7 Spot Bitcoin ETF Impact and Potential

Bitcoin spot ETFs are back in the news after the SEC approved 11 Bitcoin spot ETF proposals. With the approval of Bitcoin spot ETFs, many believe it will positively impact Bitcoin and the crypto market. What are these positive impacts? Read more in the following article.

Article Summary

- 🪙 Bitcoin ETFs are investment instruments that track the price of Bitcoin and are traded on traditional exchanges. It can give investors exposure to Bitcoin without having to own it.

- 👀 After a long process, the SEC finally approved 11 Bitcoin Spot ETF proposals.

- 🚨 In the midst of this, Blackrock and other fund managers moved quickly to submit a proposal for a spot Ethereum ETF.

- 🚀 The approval of spot Bitcoin and Ethereum ETF could increase the flow of funds into the crypto market, improve liquidity, clarity on regulatory issues, and encourage the recognition of Bitcoin and Ethereum as an investment asset class.

About Bitcoin ETF

Bitcoin ETFs are investment instruments that reflect the price of Bitcoin and are traded on traditional exchanges rather than crypto exchanges. Bitcoin ETFs aim to provide access for investors who want to gain exposure to the price of Bitcoin without owning it.

You can learn more about Bitcoin ETFs and their examples in the following article.

So far, the only approved Bitcoin ETF tracks the price of Bitcoin futures contracts traded on the Chicago Mercantile Exchange. However, this type of Bitcoin ETF has the problem of inaccurate pricing because it is based on speculative futures contracts.

The Securities and Exchange Commission (SEC) of the United States, authorized to supervise and regulate securities in the US, has yet to allow spot Bitcoin ETFs. Still, this condition will likely change after the SEC’s ruling was rejected. Now, they are required to approve Bitcoin ETFs from 12 investment managers who have submitted their Bitcoin ETF proposals.

The Latest Bitcoin ETF Developments

After a long process, the SEC finally approved 11 Bitcoin Spot ETF proposals on January 10, 2024. Thus, Bitcoin Spot ETFs can be traded starting January 11, 2024, on the United States stock exchange.

The following is a list of the 11 Bitcoin Spot ETFs along with the amount of Asset Under Management (AUM) owned by their investment managers:

- iShares Bitcoin Trust (IBIT). Managed by Blackrock with an AUM of US$8.59 trillion.

- Wise Origin Bitcoin Trust (FBTC). Managed by Fidelity with an AUM of US$4.5 trillion.

- Invesco Galaxy Bitcoin ETF (BTCO). Managed by Invesco Galaxy with an AUM of US$1.54 trillion.

- Franklin Bitcoin ETF (EZBC). Managed by Franklin Templeton with an AUM of US$1.53 trillion.

- Wisdomtree Bitcoin Trust (BTCW). Managed by Wisdom Tree with an AUM of US$94.2 billion.

- VanEck Bitcoin Trust (HODL). Managed by VanEck with an AUM of US$76.4 billion.

- Grayscale Bitcoin Trust (GBTC). Managed by Grayscale with AUM of US$60 billion.

- ARK 21Shares Bitcoin ETF (ARKB). Managed by ARK Invest with AUM of US$14 billion.

- Valkyrie Bitcoin Fund (BRRR). Managed by Valkyrie with an AUM of US$1 billion.

- Hashdex Bitcoin ETF . Managed by Hashdex with an AUM of US$567 million.

- Bitwise Bitcoin ETP Trust (BITB). Managed by Bitwise with an AUM of US$ 720 million.

With the approval of the 11 Bitcoin Spot ETFs, more investment managers may submit their respective Bitcoin ETF proposals to the SEC.

Find out who the SEC is and its role in the crypto industry in the following article.

The Development of Spot Ethereum ETF

Market participants are now waiting for a decision on the Ethereum spot ETF proposal after the approval of the Bitcoin Spot ETF. Previously, on November 9, 2023, Blackrock officially submitted the spot Ethereum ETF proposal to the SEC. The Ethereum ETF is not much different from the spot Bitcoin ETF except that it reflects the price of the ETF.

