What is Algorand (ALGO)?

The crypto industry currently has hundreds of blockchain networks competing for users. The competition is especially fierce among Layer-1 blockchains such as Ethereum, Solana, Avalanche, and Fantom. Each blockchain tries to show its own advantages such as the speed of processing transactions, the number of transactions per second or TPS, and the degree of network decentralization. Most blockchains will prioritize one of the three important aspects of the blockchain trilemma (security, decentralization, and scalability) at the expense of the other two. However, some blockchains are trying to strike a balance between the three, one of which is Algorand. So, what is Algorand? What is the ALGO coin? What are the advantages of using Algorand? This article will discuss it in full.

Article Summary

- 🏎️ Algorand is a layer-1 blockchain network with smart contract capabilities that can create a decentralized application ecosystem. ALGO is the native crypto asset of the Algorand network. The Algorand network claims it can solve the blockchain trilemma by balancing the three aspects of security, scalability, and speed.

- ⚡ The Algorand network is secured using a consensus mechanism known as Pure Proof-of-Stake (PPoS). Algorand processes transactions in two phases, namely the selection of the block moderator and the voting session. Algorand’s processing method ensures every transaction is successful within seconds without compromising network security.

- 💪 Similar to Ethereum, Algorand can create a decentralized application ecosystem and the DeFi industry. Algorand can also facilitate the creation of various crypto assets such as stablecoins, NFTs, and even other cryptocurrencies.

- ⚖️ The price of the ALGO coin is in a downward trend since reaching its highest level in September 2021. This trend is consistent with the Bitcoin price which has also declined since the beginning of 2022. Fundamentally, Algorand manages to secure agreements with various institutions including FIFA, the largest football organization in the world. However, Algorand’s weakness is that it does not yet have an application that can attract a large number of users.

What is Algorand (ALGO)?

Algorand (ALGO) is a layer-1 blockchain network with smart contract capabilities that can create a decentralized application ecosystem. ALGO is the native crypto asset of the network. The Algorand network is secured using a consensus mechanism known as Pure Proof-of-Stake (PPoS). The PPOS algorithm allows Algorand to process transactions quickly at low costs. Algorand explains that the network is trying to solve the blockchain trilemma by balancing the three aspects of security, scalability, and speed.

According to CoinMarketCap, ALGO is the 27th largest crypto asset in the world with a market cap of $2.9 billion US dollars. The ALGO coin price is $0.4 USD (30 May 2022) with a maximum supply of 10 billion ALGO. There are currently around 6.8 ALGO tokens in circulation, making it 68% of the total supply.

Algorand is a blockchain network with a strong orientation toward its user community. This can be seen in the decentralized governance system. All users and owners of ALGO tokens can participate in the management of the protocol through a voting system.

Then, who created Algorand, and what was its purpose? We’ll cover that below.

Who is the Creator of Algorand?

Algorand was created in 2018 by Silvio Micali, a professor at the Massachusetts Institute of Technology (MIT) who was also a recipient of the Turing award for his role in cryptography. Silvio Micali built Algorand as a decentralized blockchain network that could solve the blockchain trilemma. Algorand’s design enables the network to process transactions quickly without sacrificing decentralized network security. Currently, the Algorand Foundation takes responsibility for network development and governance system.

The Algorand network was launched in mid-2019. Unlike the typical blockchain network that only utilizes its native token, Algorand allows other crypto assets to run on its network through the use of the Algorand ASA standard format. This feature is similar to Ethereum, which allows tokens with the ERC-20 standard to run on its network.

Token Economy/Tokenomics Algorand

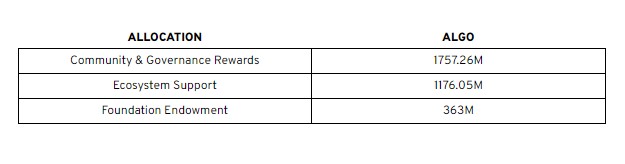

The maximum supply of ALGO tokens is 10 billion. Currently, 6.8 ALGO tokens are already circulating in the market. This is a positive thing as most of the tokens are already in circulation so there is no selling pressure from tokens unlock. The Algorand Foundation regularly releases transparency reports that you can access on the Algorand website. This report describes various aspects of Algorand including the distribution of tokens and the number of tokens held by the Algorand Foundation.

