What is Thorchain (RUNE)?

In blockchain technology, numerous networks possess native cryptocurrencies like Bitcoin, Ethereum, Solana, Avalanche, Cardano, and more. Nevertheless, when we intend to swap assets from one blockchain to another, for instance, converting BTC to ETH, we typically have to wrap assets on a decentralized exchange (DEX) first. With Thorchain, a game-changing platform that simplifies and streamlines cross-chain asset exchanges, making them more convenient and direct. So, let’s delve into what Thorchain is and how it facilitates seamless inter-blockchain asset transactions. For more insights, let’s read the following article.

Article Summary

- ⛓️ Thorchain is a blockchain protocol that uses the Cosmos SDK that enables cross-chain asset exchanges utilising a network of nodes and liquidity providers.

- 🔨 Thorchain allows users to exchange cross-chain native assets directly without additional processes, such as asset wrapping, which is often required in other DEXs.

- 🪄 To connect the Thorchain network with other blockchain networks, Thorchain uses the Bifrost Protocol, a cross-chain bridge system.

- 🪙 RUNE is the native token of the Thorchain protocol that serves as a reward, settlement asset, and validator collateral in maintaining network security.

What is Thorchain (RUNE)?

Thorchain is a blockchain protocol built using the Cosmos SDK and enables cross-chain asset exchanges through a network of nodes and liquidity providers.

With Thorchain, users can exchange native cross-chain assets directly without the wrapping process, which is often required in other DEXs.

The project’s primary goal is to bring more liquidity to all supported crypto assets.

Thorchain uses an Automated Market Maker (AMM) mechanism with the RUNE token as the trading pair for asset exchange. It increases efficiency with fewer trading pairs. RUNE is the native token of the Thorchain protocol and serves as an intermediary in the exchange of assets from various blockchains.

To exchange assets on the Thorchain protocol, you can use Thorswap.

How was Thorchain Created?

Thorchain was originally a small project at the Binance Hackathon 2018. Then a team of mostly anonymous developers continued researching Thorchain technology after the event ended.

The team needs the technology in Cosmos to create a cross-chain asset exchange DEX. They include Tendermint, Cosmos SDK, and Threshold Signature Scheme (TSS).

The team finally developed a DEX built on the Thorchain protocol, Instaswap. The product was then demonstrated at the Cosmos Hackathon in Berlin.

In 2019, Thorchain made an Initial Dex Offering (IDO) on Binance and successfully raised 1,5 million US dollars.

In April 2021, Thorchain released its temporary mainnet, the Multi-chain Chaos Network (MCCN). After 4 years of development, Thorchain officially released its mainnet in June 2022.

How Does Thorchain Work?

Thorchain includes four essential components that enable decentralized cross-blockchain asset exchanges. They are the Swapper, Liquidity Provider, Node Operator, and Merchant.

- Swapper: Swappers are users who want to exchange one crypto asset for another using Thorchain. They use Thorchain to easily exchange assets without relying on CEX or going through many complicated steps.

- Liquidity Providers (LPs): Users deposit their crypto assets into Continuous Liquidity Pools (CLP) on Thorchain. They store assets in the pools and receive RUNE in return. Liquidity Providers ensure enough liquidity in the pool to facilitate the exchange of assets quickly and efficiently.

- Node Operators: Node Operators called Thornodes are users who run specialized nodes (computers) to process transactions and keep the Thorchain network running correctly. They communicate with each other to establish a cross-chain swap network and earn RUNE in return for each swap that occurs.

- Trader: Traders are people or entities that actively participate in the asset exchange on Thorchain. They can be swappers or liquidity providers, or even both. As traders, they can use Thorchain to buy or sell crypto assets at the current market price without waiting for order settlement or requiring a third party as an intermediary.

