Market Analysis Jul 31st 2023: Bitcoin Still Sideways at $30,000 as Market Uncertainty Continues

Although the Fed raised interest rates last week, BTC only responded with a brief drop and the overall crypto market was not significantly affected. BTC continues to move sideways, hovering around the $30,000 price level. So, what indicators could possibly boost BTC’s price? Find out more in the article below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 📈 The Fed raised interest rates by a quarter point in July, pushing benchmark borrowing costs to their highest level in 22 years.

- 📉 Initial jobless claims fell by 7,000 to 221,000 and the four-week average for jobless claims fell to 233,750, below market expectations.

- 💪🏻 The U.S. international trade deficit fell 4.4% to $87.8 billion in June, a significant improvement from the market’s expectation of $92 billion.

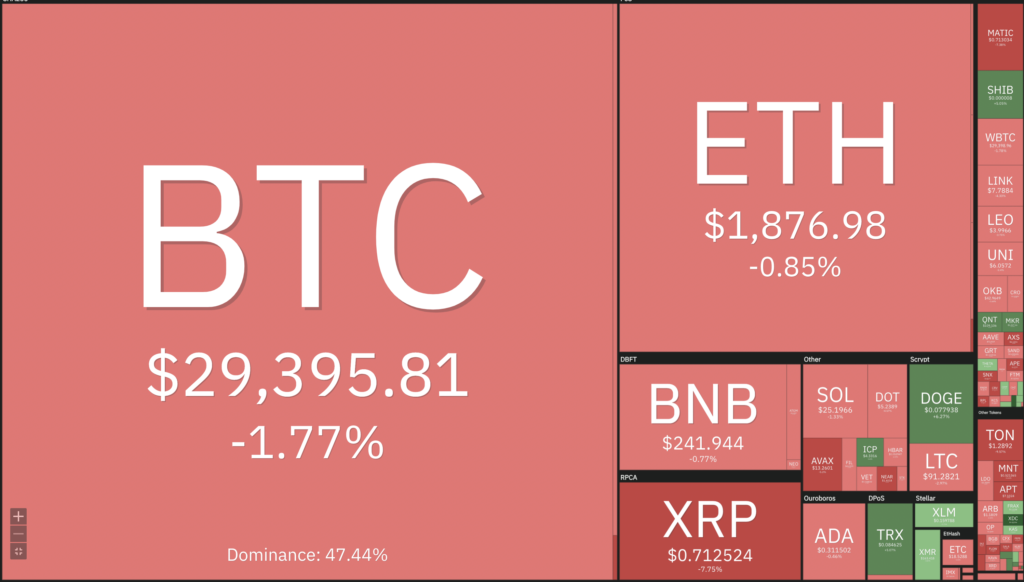

- ✍🏻 Bitcoin and Ethereum prices continue to fluctuate, with BTC consolidating below $30,000 and ETH encountering strong resistance at $1,925.

