How Will the Fed Rate Cut Impacts Crypto?

Macroeconomic conditions are usually a factor that many crypto investors and traders don’t consider. In fact, as a high-risk asset, crypto is even more sensitive to economic conditions. Interest rates are one of the most talked about economic indicators. How do interest rates affect the crypto market? Are falling interest rates and crypto positively correlated? We will discuss it in detail.

Article Summary

- 🌐 Macroeconomic Impact on Crypto Markets: Investors often overlook macroeconomic conditions when investing in crypto, even though these assets are very sensitive to changes in the global economy.

- 💵 The Role of the Fed and Interest Rates: The Fed, as the US central bank, plays an important role in economic stabilization. Changes in interest rates have a significant impact on economic activity, including the stock and crypto markets.

- 🏦 Rate Decreases and Their Impact: A decrease in interest rates is usually considered positive for crypto assets as it increases liquidity in the market. However, a negative impact can occur if the rate cut is done in response to a weakening economy.

- 📈 The 2024 Bull Market: The correlation between global money supply and BTC price suggests that interest rate cuts and potential Quantitative Easing (QE) by the Fed could increase global liquidity to support speculation on high-risk assets, including BTC.

What is the Fed?

The Fed is a body of the United States Central Bank that regulates the country’s monetary policy. Central banking institutions such as the Fed issue various policies to regulate the demand and supply side of the country’s currency. The Fed’s policies are aimed at stabilizing the economy and the value of the US dollar.

The US dollar is the most widely used currency in the world –it accounts for 58% of the world’s total reserve assets. So, the Fed’s policies automatically affect the global economy, including asset markets such as stocks and commodities.

The Fed has various policy instruments. Examples of the Fed’s policy instruments are interest rate setting and purchasing or selling bonds.

Interest Rates and Their Impact

One of the important instruments that the Fed has is interest rate setting. Interest rates are the percentage of interest that banks charge for loans. Decreases and increases in interest rates will affect various economic activities such as borrowing, spending, inflation, and the value of the US dollar.

When interest rates are raised, loans become more expensive, slowing economic growth but helping to control inflation. Conversely, falling interest rates boost economic activity through cheaper borrowing costs.

Currently, we are about to enter a cycle of interest rate cuts by the Fed after more than a year of hikes. This is because the Fed sees inflation starting to decline and wants to boost economic activity in the US. This rate-cut policy will have an impact on asset markets such as stocks and crypto.

Does Cutting Interest Rate Positive or Negative for the Market?

Theoretically, a rate cut is a very positive catalyst for assets like stocks and crypto. Why? Lowering interest rates is indirectly a form of money printing as it increases the supply of money through cheaper loans. The more money circulating in the market, the more liquidity to buy investment assets.

Furthermore, as interest rates decrease, investors will look to other assets for profit. Investors will take greater risks to seek profits such as buying stocks or cryptocurrencies (especially BTC).

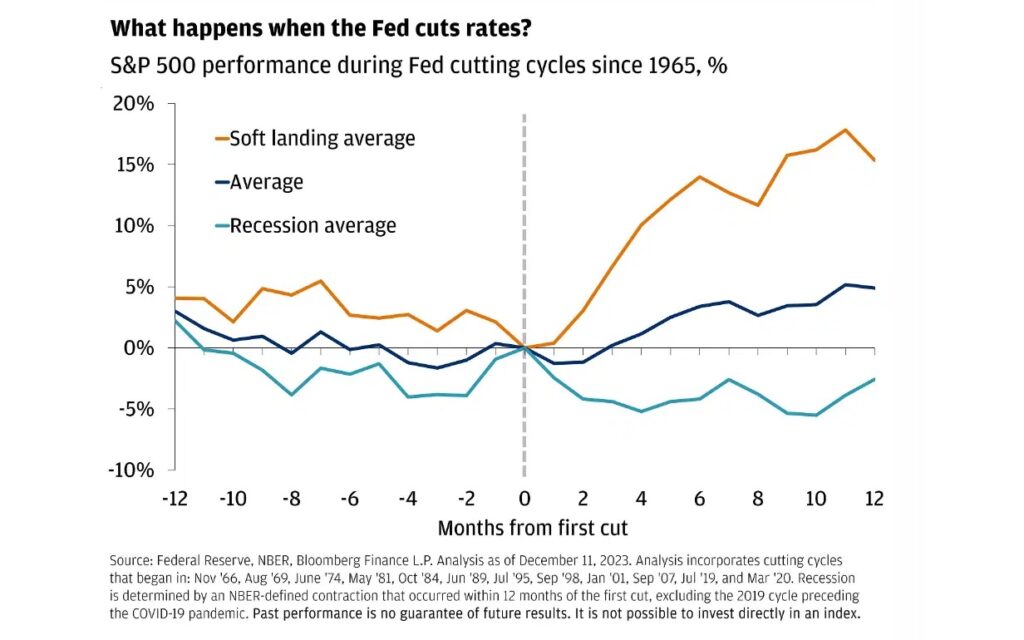

While rate cuts are generally bullish, there are scenarios where they adversely affect asset markets. According to Austin Pickle, an analyst at Wells Fargo Investment Institute, the Fed’s rate cut cycle usually results in a large correction in the stock market. The negative impact occurs because rate cuts are made in response to a weakening economy.