The image above describes the supply of ALGO tokens stored by the Algorand foundation. The number of tokens represents the remaining ALGO tokens that have not yet entered the market circulation. The two tokens with the largest number of tokens have a clear role to play in supporting the Algorand ecosystem and its users. With the regular distribution of tokens issued, the remaining locked ALGO tokens will not create pressure on the price of the ALGO coin.

Read: Algorand whitepaper and other important information

So, how do Algo tokens work? How does the Algorand network operate? The next section will discuss this.

How Algorand Works

Algorand utilizes a variety of proof-of-stake technology to secure its network. This modification is an innovation by the Algorand team called Pure Proof-of-Stake (PPoS). Unlike the proof-of-stake mechanism in general, the minimum number to become a validator is only 1 ALGO. Even so, the opportunity to be selected to process blocks is still determined by the number of stakes owned.

Also read: What is Proof-of-Stake (PoS)?

The transaction processing and block generation method of Algorand is based on the Byzantine Consensus concept. The Algorand network will continue to function as long as the majority (2/3) of validators behave honestly. This ensures a small minority of actors cannot manipulate or harm the system and prevents the majority from misbehaving because it will reduce the value of their assets.

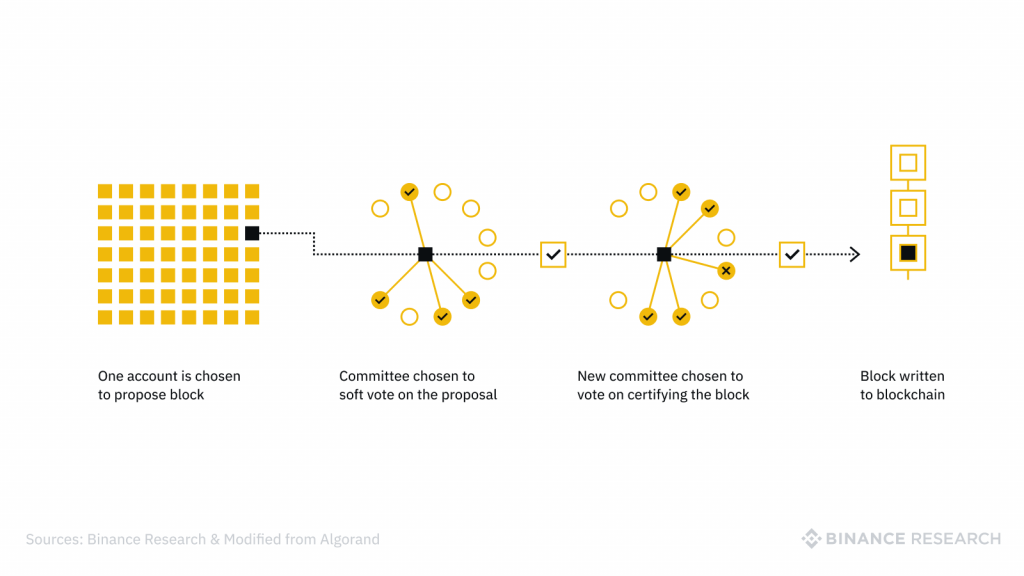

The Algorand network processes transactions in two stages: block moderator selection and voting session. The validator of each transaction block is chosen randomly and secretly. Each validator node then checks the secret participation key using Verifiable Random Function (VRF) to see if they were selected or not. Furthermore, at the voting session, two groups or committees will be selected who are responsible for checking the validity of each block that will be processed and voting on the block. The two voting sessions are soft vote and certifying the vote. The two voting sessions have different validator groups to improve system security.

The identities of each validator who participates in the Algorand block creation process are hidden. Information on the participants in the creation of a new block is also hidden until a block has reached consensus and has been successfully verified. This prevents any malicious acts committed by other validators or outsiders.

Algorand Smart Contracts (ASC1)

The Algorand network is a blockchain that has smart contract capabilities with its own programming framework called Algorand Virtual Machine (AVM). Algorand also has its own smart-contract programming language called Transaction Execution Approval Language (TEAL). Algorand distinguishes between two types of smart contracts, namely smart contracts and smart signatures. In addition, it has a two-layer system in its smart contracts.

