Market Analysis Feb 5th, 2024: 3 Short-Term Price Drivers for BTC: Powell’s Comments, Halving, and BTC On-Chain Metrics

The Fed Chair stated that inflation is still considered high, and there are indications that a rate cut is unlikely to occur in March. The price of Bitcoin has the potential to be affected by this statement, especially considering that BTC is currently in a sideways pattern with no signs of positive movement.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- ✍🏻 The BTC continues to trade sideways on the back of the Fed Chairman’s comments that inflation is still too high. The strongest support level for BTC is currently at the 21-day exponential moving average (EMA).

- ⚠️ The Fed has decided to keep interest rates stable at 5.25-5.5%. However, the Fed is waiting for clearer signs of a decline in inflation and is taking a more cautious approach to interest rate changes.

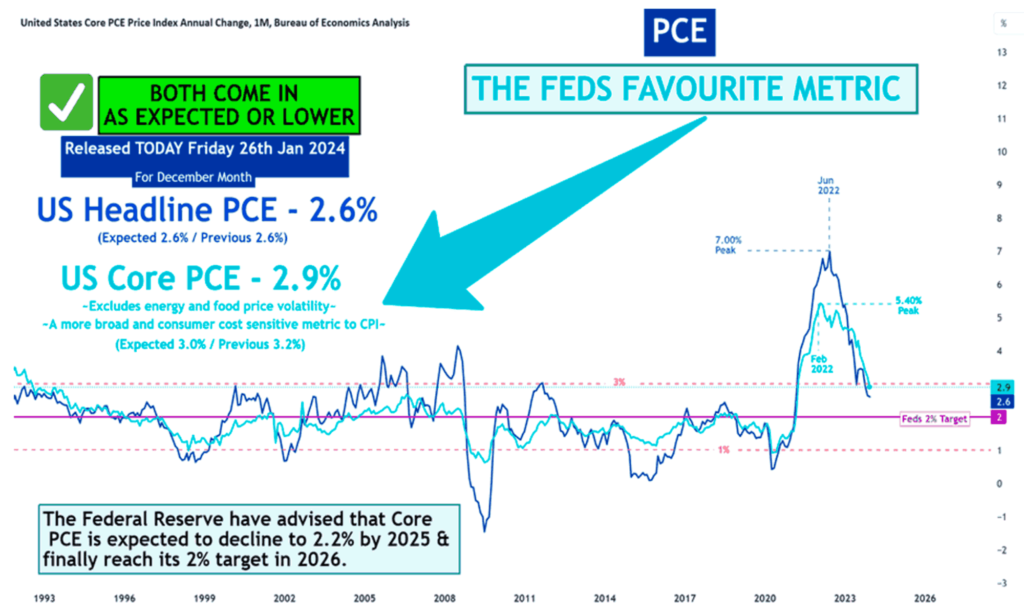

- 📈 The Fed’s main gauge of inflation, the core PCE price index, rose 0.2% month-on-month and 2.9% year-on-year in December.

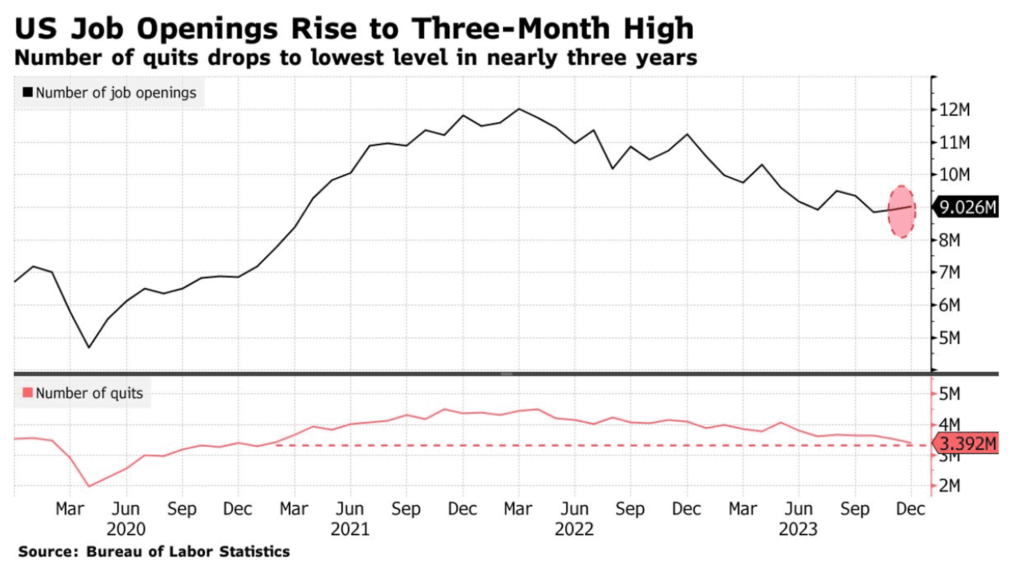

- 💼 Job openings rebounded to 9 million last month.

