Scalping Techniques in Crypto Trading

Scalping adalah strategi trading jangka pendek

Crypto assets are known to have high volatility, making them high-risk investment assets. However, the high volatility offers great opportunity for scalping methods. Discover the concept of scalping and how the volatility of crypto can be leveraged as an opportunity through this article.

Article Summary

- Crypto scalping is a technique used in cryptocurrency trading where the goal is to make quick profits from small price movements in the market.

- Systematic and discretionary scalping are the two methods most frequently used in crypto scalping.

- Cryptocurrency scalping frequently makes use of technical indicators including bollinger bands, stochastic, exponential moving average, moving average convergence divergence, and candlesticks.

- Strategies used in crypto scalping include trading ranges, bid-ask spreads, leverage, and arbitrage.

What is Scalping?

Crypto scalping is a crypto trading strategy where the goal is to make quick profits from small price movements in the market. Scalping is a popular trading strategy due to the volatility of crypto prices and scalpers can take advantage of those price movements to make a profit.

However, a scalper must have a high win ratio to achieve a substantial amount of profits. Thus, they should be able to make as many trades as possible in a short amount of time. By combining all the small profits, scalpers can finally get decent profits.

In crypto scalping, the fundamental aspect of an asset will not be seen as a main factor. The most important thing is that the crypto asset has a high volume and good liquidity. Thus, momentum drives such as news sentiment or pumping play a significant role in scalping.

The three key competencies that a scalper needs to excel are charting, speed, and consistency. Since scalping relies heavily on technical analysis, the ability to read charts is a must-have skill. Meanwhile, as the scalping process only takes minutes or seconds, a quick making decision skill is also necessary. Then, as scalpers must have a winning ratio while making many trades in a day, scalpers must have consistency. In addition to that, another important skill that scalpers must have is an understanding of how the market works. Having all of these skills will make it easier for scalpers to develop scalping strategies.

block-heading joli-heading" id="the-difference-between-scalping-and-swing-trading">The Difference Between Scalping and Swing Trading

While both scalping and swing trading are short-term trading strategies, they have key differences in terms of the time frame and the potential profits.

Scalping typically involves making multiple trades within a very short period of time, such as within a few minutes or even seconds, with the goal of earning small profits on each trade. On the other hand, swing trading involves holding positions for a slightly longer period, such as a few hours or days, with the aim of profiting from larger price movements.

Types of Scalping

Scalping is classified into two categories based on the method used.

