Celestia: The First Modular Blockchain in The World

Celestia is here to solve the need for a more efficient and highly scalable blockchain. Celestia pioneers a revolutionary concept: modular blockchain. Celestia’s modular architecture also opens a new page on flexibility and freedom for decentralized application developers. How exactly does Celestia do all this? So, what is a modular blockchain? Why can it bring flexibility and freedom to the developers? Find out all the answers in the following article.

Article Summary

- ⛓️ Celestia is the first modular blockchain that separates blockchain layers into several independent functions to improve scalability and efficiency.

- ⚡ Celestia introduces the Data Availability Sampling (DAS) technology to optimize data availability verification. DAS allows nodes to validate blocks by downloading a small portion of the entire data.

- 💡 Some of Celestia’s innovative features are sovereign rollups and Rollkit, which give developers the freedom and flexibility to launch and manage their rollups and Dapps without high costs.

- 🪙 Celestia has a native TIA token that serves as a payment instrument in the Celestia ecosystem, a staking asset, and an instrument for decentralized governance.

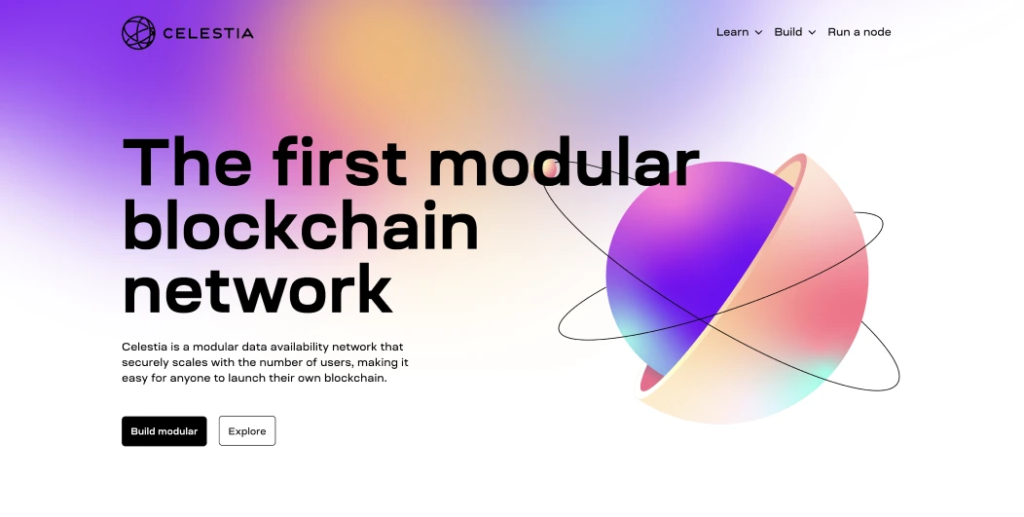

What is Celestia?

Celestia is the first blockchain to use a modular architecture instead of the monolithic one that most blockchains use. Celestia is built using the Cosmos SDK and uses Proof of Stake consensus.

With its modular architecture, Celestia can address scalability issues while maintaining the decentralization and security aspects of a network. Furthermore, Celestia utilizes Data Availability Sampling (DAS) to improve scalability and transaction execution. In simple terms, DAS is a system to verify all data on the blockchain.

Celestia’s Beta mainnet was launched on October 31, 2023, under the code name Lemon Mint. The discussion about how Celestia works, features, technology, and many other things will be discussed in the next section.

Before discussing more about Celestia and how it works, make sure first to understand the concept of modular blockchain. Pintu Academy has prepared a special article that goes deeper into modular blockchains and how they differ from monolithic blockchains.

Celestia Labs, the team behind Celestia Network, comprises experienced individuals such as Mustafa Al-Bassam (blockchain research), John Adler (Layer 2 blockchain), and Nick White (Harmony founder). Celestia has successfully raised $55 million from venture capitalists including Spartan Group, Jump Crypto, Blockchain Capital, and Polychain Capital.

