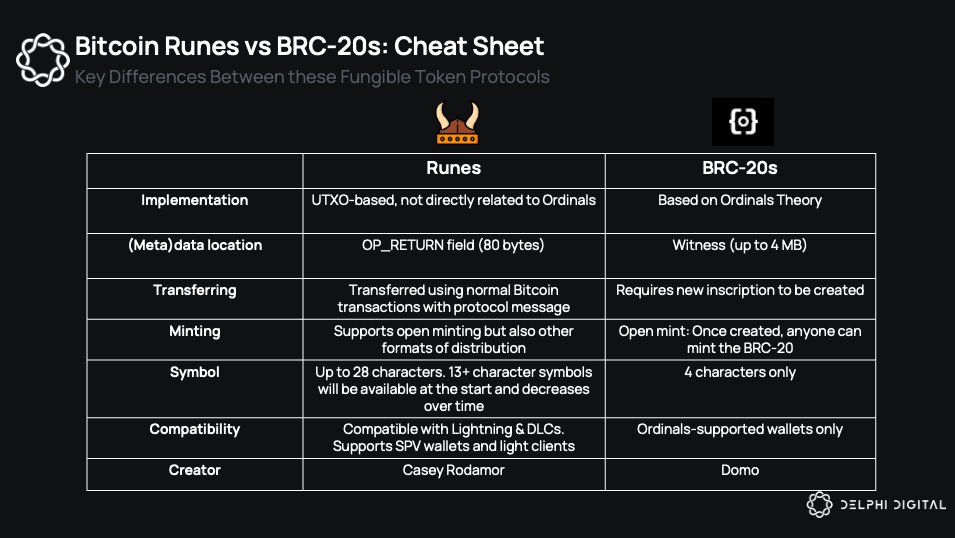

Runes work like Ordinals in that they are embedded in BTC transactions. However, the way Runes works is much simpler as they utilize the network’s UTXO system. UTXO (Unspent Transaction Outputs) are records kept when you send or receive BTC. So, Runes is pasted into the UTXO of each transaction using the OP_RETURN function.

The comparison in the image above clearly shows the advantages of Runes over Ordinals. The use of the OP_RETURN function and UTXO makes Runes smaller in size and easier to move. This is in contrast to Ordinals which can reach 4 MB and requires special parameters.

In addition, Runes has a flexible minting scheme that can be modified by the creator. The open nature of the Runes protocol also makes it composable and easy to integrate with many wallets in Bitcoin.

If you want to dive into the world of Runes, you need to know some of the unique terms of the Runes protocol.

- Runes: A term for a new type of token created by Casey Rodarmor.

- Etching: Etching is the term for creating new Runes. After the etching process, the details of a Rune cannot be changed.

- Minting: Minting is the term for claiming Runes, similar to minting an NFT or claiming airdrops. Runes creators can set the amount of mintable tokens or limit the minting process.

- Runestones: Runestones are the name for messages created by the Runes protocol. So, each Bitcoin transaction can store 1 Runestone and each Runestone can carry various instructions such as minting and transferring Runes.

- Edicts: Edicts is the term for special instructions in each Runestones created by users. For example, an Edict could contain instructions to send 100 tokens of Rune A to 20 different wallets. Edicts make Runes very flexible and easy to operate.

How to Buy and Sell Runes?

Casey Rodarmor designed Runes so that buying and selling is much easier than Ordinals and BRC20. Currently, many teams have developed platforms to buy and sell Runes. The Runes protocol also has high composability so the integration of wallets with runes is very easy.

One of the easiest ways to buy Runes is through Magic Eden using Xverse, or Unisat digital wallets. Here are the steps to buy Runes:

- Create a Magic Eden, Xverse, or Unisat digital wallet.

- Send BTC to the digital wallet.

- Go to https://magiceden.io/runes page on MagicEden.

- Select the Runes collection

- Purchase the amount that suits you.

One of the current bottlenecks of Runes is that you cannot buy Runes in small units. For example, in the DOG-GO-TO-THE-MOON collection, you must buy at least 889 thousand DOGs for $1,996 because that is the cheapest price sold by others. DEXs like Saturn and Sovyrn are building more flexible Runes trading systems.

Runes Potential and Future

Runes have the potential to have a huge impact on the Bitcoin ecosystem. So far, the problem with Bitcoin is that it does not support the creation of token standards such as ERC20. Runes could be the first fungible token used by thousands of users in Bitcoin. Furthermore, Runes could catalyze the development of the DeFi sector.

The easy-to-use and modifiable Runes protocol could also drive developers into the Bitcoin ecosystem. Additionally, Runes also coincides with the rapid development of many new L2s in the Bitcoin ecosystem.

