9 Differences Between Forex and Crypto Trading

The popularity of crypto as risky investments is on the rise and investing in it is becoming more mainstream lately. Many traders choose crypto assets due to the high volatility of price movements.

Many traders then draw comparisons between crypto and forex as both are considered as risky assets. However, there are differences between the two. Forex price movements are relatively more stable because currency exchange rates don’t experience significant changes as crypto assets do.

Apart from price movements, forex and crypto have several other differences. We will discuss the difference between forex and crypto in the following article.

Article Summary

- 💰 Forex is an exchange of foreign currency, while crypto is a decentralized digital currency. Forex and crypto are two different assets, but both come with their own set of risks.

- ⚠️ The differences between forex and crypto include the variety of assets available, the level of volatility, profit potential, risk level, liquidity, trading hours, security measures, and regulation.

- 🔀 Both forex and crypto traders rely on the fluctuation of prices to make profit, but crypto investors also have the option to earn through mining, airdrops, staking, and lending.

- 🔁Despite their differences, forex and crypto share one key similarity: their prices are affected by the balance of supply and demand.

The Differences Between Forex and Crypto

Forex and crypto, while both being financial assets, have distinct characteristics. Forex is an acronym for foreign currency and exchange. Meanwhile, crypto is a decentralized digital currency that is secured by cryptography to work as a medium of exchange.

So, what is the difference between forex and crypto, particularly when it comes to trading these two asset classes? The following are some of the key differences between forex and crypto.

1. Fundamental Aspect

In the case of forex, fundamental analysis typically involves analyzing a country’s economic data and comparing it to other countries whose currencies are being traded. Political sentiment also plays a significant role in determining the exchange rate of a currency. On the other hand, the fundamental analysis of crypto assets is based on the use-case value, how many people use it, and the development team behind it.

Forex and crypto fluctuation of prices are both influenced by supply-demand factors. So, when there are more buyers than sellers, the price will move higher. Meanwhile, the price will decrease when there are more sellers than buyers.

Want to know how to do fundamental analysis on crypto assets? Read the following article to find out.

2. The Variety of Assets

In forex trading, traders usually focus on major currency pairs. Look at the table below. The bold-colored currency pairs are the main currencies in the forex market. However, apart from these 21 currency pairs, traders can also trade exotic currencies, a pair between major currencies and currencies from developing countries.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | |

| USD | EUR/USD | GBP/USD | USD/JPY | USD/CAD | AUD/USD | NZD/USD | |

| EUR | EUR/USD | EUR/GBP | EUR/JPY | EUR/AUD | EUR/AUD | EUR/NZD | |

| GBP | GBP/USD | UER/GBP | GBP/PY | GBP/CAD | GBP/AUD | GBP/NZD | |

| JPY | USD/JPY | EUR/JPY | GBP/JPY | CAD/JPY | AUD/JPY | NZD/JPY | |

| CAD | USD/CAD | EUR/CAD | GBP/CAD | CAD/JPY | AUD/CAD | NZD/CAD | |

| AUD | AUD/USD | EUR/AUD | GBP/AUD | AUD/JPY | AUD/CAD | AUD/NZD | |

| NZD | NZD/USD | EUR/NZD | GBP/NZD | NZD/JPY | NZD/CAD | NZD/AUD |

In comparison, the number and variety of crypto assets is much more than forex. According to CoinMarketCap, there are currently at least 22,349 crypto assets. Of the many crypto assets, several popular assets, such as BTC, ETH, SOL, ADA, DOGE, and MATIC, are the most actively traded. But apart from these popular assets, there are other altcoins that only hard-core crypto enthusiasts know about.

As such, the crypto market presents a wide choice of assets to trade. From assets whose movements are not too volatile to the most volatile. Meanwhile, from the forex market, the number of currency pairs that can be traded is far less than in the crypto market. In terms of price movement, forex also tends to be more stable.

Confused about which crypto asset to buy? The following article will help you how to choose crypto assets to invest