How Celestia Works

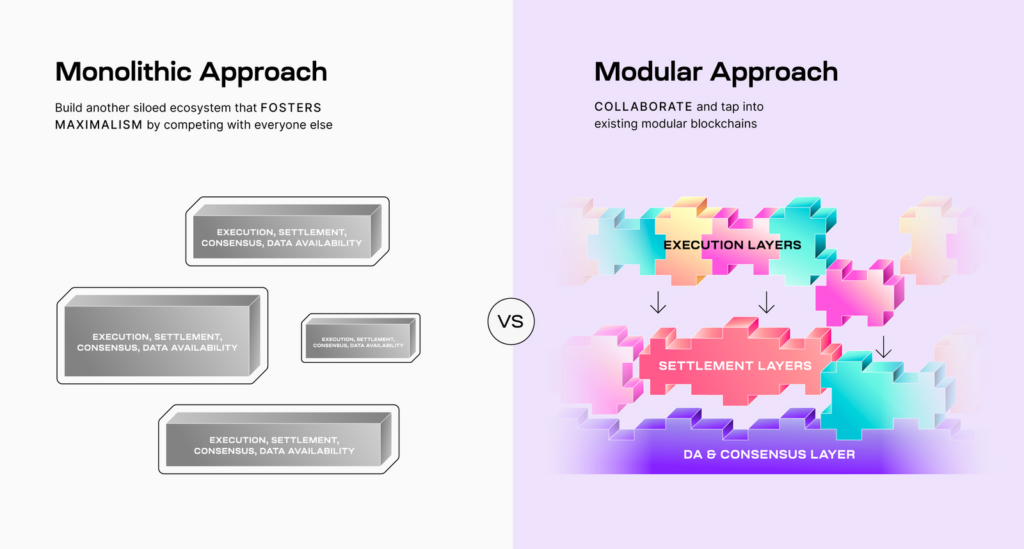

Modular blockchains architecture is very different from monolithic blockchains. Monolithic blockchains function as one inseparable layer while modular architecture separates blockchain layers to perform specific functions. As each layer performs each task, the entire network becomes more optimized.