Macroeconomic Analysis

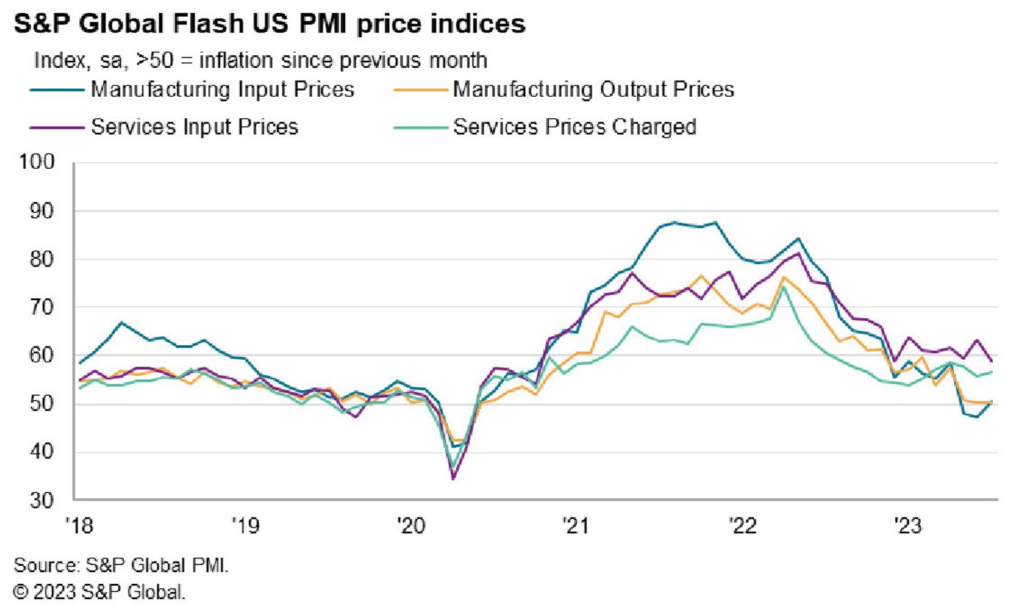

At the beginning of July, US private sector economic activity showed two aspects. The first aspect showed a slower decline in business activity with the S&P Global Composite Purchasing Managers’ Index (PMI), an economic health indicator for the manufacturing and services sectors, falling from 53.2 to 52. On the other hand, the services PMI fell from 54.4 to 52.4. The second aspect showed an increase in the S&P Global Manufacturing PMI from 46.3 to 49 over the same period.

Chris Williamson, Chief Economist at S&P Global Market Intelligence, also commented on the July economic report. According to him, there is a worrisome combination of slower economic growth, weak employment, declining business confidence, and persistent inflationary pressures. Taking into account the output of the manufacturing and service sectors, the U.S. gross domestic product (GDP) is expected to grow at an annual rate of 1.5% at the beginning of the third quarter.

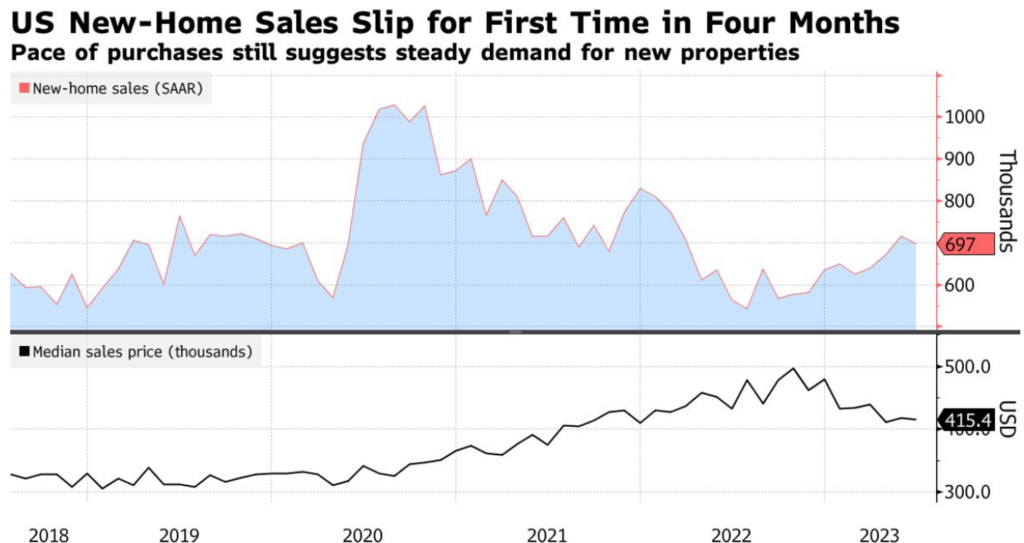

For the first time in four months, the housing sector, specifically new home sales in the US, declined. This decline indicates that the market’s momentum is being constrained by high borrowing costs and prices. According to U.S. government data released last week, purchases of new single-family homes fell 2.5% to 697,000, below the average estimate of 725,000.

Despite the decline, home sales have rebounded over the past year due to the limited availability of existing home inventory. As a result, homebuilder sentiment has reached its highest level in more than a year, and builder applications to start single-family projects have increased.