Systemic Scalping

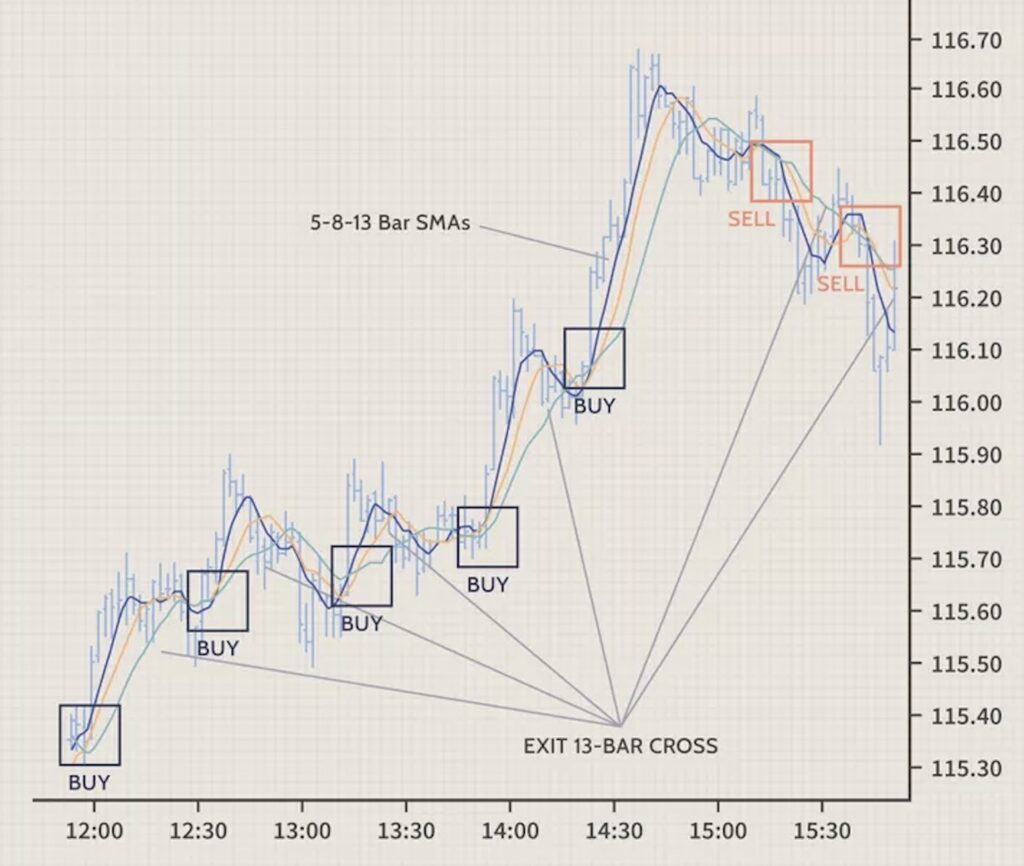

As the name implies, systematic scalping is carried out systemically based on predetermined parameters. In this case, usually, the scalper has determined an ideal time to enter and exit the market based on technical analysis. As a result, scalper decisions are influenced by the technical indicators used. In this type of scalping, some scalpers will use trading bots to facilitate the execution process.

Discretionary Scalping

Discretionary scalping is the opposite of systematic scalping, as the decision-making is more spontaneous and based on market conditions. So, instead of relying on indicators, discretionary scalpers tend to improvise more and adjust to market behavior at the time. However, it is worth noting that discretionary scalpers may still have a general trading system or framework in place.

Technical Indicator for Scalping

Scalpers can use various technical indicators to assist their decision-making. The following is a list of technical indicators that scalpers commonly use:

- Bollinger Bands

The Bollinger Bands indicator can be useful for scalpers when trying to identify crypto assets with increasing volatility. This tool can provide insight into potential trend continuation or reversal, as well as periods of market consolidation. Additionally, Bollinger Bands can be used to indicate when an asset may be overbought. In crypto scalping, the timeframe used for bollinger bands is generally M15, M30, or H1.

- Stochastic

When scalping, the stochastic indicator can be utilized to look for buy and sell indications from a cryptocurrency asset. By using stochastic, scalpers can identify overbought and oversold levels. This can be done by comparing the closing price of an asset with the high-low area for a certain period. When an asset enters the oversold area, scalpers can make purchases, and vice versa.

- Candlestick Chart

Candlestick charts can provide all the necessary information about the price of crypto assets. By reading candlestick patterns, scalpers can find the correct entry and exit points. Candlesticks are also helpful for predicting future market movement trends.

- Exponential Moving Average

Since scalping has a short time, using the exponential moving average (EMA) indicator is much more appropriate than the simple moving average (SMA). EMA assigns a higher weight and significance to newer prices than the SMA (the SMA assigns the same weight to all prices) so it moves relatively quickly to changing prices.

- Indikator MACD

The next indicator is the Moving Average Convergence Divergence (MACD) which can describe the price trend. MACD is showing the relationship between the two moving averages of the crypto price. The way to calculate this indicator is to subtract the 26-day EMA from the 12-day EMA. After getting the MACD line, scalpers can add a 9-day EMA or commonly refer to a signal line. After that, the signal line was marked above the MACD line. The results can be used to see buy or sell signals for an asset.

💡 However, none of the technical indicators can be said as the most accurate scalping indicator. Various technical indicators will be much better for getting signals rather than depending on just one technical indicator.

The Pros and Cons of Crypto Scalping

Each trading method has its advantages and disadvantages, including scalping. The followings are the advantages and disadvantages of the crypto scalping method:

Pros

- Scalpers can avoid the possibility of significant losses due to short exposure to market conditions.

- Trade execution can be done automatically with the help of bots while minimizing trading decisions based on emotions.

- While targeting small profits, it is easier for scalpers to get profits because any price movements can be exploited.

Cons

- With so many transactions being made, trading fees are quite expensive.

- Requires additional fees if using a scalping bot service.

- Requires large capital so that the level of profit earned can be substantial.

- Scalping can be demanding and aggressive, it can be exhausting as the scalper must constantly focus and monitor the chart movement.