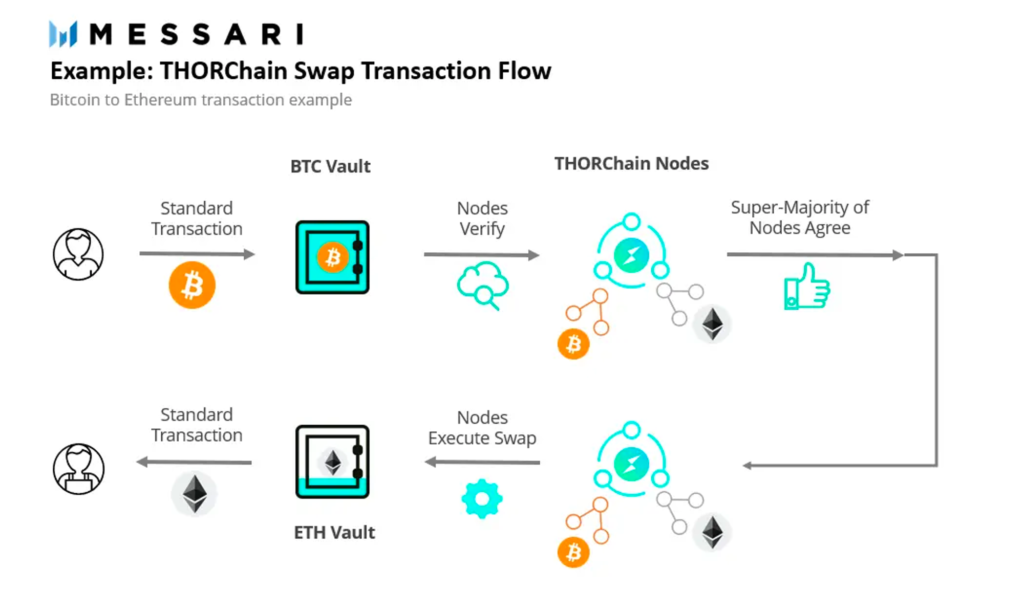

Thorchain Swap Transaction Flow

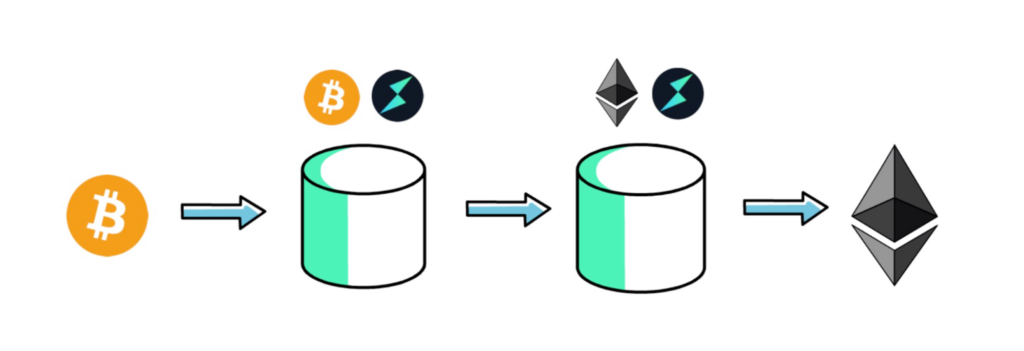

When exchanging assets on Thorchain, swappers will send their assets to Thorchain and receive other assets.

For example, when a swapper initiates the exchange of BTC for ETH, they will send BTC to Thorchain’s inbound vault. Subsequently, the Thorchain network will execute the exchange of BTC for RUNE. Next, the network will perform the exchange of RUNE for ETH. Finally, the network will send ETH back to the swapper from Thorchain’s outbound vault.

It allows Thorchain to exchange assets directly without needing asset wrapping.

Basically, double swapping with instant execution enables non-custodial exchanges on the Thorchain protocol.

To connect the Thorchain network with other blockchain networks, Thorchain uses the Bifrost Protocol, a cross-chain bridge system.

Its main task is to monitor vaults to detect incoming transactions and convert them into witness transactions on Thorchain. Once the incoming transaction is approved, the user’s Bitcoin deposit or native asset is recorded on the Thorchain blockchain. Next, the Bifrost Protocol is reused to initiate the withdrawal of the destination asset from outbound vaults on Thorchain and send it to another network, such as Ethereum, to complete the exchange.

With Bifrost, Thorchain can achieve high interoperability between blockchain ecosystems.

Vault

Thorchain has two types of vaults: inbound vaults (Asgard TSS Vaults) and outbound vaults (Yggdrasil Vaults). Inbound vaults store most assets and are controlled by a large committee. Although slower, inbound vaults are more secure as they require approval from ⅔ transaction signers.