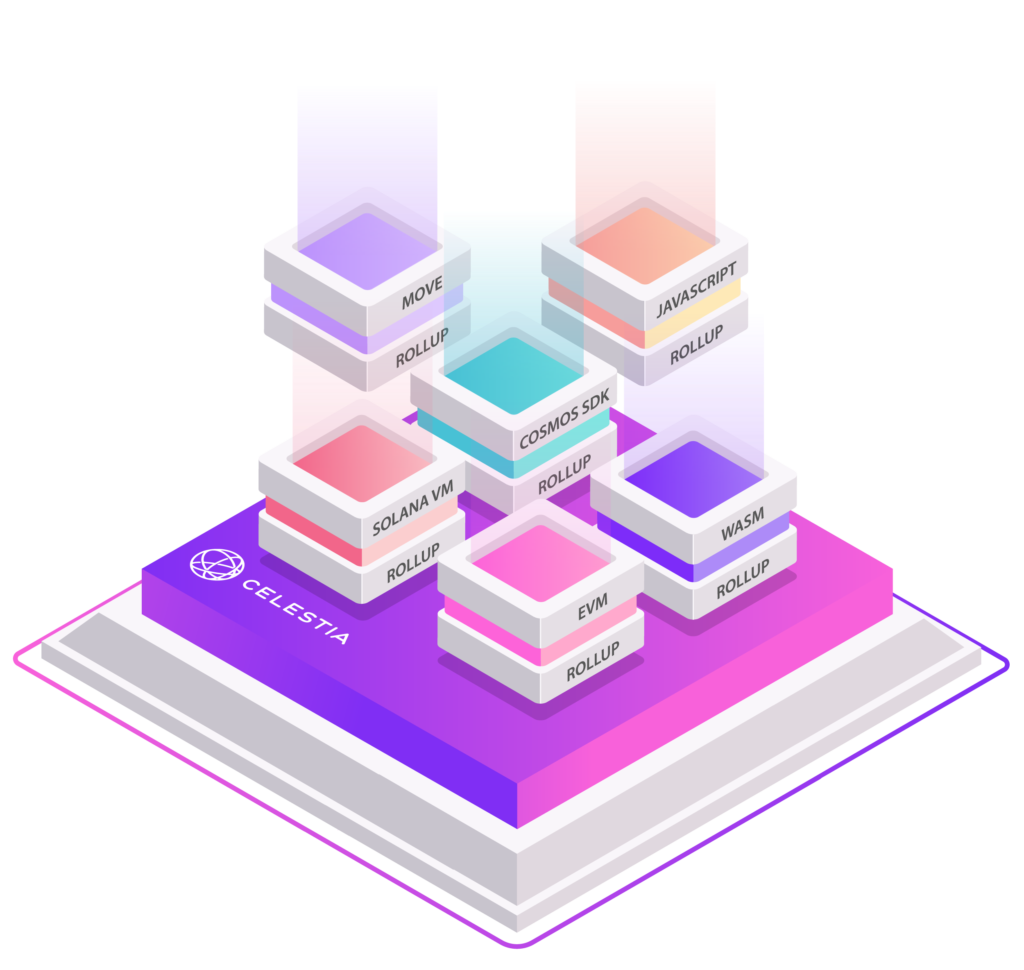

As a modular blockchain, Celestia separates the data availability, consensus, settlement, and execution layers. Celestia itself focuses on the data availability layer as well as modularity and flexibility. It does not take care of smart contracts or perform computations. Those tasks will be delegated to other rollups or blockchains.

By separating the layers, Celestia offers greater flexibility to its users. This gives freedom to the developer’s team as they can mix and match network layers according to their needs. The developers can choose the completion and execution layer according to their preference while utilizing the data availability layer function, which is Celestia’s strength.

Celestia Features

Here are some of Celestia’s features:

1. Data Availability Sampling

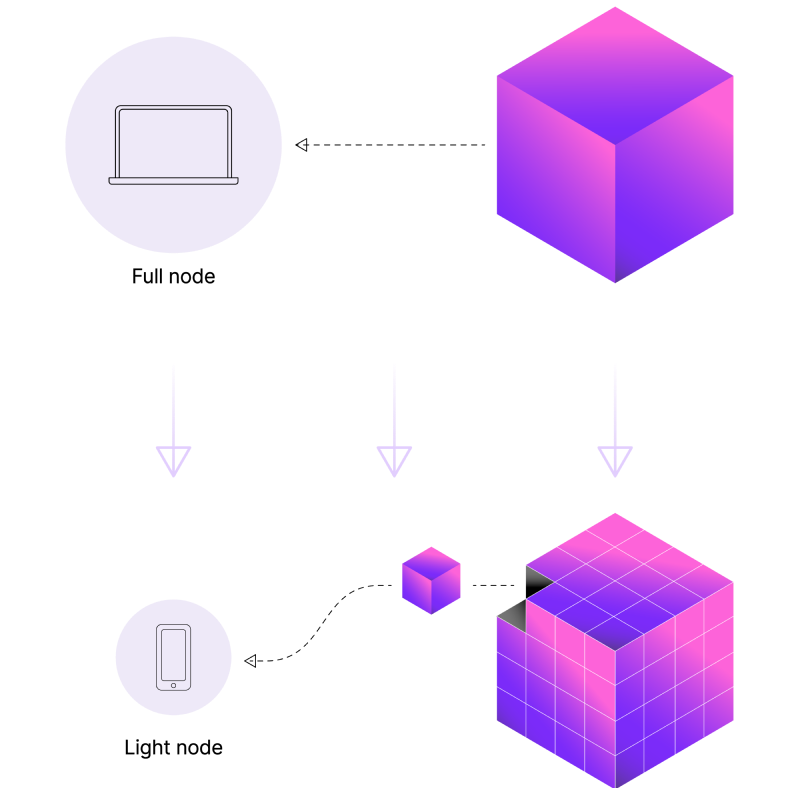

To verify data availability, most blockchains require nodes to download all transaction data in the block. However, the problem is that as blocks get larger, downloading all transaction data becomes impractical. This problem is one of the factors that hinder the scalability of blockchains.

Celestia, with its DSA feature, seeks to simplify the process. With DSA, light nodes (nodes that do not store the entire data) only need to download a tiny portion of the block. After that, the light nodes will sample the downloaded data several times. When the sampling results have reached the specified confidence level of 99%, the data in the block will be considered available.

For example, there is a 4MB block. With DSA, nodes only need 20 samples, each 1kB in size. This means they only need to download 0.5% of the total block instead of the entire block. Thus, the process can be 200x faster. The larger the block size, the more efficient the process will be.

