Hunting for Airdrops While Earning Profit from Liquid Restaking? Find Out How Here!

Ethereum restaking is one of the popular crypto narratives in 2024. Various Ethereum restaking platforms are also implementing a points system, increasing the potential for airdrops for their users.

In this article, Pintu Academy will explain in detail how to deposit Liquid Restaking Tokens (LRT) with high bonuses or APY while hunting for airdrop points using the Pintu Web3 Wallet. Let’s dive in!

Article Summary

✨ Ethereum restaking is one of the evolving narratives in the crypto world this year, and Liquid Restaking Tokens (LRT) can be deposited on DeFi platforms to earn yields, such as in Pendle.

🚀 Some restaking platforms have a points system that could become valuable for future airdrops. Examples include EigenLayer and Renzo Protocol.

🪂 By depositing LRT, investors not only receive yields but also earn points to increase their potential for receiving airdrops.

About Restaking

Ethereum restaking has been a recent focus in the crypto world. Essentially, with ETH restaking, investors can restake their staked assets to maximize rewards on other DeFi platforms.

When restaking, users receive Liquid Restaking Tokens (LRT) that can also be deposited in liquidity pools to earn interest or yields. One platform facilitating this is Pendle Finance.

In this article, we’ll explain how to deposit LRT on Pendle while collecting airdrop points from restaking platforms like EigenLayer and Renzo Protocol.

Why has liquid restaking become such a popular narrative? Essentially, LRT itself plays a role in increasing the value of ETH. This is because by locking ETH on staking platforms, the supply of ETH in the market decreases, encouraging investors to hold onto their ETH rather than selling it.

About EigenLayer and Renzo Protocol

One of the protocols pioneering restaking is EigenLayer, which essentially restakes ETH to secure various other protocols on Ethereum.

Meanwhile, Renzo is a restaking platform that simplifies the restaking process on EigenLayer. This protocol abstracts all complexities and enables easy collaboration between users and EigenLayer node operators.

By restaking on Renzo, users will receive ezETH, which is Renzo’s Liquid Restaking Token (LRT), as well as EigenLayer Points and Renzo ezPoints. The higher the points, the higher the potential for receiving airdrop allocations from both platforms in the future.

Read more about EigenLayer in this article.

About Pendle Finance

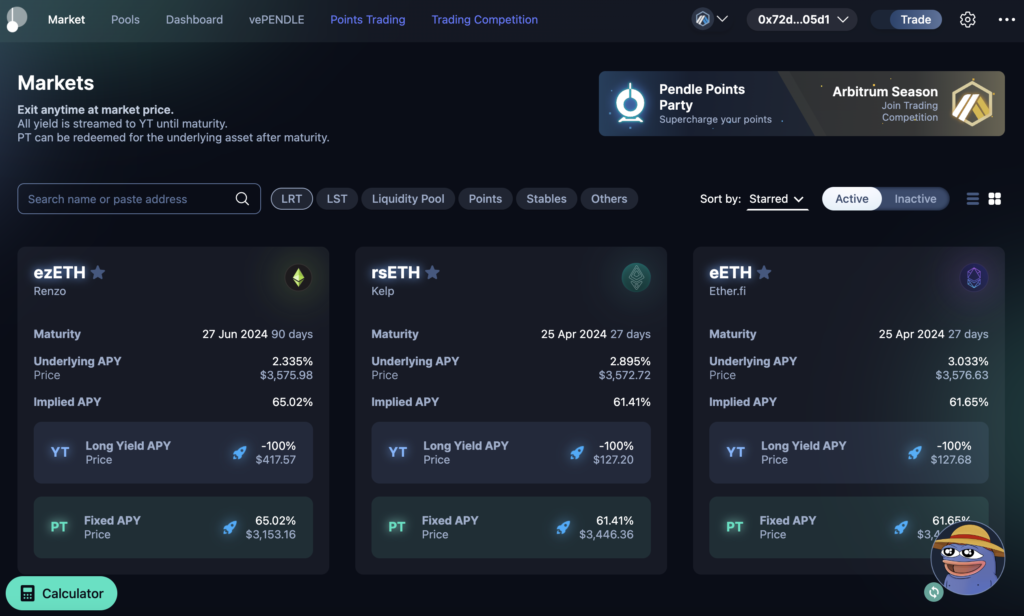

Pendle is a DeFi protocol that facilitates the tokenization and trading of future yield from a yield-bearing asset using an automated market maker system.

The main goal of Pendle is to provide a way for users with yield-generating assets to increase their profits. Additionally, users can also buy assets at a lower price than the market price. This is because Pendle divides yield-bearing assets into principal tokens and yield tokens, with this division making the price of the principal token cheaper.

Users can then trade or lock these yield tokens through Pendle’s DEX. Tokens available on Pendle include Liquid Staking Token (LST), Liquid Restaking Token (LRT), stablecoins, and others.

Pendle Finance is one of the leading protocols with a market capitalization of US$396 million. At the time of publication, the native token PENDLE has experienced a price surge of 47% in the last 7 days, reaching US$4.13.

Read more about Pendle Finance in this article.

How to Make a Deposit on Pendle and Earn EigenLayer and Renzo Points

- To start depositing on Pendle, make sure you have ETH first. You can buy ETH on Pintu and then transfer it to your Pintu Web3 Wallet using the Arbitrum network to reduce gas fees.

