Is This the Start of a Crypto Bull Market? Here’s How to Identify the Phases

After the crypto market goes through a bearish phase, investors naturally look forward to a bullish phase. Generally, certain phases initiate a crypto bull market. Identifying these phases will be a great advantage as investors can enter the market early.

In recent weeks, there have been several positive catalysts that have boosted the price of crypto assets. Then, are these catalysts a sign of the initial phase toward a bull run? How to identify the phases that will occur? The following article will help you to determine the phase of the crypto bull market.

Article Summary

- 🐂 Before entering the crypto bull market phase, the crypto market will experience the transition and initial bull run phases. Knowing the position of Bitcoin holders through HODL Waves is one way to identify it.

- 🌟 In the crypto bull market phase, there are several phases in it. Started from the Bitcoin, Ethereum, Large Cap, to Altseason phases.

- 👀 Currently, the crypto market is trying to exit the transition phase and enter the initial phase of the bull run. It needs a strong positive catalyst for the crypto bull market.

The End of Bear Market

If you look at the current market situation, the crypto market has undoubtedly reached its bottom. The FTX crash period in November 2022, which made Bitcoin fall to the US$ 15,000 area, was the bottom of the bear cycle. After the FTX polemic and several related cases, Bitcoin and the crypto market are slowly recovering.

Before the crypto bull market starts, there will be a transition phase. In this phase, every time the prices increase sharply, it will be followed by a correction.

During this transition phase, Bitcoin experienced a breakout from the lower range and sought out new levels of resistance. Initially, US$ 20,000 emerged as the fresh resistance level. Surprisingly, Bitcoin managed to transform this resistance level into a robust support level. Consequently, whenever corrections took place, the Bitcoin price refrained from falling below that level.

Unfortunately, Bitcoin has been unable to surpass the new resistance level in the US$ 31,000 range. Over the past few months, Bitcoin has displayed limited movement within this resistance area. According to Glassnode co-founder Yann Alleman, in order to initiate the phase toward a bull market, Bitcoin must be able to turn US$ 31,000 from a strong resistance level into a support level.

Find out more and how to differentiate between bull and bear markets in the following article.

The Early Phase of the Crypto Bull Market

After going through the transition phase, Bitcoin and the crypto market will move into the crypto bull market phase. However, knowing when the bull market phase will begin is very difficult. Investors can only guess using various on-chain metrics and other indicators.

