How to Use Tokenomics to Evaluate Asset Value

One of the tools investors can use to evaluate the value of a crypto asset is Tokenomik. Various important information can help determine whether an asset is worth investing. So, how do we use tokenomics in evaluating asset value? Find out the answer through the following article.

Article Summary

- 📄 Tokenomics is the study of the creation, distribution, and management of tokens or crypto assets. It is an important tool in evaluating the value of a token.

- 🔑 Some important elements in tokenomics include token utility, total supply, allocation and distribution, lockup period, and burning mechanism. All these elements contribute to the stability and potential sustainability of a project.

- 🌟 ‘Green flags’ such as security audits and balanced token allocation are positive indicators of good tokenomics. Whereas ‘red flags’ include unclear use cases and uncertain launch schedules.

- 🔭 Understanding tokenomics is one of the keys to evaluating a token’s long-term potential and risks.

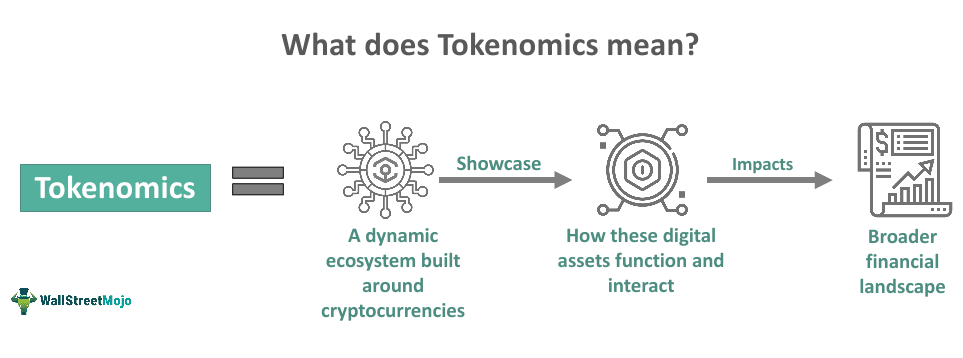

What is Tokenomics?

Tokenomics is the study of how tokens or crypto assets are created, distributed, and managed in an ecosystem. It combines the words ‘token’ and ‘economy.’ Tokenomics also studies how a token has value through related elements, such as supply, inflation rate, distribution, utility, incentives for its hodlers, and accessibility.

Tokenomics can also be referred to as a framework that ensures a token has a clear purpose and value and can support the ecosystem around it. The developers usually also include extensive information behind the philosophy of their tokenomic to attract potential investors.

A tokenomic plays a vital role in the success of a crypto project. Projects that have well-crafted and clear tokenomics have the potential for long-term success. This is because investors can get complete information from it. So, they are interested in buying and holding the tokens.

Want to know five great crypto investment strategies? Learn about them in this article.

Key Elements in Toxenomics

- ⭐ Utility. The most crucial element of tokenomics is the utility of the token. Whether the token’s utility has a specific use case or solves a particular problem.

- 🪙 Token supply. Each tokenomics will explain the token supply. Starting from how much the total token supply is, the circulating token supply, and the maximum token supply.

