3 Key Reasons Behind Bitcoin’s Price Surge Amid U.S. Military Operations in Venezuela

Jakarta, Pintu News – Bitcoin price is in the spotlight after surging through $93,000, triggered by the United States military operation in Venezuela that led to the arrest of President Nicolas Maduro.

Most traders are now focusing more on price movements and are starting to abandon their positioning strategies, as the crypto market shows strong upward momentum and leaves traders in doubt.

Here are the 3 main reasons behind the significant surge in Bitcoin price.

Bitcoin price continues to rise amid the “Clean-Slate” effect: Matrixport

While traders are still torn between predictions of a bear market or a sustained bull market, Bitcoin price has managed to stay above $88,000 and continues to build upward momentum towards 2026.

Read also: Mega Bullish Predictions in the Crypto Market This Week: What to Watch Out For?

Doubtful traders chose to wait on the sidelines during the long New Year holiday, so the market focus was more on price movements than BTC positions.

Matrixport stated that “starting the new year with a clean portfolio and light positions is often the ideal setup.” This prompted the global Bitcoin and crypto markets to undergo a natural reset, following the liquidation of leveraged positions on Bitcoin and Ethereum futures that reached nearly $30 billion since their peak in October.

BTC’s position at the start of 2026 is now much leaner, with excessive speculation having been eliminated. Matrixport predicts that the price of Bitcoin and the crypto market now has room to follow its natural course – which is mostly upwards – without being weighed down by overcrowded speculative positions.

Venezuela’s 600,000 BTC Shadow Reserve Could Make Its Way into the US Strategic Reserve

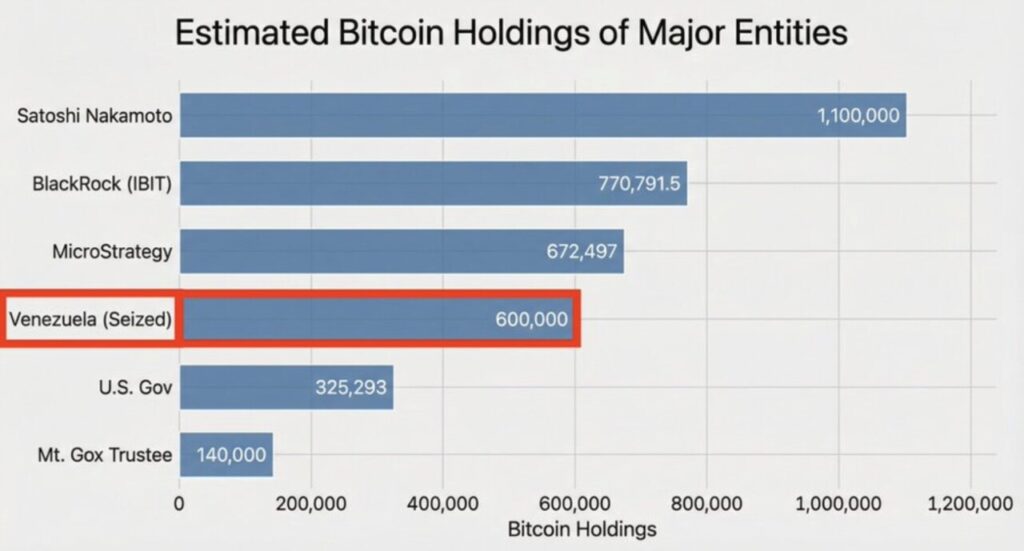

Intelligence reports reveal that Venezuela may be in control of large “shadow” Bitcoin reserves, up to 600,000 BTC. The potential value of these reserves amounts to around $60 billion, equivalent to the BTC holdings of MicroStrategy (MSTR) and BlackRock.

The Nicolas Maduro regime is known to accumulate Bitcoin (BTC) and Tether through gold swaps and oil export payments in USDT as a way to circumvent US sanctions.

Following the US military operation in Venezuela that led to Maduro’s arrest on January 3, attention has now turned to recovering the crypto assets. If seized, the BTC could be frozen as confiscated assets or even put into the United States’ strategic reserve.

This will lock in a large amount of supply, which is fundamentally bullish for the Bitcoin price.

Read also: Global Oil Prices Today: Live Oil Price Chart for January 5, 2026

Bitcoin price surges amid technical breakout

Some whales and traders responded to the latest news by adding to their holdings and opening long positions on BTC. The price of Bitcoin rose by more than 2% in the last 24 hours, managing to break back above the $93,000 level. At the time of writing this report, BTC price is trading at around $92,432.

In the last 24 hours, the lowest and highest prices were recorded at $90,877 and $93,204. Additionally, trading volume increased by 41%, signaling renewed interest from traders.

Analyst Joe Consorti highlighted that Bitcoin price managed to break back above its 50-day moving average for the first time since October. BTC is currently testing price levels that haven’t been seen since early December, indicating that selling pressure has decreased considerably.

He predicts a further rally will occur if BTC manages to seize and hold above the 50-week MA at the $101,000 level.

Moreover, Bitcoin price has also broken above the 200 MA and 200 EMA on the 4-hour chart, which is a signal of a potential uptrend in the short to medium term. The key level that the bullish side needs to break now remains at the $94,000 horizontal area, which is also the upper limit of the previous price range.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. 3 Reasons Why Bitcoin Price Is Rising amid US Operation in Venezuela. Accessed on January 5, 2025