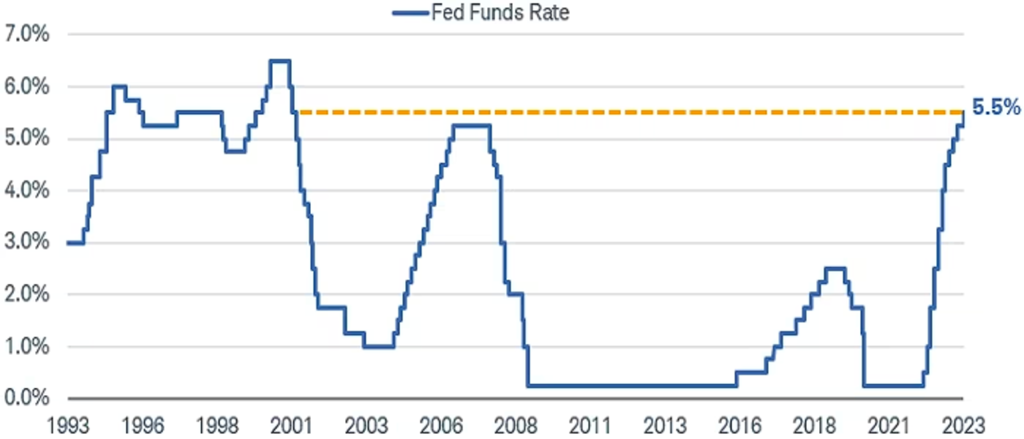

Turning to interest rate developments, after delaying a rate hike in June, the Fed finally raised rates by a quarter point to a target range of 5.25% to 5.5%. This increase took the federal funds rate to its highest level in 22 years and the highest level since early 2001.

This rate hike is the 11th since March 2022 and is aimed at curbing inflation. While the Fed Chair acknowledged the positive signs of the rate hike in controlling price pressures, he emphasized that there is still a long way to go before inflation can return to the 2% target.

There are many questions about whether interest rates will rise in the future? Jerome Powell refused to give a definite timetable, arguing that the Fed needs to analyze several economic reports at the September meeting. These reports include two employment reports, two consumer price inflation reports, and labor cost data. Powell mentioned that there could be a rate hike or a decision to hold rates steady at the September meeting.

The financial markets reacted to the decision with rising stock prices, while Treasury yields and the dollar fell. Swaps traders maintained a relatively stable probability that the Fed will raise rates another quarter point before the end of the year. This pricing implies that there is more than a 50% chance of one more hike before the Fed ends its tightening cycle.

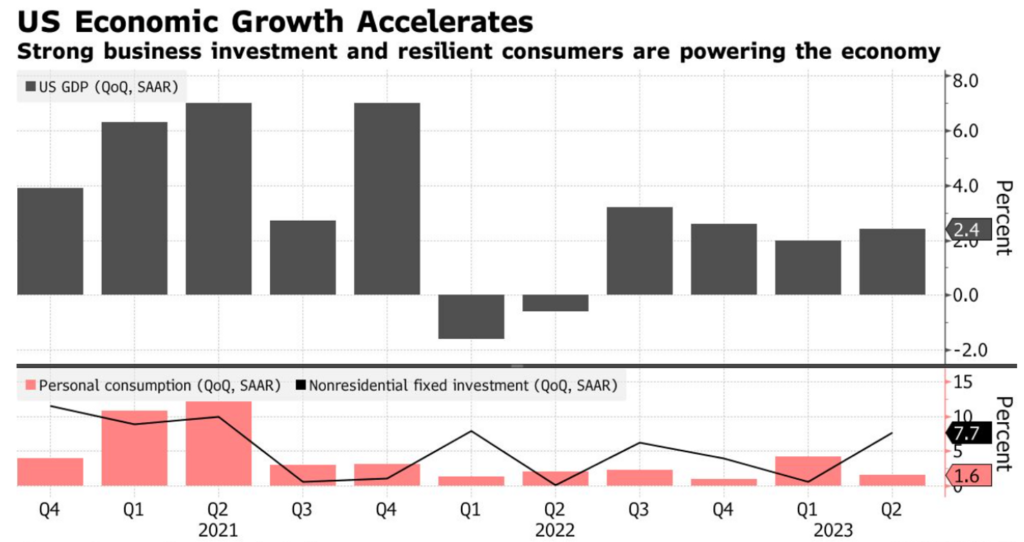

Despite the Fed’s 525 basis point rate hike since March 2022 to combat inflation, the economy, with the exception of the housing and manufacturing markets, has largely withstood the impact.

