INJ as an Investment: Tokenomics and Its Potential

Since the start of 2023, the INJ token price has surged by almost 600%, mainly due to the network’s new acquisitions and growing investor interest in the project. Injective has successfully onboarded several new projects to expand its ecosystem since the year began. In this article, we will explore the INJ tokenomics and its potential as an investment asset.

Article Summary

- 🔗 Injective Protocol is a blockchain specifically built to facilitate the creation of DeFi applications such as cross-chain derivatives trading.

- 🪙 INJ is the native token of Injective Protocol that functions as both a utility token and a governance token.

- 📈 Since the beginning of April 2023, the INJ token price has increased by 87%. The increased development of the Injective ecosystem influenced it. These include the integration of the Injective mainnet with Kraken, Pyth and Celer, and also the Injective Hackathon 2023.

- 🤑 Users can stake INJ directly on the Injective platform with an APR offer of 16.08%. Apart from earning rewards, users will also get voting power.

Overview of Injective Protocol

Injective Protocol is a blockchain specifically built to facilitate the creation of DeFi applications such as cross-chain derivatives trading. Injective Chain is the name of Injective Protocol’s main blockchain, which uses Cosmos-SDK and operates using Tendermint consensus.

DeFi applications on Injective include exchanges, options, derivatives markets and lending. It supports financial project applications by prioritizing trading solutions, interoperability, scalability, and PoS infrastructure.

Injective Protocol was founded by Eric Chen and Albert Chon, who are experts in finance and technology. Injective is also backed by Pantera Capital, Jump Crypto, Binance, Hashed, BH Digital, Cadenza Ventures, CMS, QCP Capital, Mark Cuban, BlockTower, and others.

Users can trade assets in the Injective Protocol ecosystem through its technology without gas fees, thanks to the implementation of the Injective's fee delegation mechanism.

To learn more about Injective Protocol, you can read the article here.

INJ Tokenomics

INJ is a native token of the Injective Protocol that functions as both a utility token and a governance token. This token plays an essential role in the Injective ecosystem, as follows:

- Governance token

INJ token holders can participate in submitting proposals related to developing the Injective Protocol. To avoid spam or too many proposals, users must first deposit 500 INJ for the proposal to be voted on. Other INJ holders have the right to vote on the proposals.

- Developer incentives

40% of the trading fees generated from dApps users will be used to incentivize new dApps developers.

- Exchange fee value collection

60% of all fees generated from dApps will go into an on-chain buy-back-and-burn auction to maintain the deflationary of INJ.

- Collateralization of the Derivatives Market

INJ tokens can be a stablecoin alternative to provide collateral for margin trading and the Injective derivatives market. In addition, INJ also serves as collateral in futures markets and insurance staking pools. It allows stakers to earn passive income on their locked liquidity provider tokens.

Users can stake INJ tokens on the Injective Chain by delegating to an existing validator or becoming a validator themselves as an INJ token holder. By staking, users will receive rewards in exchange for maintaining the security and stability of the Injective network and participating in decision-making regarding protocol development.

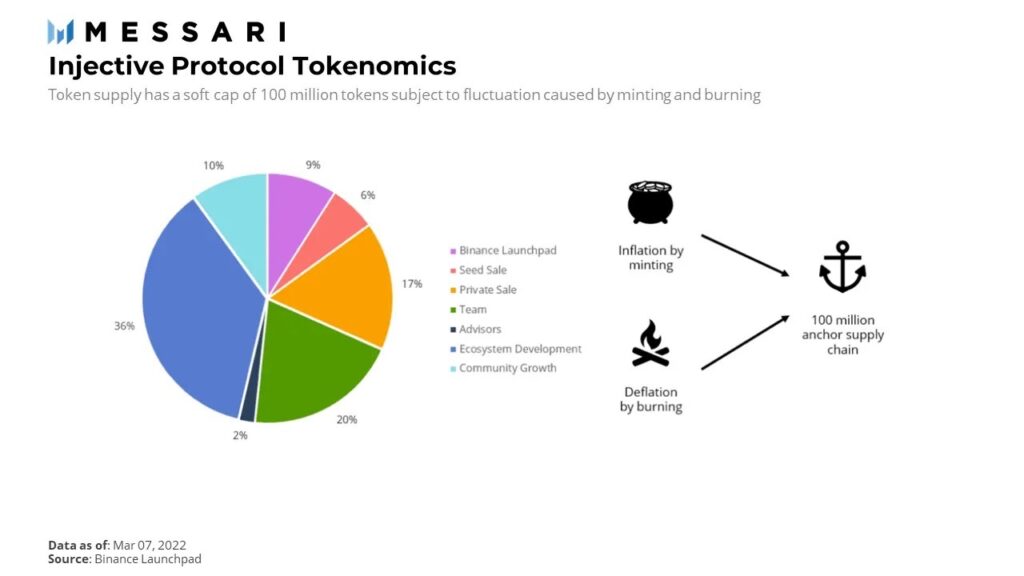

Injective Protocol has a maximum supply of 100,000,000 INJ, with 80,005,555 INJ, or 80% of INJ, already circulating in the market. Currently, Injective is the platform with the highest token-burning system. Quoted from Messari, the total supply of INJ may exceed the capitalization value. It is due to the weekly burning of supply that creates a deflationary effect and offsets the increase in supply resulting from token minting.

