Predicting Bitcoin’s Uptober in 2024

Crypto market participants are entering October with enthusiasm. Historically, this month has proven to be the best month for BTC. Data shows that BTC achieved an average increase of up to 21.08% in October. This phenomenon is known as Uptober. So what is the potential for Uptober this year? Will BTC once again record its best performance? Find out more in the following article.

Article Summary

- 🔝 Uptober is the phenomenon of BTC price bullish throughout October. Historically, October has been the best month for BTC.

- 📈 On average, BTC recorded a price increase of 21.08% throughout October.

- 🚨 Four possible catalysts that could drive the uptober rally: accommodative monetary policy, positive economic data releases, US election results, and institutional investor adoption.

What is Uptober?

Uptober is a much-anticipated trend phenomenon among crypto traders and investors every year. It combines the words “Up” and “October.” Uptober describes a bullish trend that occurs in October. In fact, October is Bitcoin’s most bullish month.

When Uptober occurs, BTC experiences a significant rally, followed by price increases in other altcoins. According to data from Coinglass, BTC has seen an average increase of 21.08% in October over the past 13 years.

Since its inception, BTC has recorded positive performance nine times during October. The highest increase occurred in October 2017, when BTC surged by 47.81%. Notably, Uptober didn’t happen only in 2014 and 2018, where BTC declined by 12.95% and 3.83%, respectively.

Historically, when BTC's performance in September is positive, it tends to experience a bullish rally for the rest of the year. This has happened in 2023, 2016, and 2015.

Uptober is special not only because BTC delivers its best performance for the month. It also plays a crucial role in driving the market towards a bull run. As Bitcoin halving is a sign of a bull market, the existence of Uptober further increases the probability of such a bull market.

Must-do! Prepare the following five things to welcome the upcoming bull market.

Bitcoin’s Situation Ahead of Uptober 2024

As previously mentioned, Uptober has historically been the best month for BTC prices. Naturally, many market participants expect the same to happen in October this year. But what is the reality? How likely is it that BTC prices will follow this historical trend? \

After struggling in the $53K-$60K range in early September, BTC managed to end September on a positive note. Following the Fed’s 50 bps interest rate cut, BTC gained new momentum and rallied. BTC briefly touched the $66K level on September 27th.

This resulted in a 7.29% increase for BTC in September. This performance is the best record, especially since September has historically been the worst month for BTC. Notably, BTC was in the red eight times, more than any other month.

The initial optimism, however, didn’t last long. BTC weakened in the first two days of October. At the time of writing, BTC has returned to the $61,000 area. This has caused BTC’s performance for the entire month of October 2024 to decline by 2.95%.

Taking the average BTC performance during October, which is 21.08%, from the current price level, BTC could reach the $74,000 level. This means Uptober could lead BTC to break its all-time high. This possibility ultimately makes market participants enthusiastically await the effects of Uptober this year.

Uptober Catalysts

The following catalysts are some of the factors that can fuel Uptober:

1. Monetary Policies

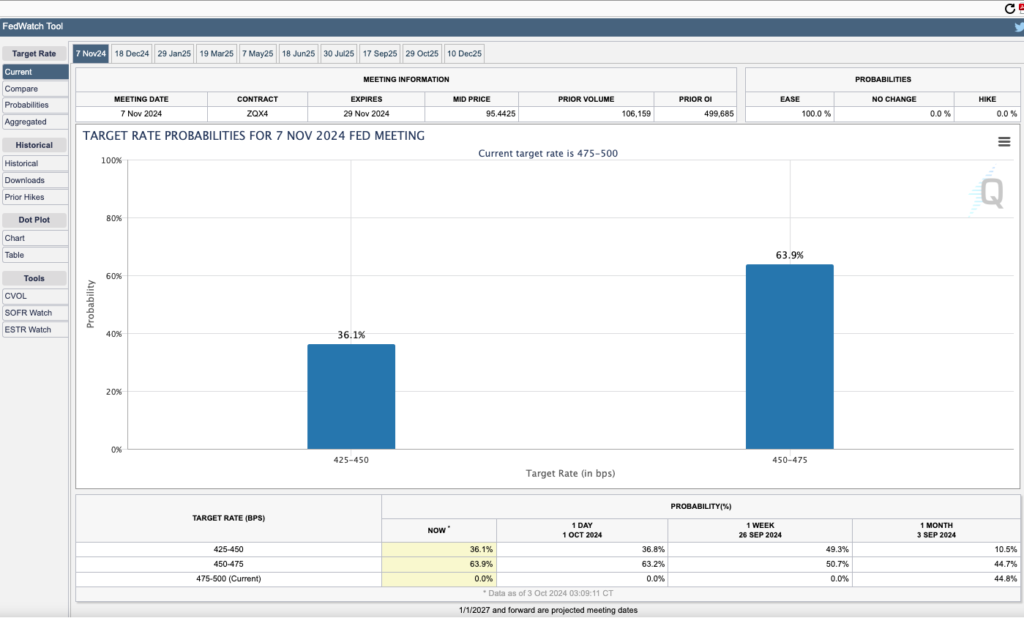

In his last speech, Jerome Powell implicitly conveyed that aggressive cuts will still be made for the rest of this year. The Fed still has two more meetings this year: November and December.