Citing data from the Commerce Department’s estimate of second-quarter GDP, a broad indicator of economic growth increased at an annual rate of 2.4%. In the previous quarter, from January to March, the economy grew at a rate of 2.0% versus expectations of 1.8%.

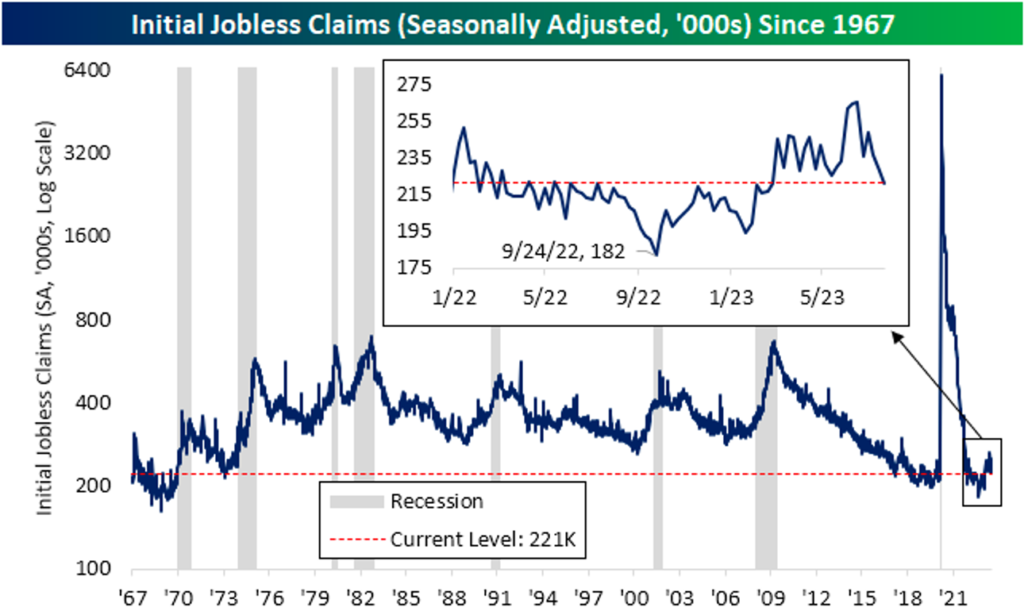

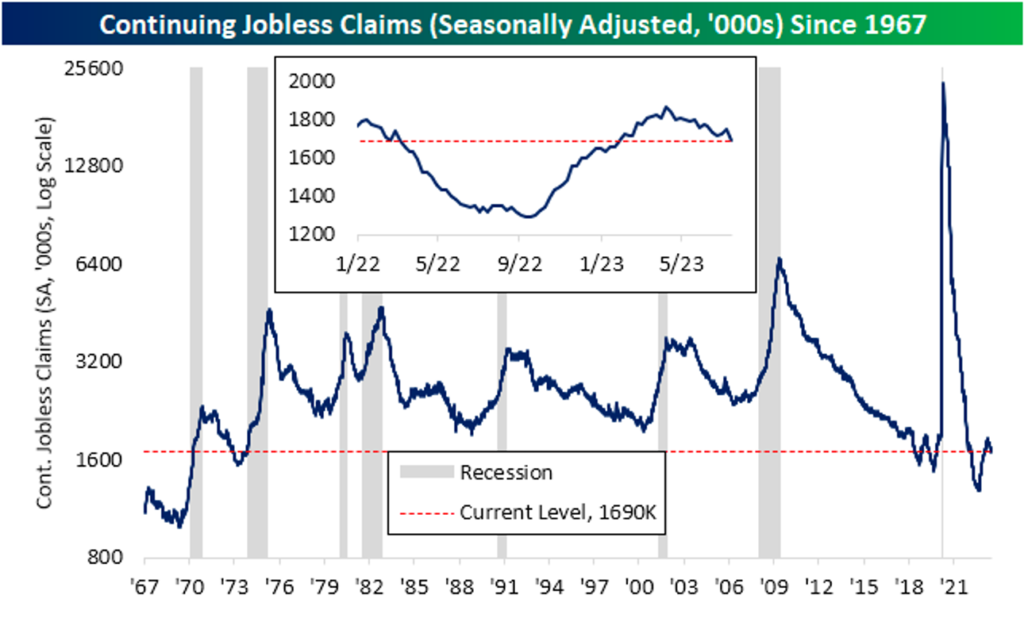

The labor market plays a critical role in economic growth. According to the Labor Department report, initial claims for U.S. unemployment benefits fell by 7,000 to 221,000. The four-week average of jobless claims fell below market expectations of 242,000 to 233,750.

In response to the workforce challenges faced during the pandemic, many companies maintained their workforce after experiencing difficulties in recruiting new employees. However, employment in the leisure and hospitality sector remains below pre-pandemic levels.