In this case, 5% yearly inflation on 13 million staked INJ equals 650,000 INJ minting in a year. However, the total INJ burn for eight weeks alone was about 204,000 INJ. Therefore, the total INJ burn in a year comes to approximately 1,326,000 INJ, equivalent to 1,325% of the total supply.

INJ as an Investment

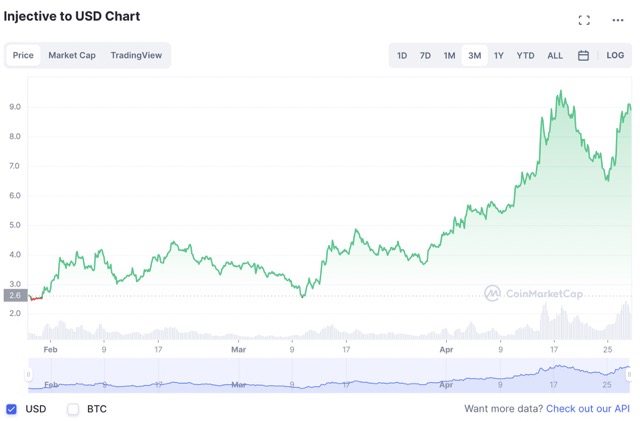

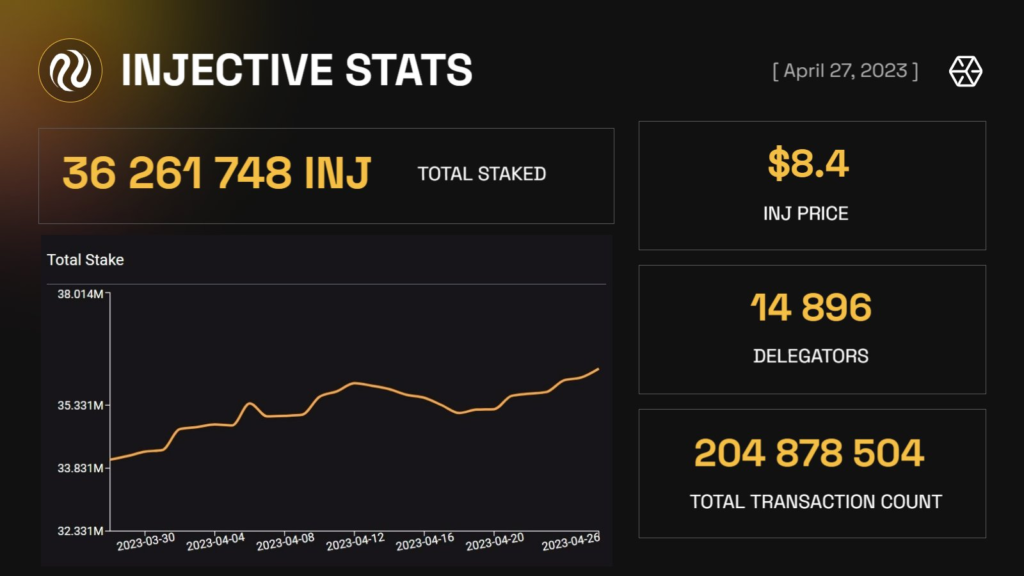

From the image above, the price of INJ as of April 28, 2023, is at 8.9 US dollars, with a trading volume of over 200 million US dollars in 24 hours. Currently, INJ is ranked 65th with a market cap of 709,701,092 US dollars.

Since the beginning of April 2023, the INJ token price has increased by 87%. The increased development of the Injective ecosystem influences this condition. One of them is the integration of the Injective mainnet with the US-based crypto exchange, Kraken.

Injective Hackathon, which was held in April 2023, also contributed to the INJ price increase. Injective Hackathon is a month-long online mentorship event attended by venture capitals, technologists, researchers, financial institutions, DeFi developers, and other parties. Participants can launch innovative dApps and get funding opportunities from venture capitals. As of April 24, 2023, there are already 29 projects registered in Injective Hackathon.

