How to Choose Crypto to Invest

Investing in crypto assets can be very intimidating and confusing for new investors. Currently, Pintu has hundreds of crypto assets, each with different functions. Beyond that, there are thousands of other crypto assets and not all of them have a promising future. This is exacerbated by bear market conditions that make price fluctuations more dramatic. Therefore, you need to have a system to choose and evaluate an asset. This article will take a deeper look at how to choose crypto to invest in and the criteria you need to evaluate.

Article Summary

- 🧺 Crypto assets can be categorized into two types, Bitcoin and altcoin. Bitcoin is the safest and most stable crypto investment asset. Meanwhile, altcoins carry a considerable risk with higher potential returns.

- ⚖️ In choosing crypto for investment, you need to evaluate the fundamental value of these assets and their role in the crypto market.

- 🧠 You can use the following criteria to evaluate the value of a crypto project such as clear utility, tokenomics, the project’s activity, number of users, and competition.

- 📊 After evaluating the fundamental value of the asset, you need to consider the metrics of the asset related to the crypto market and its price movements.

How to Choose Crypto Assets For Investment?

If you got here, it means you want to invest in crypto assets. Before we look at the criteria for selecting crypto assets for investment, we need to understand the basic concepts of altcoins and Bitcoin. In the crypto industry, there are two categories of assets namely Bitcoin and altcoins. Bitcoin is the largest and most expensive crypto asset at the moment. Meanwhile, altcoins are a term for all other crypto assets besides Bitcoin.

Basically, Bitcoin is an asset that is considered a “safe” investment in the crypto industry. As a pioneer of crypto, Bitcoin has a loyal community as well as good tokenomics that carefully balance its supply and demand.

After Bitcoin, Ethereum is the second largest altcoin asset. Ethereum is the first altcoin with smart contract technology and has succeeded in creating new industries, DeFi and NFT. BTC and ETH are giants in the crypto industry and have the lowest fluctuations compared to other crypto assets.

In choosing crypto assets outside of BTC and ETH, we need to keep in mind several criteria. This is done to evaluate whether the fundamental value of the asset matches its market value. We also have to look at the market data of an asset such as its market capitalization and trading volume. Finally, we must consider the market conditions before purchasing the asset.

We will divide these three things and explore them below.

1. Evaluating Several Criteria for Investing in Crypto Assets

Clear Utility

The first thing you should look for when you want to invest in a crypto asset is its use case. You have to know what is the role of the project including the use cases of the token and how the technology can benefit users. A crypto project with good technology but no clear use case will find it difficult to attract users. On the other hand, some crypto projects have a clear purpose and utility but their tokens have very limited utility.

So, ideally, a crypto project meets two criteria:

- The platform or blockchain has a clear utility and purpose

- The token has wide use cases in the project’s platform

Ethereum is an example of an asset that meets these utility criteria.

You can read the white paper of a crypto project if you want to understand it more deeply. This is part of the fundamental analysis.

Tokenomics

Token economics or tokenomics are aspects related to the supply, function, and distribution of tokens of a crypto project. Tokenomics manages the allocation of tokens at the start of a project’s launch and distribution thereafter. In addition, an aspect that is often forgotten about tokenomics is how the token captures value from the users. However, before getting into that, the most basic things to know about tokenomics are maximum supply, circulating supply, token growth (token inflation), and token distribution schedule (vesting schedule).

Tokenomics is one of the most overlooked aspects of a project. In fact, it is no less important than knowing the technology and uses of a crypto project.

A good crypto asset should ideally have a maximum supply cap and a high circulating supply. In addition, it has low token inflation and has passed the majority of its token distribution schedule so there is no high selling pressure from locked tokens.

The two assets that meet all of these conditions are Bitcoin and Ethereum. Beyond these two, you need to find out about this information before investing in a crypto asset. You can use Coinmarketcap or Coingecko to find basic information about tokenomics.

How Active is the Project?

One sign of a good crypto project is its activity. Large crypto projects such as Solana, Ethereum, and Cardano always try to provide information to their users through social media, blogs, or websites. Beyond that, the social media activity of the community is very much alive and they actively contribute to attracting other users to their respective ecosystems.

Here are some indicators of crypto asset activity that you can see:

- Developer activity: You can use the developer activity as a benchmark to judge projects that attract the most builders into their ecosystem. You can use Gokustats by Artemis to view important statistics such as daily transactions and developer activity.

- Social media activity: Crypto projects with an active community have social media accounts that are active. You can use Lunar Crush to view various social statistics of crypto projects.

- Frequency of website updates: The majority of large crypto websites like Ethereum always provide the latest information through posts on blogs or social media.

