Crypto Risk Management: Why It Is Important and How to Do It

Cryptocurrencies are an asset class that falls into the high-risk high-reward category. This means that many investors consider the ratio of profit and risk of investing in crypto to be linear. The crypto industry has many stories of traders and investors making hundreds of times the profit in bull markets but losing it all in bear markets. In addition, hacking and fraud have also caused thousands of investors to suffer significant losses and lose all their assets. In the crypto world, those who can manage risk are the ones who will survive until the next bull market. Risk management is one of the most important skills for every investor and trader. So, how to do crypto risk management? What are the basic principles of risk management? This article will discuss it in detail.

Article Summary

- ⚖️ Cryptocurrencies are assets with high risk but high potential for profit. So, significant price fluctuations require careful risk management.

- 🧠 One of the most basic risk management is to separate assets for long-term investment and short to medium-term trading. This is to prevent you from losing large amounts of assets.

- 📊 Secondly, understanding market dynamics is crucial in crypto risk management. Risk management strategies will differ in bull and bear markets. In a bear market, risk management needs to be more prudent and cautious.

- 💰 Fund allocation is also an important part of risk management. Investors’ confidence in the asset and market conditions will determine asset allocation in your portfolio.

- ⚔️ Fourth, risk management can be likened to a sports game, where there is a time for offense and defense. This shows the importance of knowing when to take risks and when to keep risks to a minimum.

- 🔐 Diversification and standard security practices are also basic principles of risk management. Diversification aims to reduce the risk of loss, while security practices are necessary to prevent fraud and hacking.

Why is Crypto Risk Management Important?

Crypto assets are a highly volatile and dynamic asset class. The rise and fall of crypto asset prices can be rapid and drastic. An asset can rise 150% one week and fall 80% the next. Not to mention pump and dump, rug pull, and other fraudulent practices.

But, what is crypto risk management? Crypto risk management is a set of principles and actions you take to prevent losses and preserve profits. It ranges from basic investment principles like only using the money you can afford to lose and applying security standards, to discussing asset allocation. The goal of crypto risk management is to make sure you don’t lose everything when taking high-risk investments or trades.

Read Pintu Academy’s article on 7 things you need to do before investing.

Additionally, there is a popular saying that “Manage your risk or the market will manage it for you “. This saying means that if you don’t consider and adjust your risk, the outcome will be highly dependent on other market participants.

For example, you bought FTM with all your assets expecting it to go up after the Ripple news. As it turns out, negative news emerges that there was a hack on Fantom and traders sell FTM. Within 2 days, you lost 60% of your entire net worth.

This will not happen if you do risk management. In risk management, you will definitely consider minimal asset allocation because this is short-term trading in response to the news.

How to do Crypto Risk Management?

1. Separate Investing and Trading

One of the most fundamental things in crypto risk management is to separate investment and trading asset allocations. In fact, it’s even better if you have separate accounts for investing and trading so that the two don’t mix. By investment, we mean assets that you believe have good long-term potential. Trading, on the other hand, can consist of assets that you believe have potential in the short and medium term.

The purpose of separating trading and investing is also to train you to have a different mindset for different asset categories. For example, the assets that you categorize as long-term investments are ETH and BTC so you will continue to buy these assets every time they hit a certain price. You are determined to hold on to these investment assets and only take them out during the next bull run. On the other hand, you also keep an asset allocation for short-term trading based on market momentum.

This segregation also prevents you from losing all your assets due to failed short-term trades or unexpected events that have a negative impact. Also, it trains you to plan for the short, medium, and long term to assess various scenarios.