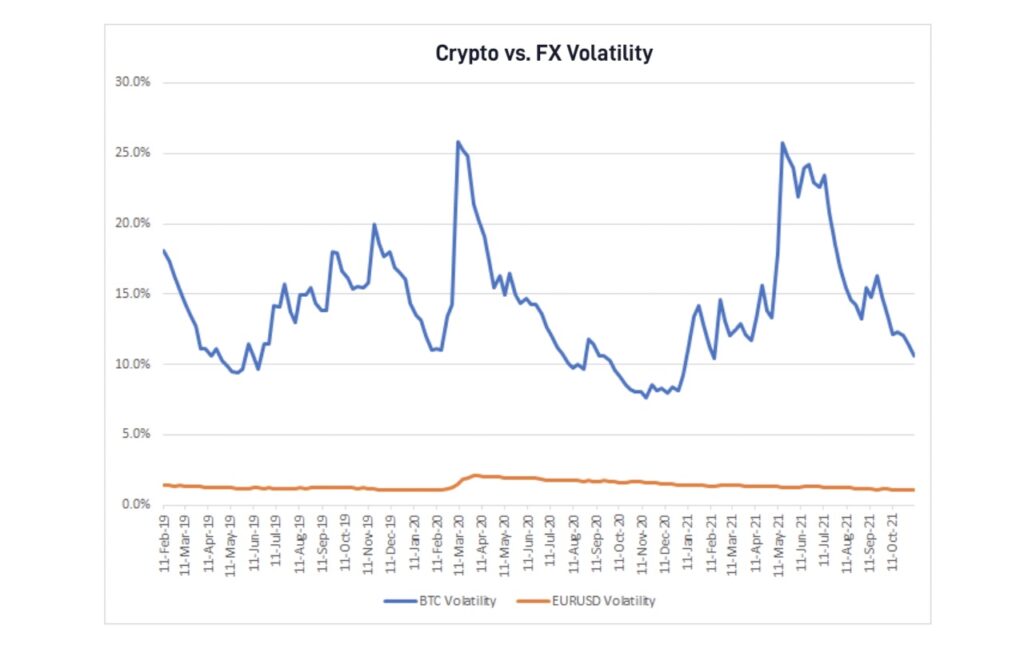

3. Volatility

When it comes to price fluctuations, one of the main differences between forex and crypto is the level of volatility. It is well-known that the value of crypto assets can experience significant fluctuations. For instance, the value of Bitcoin can fluctuate dramatically; after reached an all-time high of US$ 68,990 in November 2021, Bitcoin’s value dropped to around US$ 30,000 in May 2021. It didn’t take long for it to drop back to US$15,000 in November 2022. While recently, the price has returned to US$ 22,000. Crypto assets other than Bitcoin may have sharper up-and-down fluctuation of prices.

Such highly volatile movements rarely occur in the forex market. When it does occur, it’s usually only on exotic currency pairs. Usually, these sharp movements can only occur if there is a tremendous economic sentiment. Thus, price movements in the forex market are much more stable compared to the crypto market. As a result, this makes risk management in the forex market much more measurable. Although, in terms of potential profits, the crypto market offers more significant opportunities.

Diversification can be one way to deal with crypto market volatility. Find out how to diversify in the following article.

4. Profit

To make a profit, both forex and crypto rely on the price movements of each asset. But, the potential gains can be significantly different. In the crypto world, tens, hundreds, and even thousands of percent profits can be achieved. Meanwhile, in the forex world, the profits are much smaller when compared to crypto assets.

On the other hand, crypto assets also have differences in generating profits compared to forex. Investors can profit more through crypto by doing various activities such as mining, airdrops, staking, and lending.

Meanwhile, in forex, the profits are only obtained from the difference between buying and selling prices. Even so, forex can generate far more significant profits. The reason is forex trading offers much greater leverage than crypto. However, the higher the leverage used, the higher the risk.

5. Risk

Regarding investment risk, both crypto and forex have high risks. Crypto risks come from very volatile price movements. A crypto asset’s price is likely to experience a significant correction in a moment. If a crypto asset is not doing well fundamentally and the project has problems, its price can shrink by almost 100%.

So, does forex, whose price is much more stable, have lower risk? The answer is not necessary. Forex is also considered to have risks and the potential for significant losses. However, the cause did not come from the drastic price drop but the leverage factor. Leverage is borrowed funds used to boost profits from trading.

In Forex trading, leverage starts from 1:100 to 1:1000. Meanwhile, in the crypto market, the leverage ratio is much smaller. For example, in Bitcoin, the leverage ratio is only in the range of 1:2 to 1:20.

However, leverage is like a double-edged sword. If you make the wrong decision when using leverage, the losses you experience will be much more significant. The greater the leverage ratio used, the greater the loss you will get when you lose. That is why, even though the price movements are more stable in forex trading, the risks can be higher than in crypto trading.

Don’t miss out on the forecast of the crypto market condition in 2023 in the following article.