So far, CME FedWatch, a tool that tracks the probability of a change in the Fed’s target rate, estimates the likelihood of a 50 bps cut in November at only 36.3%. If optimism towards the possibility of a 50 bps cut can increase, then it could be a positive catalyst that strengthens the rally post-October.

Besides the Fed’s stance, the Bank of Japan’s decision should also be interesting. After raising interest rates in July and triggering the carry trade, the BoJ’s next policy will be crucial. Meanwhile, the BoJ will hold another meeting at the end of October. The meeting results are believed to have a significant effect because they provide clues as to the Fed’s attitude at the November meeting.

Meanwhile, the People’s Bank of China (PBOC) plans to lower its benchmark interest rate before October 31. The move by China’s central bank is an effort to encourage improvements in China’s property demand.

Find out why a Fed rate cut could positively impact the crypto market here.

2. US Economics

In October, the US economic data will be announced. Throughout this year, these data releases strongly correlate with BTC’s movement. This is because data such as inflation and labor force have important implications for the policy taken by the Fed in November.

If the data released in October shows improvement in the US economy and purchasing power, it will strengthen the signal of monetary policy easing at the next Fed meeting. However, if it turns out that the data shows stagnation, the Fed will likely not rush to cut interest rates again. This could hamper the Uptober rally.

3. US Presidential Election

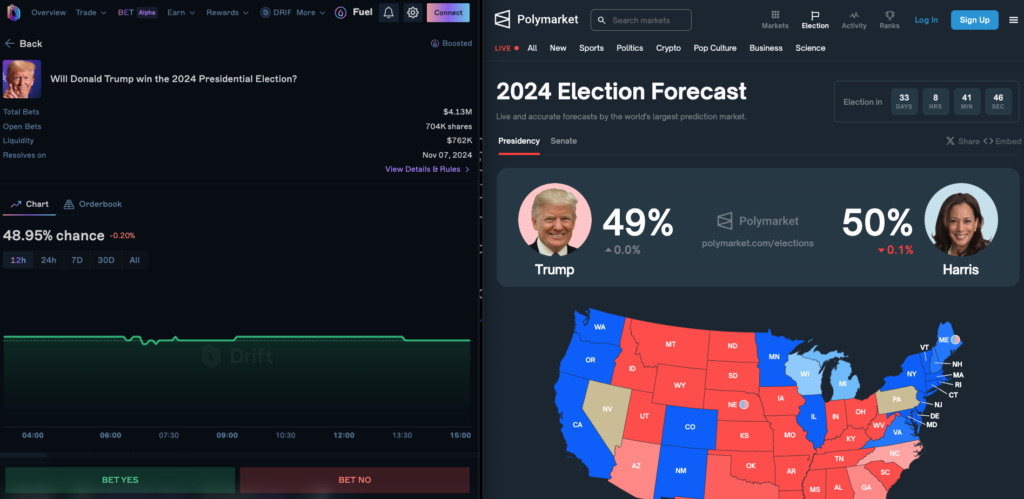

The United States presidential election will be held on November 5, 2024. Developments that occur throughout October are crucial to see who will be elected. If we look at the attitude of each presidential candidate, the election of Donald Trump is believed to impact the crypto market positively.

However, Kamala Harris surprisingly said she would support the crypto industry if elected. Harris said she plans to ensure the US remains dominant in emerging technology sectors such as blockchain, AI, and quantum computing. She added that these sectors will define the next century.

This statement shows a 180-degree difference from the Joe Biden administration, which is considered unfriendly to the crypto market. Despite Harris’ efforts to reach crypto voters, Trump is still considered the most pro-crypto candidate.

However, suppose it turns out that Harris was elected as the US president. In that case, many believe that it will not entirely adversely affect the crypto market as Harris’ attitude changes. According to betting markets Polymarket and Drift Bet, both are equally strong at 50% predicted to be elected US president.

In the following article, you will learn more about the impact of the US election on the crypto market.