Currently, there is a 62.5% potential rate cut in September. The cuts still bring fears of a recession in the US. Although the percentage of a potential recession continues to decline, some analysts still believe the risk still exists.

Therefore, analysts like Austin Pickle still believe we should monitor the market response to the September rate cut. If stocks fall dramatically immediately, it means that many market participants believe that the US economy will go into recession, at least in the short term.

The 2024 Bull Market and Interest Rate Cuts

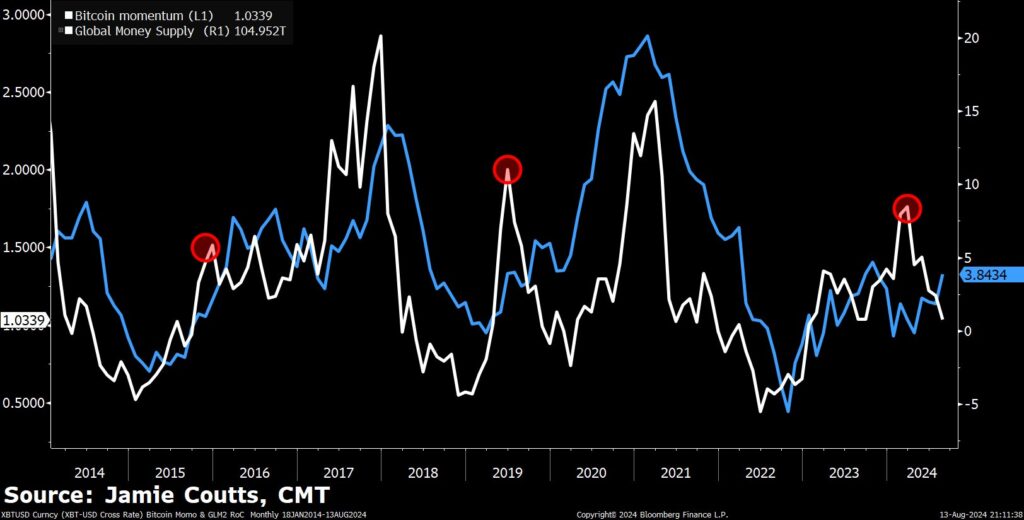

One of the most interesting things about BTC is its correlation with the global money supply. In the chart above, there is a strong correlation between BTC momentum (white line) and global money supply (blue line).

Interest rate cuts by the Fed are the first stage of restoring global money supply. Low interest rates will cause money liquidity to continue to increase.

Furthermore, if the Fed continues its policy of cutting interest rates, there is a potential for Quantitative Easing (QE) in 2025. QE is the Fed’s policy strategy to boost a sluggish economy. In QE, the Fed not only cuts interest rates but buys bonds from banks which will add to the supply of US dollars.

As of August 2024, the Fed is still conducting its Quantitative Tightening (QT) policy by selling its bonds. This is done to reduce the amount of assets the Fed has after the QE policy during the Covid-19 period 2020-2022.

Both of the above policies have one main goal, which is to increase liquidity and promote economic growth. The combination of QE and US interest rate cuts will create a period where institutional and retail investors are willing to speculate on high-risk assets like BTC. In times of abundant global liquidity, BTC will usually experience a parabolic movement that marks the top of a bull market.

Conclusion

Interest rate policy by the Fed has a huge influence on asset markets, including crypto. A decrease in interest rates can create greater liquidity in the market, triggering a rise in crypto asset prices. However, the policy becomes bearish if the cuts are made in response to a potential recession. Therefore, investors need to be vigilant and continue to monitor the Fed’s policy developments as well as the market response to the policy. Continued rate cuts and QE policies will create the perfect conditions for drastic price appreciation for crypto assets, especially BTC.

References

- Boffin, “The FOMC and You“, Page One Substack, accessed on 7 August 2024.

- Omkar Godbole, “The Bullish Fed Rate Cut Play in Bitcoin (BTC) is Not as Straightforward as You Think“, Coindesk, accessed on 8 August 2024.

- James Royal and Brian Baker, “How The Fed Impacts Stocks, Crypto And Other Investments“, Bankrate, accessed on 9 August 2024.

- @cryptogirlnova, “Despite all the predictions we all have made to predict when the next up-only phase starts: – The 4 year halving cycle – New Bitcoin highs – Ethereum surging – Bitcoin dominance dropping“, X, accessed on 12 August 2024.

- CryptojelleNL, “Rate Hikes and the Fed – How Do They Affect Crypto Markets?“, Coinmarketcap, accessed on 13 August 2024.

- James Butterfill, “Bitcoin’s Price Dynamics: Federal Reserve Policies and Economic Shifts in Focus”, CoinShares, accessed on 14 August 2024.

- Roger Huang, “What Will Happen To Bitcoin Prices If The Fed Lowers Interest Rates?”, Forbes, accessed on 15 August 2024.

Share