Here is Nick White’s brief explanation of how DAS works, which is similar to tossing a coin:

.

Celestia’s DSA feature can be a game-changer. This is because L2 rollups can utilize Celestia’s DSA as an alternative to Ethereum DA. As we know, rollups must send proof of each batch of transactions to layer 1 for settlement. If the data is not available for verification, then the rollup operator will be considered dishonest. With DSA, the process can become cheaper, faster, and more efficient.

2. Sovereign Rollup

One of the critical features Celestia offers is the creation of sovereign rollup technology. Simply put, it is an independent rollup or blockchain that can be self-managed by the development team. Unlike Ethereum, Celestia’s blockchain will not perform traditional execution. They instead only prepare a block space designated for the compressed data of the rollup.

With this mechanism, rollups will not share block space with smart contract applications, which in turn reduces concerns about congestion. Furthermore, what makes the rollups independent is that the full nodes determine the rules of their fork. In other words, they can fork as they wish and will not be hindered or have to seek Celestia’s approval.

Although independent, the rollup will still get security and functionality aspects from Celestia, considering it acts as the foundation layer for transaction logging and data publication. Meanwhile, developers can choose the transaction execution process. This means that through sovereign rollup, the development team can combine various execution ecosystems to create a layer 2 chain according to their needs.

Currently, the most commonly used rollup technologies are ZK-Rollup and Optimistic Rollup. Find out the differences here.

3. Rollkit

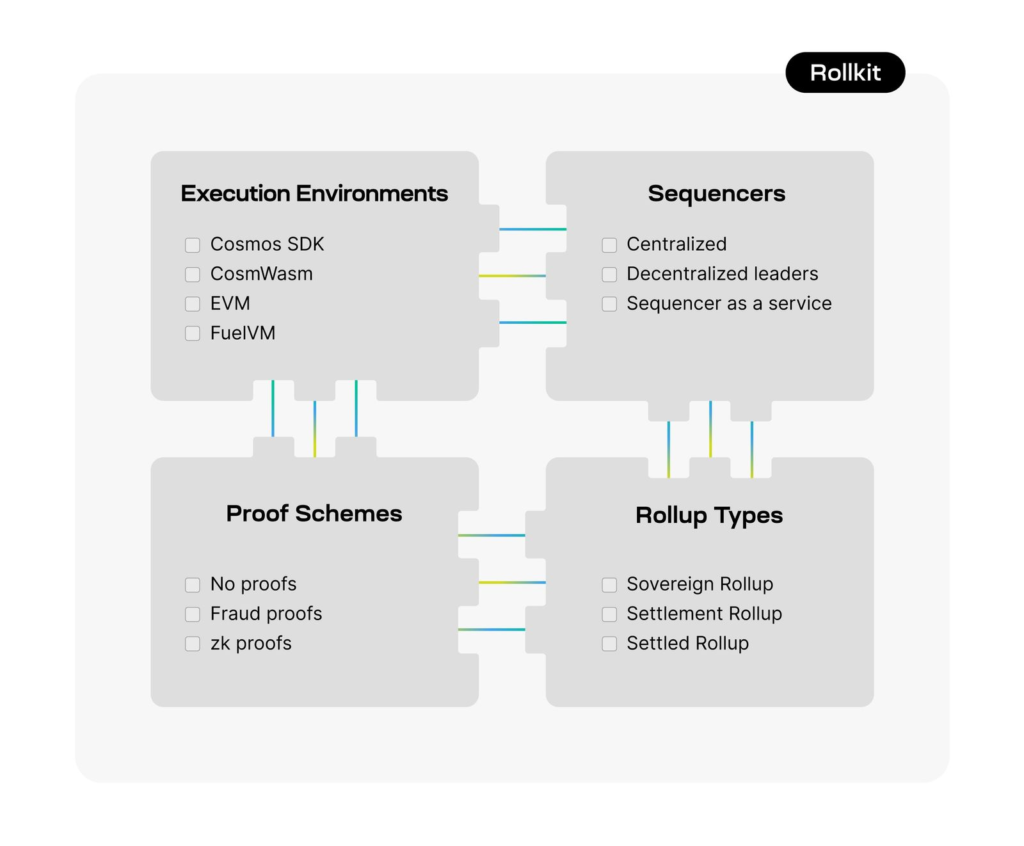

Deploying your decentralized application as a smart contract means it will share computational resources and is restricted to that blockchain’s execution environment. This limits your application’s scalability and flexibility.