2. Understanding Market Dynamics

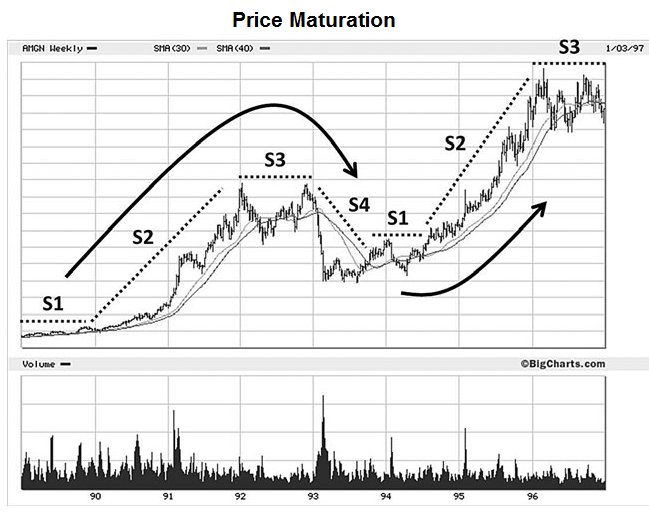

The second important aspect of risk management in crypto investing is our understanding of market dynamics. Bull and bear market conditions require different risk management strategies. In a bear market, buying altcoin assets carries a very high risk as sentiment is at a negative peak. Many altcoins can lose 90% of their value in a bear market. These market conditions require prudent and cautious risk management.

You can separate trading and investing into several categories based on risk level such as conservative, risky, and aggressive.

On the other hand, a bull market is a market where you can focus your risk management on asset allocation and good security practices. In this market condition, you only need to choose altcoin following the market trend. A bull market is a risk-on market situation where other market participants are equally aggressive in taking risks to maximize profits.

An understanding of market dynamics is usually the difference between experienced traders or investors and those just starting out.

3. Determine Portofolio Allocation

The third aspect of crypto risk management is the issue of allocating a percentage of your portfolio to an asset. The allocation of funds to a crypto asset will relate to two aspects, your confidence in the asset and market conditions. These are both internal and external factors that can affect the risk when buying crypto assets.

Building confidence in the asset you are about to buy involves making provisional assumptions about the asset’s potential, conducting research, and finally assessing the risks involved. These three things will affect the allocation of the crypto asset in your portfolio.

For example, you buy SOL because you see its potential as an alternative L1. After doing some research, you are even more convinced because the TVL number of the DeFi Solana sector continues to increase. You also think that at the current price point, there is no significant downside risk. After that, you decide that you want to allocate SOL 25% of your total assets and will buy it in 10 instances over the next 3 months.

This is a good example of measurable risk management. If you allocate funds based on intuition or FOMO, you will almost certainly lose money because the market will manage your risk.