On a separate occasion, James Seyffart said that apart from Blackrock, five other investment managers are currently submitting spot Ethereum ETF proposals to the SEC. They are VanEck, ARK 21Shares, Invesco, Grayscale and Hashdex.

A report from FOX News said Blackrock is confident that the SEC will approve the proposal in January. At the same time, the SEC approved the spot Bitcoin ETF proposal.

The market responded positively to the news, reflected in the rise in ETH prices. After Nasdaq confirmed Blackrock’s plan, ETH immediately soared more than 10% to US$ 2,128.61 based on data from CoinGecko.

Spot Bitcoin and Ethereum ETF Impact

The approval of the spot Bitcoin ETF could significantly impact the crypto market going forward. The most important impact is the capital inflow into the crypto market through spot ETF.

The following is the impact of the spot Bitcoin and Ethereum ETF if approved.

1. Capital Inflow into the Bitcoin Market

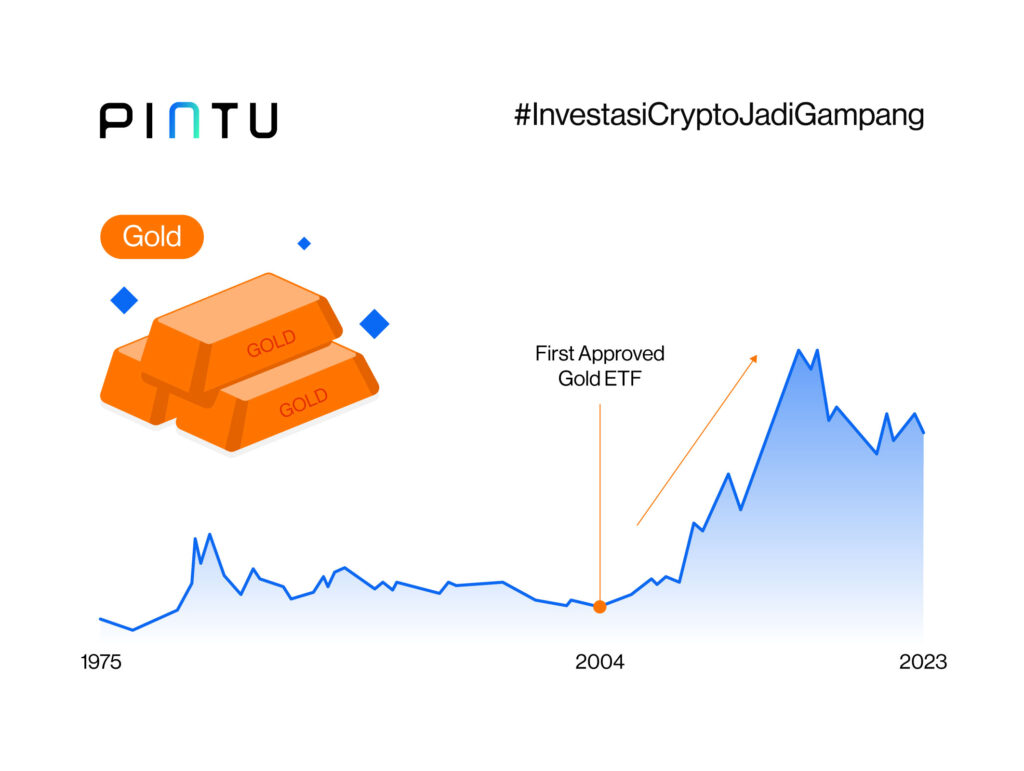

Based on historical gold prices, it has been on a positive trend ever since the first gold ETF was approved in 2004. Since Bitcoin is often referred to as digital gold, there is a good chance that BTC will experience the same thing. Coupled with various positive impacts that can also help lift the price of BTC.