For that reason, many developers have turned to launching their layer 1. However, deploying a new layer 1 chain presents its own set of complex challenges and trade-offs. To deploy a new layer 1 chain, a developer must gather a set of validators to secure the chain, issue a token to compensate these validators, and continuously maintain the network infrastructure.

With Rollkit, developers no longer have to worry about the complex challenges of deploying a new blockchain. Rollkit acts as a community-driven platform to provide developers the tools to launch dapps through a modular stack. Rollkit is Celestia’s implementation of making sovereign rollups easy and practical.

The way Rollkit works is that rollups leverage an underlying layer for consensus. Thus, developers do not need to build their consensus network. At the same time, it will inherit the security of Celestia’s data availability layer. This also eliminates the need for a full set of validators and reduces technical barriers for developers.

In the spirit of modularity, Rollkit’s long-term vision is to give developers various options to choose from so that they can easily plug in, switch, or replace features in Rollkit.

To ensure Celestia's neutrality and decentralization in providing the availability data layer, Rollkit has been separated from Celestia Labs. It is now a separate project with a different GitHub and docs page from Celestia.

Token Celestia (TIA)

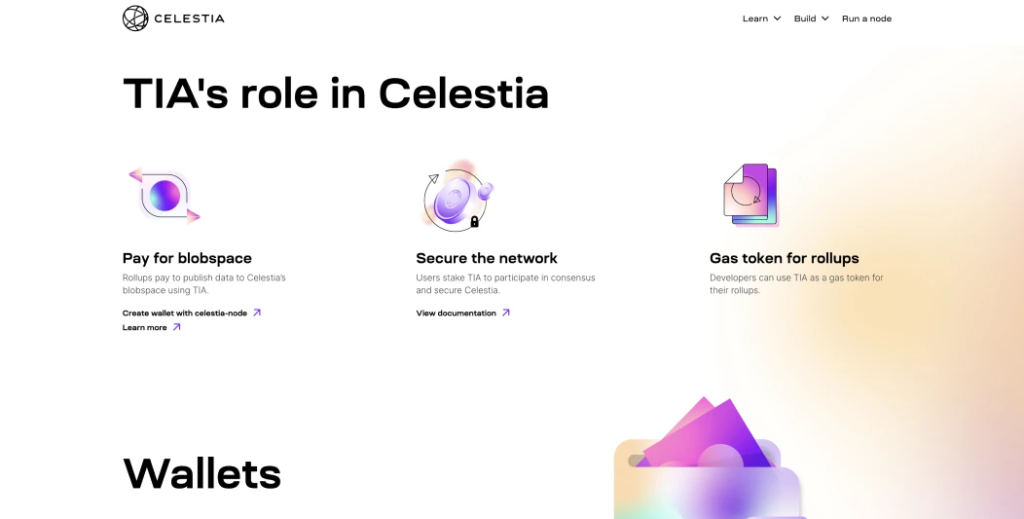

Celestia has a native token called TIA. It is an important element in the Celestia ecosystem as it is used to secure the network through Proof of Stake and pay transaction fees.

Based on Celestia’s white paper, the following are some of the uses of TIA tokens:

- Paying for Blobspace. To use Celestia’s availability data layer, the rollup developers team must make a PayForBlobs transaction. Payment is made using TIA.

- Bootsrapping New Rollups. Just like Ethereum-based rollups, development teams can bootstrap their chain by using TIA for gas tokens and currency.

- Proof of Stake. As a Proof of Stake blockchain, Celestia uses TIA to secure the network and provide rewards through a staking mechanism.

- Decentralized Governance. For TIA stakers, they will be able to participate in Celestia’s decentralized governance.

Not sure how to read a white paper? Here is Pintu Academy’s guide on how to read a white paper.