Macroeconomic Analysis

Core PCE Price Index

The Fed’s primary inflation measure, the Core PCE Price Index, rose 0.2% monthly and 2.9% annually in December, excluding volatile food and energy costs. Though slightly below expectations, this annual rate is the lowest since March 2021 and signals a gradual decline in inflation. Even including food and energy, headline inflation remained stable at 2.6% annually with a monthly increase of 0.2%. This muted data hints at the possibility of the Fed cutting interest rates later this year to reach its 2% target, although the market reaction was muted. Overall, the Core PCE data indicates the Fed is on track to meet its 2% inflation target, paving the way for a potential shift towards lowering interest rates.

Other Economic Indicators

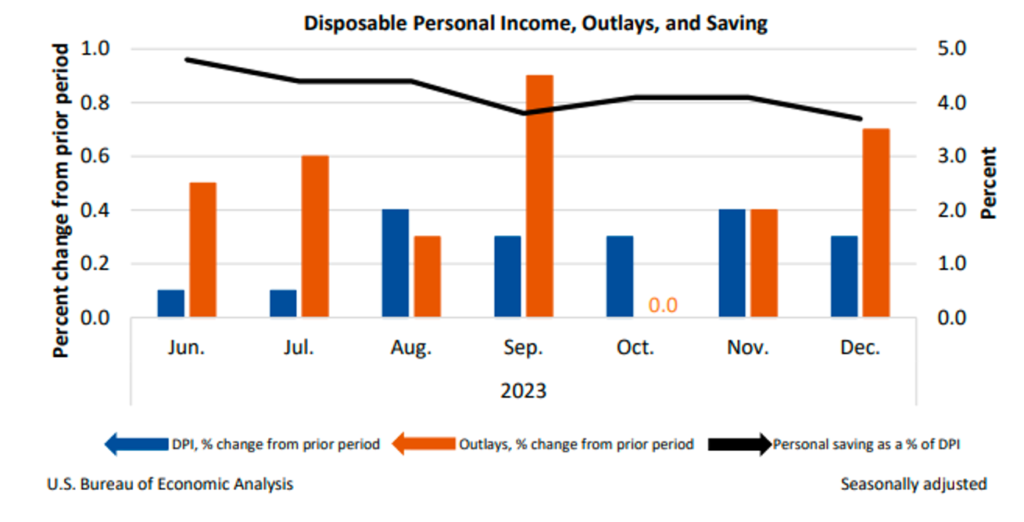

- Personal Income and spending: In December, personal income rose by $60.0 billion, representing a monthly growth of 0.3 percent, as reported in the latest estimates from the Bureau of Economic Analysis (refer to tables below). Disposable personal income (DPI), which is calculated as personal income minus personal current taxes, experienced a $51.8 billion increase (0.3 percent), while personal consumption expenditures (PCE) saw a rise of $133.9 billion (0.7 percent).

- JOLTS Job opening: Unexpectedly, job openings in the US surged in December, reaching the highest level in three months, and fewer Americans chose to resign from their positions. This suggests that workers are becoming more cautious despite the ongoing strength in labor demand. According to the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics, vacancies increased to 9 million, up from an upwardly revised 8.9 million in the previous month. The December figure surpassed all estimates provided in a survey of economists.

- ADP employment: In January, private sector employment saw a growth of 107,000 jobs, with annual pay registering a 5.2 percent year-over-year increase, as reported in the ADP report for the month. The hiring deceleration observed in 2023 extended into January, and there is ongoing relief in wage pressures. The pay advantage for individuals switching jobs reached a new low last month.

- Federal Funds Rate: The Fed held interest rates steady at 5.25-5.5%, despite inflation remaining above their target. While a rate cut isn’t imminent, removing language suggesting further hikes implies a possible shift towards lowering rates in the future. However, the Fed will wait for a more sustained slowdown in inflation before adjusting policy, indicating a cautious approach.

- Initial Unemployment Claims: Initial unemployment claims in the U.S. rose to 224,000 for the week ending January 27. This increase marks two consecutive weeks of claims exceeding expectations and the previous week’s figures. While the insured unemployment rate and the four-week moving average show a slight increase. Moreover, continuing claims also rose to 1.89 million. This data triggered a weakening of the U.S. dollar against major currencies and reflects concerns over potential weakening in the labor market.

BTC Price Analysis

On Thursday, BTC maintained a sideways trading pattern around $42,000, showing a slight recovery from the previous day’s low of $42,276. This movement followed remarks by The Fed Chief who stated that inflation is still too high and indicated that a rate cut in March is unlikely.

Market participants appear to be on edge as the Fed has not disclosed any immediate plans to adjust its monetary policy. In such a scenario, there is potential for increased capital outflows from BTC and other risk assets.

Powell’s comments, coupled with the anticipation surrounding the upcoming halving event and BTC on-chain metrics, play a pivotal role in influencing the short-term price of Bitcoin. Despite this, the on-chain metrics present a short-term bullish outlook for BTC price, countering the historical pattern of a “sell the news” effect associated with pre-halving events.