Smart contracts are small programs that can fulfill various functions. Smart contracts enable the creation of applications such as DEX, games, and lending platforms. Meanwhile, smart signatures are smaller versions of smart contracts with limited capabilities. It serves to ensure that the AVM can process a transaction and execute commands within it.

Algorand’s two-layer architecture functions similarly to the Ethereum network. Smart contract layer-1 Algorand can process transactions as usual. Meanwhile, layer-2 contains an off-chain contract similar to a side chain technology. This layer-2 can process more complex applications that require stronger computing power.

The current weakness of Algorand is that it lacks interoperability with other blockchains. The Algorand Foundation seems aware of this because In February 2022 they announced it would provide a $10 million dollars grant. A grant called SupaGrant is awarded to teams that can integrate Ethereum virtual machines (EVM) into the Algorand network. This is very important so that Algorand can attract more users and developers from Ethereum.

Algorand Standard Assets (ASAs)

ASA or Algorand Standard Asset is the standard format of tokens for the Algorand network. This is similar to Ethereum standard token formats such as ERC20, ERC721, and ERC1155. The ASA token format can be used to create various types of crypto assets such as stablecoins, new cryptocurrencies, as well as NFTs. The ASA standard token allows the network potential for various products in the crypto world such as DeFi applications, gaming, and an NFT digital marketplace.

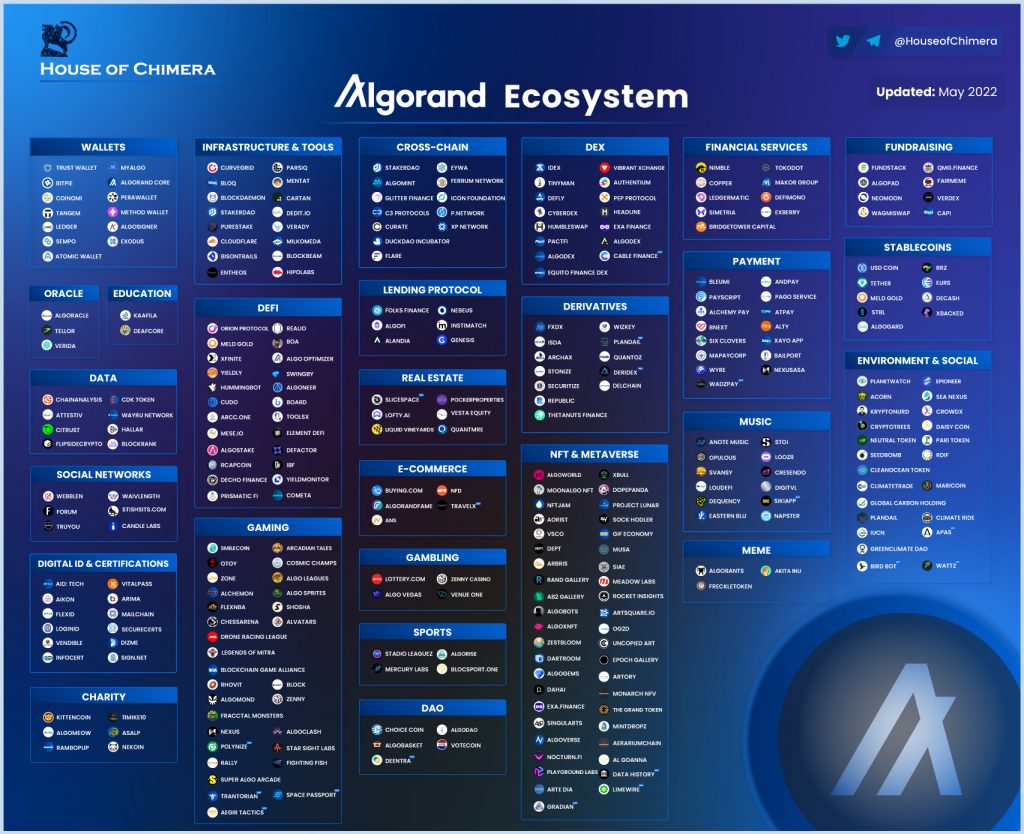

What Can You Do in Algorand?

Using Applications On Algorand Network

- AlgoFi: AlgoFi is a decentralized crypto exchange (DEX) platform that wants to combine several DeFi products. You can use the AlgoFi platform to exchange crypto assets, borrow and lend crypto, and earn interest. AlgoFi owns US$104 million worth of TVL, the largest in Algorand.