TIA Tokenomics

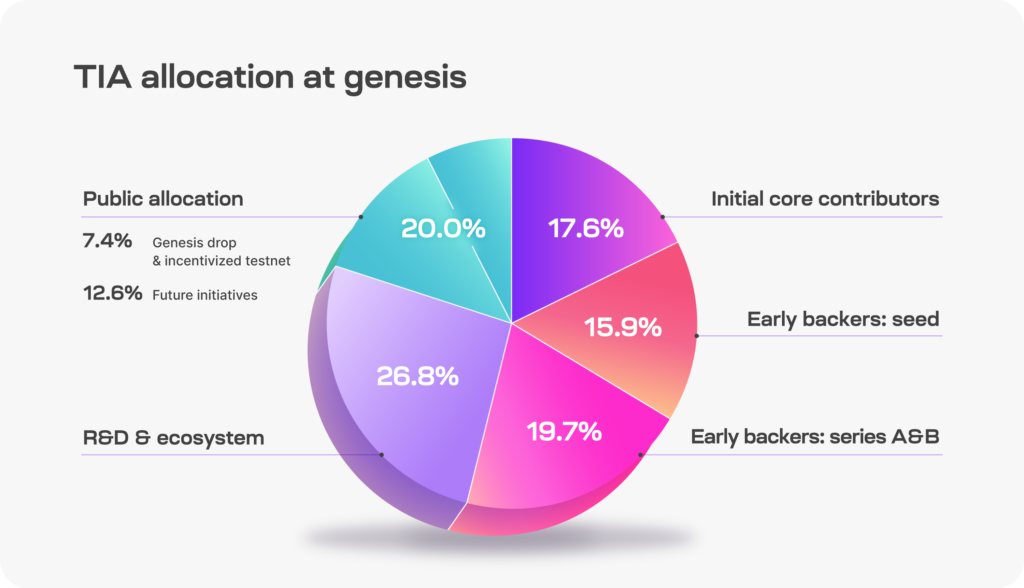

TIA has a total supply of 1 billion TIA, of which the current initial circulating supply is 14.1% (141 million TIA). So, 20% of the total TIA supply is allocated to the public through testnet incentives or for other future initiatives.

One of the incentives was a genesis airdrop of 60 million TIA tokens done at Celestia’s mainnet launch. The tokens were dubbed to 576,653 wallet addresses that met the requirements. Some of these requirements are active users of the Ethereum layer-2 network and Cosmos with a wallet balance equivalent to US$50 before January 1, 2023.

When viewed, the number of airdrops or token allocations for the public is relatively small, while the allocation for insiders (investors, contributing teams) is quite large. However, one of the justifications is that Celestia needs significant funding at the beginning to develop its highly complex technology. Amid competitive market conditions, early investors must be incentivized (token allocation) to be interested in funding projects like Celestia.

Meanwhile, the TIA Token has an inflation rate of 8% for the first year. The rate will decrease by 10$ per year until it finally reaches a limit of 1.5%.

Find out how to evaluate the value of an asset based on its tokenomics in the following article.

Conclusion

So far, Ethereum is still the protocol of choice for development teams who want to build chains or dapps. However, there are premium fees that must be paid to get facilities from Ethereum. Therefore, one way Celestia can compete with Ethereum is by offering better fees and optimization. Celestia’s DSA and Rollkit are expected to be the added value that development teams look for.

As the first modular blockchain, Celestia certainly offers scalability solutions that are different from existing ones. This makes Celestia have exciting potential in the future. The existence of Celestia will also make the competition and development of the blockchain industry more competitive.

How to Buy TIA on the Pintu App

You can start investing in Celestia by buying the TIA token on the Pintu app. Here is how to buy Tia on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for TIA.

- Click buy and fill in the amount you want.

- Now you are a Celestia investor!

Looking to invest in other crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

Reference

- Stephanie Dunbar, The Modular Blockchain Landscape, Messari, accessed on 3 November 2023.

- Joseph Al-Chami, Introducing Rollkit: a modular rollup framework, Celestia Blog, accessed on 3 November 2023.

- Celestia, What is Celestia? accessed on 3 November 2023.

- Emiliy Shin, Celestia Explained, Data Wallet, accessed on 3 November 2023.

- Celestia Docs, Overview of TIA, accessed on 3 November 2023.

- Dustin Teander, Celestia Token Launch and Valuation Dynamics, Messari, accessed on 6 November 2023.

Share