The present BTC price finds support from the 21-day EMA line. Throughout the week, BTC underwent a correction, dipping below and solidifying the 55-day EMA as a robust support level before bouncing back to its 21-day EMA line.

The overall cryptocurrency market is presently situated under the support line of the 21-day EMA, having initially found support at the 55-day EMA line. This underscores a robust support level, as the market consistently relied on the 55-day EMA as its support for three consecutive days at the start of the week.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long-term holders’ movement in the last 7days was higher than the average. If they were moved for selling, it may have a negative impact. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay short traders. Selling sentiment is dominant in the derivatives market. Takers fill more sell orders. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in OI could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Ethereum prepares for ‘Dencun’ upgrade activation on the main network. Ethereum announced steps towards activating the “Dencun” upgrade with its successful launch on the Sepolia testnet, making it the second testnet to successfully run this upgrade simulation after Goerli. Scheduled to run on the final testnet, Holesky, on 7 February, Dencun introduces the “proto-danksharding” feature designed to reduce transaction costs on layer 2 blockchains and improve data accessibility through the introduction of “blobs”. This upgrade, the largest since the Shapella upgrade last March, is eagerly anticipated to support the rapid growth of layer-2 networks on Ethereum by improving efficiency and capacity. Following Dencun’s activation on Holesky, developers will set a date for its official launch on the main blockchain, marking a significant milestone in the Ethereum ecosystem roadmap.

News from the Crypto World in the Past Week

- Vitalik reveals the prospects and challenges of crypto+AI. In his latest exploration of the intersection of blockchain and artificial intelligence (AI), Ethereum founder Vitalik Buterin provides valuable insights into the synergies and challenges of integrating these two innovative technologies. In a blog post, Vitalik highlights four main areas where blockchain and AI can reinforce each other, including the use of AI in blockchain-based game mechanisms and as an interface to simplify the use of crypto applications. While recognizing the potential benefits, Vitalik emphasized the importance of a cautious approach, warning of security risks and biases that could emerge, particularly in systems that rely heavily on AI. Stressing the importance of transparency and security, Vitalik calls on the community to critically consider the best ways to integrate these technologies in the development of secure and trustworthy applications, marking a cautious yet optimistic step in the evolution of blockchain and AI.

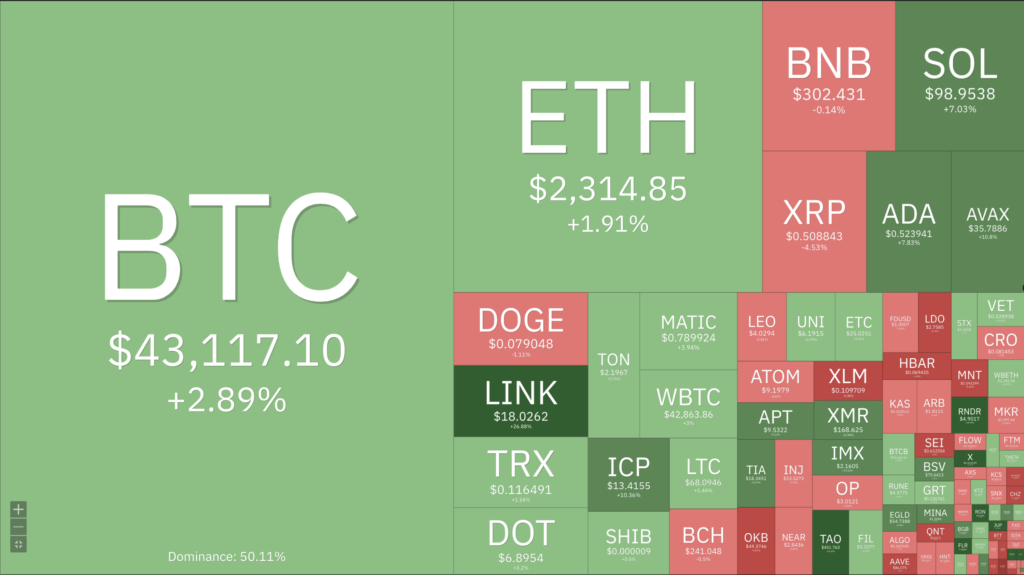

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Chainlink (LINK) +26,83%

- Render +25,11%

- Pendle +18,72%

- Pyth Netwok (PYTH) +16,72%

Cryptocurrencies With the Worst Performance

- Jupiter (JUP) -63,92%

- Manta Network -14,14%

- SATS (100SATS) -9,43%

- Mantle -9,26%

References

- Margaux Nijkerk, Ethereum’s ‘Dencun’ Upgrade Goes Live on Second Testnet, With Just One Remaining, coindesk, accessed on 3 February 2024.

- David Sencil, Vitalik Buterin Explores Crypto-AI Synergy Amidst Rising Interest in Blockchain and AI Applications, bitcoin, accessed on 3 February 2024.

Share

Related Article

See Assets in This Article

BTC Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-