- Calculating the Capital Inflow into the Bitcoin Market

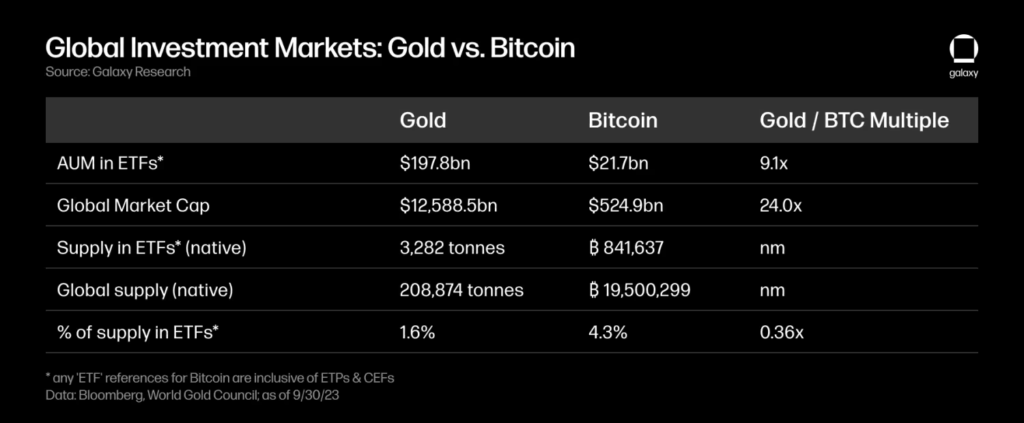

Here are the potential capital inflows to the Bitcoin market and their effect on BTC price based on research made by Galaxy. As of September 30, 2023, Gold ETFs collectively are worth US$ 198 billion or equivalent to 3,282 tons of gold. This amount represents 1.7% of the overall gold supply in the world, based on data from the World Gold Council.

Meanwhile, Bitcoin, held in investment products (ETF Futures and closed-end funds), is worth US$ 21.7 billion or the equivalent of 842,000 BTC. This amount represents 4.3% of the total issued BTC supply.

With gold estimated to have a 24x larger market capitalization and 36% less supply than Bitcoin, the capital inflow into the Bitcoin market will be greater. Galaxy estimates that a dollar-equivalent amount of fund inflows has a ~8.8x greater impact on bitcoin markets than gold markets.

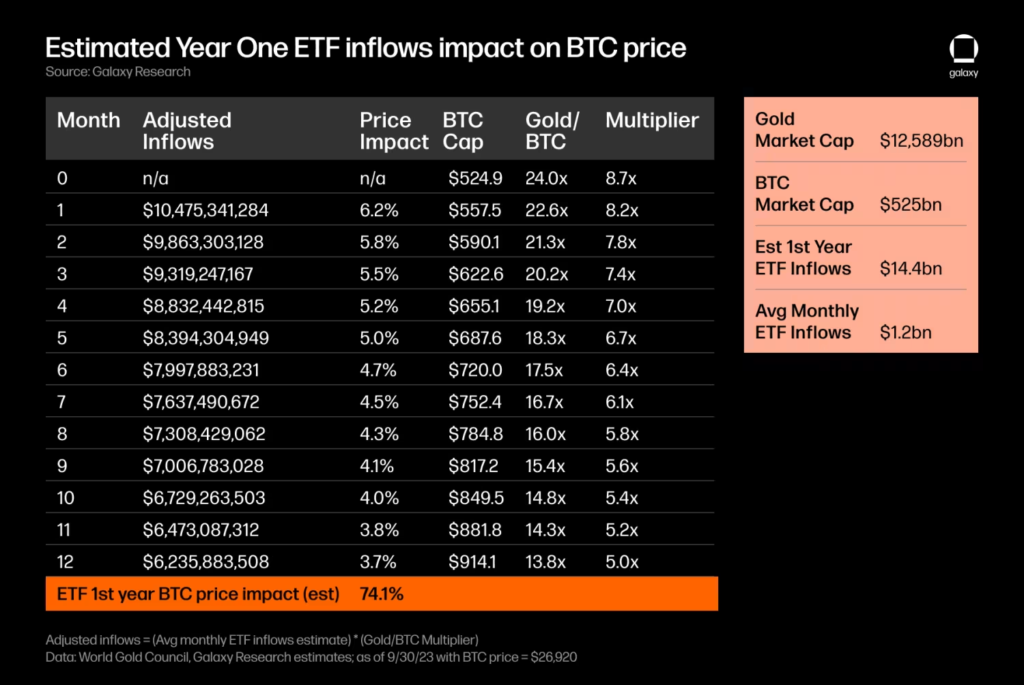

Assuming a one-year inflow of US$14.4 billion (US$1.2 billion per month or US$10.5 billion based on a multiplier of 8.8x) into the historical relationship between gold ETF fund flows & change in the gold price, is estimated that the price of BTC will increase by 6.2% in the first month.