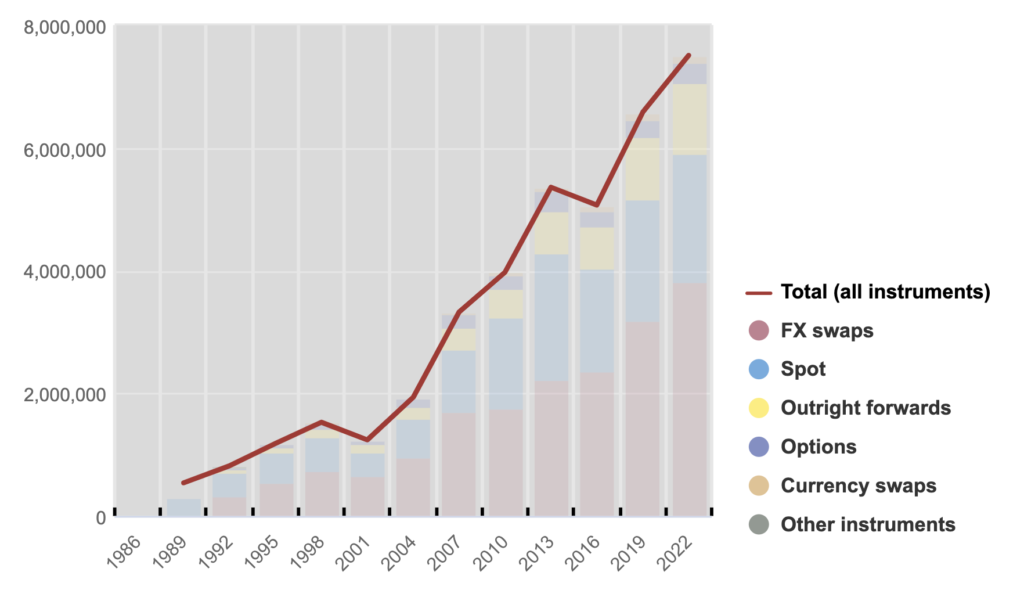

6. Liquidity

Liquidity is another factor that differentiates forex and crypto. Currently, the forex market has a higher level of liquidity than the crypto market. The Bank for International Settlements data shows that daily forex trading was at US$ 7.51 trillion in 2022. The worldwide forex market capitalization in 2021 is worth $2.409 quadrillion.

Meanwhile, for the crypto market, given its decentralized nature, it is pretty difficult to get absolute numbers. However, the daily trading volume of the crypto market is only around US$ 100 billion – US$ 200 billion. At the peak of the bull run in May 2021, the figure only touched US$ 500 billion. In terms of capitalization, the crypto market had a capitalization value of US $ 2.91 trillion at the peak of the last bull run.

As the liquidity of the forex market is much greater, it will be easier to make large transactions. With the market size, Traders can sell or buy forex at the desired price. Meanwhile, for the crypto market, the case is quite different. For large and popular assets such as Bitcoin and Ethereum, buying and selling will be easier as the liquidity is quite good. But for other assets, selling at the desired price will be more challenging.

7. Operational Hours

Operational hours are also one of the differences between forex and crypto. On the crypto market, all transactions can be done at any time because the crypto market operates 24 hours non-stop every day.

Meanwhile, for the forex market, although trading can be done 24 hours a day, the market is only open Monday – Friday. Some brokers may stay open over the weekend. It’s just that transactions are limited to being made with the broker, there are no other traders.

8. Security

From a security standpoint, forex and crypto have different positions. The main risk from forex is losses due to falling asset prices, whereas in cryptocurrency, there are additional risks such as scams and rug pulls. Some cryptocurrency projects are created solely to deceive investors. Additionally, there have been instances of pump and dump schemes and malicious projects in the crypto space. So, investors need to be well informed before diving into the crypto space.

The central bank guarantees the currency in forex trading, making it less likely for it to be involved in scams or rug pulls. However, this does not eliminate the risk of dealing with irresponsible brokers or exchanges.

Find out the types of crypto scams and how to avoid them in the following article.

9. Regulations

Forex trading is heavily regulated by governments and central banks around the world. Crypto trading, on the other hand, is largely unregulated and the policies are different to each countries. Some countries take a neutral stance, and some outright prohibit it.

In Indonesia, the government regulates and oversees both forex and crypto trading. The Commodity Futures Trading Regulatory Agency (Bappebti) supervises and regulates both forex and crypto trading.

The Similarity between Forex and Crypto

As supply-demand factors influence forex and crypto price movements, traders and investors can use the same technical analysis techniques. Chart movement patterns from forex and crypto have the exact mechanism. So, every crypto trader who can do technical analysis will be able to adapt and trade forex quickly and vice versa.

Start Investing at Pintu

After knowing the difference between forex and crypto, are you interested in buying crypto assets? At Pintu, you can invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

FaQ

1. What are the trading hour differences between Forex and Crypto?

The Forex market operates 24 hours a day during weekdays (Monday to Friday), while the crypto market runs nonstop 24/7, including weekends and holidays.

2. Which is more liquid: Forex or Crypto?

In general, Forex is more liquid due to its significantly larger and more stable trading volume compared to the crypto market, which is highly driven by sentiment and volatility.

3. How does regulation affect trading security between the two?

Forex is heavily regulated by global financial authorities, making it relatively safer from fraud, while crypto still faces regulatory uncertainty that increases security risks.

4. How do risk and volatility differ between Forex and Crypto?

The crypto market is far more volatile than Forex, offering greater profit potential but also exposing traders to higher risks of sharp losses in a short period.

Reference

Bybit Learn. Forex vs. Crypto Trading: Which Should You Choose? Bybit, accessed on 24 January 2022.

Vladimir Zernov, Cryptocurrency vs Forex Market – Similarities and Differences, Yahoo Finance, accessed on 24 January 2022.

James Chen, Forex Trading: A Beginner’s Guide, Investopedia, accessed on 24 January 2022.

Share