Antam Gold Price Chart Today December 10, 2025: Up or Down?

Jakarta, Pintu News – Antam’s gold price is back in the spotlight after the latest chart shows a strengthening on December 10, 2025. Based on data from HargaEmas.com, the movement of gold prices in rupiah recorded significant dynamics, both at the global spot level and Antam prices in the domestic market.

Spot Gold Price: USD/oz Weakens, but Price Per Gram Remains High

Data as of December 10, 2025 at 16:40 WIB shows the spot gold price at USD 4,196.50 per troy ounce, weakening USD 11.30 compared to the previous session. However, the weakening of the US dollar against the rupiah made the price of gold in rupiah remain high.

The USD/IDR exchange rate was recorded to rise to IDR16,690.54 (+13.04), bringing the spot gold price in rupiah terms to IDR2,251,898 per gram, down slightly by IDR3,965. The daily price range (Hi-Lo) moves between IDR2,263,339 – IDR2,251,898, indicating relatively manageable volatility.

Daily Spot Gold Price Chart: December 9-10, 2025 Movement

Based on the spot gold price chart in rupiah:

- The movement on December 9 was dominated by downward fluctuations, touching the lowest level of around Rp2,239,306.

- On December 10, prices moved more steadily although they tended to decline, before finally strengthening again at the end of the session.

This pattern indicates short-term pressure due to global weakness, but the strengthening rupiah and domestic demand keep gold prices high.

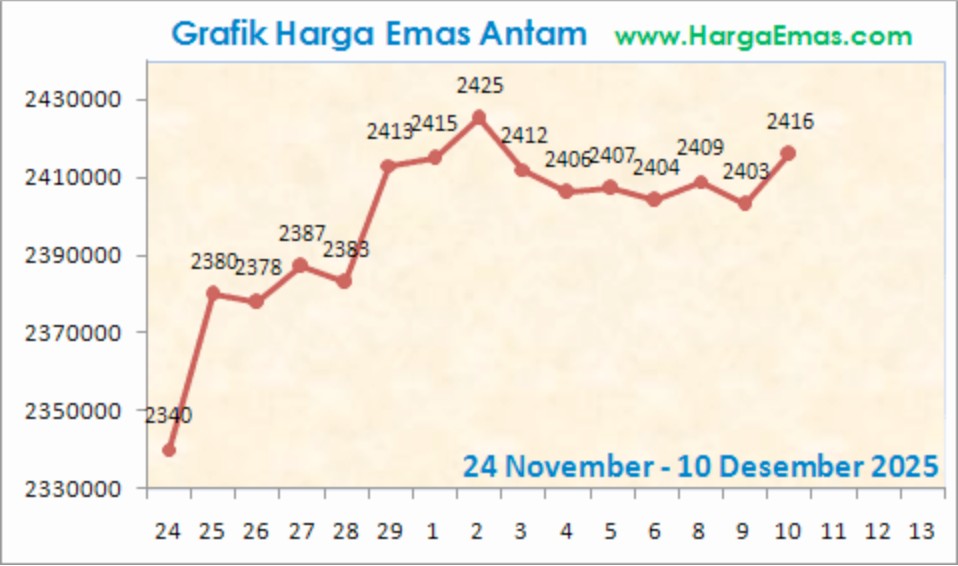

Antam Gold Price Chart: November 24-December 10, 2025 Trend

In the Antam price chart, the trend during the period from November 24 to December 10, 2025 shows a significant upward pattern:

- The price on November 24 was at around IDR2,340,000 per gram.

- Prices moved up steadily until they reached a peak of IDR 2,425,000 in early December.

- After experiencing a mild correction in the range of IDR 2,404,000 – IDR 2,407,000, the price strengthened again to IDR 2,416,000 per gram on December 10, 2025.

This data shows that Antam’s gold rally is still maintained despite pressure from global spot prices.

Summary of Gold Conditions Today

- Global spot gold price: USD 4,196.50/oz (down).

- USD/IDR exchange rate: IDR16,690.54 (rising).

- Spot gold price in rupiah: IDR 2,251,898/gr (slightly lower).

- Antam gold price: IDR 2,416,000/gr (stronger on December 10).

The combination of exchange rates, domestic demand, and global trends has kept Antam gold moving in a strong zone despite increased daily volatility.

FAQ

What are the main factors affecting gold price movements today?

Gold prices are influenced by a combination of changes in global spot prices in USD, movements in the USD/IDR exchange rate, as well as demand and supply dynamics in the domestic market according to HargaEmas.com data.

Why can Antam’s gold price rise despite weak global spot prices?

An increase in Antam’s gold price can occur if the rupiah exchange rate weakens against the US dollar or domestic demand increases, so that the price in rupiah remains high even though global prices move down.

What is the spot gold price per gram in rupiah on December 10, 2025?

Based on HargaEmas.com data, the spot gold price is around IDR 2,251,898 per gram on December 10, 2025.

What is the trend of Antam gold price during November 24-December 10, 2025?

The trend showed a steady strengthening from around Rp2,340,000 per gram to Rp2,416,000 per gram, with the peak reaching Rp2,425,000 in early December according to Antam’s price chart.

Did gold price volatility increase in December 2025?

Yes, the daily chart shows higher volatility, especially in the intraday movements of global spot and spot rupiah, influenced by fluctuations in the USD/IDR rate and international market conditions.

What is the difference between spot gold price and Antam gold price?

The spot gold price reflects the international market price of pure gold, while the Antam gold price includes production costs, certification and distribution margins and is therefore usually higher according to the precious metals market explanation.

Why is the USD/IDR exchange rate important in determining the price of gold in Indonesia?

Global gold prices are quoted in USD, so changes in the USD/IDR exchange rate directly affect the value of gold in rupiah; a rise in the exchange rate usually pushes up domestic gold prices.

Is the gold price on an upward or downward trend?

Based on data from November 24-December 10, 2025, Antam gold prices are in an upward trend, while daily spot prices fluctuate but remain in a high range according to the HargaEmas.com chart.

Reference

- HargaEmas.com. Spot Gold & Antam Gold Price Chart. Accessed on December 10, 2025.