In addition, Thorchain also has smaller and less secure outbound vaults that each Thornode runs. This outbound vault is faster as it only requires one signature from the operating node.

The system automatically refills outbound vaults as funds are used for outbound transactions, and this design creates an incentive to prevent the theft of funds from outbound vaults.

Continuous Liquidity Pool (CLP)

Thorchain uses a liquidity pool known as the “Continuous Liquidity Pool” (CLP), which differs from Uniswap in several ways. Liquidity pools on Thorchain are called vaults that are controlled by node operators, and assets stored in those pools are pooled into addresses on their originating blockchain.

CLP allows users to provide liquidity for various assets on different blockchains supported by Thorchain as long as sufficient demand exists for those assets. In addition, all assets in Thorchain’s liquidity pool must be paired with RUNE, and trading fees in this pool are determined by slippage, in contrast to Uniswap, which uses a fixed trading fee of 0.3%.

Advantages of Thorchain (RUNE)

- Exchange Cross-chain Crypto Assets.

Thorchain’s technology allows users to exchange crypto assets cross-chain easily and quickly.

- Pool with One Type of Asset

LPs can manually enter a pool with one type of asset. Half of the deposited asset, e.g. BTC, will still be converted into RUNE to keep the LP’s position balanced with both assets. Also, if someone deposits RUNE only, half of it will be converted into BTC in the pool.

- No Oracle.

Thorchain differentiates itself from most DEXs by eliminating often centralized oracles. Instead, Thorchain uses “arbitrage traders” to keep asset prices accurate within the liquidity pool.

If the price of a token is too low, traders will buy and sell it on other DEXs for a profit, while if the price is too high, they will buy from other DEXs and sell on Thorchain. It automatically balances the market without compromising decentralization, and arbitrage traders are incentivized to ensure asset prices stay consistent by using the price difference between DEXs.

- Liquidity

Thorchain’s structure helps avoid LP liquidation. Liquidation occurs when there are too many trading pools for a particular coin. Since each pool is paired with a RUNE inside the DEX, the number of pools needed is much less. This strategy is ideal for investors as it helps centralize liquidity.

- Low Transaction Fees

Thorchain users enjoy low fees compared to the current rates on the Ethereum network. The fees charged to users consist of a fixed Outbound Fee and a Liquidity Fee that fluctuates according to demand. Some of these fees will be returned as rewards to Validators and liquidity providers.

RUNE Token

RUNE is a Thorchain platform token that has an essential role in the Thorchain ecosystem. Here are some of the functions of RUNE:

- Security

In the Thorchain ecosystem, the RUNE token staking process is called bonding. You must bond 1 million RUNE to run the role of a validator. RUNE is kept as collateral so that validators work in line with the system and avoid mistakes that result in losing that collateral.

- Liquidity

In Thorchain’s liquidity pool, every token is paired with RUNE. It is important to create the liquidity needed in the asset swap process.

- Rewards

Validators and liquidity providers receive rewards in RUNE tokens.

Conclusion

Thorchain allows users to exchange crypto assets cross-chain with ease. Users can exchange assets from various blockchains without asset wrapping or pegging, thus ensuring a direct and transparent exchange.

Although developed by a mostly anonymous team, Thorchain provides open access to the entire community (Thorchads) through various communication channels and platforms. The Thorchain community can follow the project’s development, contribute, provide feedback, and participate in decision-making through forums, social media, and other communication channels.

Buying RUNE on Pintu App

After knowing what Thorchain is, you can invest in RUNE and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download Pintu app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Thorchain Team, Introduction to Thorchain, Thorchain, accessed 27 Juli 2023.

- Jakub, How Does Thorchain Work? DeFi Explained, Finematics, accessed 27 Juli 2023.

- Ryan Watkins, THORChain: Infrastructure For a Multichain Future, Messari, accessed 27 Juli 2023.

- Walter Smith, What is Thorchain? The DeFi Bridge for Bitcoin, Ethereum and More, Decrypt, accessed 27 Juli 2023.

- David Hamilton, Investing In THORChain (RUNE) – Everything You Need to Know, accessed 27 Juli 2023.

- Miles Deutscher, Why $RUNE is pumping, Twitter, accessed 28 Juli 2023.

Share