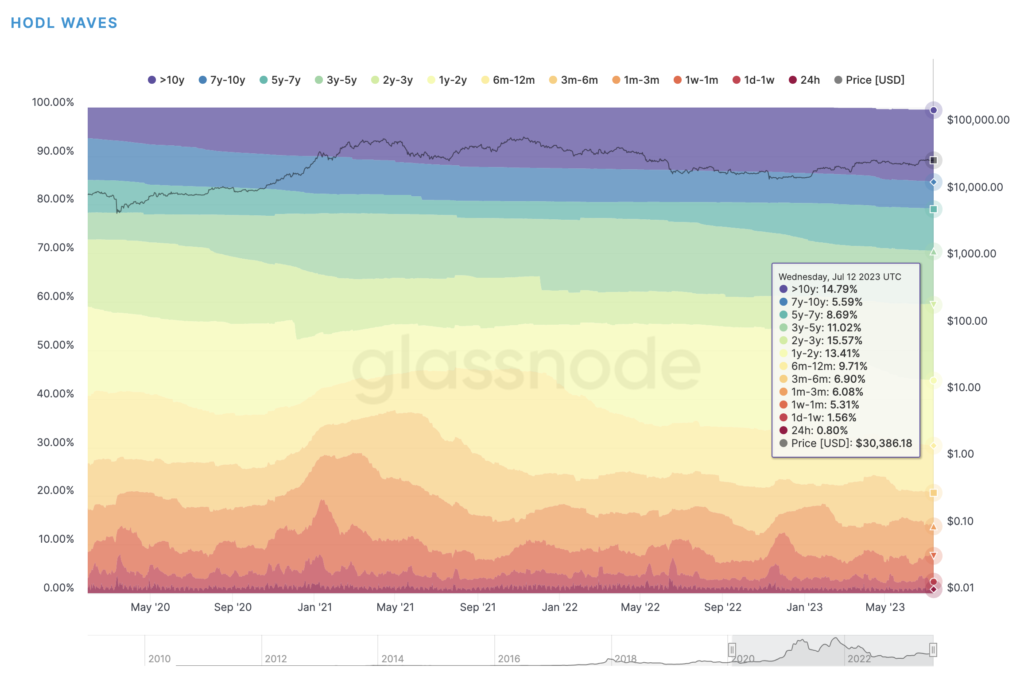

One pattern that can be observed is the HODL Waves chart. In simple terms, the chart displays Bitcoin’s Unspent Transaction Output (UTXO) which is practically like the age of Bitcoin. UTXO shows the last time a Bitcoin was used in a transaction.

By observing the HODL Waves pattern, we can see how Bitcoin’s ownership change over time. If there is a spike in the warmer-colored age bands (BTC holders under a month), it indicates a large purchase of Bitcoin by new investors. Meanwhile, if the dark-colored age bands (above two years) have steady growth, it shows that Bitcoin’s not being transacted. This means that long-term BTC holders are increasing. The interaction between the two patterns can show investor behavior during a market cycle.

Generally, a crypto bull market is characterized by a shift in the percentage of BTC holdings from long-term to short-term holders, along with the rising price of BTC. This is due to the massive accumulation that is taking place, increasing the portion of short-term holders.

Pintu Academy has prepared an article to help you understand the Bitcoin bull run cycle here.

The Crypto Market Bull Phase

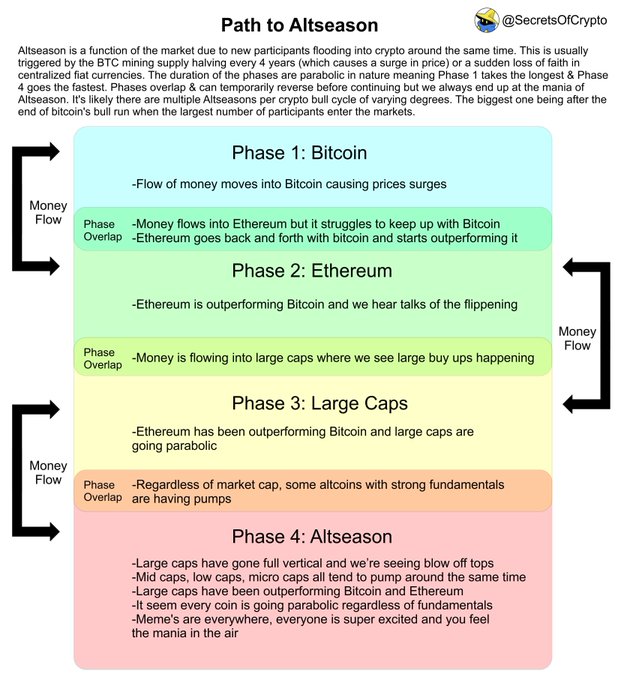

After entering the crypto bull market phase, the crypto market will have a few more phases. The following are the phases that occur when the crypto market is in a bull market:

- First Phase: Bitcoin. When entering the crypto bull market phase, investors’ money will always flow to Bitcoin first. As the main asset, Bitcoin will be the target for institutional and retail investors, especially new investors. This makes the price of Bitcoin continue to rise.

- Second Phase: Ethereum. After Bitcoin, the next money will flow into Ethereum, making it outperform Bitcoin’s performance. Ethereum being the home of thousands of DeFi gives it an additional catalyst that lifts its price.

- Third Phase: Large Caps. As Ethereum continues to outperform Bitcoin, large-cap crypto assets will skyrocket. Large-cap crypto assets will be an option for investors who want to maximize momentum but remain cautious.

- Fourth Phase: Altseason. This phase occurs when the prices of large-cap crypto assets outperform BTC and ETH. All altcoin tokens, even meme coins, will experience significant gains thanks to FOMO. Thus, Altseason occurs.