Crypto Scalping Strategies

In crypto scalping, there are several strategies that scalpers can choose. Ideally, the selection of a crypto scalping strategy adjusted to the characteristics and abilities of the scalpers. The following are some strategies that scalpers can choose:

- Range Trading

Range trading requires scalpers to sell and buy within a predetermined price range (high and low). When scalpers determine the ideal price range for trading, they buy at the support level and sell at the resistance level. In the range trading strategy, scalpers can also use stop-limit orders to execute buy or sell automatically when they reach each predetermined price target.

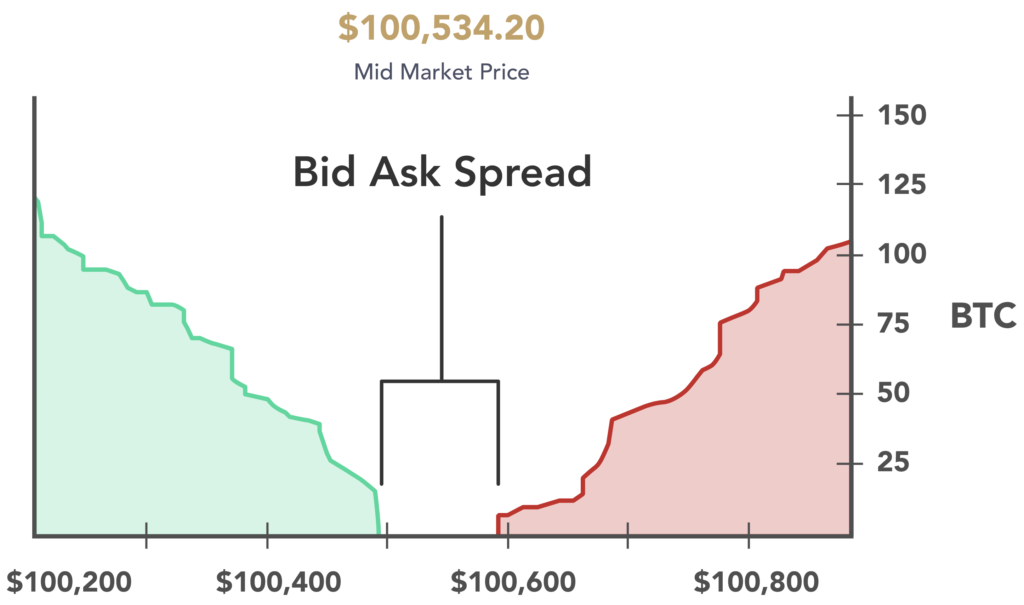

- Bid-Ask Spread

Through the bid-ask spread strategy, scalpers can take advantage of the significant difference between the highest bid price and the lowest ask price. Scalpers can open a position at the ask or bid price, then close the position when the price moves up or down to reap a profit. The bid-ask spread strategy can happen in two scenarios: wide and narrow bid-ask spreads.

A wide bid-ask spread can occur when there are more buyers than sellers, so the price will surge. At this moment, scalpers will sell their assets. Meanwhile, a narrow bid-ask spread occurs when the asking price is much lower and the bid price is much higher than usual. In this scenario, the number of sellers outweighs the number of buyers.

- Leverage

Leverage strategy is a method to increase the margin of owned capital by borrowing funds from third parties to enhance potential gains. By using leverage, it allows scalpers to trading with higher amounts and to obtain bigger profits as a result. However, keep in mind the use of leverage, on the other hand, can increase your risk.