Assuming the inflow of funds is constant, but the multiplier is adjusted for the changes in the gold/BTC market cap ratio as the BTC price rises, it is estimated that the monthly returns gradually ramping down from 6.2% in the first month to 3.7% in the last month of the first year. Thus resulting in an estimated 74% increase in BTC price within the first year after the ETF approval (using BTC price at US$26,920 as the starting point).

2. More Efficient

So far, there are no official figures regarding the spot Bitcoin and Ethereum ETF fees. However, ETFs generally offer lower fees than hedge funds or index funds. On the one hand, the liquidity of Spot ETFs will also be better because they are traded on more exchanges like stocks.

3. Greater Reach

Currently, BTC and ETH can only be acquired via crypto exchanges. The spot ETF will add distribution channels and platforms for BTC and ETH purchases, such as banks or investment managers. This offers an easy on-ramp process for retail or institutional investors who do not yet have exposure to BTC and ETH.

Find out what it takes for crypto mass adoption to happen.

4. Addresses Regulatory and Compliance Concerns

In some countries that do not have clear regulations on crypto assets, spot ETFs will be a product with stronger regulatory compliance, from custodial arrangements, oversight, and price transparency to bankruptcy protection. Clearer regulations can make the acceptance of Bitcoin and Ethereum even wider.

5. Formal Recognition of Bitcoin and Ethereum as Asset Classes

Most investors prefer ETF products over conventional products for their portfolios. ETFs are considered to provide more optimized returns, provide exposure without direct ownership, and act as a portfolio automation solution. As BTC and ETH are recognized as asset classes through spot ETFs, it can support their use in a portfolio’s investment strategy.

6. Greater Wealth Opportunity

Research from the Pew Research Center shows that 62% of all wealth levels in the United States are held by the Boomers & earlier (aged 59+). Of that group, only 8% have invested in crypto. Having a bitcoin ETF offering through familiar, trusted brands could help attract a larger portion of the older, wealthier population that has not yet been onboarded.

7. More BTC and ETH-based Investment Products

The approval of the spot Bitcoin and Ethereum ETF could lead to other investment products that provide BTC and ETH exposure. In the future, fund managers may add BTC and ETH to their mutual fund strategies. For example, a BTC or ETH index fund. This will encourage the adoption of BTC and ETH to a broader range of investors.

Conclusion

Now, market participants will be waiting for the SEC’s next step concerning the proposal. With the developments so far, it is only a matter of time before the SEC finally gives its approval. If spot Bitcoin ETF or spot Ethereum ETF is finally approved, it will be good news for BTC, ETH, and other crypto assets.

Not only will it lift the price of BTC and ETH, but the decision will have huge implications for the adoption of BTC and ETH. With the Spot ETF, there will be more opportunities for new retail and institutional investors. In addition, Spot ETFs are also a form of recognition that BTC and ETH are an investment asset class. Therefore, watching the following developments regarding the spot ETF will be interesting.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Brayden Lindrea, BlackRock’s spot Ethereum ETF plan is confirmed after Nasdaq filing, CoinTelegraph, accessed on 10 November 2023.

- Michael Grullon, BlackRock confident SEC will approve Spot Bitcoin ETF by January, accessed on 10 November 2023.

- David Knowlton, The Impact and Opportunity of Bitcoin in a Portfolio, Galaxy Research, accessed on 10 November 2023.

- Charles Yu, Sizing the Market for a Bitcoin ETF, Galaxy Research, accessed on 10 November 2023.

- Ki Chong Tran, Bitcoin ETF: Everything You Need To Know, Decrypt, accessed on 9 November 2023.

Share

Related Article

See Assets in This Article

DEFI Price (24 Hours)

Market Capitalization

-

Global Volume (24 Hours)

-

Circulating Supply

-