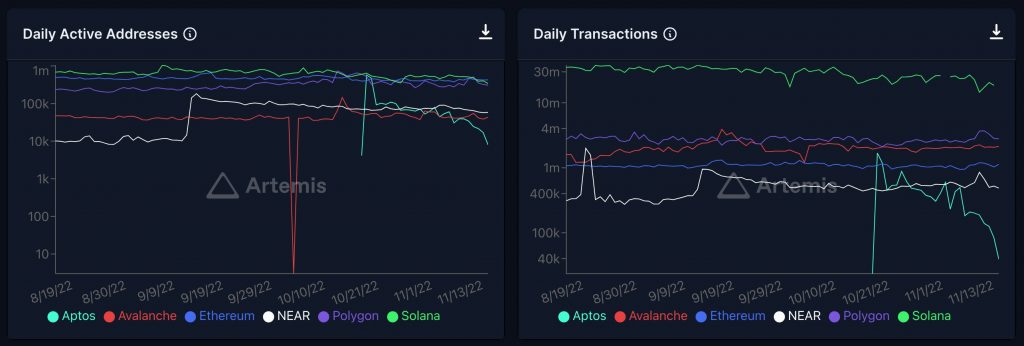

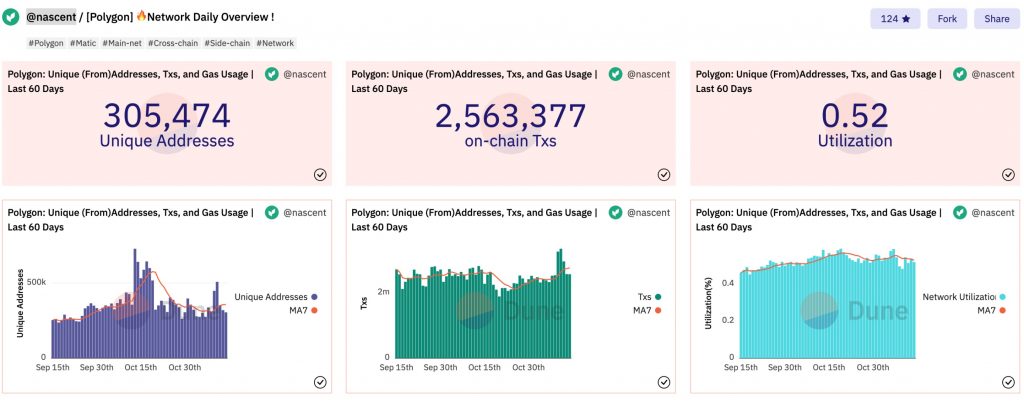

Number of Users and Daily Activity

The number of users is also one of the criteria for a crypto project that is often overlooked. Now, investors are starting to see this data as an important measuring tool to see the sustainability of a crypto project. User activity and numbers become more important in a bear market to see if a project can retain its users.

In crypto, we can see user activity through unique addresses, unique active wallets, and unique transactions. The two images below show users’ activity of several large blockchains such as Ethereum and BNB Chain.

You can find this data on several sites such as Gokustats by Artemis and Dune Analytics (a forum for data). Avoid investing in blockchain and crypto projects with no user activity.

Considering the Competition

In assessing a crypto project, we can also compare it with other projects in the same sector. For example, you can compare Cardano to other proof-of-stake blockchains so that you understand Cardano’s position and role compared to other assets such as Solana or Cosmos. Analyzing a crypto project with its competitors will enable you to see the bigger picture.

In addition, several sectors in the crypto industry also have dominant market leaders in the market. Ethereum and OpenSea are examples of market leaders in their respective sectors, the layer-1 platform, and the NFT marketplace.

2. Using Basic Crypto Metrics

Market Cap

Market capitalization or market cap is a metric to see the market value of a crypto asset. It calculates the number of tokens in circulation multiplied by the price. The market cap will give a more accurate picture of the value of an asset than its price. In addition, the market cap is also related to fluctuations in price because assets with a large market capitalization are usually more stable than others.