- Tinyman: Tinyman is a DEX platform on the Algorand network. Similar to UniSwap on Ethereum, Tinyman functions as DEX. Therefore, you can become a liquidity provider to get rewards from a portion of the transaction fees earned by the platform.

- Rand Gallery: Rand Gallery is one of the most popular NFT digital marketplace platforms on the Algorand network. It has a large collection of which the majority focuses on popular NFT art that you can usually find in marketplaces like OpenSea. The price of most NFTs at Rand Gallery is still relatively cheap because it targets the NFT user market.

- ZestBloom: ZestBloom is an NFT digital marketplace platform on the Algorand network with a more artistic concept. It has various NFT collections that are more catered to the art lover market in the NFT space.

Algorand’s DeFi ecosystem is still relatively new when we compare it to other blockchains like Ethereum or Binance. Apart from that, one of the concerns regarding some of the DeFi apps on Algorand is the low TVL and transaction volume. This can create a high slippage especially if you make a large transaction. Therefore, always pay attention to risk management when you want to use DeFi applications.

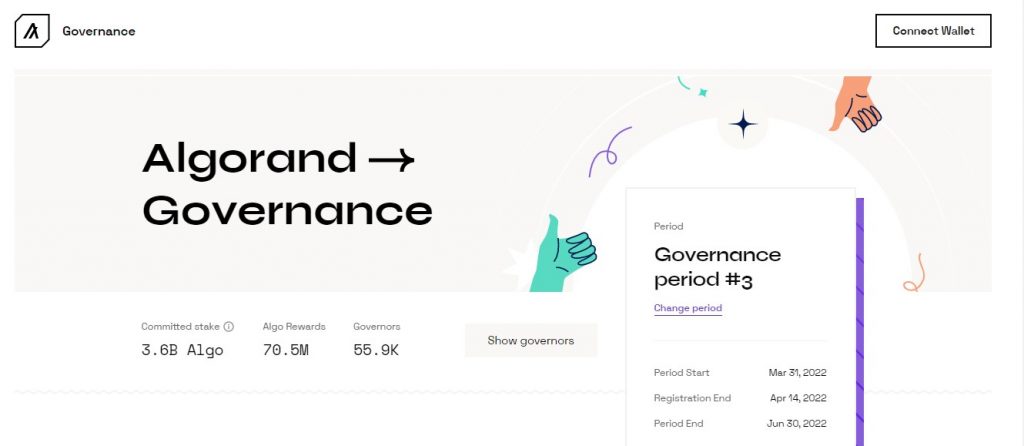

Participate in Governance Algorand

The Algorand network has a unique decentralized management system. In Algorand, everyone can participate in its governance session that is divided by quarters. This decentralized governance model has only been active since Q4 2021. In this system, each ALGO coin owner can participate to become a governor of each governance session. Once elected, each governor must set aside a portion of their ALGO coins as a sign of commitment.

Each governor will get rewards from Algorand based on the number of ALGO tokens set aside as a commitment (1-19% APY). Furthermore, each governor must actively vote on every active proposal in each governance session. The rewards obtained are also adjusted to the level of participation of each governor. All governors will serve for 3 months and must re-register in order to take part in the next governance session.

Algo Coins As Investment

The price of the ALGO coin has unfortunately been in a downward trend since reaching its all-time high in September 2021. This trend is consistent with the Bitcoin price which has also declined since the beginning of 2022. However, apart from the downward trending crypto market conditions, the ALGO coin is also facing sell pressures from new ALGO tokens. Many of the ALGO tokens held by large investors are released to the market in 2021.

Read more: What is Technical Analysis and How Do You Do it?

Based on Messari data, At the end of August 2021, there were 3.5 billion ALGO tokens in circulation. However, on January 1, 2022, that number almost doubled to 6.3 billion ALGO. Although this data isn’t conclusive, the number of tokens that increased by 100% could be the reason why the price of the ALGO coin tends to stagnate since Q4 2021. The drastic increase of ALGO tokens suppresses the price of ALGO which translates into more sell pressure.