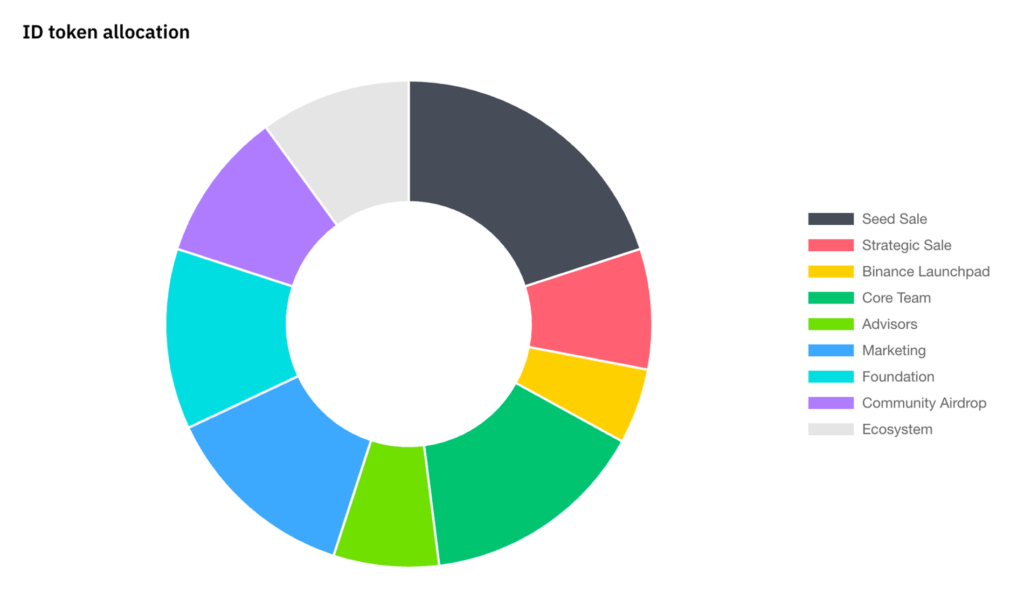

- 🔁 Token allocation and distribution. There are generally four categories of allocation in a tokenomics: public sale, community, core team and early investors, and grant pools and rewards.

- 🔒 Lock-in period. In tokenomics, it will be stated how long the lock-up period is for early token holders (core team and early investors). The lock-in period can protect general investors from pump-and-dump schemes.

- 🔥 Token burning mechanism. To prevent inflation, a protocol requires a token-burning mechanism to remove them from circulation permanently. With a reduced supply in circulation, the token price will be able to increase.

- 💠 Consensus Mechanism. These rules determine how transactions are verified and how new tokens are created. In addition, the consensus mechanism also plays a role in how a token incentivizes participants.

The Importance of Tokenomics

Tokenomics is an essential part of any crypto ecosystem. It allows a project to gain the trust of investors, as well as create a strong ecosystem in the long run. No matter how innovative a project is, it may fail if its tokenomics does not have a good structure.

Since the crypto landscape lacks regulation and protection, a tokenomics can help investors do in-depth research before buying a token. This is because a tokenomics will present initial information about the value and purpose of a project.

In terms of purpose, a tokenomics describes whether the project aims to solve a current problem and how it will continue to be relevant in the future. On the fundamental side, it can determine tokens’ supply, allocation, and distribution. By examining the them, investors can evaluate the project’s and token’s value.

A good tokenomics will showcase the concept of how the value of the token will continue to grow in the long run, encourage hodl, and incentivize early adopters. All while controlling the inflation rate of the token and encouraging sustainable growth.

These six analysis websites can help you analyze the fundamentals of a crypto asset.

How to Evaluate Asset Value Using Tokenomics

Now that you know the essential elements of tokenomics, use them to evaluate the value of a token. Here is a quick guide:

1. Find out the Token’s Utility

Every token has a utility, which could be for governance, on-network activities, stablecoins, and so on. Some tokens also have a utility for how much they are incentivized when used on the network. The more transparent and attractive the token’s utility, the more likely it is to have higher demand. This can give investors confidence that its potential and value will continue to grow.

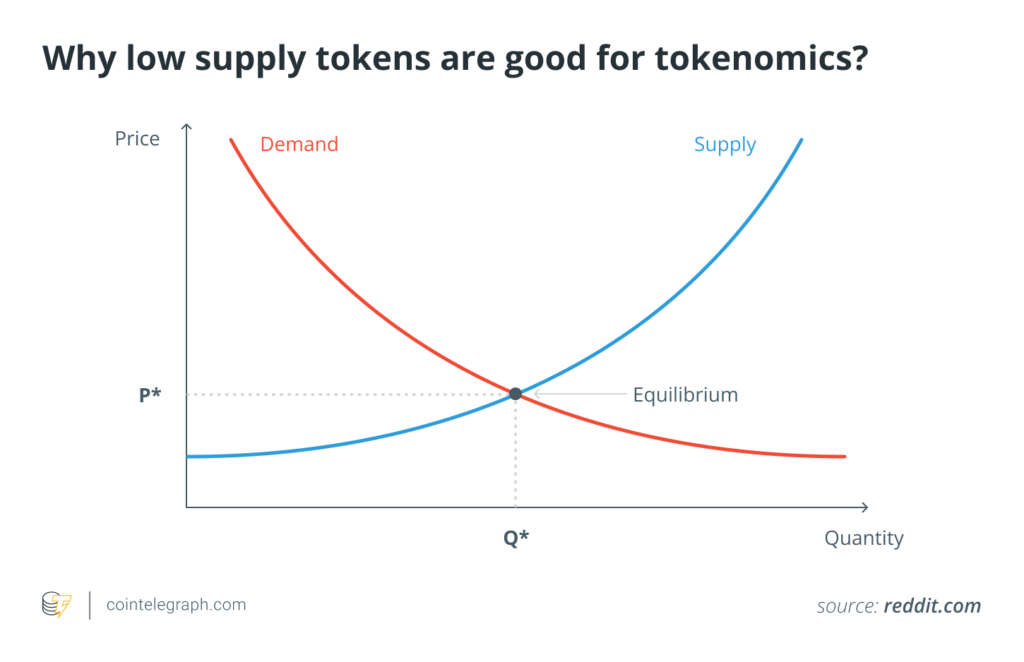

2. Analyze the Supply

For investors, comparing the maximum supply to the circulating supply can be the quickest way to determine if a token is worth investing in. A token with a high max supply but a low circulating supply tends to decrease in value. This is because each new token created reduces the concentration of the total supply.