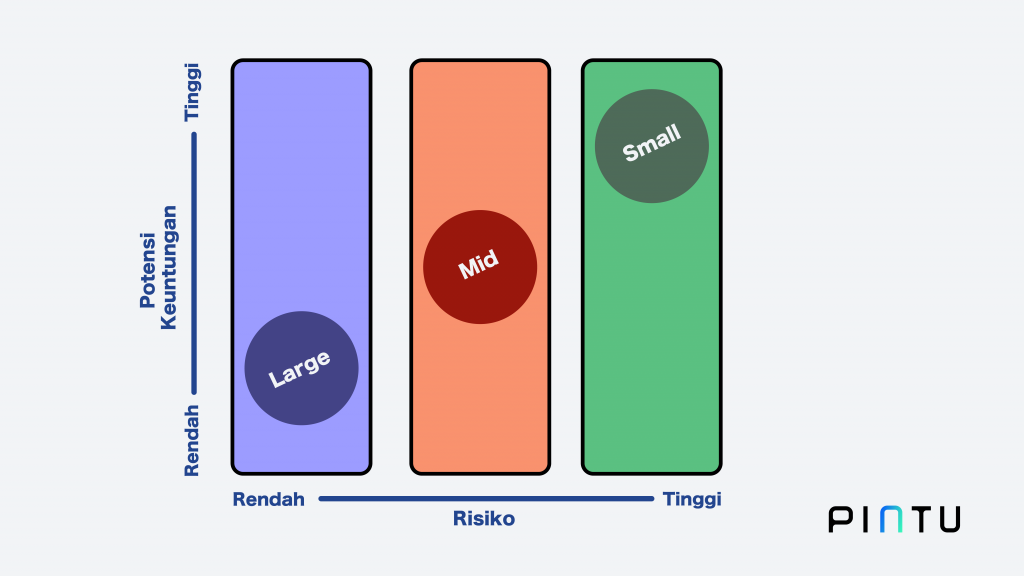

In the crypto market, we can distinguish between three market cap categories: large cap, mid cap, and low cap. You can read the market cap article to find out more about this. The image below can give you an overview of the relationship between market cap and investment strategy.

Liquidity and Trading Volume

Trading volume and liquidity are important metrics to consider when investing in altcoins. These two metrics determine price volatility as well as the price you get when you sell or buy an asset. In a large asset like BTC, these two things are not really important because Bitcoin almost always has a large liquidity and trading volume. However, in small altcoins, it matters a lot.

Liquidity has a close relationship with trading volume. Both regulate the volatility and ease of selling or buying an asset. The lower the liquidity and trading volume, the more difficult it will be for you to sell or buy an asset. Assets with low liquidity and trading volume will also fluctuate more dramatically. Low trading volume usually indicates low interest from investors. Additionally, assets with low liquidity and trading volume also carry a higher risk.

3. Determining When to Buy Crypto Assets

The question of when to buy assets is one of the most difficult to answer. In fact, even experienced investors often make mistakes in buying an asset and suffer losses. There is no 100% exact guide in buying assets at the right time. However, you can use some of the things below as a general guide before buying an asset.

Watching Price Trends

Before you decide to buy a crypto asset, please pay attention to price trends in recent weeks. Is it down? is it rallying? Or stagnant?

In recent weeks, CHZ and MATIC Assets have shown strong price movements amidst a bear market. Instead of continuing corrections like other assets, CHZ and MATIC have had a rally since mid-October. This is due to the World Cup momentum in Chilliz and Polygon’s partnerships.

There are three general movement trends: uptrend, downtrend, and sideways. It is best to not buy an asset in a long-term decline unless you are deliberately doing DCA or buying the dip. There will always be some crypto with strong price trends despite a bearish market.

Want to understand how to read crypto price charts? You can read Pintu Academy’s collection of trading articles to understand how to read price charts and perform technical analysis.

However, you also have to consider general market conditions. Is the crypto market in a bear or bull market? There is a big risk in buying altcoins in a bear market.

Understanding Market Conditions

In the crypto market, the difference between price movements in a bear and bull market is night and day. In a bull market, an asset can rally up to thousands of percent. However, these price increases can disappear in an instant in a bear market. This is especially true for the majority of altcoins that can experience corrections of more than 60%. In a bear market situation, BTC, ETH, and stablecoin assets are usually the choice for many experienced investors who will wait until the market starts to recover.

Despite that, there have always been altcoins that have shown strength in a bear market. You need to see which altcoins are not in a downtrend or have just done a trend reversal even though the situation is bad.

Start Small

Lastly, you need to consider risk management before you start buying crypto assets. There is an important piece of advice that experienced investors often give “Only invest what you can afford to lose”. The mistake of beginners is losing 100% of their money that should be used for daily needs or more important needs.

If you are new to investing, read the articles “5 Basic Investment Principles Guide” and “8 Things To Consider Before Investing in Cryptocurrency” so that you understand the risks and are ready to invest in crypto.

How to Buy Cryptocurrencies at Pintu

You can start investing in cryptocurrencies by buying them in the Pintu app. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite crypto assets.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by CoFTRA and Kominfo.

You can also learn more crypto through the various Door Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Alex Gailey, How to Evaluate Any Cryptocurrency: A Guide for Investors | NextAdvisor, The Time, accessed on 8 November 2022.

- How to Assess Crypto Projects & Altcoins, Andryo, accessed on 8 November 2022.

- Emma Newbery, Your 7-Point Checklist to Crypto Research, Fool, accessed on 9 November 2022.

- What is Tokenomics? A beginner’s guide on supply and demand of cryptocurrencies, Coin Telegraph, accessed on 10 November 2022.

- Hasan Furkan Gök, Crypto Investing: The Complete Guide (2022), Nansen, accessed on 11 November 2022.

- 7 Key Ways to Evaluate a Cryptocurrency Before Buying It, Coin Desk, accessed on 14 November 2022.

Share