In addition, the adoption of Runes will also have a major impact on miners affected by the halving. Bitcoin protocols like Runes can be a great incentive to mine BTC. As of 20 April 2024, the total fees for Runes transactions have reached 2.286 BTC. With the halving, protocols like Runes and BRC20 ensure miners have a steady source of additional income.

However, in the short term, the popularity and hype for Runes are on the decline. The limitation of purchasing Runes, which must be at least around $1000, also makes people hesitant. Until there is a way to overcome this, Runes buyers will be limited to investors with large capital.

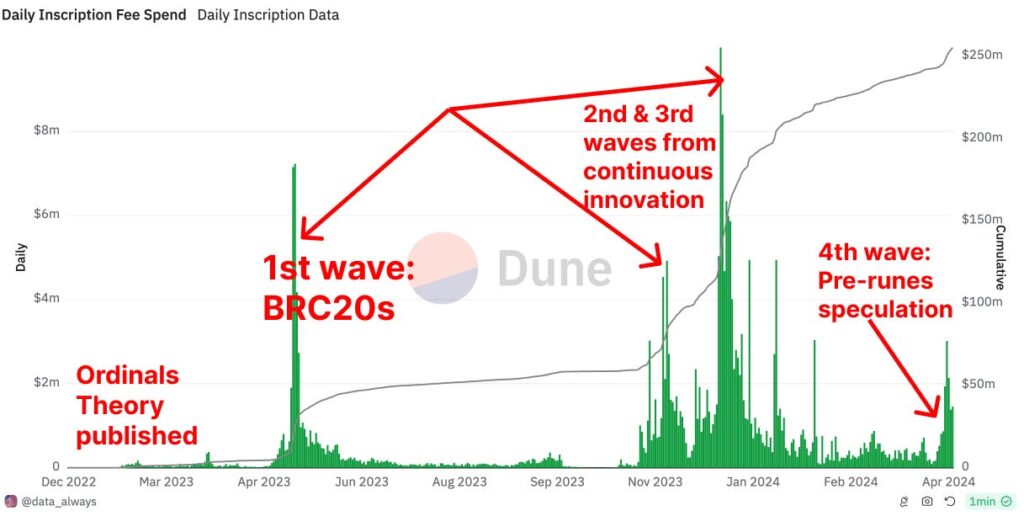

However, @DefiIgnas found an interesting perspective on the BRC20 adoption that is likely to happen in Runes. As in the image above, there are several waves of BRC20 adoption. The initial BRC20 hype dissipated then exploded again a few months later.

The second and third adoption phases of BRC20 happened because several platforms made trading BRC20 easier. The same thing is happening with Runes. Many BTC L2 are integrating Runes and no major CEX has listed Runes on its platform yet. When ordinary investors can buy Runes with small capital, we will see the 2nd adoption phase for Runes.

Conclusion

Runes has the potential to bring about major changes in the Bitcoin ecosystem by offering a more efficient and easy-to-use fungible token solution. This protocol could be a catalyst for the development of the DeFi sector in Bitcoin and provide additional incentives for BTC miners post-halving. Currently, Runes needs a platform that makes trading easy and lowers the minimum purchase threshold so that it can be accessed by more people. As with BRC20, the adoption of Runes will happen in several waves that rise and fall.

How to Buy BTC in Pintu

After knowing what Ethena is, you can start investing in BTC by buying it on the Pintu app. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for BTC.

- Click buy and fill in the amount you want.

- Now you have BTC!

In addition to BTC, you can conveniently purchase a wide range of cryptocurrencies such as ETH, SOL, and others. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask. Download Pintu app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. All Pintu Academy articles are for knowledge and educational purposes, not as financial advice.

References

- Gaz, “What Are Bitcoin Runes? Everything You Need To Know”, Blocmates, accessed on 7 May 2024.

- “What Are Runes on Bitcoin? A Beginner’s Guide”, Sovyrn, accessed on 7 May 2024.

- Ignas, “Navigating Runes Protocol Launch: Beyond the Initial Hype”, Substack, accessed on 8 May 2024.

- @leonidasNFT, “The Ultimate Runes Glossary Rune: A fungible token on Bitcoin (for example a memecoin or a utility token) Etch: How a Rune comes into existence (once set these properties are immutable)”, X, accessed on 9 May 2024.

- Serge Baloyan, “Bitcoin on Runes: Why It Can Be the Next Big Thing”, Hackernoon, accessed on 9 May 2024.

- @Delphi_digital, “The launch of the Runes Protocol is imminent, only 650 blocks left until the bitcoin halving! Confusion about Runes is widespread on CT, exacerbated by a myriad of protocols adopting similar names”, X, accessed on 10 May 2024.

- Casey Rodarmor, “Runes – Ordinal Theory Handbook’, accessed on 10 May 2024.

Share