3. Pay attention to Token Allocation and Distribution

An efficient token distribution model ensures ideal allocation and a clear distribution schedule. Ideally, large amounts of token allocations are not given to one particular group to prevent domination and interference. A good schedule features a clear token lock-in period. If the lock-up period is not staggered or the period is short, there could be a significant price drop when early holders sell.

4. Learn the Token Burning Mechanism

Token burning is one of the mechanisms that make token value more valuable. This mechanism will reduce the total supply of tokens (deflationary), making the tokens in circulation more valuable. Meanwhile, if a tokenomics has no token burning, it is called inflationary. The token supply continues to grow in this mechanism, reducing its value.

5. Understanding the Incentive Mechanism

How a token incentivizes its participants to ensure long-term sustainability is an essential aspect of a tokenomics. The most commonly used are proof-of-work (POW) and Proof-of-Stake (PoS) mechanisms. However, various protocols also have their incentive mechanisms to attract participants.

In addition, you can also learn about the development team’s track record, community development and adoption, and the security factors of a token from its tokenomics. After analyzing the various elements in the tokenomic of a token, you can conclude whether the token is worthy of being an investment or not.

Green and Red Flags in Tokenomics

In evaluating the value of an asset, the following are green or red flags that can be found in tokenomics:

Green Flag

- Security Audit

Any structured tokenomics project will enlist a third-party security firm to audit its token code or core smart contracts. The security audit guarantees that the core project team does not have the right to issue new tokens beyond the announced amount or suddenly take control of users’ tokens. The audit also ensures that the locking contract and token distribution address match the publicly available information.

- Existing User Base

Tokenomics designed to cater to existing users is likely to survive in the long run than those that target new users. For example, projects with users before launching tokenomics already have a business model. These users are known as early adopters. Early adopters will get a portion of the token allocation as a reward for supporting the project from the beginning.

- Incentives to Use

In tokenomics, a project with an incentive mechanism when used or the tokens held by investors, is a good sign. Such a mechanism shows the seriousness of the development team to grow the ecosystem and network activity. In addition, the incentive mechanism also shows that the token has a clear utility value. Thus, it is expected to maintain the demand for the token in the long run.

Red Flag

- Unbalanced Allocations

A balanced token allocation is one where tokens are distributed to stakeholders according to their respective contributions. If the distribution to the core development team is too large and the lockup time is short, it can be a red flag for investors. This can lead to price manipulation.

The same applies if the distribution to early investors is too large. This could create the potential for high selling pressure. Early investors generally buy tokens at a very low price, so they still profit when selling them. At the same time, high selling pressure can bring the token price down even further.

- Unclear Use-Cases

This can be seen as a red flag if a tokenomic shows that the token does not have clear use cases. Tokens without use cases will make it difficult to get concrete demand because they rely only on speculation and hype. Thus, its long-term sustainability will be a big question mark.

- Uncertain Schedule Release

Every tokenomics will enclose the release schedule for non-circulating tokens. If there is no particular timeline or schedule, it could indicate a red flag. The development team intends to dump the token. Such token release schedules must be publicly disclosed and updated frequently to ensure all stakeholders keep track of key dates.

In addition to tokenomics, you can also find out various detailed token information through whitepapers. Learn how to read it here.

Conclusion

Tokenomics is an important tool in evaluating a crypto asset’s value. It contains important information, such as how tokens are created, distributed, and managed. In evaluating the value of an asset through tokenomics, it is important to consider key elements. Such as utility, total supply, allocation and distribution, burning mechanism, and lockup period. A well-structured and well-rounded tokenomics can attract investor interest and trust.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- John Lee, What Is Tokenomics? The Investor’s Guide, Blockworks, accessed on 31 August 2023.

- Robert Stevens, What Is Tokenomics and Why Is It Important? CoinDesk, accessed on 31 August 2023.

- CoinGecko, What Is Tokenomics? Understanding Crypto Fundamentals, accessed on 31 August 2023.

- CoinTelegrapgh, What is Tokenomics? A beginner’s guide on supply and demand of cryptocurrencies, accessed on 31 August 2023.

Share