In addition, the number of people receiving benefits fell by 59,000 to 1.69 million in the week ending July 15. Despite layoffs in the technology and financial sectors in 2022 and earlier this year, ongoing claims are considered low by historical standards.

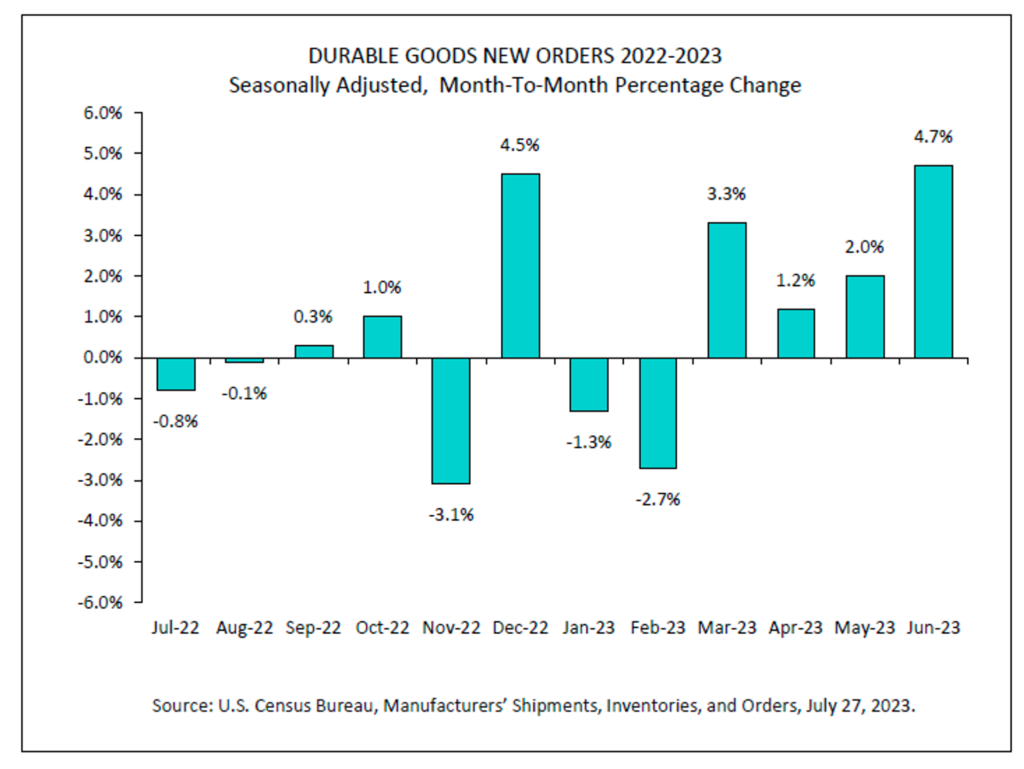

Last week, the U.S. Census Bureau released a report indicating that U.S. durable goods orders rose a significant 4.7% in June to $13.6 billion for a total of $302.5 billion. This growth follows a revised increase of 2.0% in May (originally reported as 1.8%), beating market expectations for a 1% increase.

The report also noted that excluding transportation orders, new orders still increased by 0.6%. Similarly, excluding defense orders, new orders jumped an impressive 6.2%. The main driver of the overall increase was the transportation equipment category, which posted its fourth consecutive month of growth, adding $12.4 billion, or 12.1%, for a total of $115.3 billion.