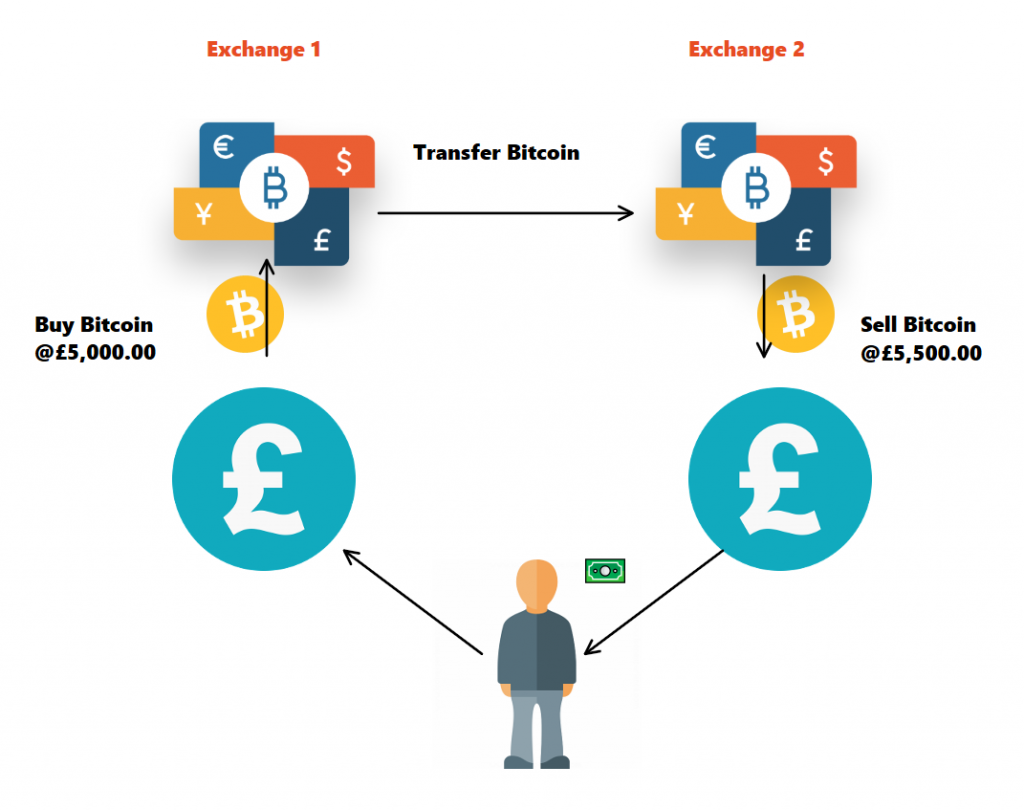

- Arbitrage

The arbitrage strategy is selling and buying the same asset through two different exchange platforms. Scalpers can benefit from the price difference between the two platforms. There are two arbitrage strategies in scalping: spatial arbitrage and pairing arbitrage.

In spatial arbitrage, scalpers can simultaneously open long or short positions at different exchanges simultaneously. Thus, scalpers hedge against fluctuations from various trends in this way. Meanwhile, pairing arbitrage is only carried out on one exchange. Scalpers take advantage of price changes in one of the asset pairs, for example, shorting the main crypto of the USD/BTC pair to mitigate risk.

Crypto Scalping Tips

- Choose a crypto asset pair for scalping. There are many crypto asset pairs that can be used for scalping. To choose wisely, mind the asset liquidity and volatility to make it easier and get more optimal results.

- Find the suitable scalping platform. In choosing a platform, there are several factors to consider. Starting from the display interface, trading experience, choice of crypto asset pairs, to the service fees charged.

- Pay attention to trading fees. Each platform must charge a fee for each transaction. As scalpers have to do a lot of trading, look for platforms that have the most competitive trading fees.

- Consider trading bots. Speed is one of the main factors in successful scalping. Manually managing portfolio are usually very time-consuming and the chances for error are high. By using a scalping program, it can speed up your buying and selling action.

- Try different strategies. In scalping, don’t get obsessed with one method. Try various strategies with small amount first until you find the most suitable strategy.

Is Crypto Scalping Profitable?

Scalping, like any other investment strategy, can be profitable if executed correctly. To be a successful scalper, it is essential to be able to read and interpret charts, understand how the market operates, and have various trading strategies at your disposal. Additionally, consistency and discipline are crucial to achieving a higher win rate than losses. However, scalping can be demanding, requiring high concentration and may be tiring for traders who are not well-trained. Additionally, achieving significant profits through scalping may require a large capital investment, which can be challenging for some investors.

However, as a strategy, scalping can be an option for some traders, especially if they are confident in their abilities and like the art of trading.

Start Investing at Pintu

If you are interested in crypto assets, you can invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for knowledge and educational purposes, not as a financial advice.

Reference

Jagjit Singh, What is scalping in crypto, and how does scalp trading work? Coin Telegraph, accessed on 5 January 2023.

Sana Ali, What Is Scalping in Crypto?, Coin Market Cap, accessed on 5 January 2023.

Alan Farleym, Top Indicators for a Scalping Trading Strategy, Investopedia, accessed on 5 January 2023.

Bybit Learn, 5 Best Profitable Crypto Scalp Trading Strategies, Bybit, accessed on 5 January 2023.

Temitope Olatunji, What Is a Cryptocurrency Scalping Strategy and How Does It Work? Make Use Of, accessed on 5 January 2023.

Share