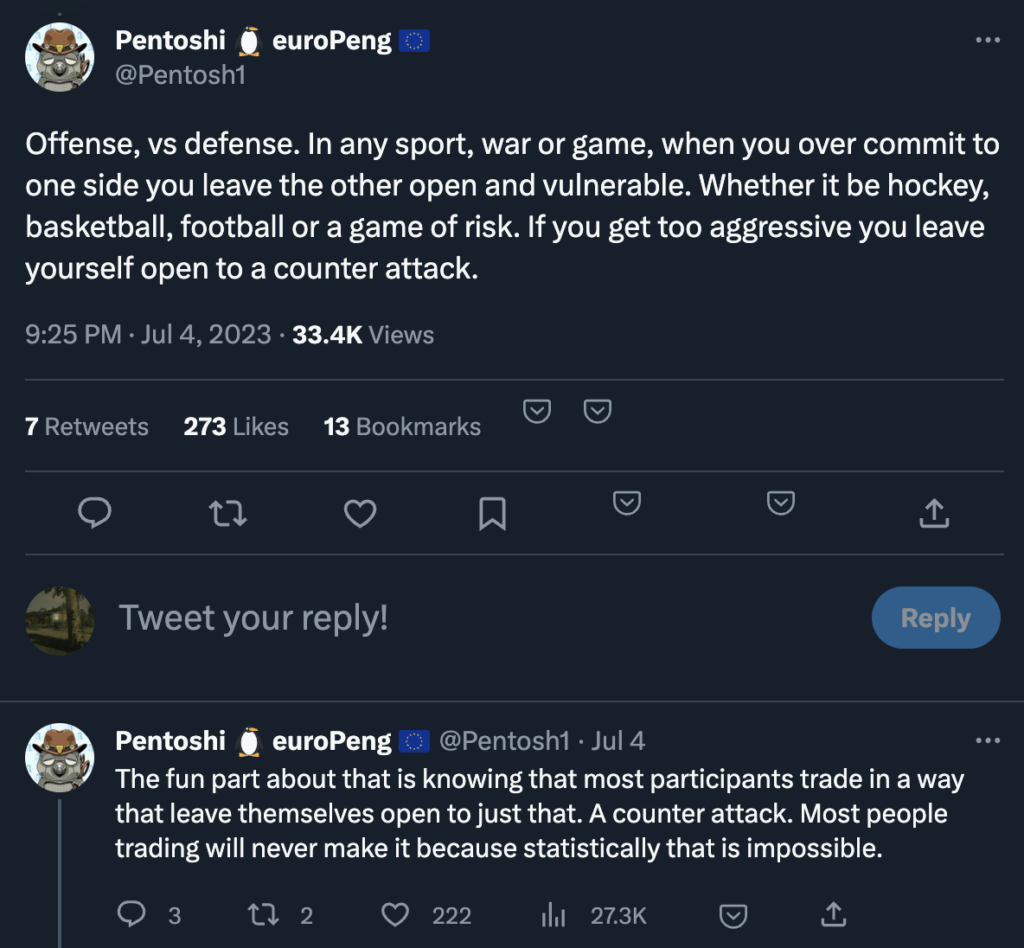

4. On Attack and Defense

Risk management in crypto is similar to a sports game or wargames. A well-known crypto influencer, @pentosh1, suggests looking at your assets like an army that can be divided into attackers and defenders. He explains that the market will give you time to attack and defend. In risk management, this relates to periods when we want to take risks or keep risks to a minimum.

In our “army”, everyone should have their own role. We manage this army with the aim of growing it. To achieve this goal, we must understand when and how to use our army.

@pentosh1 further explains that he never takes out all his troops to attack. He always waits for the moment the price “nukes” before he starts buying. Furthermore, he also separates between long-term investment assets and short-term trading.

Basically, @pentosh1 always thinks about risk management for his troops so that he can anticipate all possible price drops and increases. Good risk management gives you the leeway to take advantage of all potential scenarios that could happen.

5. Diversification and Standard Security Practices

The last risk management principle that you must do is diversification and good security practices. Diversification is a risk management strategy that aims to reduce the risk of loss by spreading your investment across multiple assets. One of the most popular investment adages is “Don’t put all your eggs in one basket” which means don’t invest all your money in one asset.

The easiest diversification is to invest not only in crypto assets but also in assets such as stocks, index funds, and others. Within crypto, separate blue chip investments like BTC or ETH and other altcoins. BTC and ETH have a much safer price drop percentage than altcoins. Do not diversify into multiple altcoin assets as they all have a high risk of loss.

Finally, good security practices prevent you from being exposed to scams and hacks. Some standard security practices in crypto are keeping private keys safe, avoiding phishing from unauthorized links, don’t buy altcoin assets you don’t know, and don’t use DeFi apps without research.

Of these, phishing and private key issues are frequently a problem. You need to understand how to use MetaMask so that you don’t fall for wallet drain schemes from phishing links. The practice of phishing through airdrop scams is very common on Twitter and Discord. So, only use links from the official website or social media account of a crypto project.

Conclusion

Cryptocurrencies are a high-risk asset class with the potential for high returns. Therefore, risk management is a crucial element of investing and trading in this asset class. Risk management in crypto is a set of principles and actions taken to minimize losses and preserve gains. This involves understanding market dynamics, determining fund allocation, separating investing and trading, and understanding when to ‘attack’ and when to ‘defend’. In addition, portfolio diversification and good safety standards are also important parts of risk management. If risk management is done well, it will provide a better opportunity to capitalize on every possible scenario in the crypto market.

How to Buy Cryptocurrency on Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto (like BTC).

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- Marko Mihajlović, “A Risk Management Guide for Crypto Traders”, Shrimpy, accessed on 20 July 2023.

- Exmo, “What is risk management in crypto trading and why is it important”, Medium, accessed on 20 July 2023.

- Andrey Sergeenkov, 5 Ways to Manage Risk When Trading Cryptocurrency, Coindesk, accessed on 21 July 2023.

- @crypto_linn, “View Risk for what it is and you open the door to Profit: My belief is that because the system is now more stable”, Twitter, accessed on 21 July 2023.

- @pentosh1, “As promised a thread to help you mentally navigate the markets. Since most people are familiar with games”, Twitter, accessed on 21 July 2023.

Share