4. Institutional Adoption

Following the approval of spot ETFs for Bitcoin and Ethereum, the U.S. Securities and Exchange Commission (SEC) recently gave the green light to Bitcoin options on BlackRock’s iShares Bitcoin Trust (IBIT) spot ETF.

According to a recent CryptoQuant report, approving Bitcoin options could enhance liquidity and investor participation in the Bitcoin market. This could lead to institutional investors’ broader adoption of Bitcoin.

CryptoQuant’s report suggests that options on the IBIT ETF could provide a new instrument for investors to generate yield from holding Bitcoin by selling covered calls. Investors can sell call options and collect premiums, earning a yield on their holdings within a regulated framework.

Although the SEC has approved, options on the IBIT ETF are currently awaiting approval from the Options Clearing Corporation (OCC) and the Commodity Futures Trading Commission (CFTC). The additional liquidity and demand could bolster the ongoing Uptober rally if approved.

Uptober Challenges

October opened with Bitcoin and most altcoins plunging, dashing the hopes of an “Uptober” for many. The missile attacks by Iran on Israel triggered a correction trend in risky assets amid rising geopolitical tensions in the Middle East.

If tensions persist, the “Uptober” trend could face significant headwinds. This situation drives investors into a risk-off mode, leading them to seek safe-haven assets like gold.

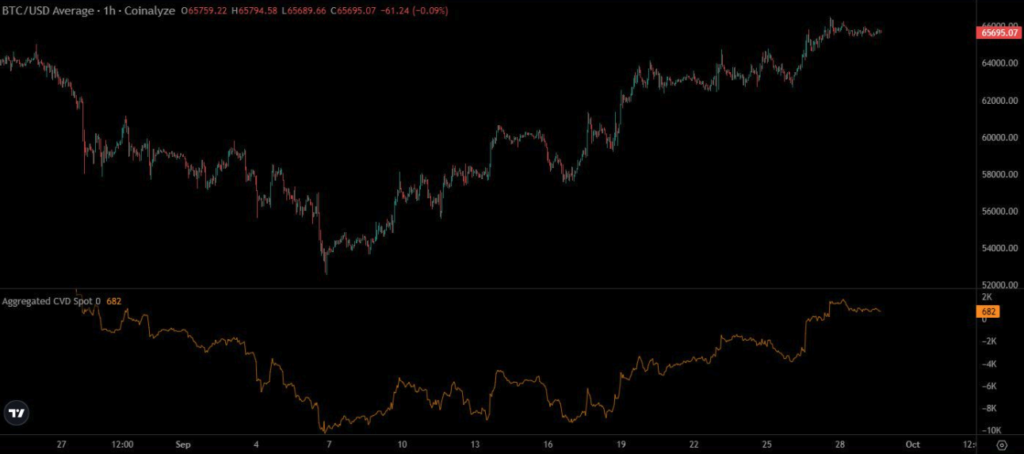

According to Bitfinex research, another factor hindering Bitcoin’s momentum is the waning buying pressure in the spot market. The Cumulative Volume Delta (CVD) metric has sharply increased since September 6, indicating strong buying activity.

However, once it reached $66,000, the metric flattened and lost momentum. This signals a temporary balance between buyers and sellers.

The same report highlights the increasing open interest (OI) in Bitcoin futures. The BTC OI surpassed $35.3 billion, which it has only breached six times before. Historically, this level has been associated with local tops, raising concerns about an overheated market.

Conclusion

October has historically been the best month for BTC, earning it the nickname “Uptober.” BTC has recorded positive performance nine times during October, with an average increase of 21.08%. If BTC is in the green in September, its bullish trend will likely continue until the end of the year.

Currently, four primary catalysts could strengthen the Uptober rally. First, accommodative monetary policies from central banks around the world. Second, positive US economic data releases will influence the Federal Reserve’s policy decisions. Third is the US election results, where a Donald Trump victory is believed to impact the crypto market positively. Fourth, the broader adoption of Bitcoin by institutional investors as Options on spot Bitcoin ETFs are approved.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- William Suberg, New all-time high in ‘Uptober?’ 5 Things to know in Bitcoin this week, Coin Telegraph, accessed on 1 October 2024.

- Frederick Munawa, Is an ‘Uptober’ Bitcoin Price Rally Imminent? Unchained Crypto, accessed on 1 October 2024.

- Gino Matos, Bitcoin’s historic ‘Uptober’ trend faces challenges amid high futures interest, cooling spot buys, Crypto Slate, accessed on 1 October 2024.

- Bitfinex, Bitfinex Alpha: 30 September 2024, accessed on 1 October 2024.

Share