However, beyond the technical aspects and price charts, Algorand’s fundamental value continues to increase. Algorand has already announced several high-level partnerships that have the potential to attract a large number of users to its platform. Some of the major partnerships that Algorand announced are collaborations with Hivemind, a crypto investment firm; Limewire and Napster, NFT music platforms; and finally FIFA, the world’s largest football organization. The partnership with FIFA is one of the biggest collaborations as Algorand will become the official sponsor of the FIFA World Cup in 2022. Algorand’s eco-friendly blockchain concept looks attractive to organizations looking for a platform to enter the crypto world.

Algorand weaknesses

However, one of Algorand’s weaknesses is that he doesn’t have many users yet. The Algorand network doesn’t have many DeFi apps yet and the few that do exist cannot attract many users. This is the opposite with blockchains such as Fantom and Solana whose applications can bring thousands of users. This weakness is recognized by Algorand who continues to provide grants for ecosystem development. If Algorand can launch an app that can attract a large number of users, its value as an investment asset will increase dramatically.

Always remember to do fundamental and technical analysis before investing in crypto assets like Algorand. Risk management is one of the most important aspects of investing in the ALGO coin.

What makes Algorand unique?

- 🚄 Atomic Transfer: The atomic swap and atomic transfer features in Algorand allow a collection of transactions to be processed simultaneously, increasing efficiency and reducing the computational load on the network. These two capabilities are ideal for DEXs and products that require a high number of transactions.

- 🍀 Carbon Neutral: The Algorand Network has a strong commitment to being a sustainable and eco-friendly blockchain. Through pure proof-of-stake technology, Algorand’s network consumes only a small amount of electrical energy. In fact, Algorand has collaborated with several environmental organizations in an effort to achieve Carbon Negative status.

- 🏎️ Transaction Speed: The Algorand network creates a block every 4.5 seconds with a maximum of 5,000 transactions. With no forking in all transactions, Algorand can complete 1,000 transactions per second.

- 🏦 Institutional Cooperation: Algorand has various collaborations with institutions and even countries. On the use cases page, Algorand describes all its institutional partnerships.

Algo Coin Roadmap

Algorand does not have an official roadmap after the launch of smart contract capabilities and governance mechanisms. However, we can take information from several sources such as interviews to see what Algorand’s plans are for the future.

- ⚽ FIFA Cooperation: Algorand’s partnership with FIFA will be realized at the 2022 FIFA World Cup where Algorand is one of the official FIFA sponsors. Algorand’s presence in this event will help increase the network’s popularity. FIFA has also yet to announce how it will use Algorand for its project.

- 💸 Role in the creation of CBDCs: Algorand is the first blockchain that can facilitate the creation of Central Bank Digital Currencies (CBDCs) or state currency in digital format. Mashall Island has entrusted Algorand to create the first CBDC, the Marshallese sovereign (SOV). Algorand also has a page dedicated specifically to discussing CBDC in Algorand.

- 🌐 EVM Compatibility: The SupaGrant program will create compatibility between the Algorand network and other blockchains with EVM. If this program is successful, Algorand will have interoperability with various EVM blockchains such as Ethereum, Polygon, and Fantom.

How to Buy ALGO Coin

You can start investing in ALGO coins in the Pintu app. Through Pintu, you can buy cryptocurrencies such as ETH, BTC, etc in a safe and convenient way.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

You can learn more about cryptocurrencies through the various Pintu Academy articles that we update every week! All Pintu Academy articles are made for educational purposes only, not financial advice.

References

- Matthew Zeitlin, What is Algorand (ALGO)? How Does It Work? Pros & Cons, SoFi, accessed on 18 May 2022.

- Marcel Deer, What is the Algorand blockchain, and how does it work?, Coin Telegraph, accessed on 18 May 2022.

- Daniel Phillips, What is Algorand? A Speedy, Scalable Platform for Dapps, Decrypt, diakses pada 19 Mei 2022.

- Smita Verma, What is Algorand (ALGO)| Explained, Blockchain Council, accessed on 20 May 2022.

- The Algorand Protocol Participation, Algorand Foundation, accessed on 23 May 2022.

- Algorand & Frictionless Finance, Algorand Foundation, accessed on 23 May 2022.

- Algorand Standard Assets (ASAs), Algorand Developer Portal, accessed on 23 May 2022.

- Introduction, Algorand Developer Portal, accessed on 24 May 2022.

- The Algorand Governance Program: A More Detailed Exposition, Algorand Foundation, accessed on 24 May 2022.

Share

Related Article

See Assets in This Article

ALGO Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-