Keep in mind that sometimes there is an overlap between these phases. For example, the first and second phases coincide, or the Altseason phase immediately follows the BTC price rise.

One unique pattern occurred during the second quarter of 2023 when there was a sudden Memecoin Season. While BTC and other altseasons only rose slightly, meme tokens emerged and experienced fantastic price increases. As the front-runner, the PEPE token experienced a price increase of up to 10,000%. Other meme tokens, such as AIDOGE, WOJAK, TURBO, and LADYS, performed similarly.

The following article can guide those who want to trade meme coins safely.

The Present State of the Crypto Market

XRP emerged victorious in its legal battle against the US Securities and Exchange Commissioner (SEC), bringing significant development that uplifted the cryptocurrency industry. The ruling by a US Judge declared that XRP token sales do not qualify as securities. Following this verdict, the value of XRP experienced a surge of more than 85%.

Taking a broader perspective, this ruling also carries positive implications for the US crypto industry, which has seen many tokens being classified as securities by the SEC in recent times. Consequently, the regulatory status of crypto assets will become more transparent. The positive sentiment from the XRP case also had an impact on Bitcoin, as its price stayed above US$ 31,000 for a day.

Is the current phase of the cryptocurrency market edging closer to the crypto bull market phase? Determining the answer is challenging as the euphoria surrounding XRP might be temporary. Nonetheless, a notable positive catalyst is essential to sustain the upward trajectory of Bitcoin and the overall crypto market.

External factors such as the Fed’s decision regarding interest rates and news about ETFs are among the important catalysts for which the market is waiting. In the context of the crypto industry, the majority of significant catalysts are in late 2023. Among the most anticipated are Ethereum’s Dencun update, Polygon 2.0, and UniSwap V4.

Read Pintu Academy's article on the predictions of three crypto trends that will be the central theme for the rest of the year.

However, the rising Bitcoin dominance rate could be a positive sign for the crypto bull market phase. Since the price of BTC crossed the US$ 20,000 level, Bitcoin dominance is now at 51.70%, the highest level since April 2021. Yet, the 52% level will be a strong resistance level that must be broken and turned into a support level, similar to the US$ 31,000 price.

On the one hand, investor bias behavior towards the last bear market conditions is still relatively high. This triggers concern and fears that Bitcoin could fall again at any time.

But worrying too much can also limit you from missing the momentum to enter the market. Moreover, crypto bull markets and positive sentiment often come when most investors are unprepared. As the old saying goes, “Fortune favors the brave,” luck will come to anyone brave and ready to embrace it.

However, the market sometimes also has a punishment mechanism for investors who are too greedy. Ultimately, investors must always be alert and ready to welcome every possibility. Whether it is the arrival of a bull run or the price increase is nothing more than a bull trap.

Conclusion

Entering a crypto bull market in its initial phase is a great opportunity, but identifying its start can be hard. Fear of falling prices due to market conditions and investors’ fear bias can make it even harder.

Therefore, investors should always research market conditions. On top of that, try looking into various on-chain metrics to gain insight into when the initial phase of the crypto bull market will begin. There is also a chance that the bull trend is nothing more than a bull trap. So, remember to prepare risk mitigation for any worst case that might happen.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Dhruv Bansal, Bitcoin Data Science: HODL Waves, Unchained, accessed on 13 July 2023.

- Tristan Greene, Breaking: Judge rules XRP is not a security in SEC’s case against Ripple, Coin Telegraph, accessed on 14 July 2023.

- Yann & Jann, Any Direction Is Better Than No Direction At All, Substack, accesed on 13 July 2023.

- Coin Telegraph, Bull vs. bear crypto market: What’s the difference and how to handle both, accessed on 13 July 2023.

- ZeroToTom, HODL Waves, one of, if not the most useful chart for Bitcoin, Twitter, accessed on 13 July 2023.

- Phoenix, It’s only the start of a fresh Bull Market, Twitter, accessed on 13 July 2023.

Share