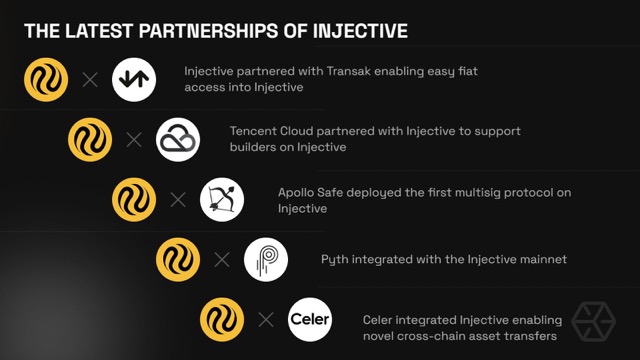

In addition, in April 2023, Injective collaborated with several institutions, as shown in the image above. On April 12, 2023, Injective collaborated with Transak to facilitate fiat money transactions in accessing Injective. Then, several names such as Tencent Cloud, Apollo Safe, and Pyth also successfully integrated their systems on Injective.

Most recently, on April 25, 2023, Injective announced its partnership with Celer, an interoperability protocol enabling seamless asset transfer for tokens across various L1 networks. This partnership will extend Injective’s reach to networks such as Astar and Polkadot. It allows dApps created on Injective to facilitate using previously inaccessible assets. This collaboration reinforces the Injective’s role as a key gateway for assets to enter the broader Inter-Blockchain Communication Protocol (IBC) ecosystem.

Also, read Cosmos Ecosystem Update and ATOM 2.0 Token

Users can stake directly on the Injective platform with an APR offer of 16.08%. As of April 27, 2023, there are already 36,261,748 INJ staked with 14,896 delegators. By staking INJ, users earn rewards and gain the power to vote on proposals. For example, a validator named Polkachu has staked 3,298,901 INJ from delegators, which entitles him to 9.10% voting power.

Injective Protocol Roadmap

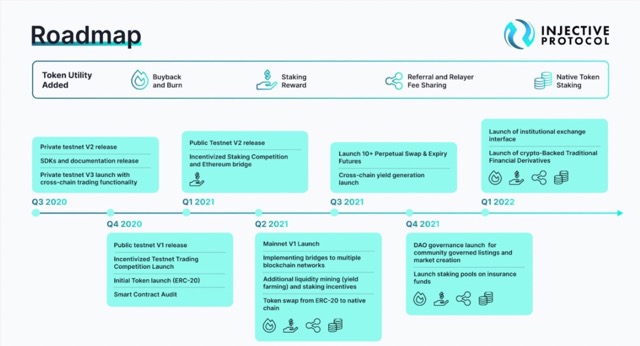

The image above is the Injective Protocol roadmap from Q3 2020 to Q4 2021. The Injective mainnet named Canonical Chain was successfully launched in Q4 2021, delayed from the estimated roadmap, which was supposed to be in Q2 2021. 2021 was a busy year for Injective Protocol in implementing its system updates. Here is the Injective Protocol’s 2023 roadmap as follows:

2023 Q1

- Injective Hub V2

- Institutional Zone

2023 Q2

- Injective Exchange Module V2

- Casablanca Upgrade

2023 Q3

- Injective Orbital Chains

2023 Q4

- Mesh chain network

- Carcosa Upgrade

Conclusion

The growth of the Injective ecosystem is evident from the surge in INJ token price since the start of 2023, particularly in April 2023. Nevertheless, the price of INJ is subject to the impact of BTC price conditions and the current global situation.

Injective Protocol is backed by some big names, such as Pantera Capital and Binance Labs, and has exciting potential to watch out for. However, before investing in INJ and other crypto assets, you must carefully analyze the market and risks.

Also, read Introduction to Crypto Fundamental Analysis.

How to Buy INJ Token on Pintu?

You can start investing in INJ by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for INJ.

- Click buy and fill in the amount you want.

- Now you have ID as an asset!

In addition, Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Hasan Furkan Gok, Injective: An Interoperable Exchange Infrastructure Protocol for DeFi Markets, Messari, accessed 27 April 2023.

- Ibrahim Ajibade, What’s Next for Injective Protocol (INJ) Price After Posting 400% Gains? Be In Crypto, accessed 27 April 2023.

- Decentralized Dog, What Is Injective (INJ)? Features, Tokenomics, and Price Prediction, Coinmarketcap, accessed 27 April 2023.

- Lucas, What is Injective Protocol (INJ)? All you need to know about INJ, Coin 98, accessed 27 April 2023.

- Binance Team, Injective (INJ), Binance Research, accessed 27 April 2023.

Share