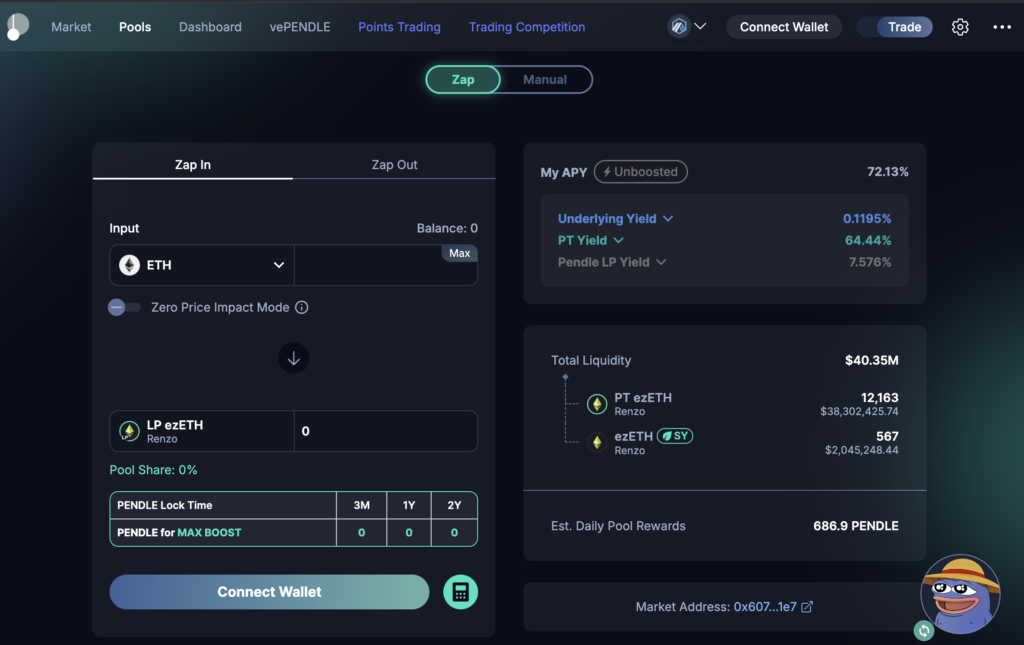

- After that, connect your Pintu Web3 Wallet to pendle.magpiexyz.io, a cross-chain protocol that allows users to access various DeFi protocols on one platform. Make sure to connect your wallet to this platform using the Arbitrum network.To learn more about how to connect Pintu Web3 Wallet with dApps, click this FAQ.

- Once your wallet is connected, you can then see various LRTs that you can deposit in the liquidity pools section.

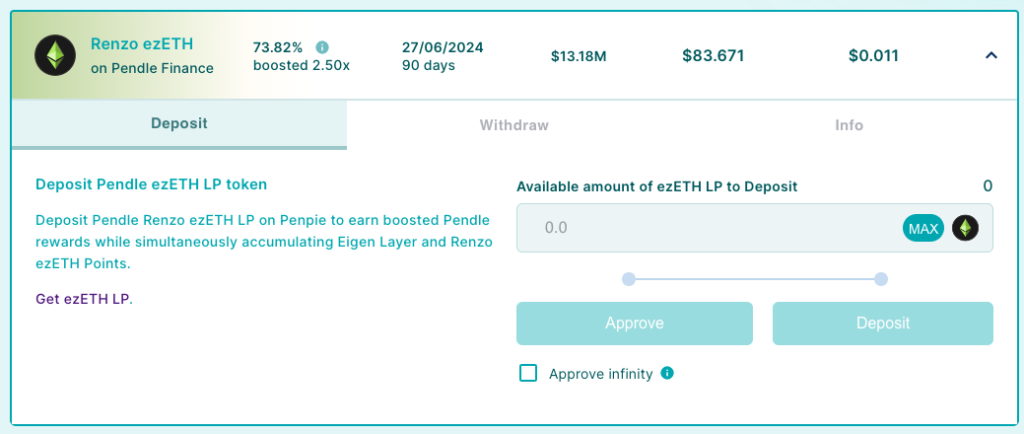

- One of the LRTs that offers a significant Annual Percentage Yield (APY) is Renzo ezETH, which at the time of writing this article offers an APY of 72.19% as shown below.

- If you want to deposit Renzo ezETH, click on Renzo ezETH and then click “Get ezETH LP,” which will redirect you to Pendle Finance.

- On Pendle Finance, specify the amount of ETH you want to restake, then click “Zap In.”

- After obtaining ezETH, return to pendle.magpiexyz.io to complete the deposit process. Keep in mind that this deposit requires a commitment of 90 days, so plan accordingly.

- Specify the amount of ezETH LP you want to deposit and click “Approve.” Then click “Deposit” to deposit your ezETH.

- To view the deposit amount and the yield you receive, click “Claim” on the main page menu, and you can monitor the amount of assets you have deposited along with the amount of rewards you have earned.

Interestingly, by depositing LRT with Pendle, investors not only benefit from the high Annual Percentage Yield (APY) but also have the opportunity to accumulate EigenLayer and Renzo ezETH Points, increasing rewards and the potential for receiving airdrops. You can check the points you have collected on the Renzo Protocol platform in the portfolio section.

🚨 Disclaimer: This article is created for educational and informational purposes, not as financial advice. Always be cautious of airdrop scams! Pay attention to the links you visit and ensure you access official sources.

Share