According to the advance estimate released by the Commerce Department on Thursday, the U.S. international trade deficit in goods fell 4.4% to $87.8 billion in June. Economists surveyed had expected the deficit to remain relatively stable at $92 billion.

BTC & ETH Price Analysis

BTC continues to trade sideways, falling as much as 3% last week and consolidating in a range below the $30,000 level. Currently, BTC has support at the price of US$28,000, which acts as a confluence of the 21-week, 100-week and 0.236 Fibonacci retracement line, and resistance at the price of US$30,000.

ETH has been rejected by the 0.382 Fibonacci retracement line for a relatively long time since the end of March this year. ETH currently finds support at the 100-week EMA at a price of $1850 and strong resistance at $1925.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Investors are in a Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Sam Altman, the CEO of OpenAI, has launched the WLD token from Worldcoin. The initial supply of the token is 10 billion, with 75% allocated to the Worldcoin community, 9.8% to the initial development team, and 13.5% to Tools for Humanity investors. Currently, there are 2 million users who have received over 43 million WLD tokens.

- Optimism, an Ethereum Layer 2 solution, has introduced the Law of Chains, an open neutrality framework for participants in the OP Stack Superchain ecosystem. The initiative aims to ensure user protection, decentralization and economic autonomy. Law of Chains sets the foundation for defining the minimum viable product (MVP) of the superchain and guiding the management of optimism. The goal is to create a cohesive collective of chains that maintain an open and decentralized block space, promote continuous development, and provide a better, more accessible infrastructure. The development of Optimism will be strengthened by the migration of Worldcoin to its scalability solution.

- Coinbase’s developer-facing Base Network has seen a surge in meme coin transactions on the decentralized exchange LeetSwap. Tokens such as BALD, COIN and BASED have seen massive increases, with LeetSwap’s trading volume reaching $200 million in a single day. BALD, a token named after Coinbase CEO Brian Armstrong’s appearance, is up 3,100%, while BASED is up up to 1 million percent and COIN is up 15,400%. Decentralized exchanges like LeetSwap are popular for meme coin trading due to the ease of token creation and listing.

- Curve Finance, a prominent stablecoin exchange in the Ethereum DeFi ecosystem, was exploited due to a “re-entrancy” bug in Vyper. This bug allowed hackers to drain multiple stablecoin pools, putting over $100 million worth of crypto assets at risk. According to BlockSec, a blockchain auditing firm, the losses suffered by Curve are estimated to be as high as $42 million. As a result of this attack, the price of the CRV token dropped by 17%. This decrease will undoubtedly affect the founder’s $70 million loan position on Aave. The Curve team is currently monitoring the situation.

News from the Crypto World in the Past Week

- Federal Reserve Chairman Jerome Powell, announced an interest rate hike of 25 basis points. This increase pushes interest rates to the highest level in the last 22 years. According to him, the purpose of raising interest rates is to maintain long-term inflation at 2%. Furthermore, in the next central bank meeting in September, Powell did not rule out the possibility of another interest rate hike.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Maker +12,78%

- GMX (GMX) +12,26%

- Dogecoin +7,21%

- Quant (QNT) +7,18%

Cryptocurrencies With the Worst Performance

- Gala (GALA) -12,50%

- Mantle -11,26%

- Injective (INJ) -10,88%

- ApeCoin (APE) -8,79%

References

- Reed Albergoti, Sam Altman’s Worldcoin token to launch Monday, Semafor, accessed on 29 July 2023.

- Nick Timiraos, Federal Reserve Raises Interest Rates to 22-Year High, Wsj, accessed on 29 July 2023.

- Optimism, Introducing the Law of Chains, accessed on 29 July 2023.

- André Beganski, Meme Coin Mania Drives Degens to Base, the Ethereum Level-2 Chain from Coinbase, Decrypt, accessed on 29 July 2023.

- Sam Kessler, Danny Nelson, Curve Finance Exploit Puts $100M+ Worth of Crypto at Risk; CRV Token Tumbles, Coindesk, accessed on 31 July 2023.

Share

Table of contents

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-