Understanding Crypto Market Cycle and How to Capitalize on Them

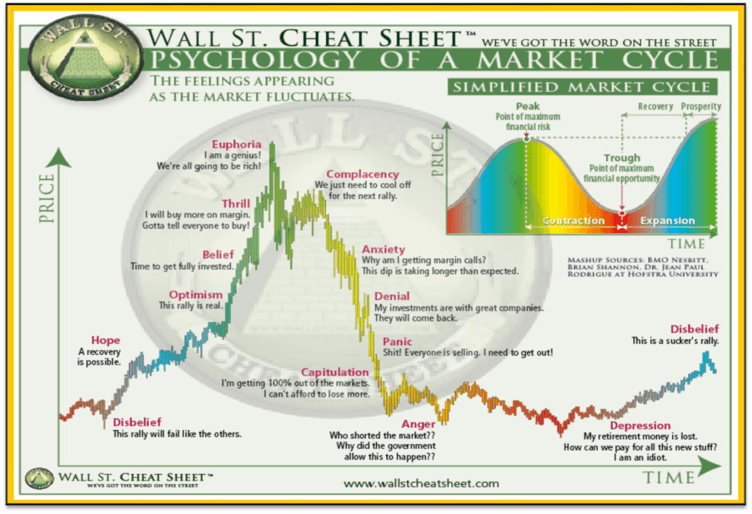

Financial markets can be confusing and uncertain, but if you keep an eye on them for a while, you’ll notice that they follow certain trends and patterns. Whether it’s stocks, bonds, or cryptocurrencies, they all depend on how many people want to buy or sell them, how people feel about the market, and how people make decisions based on their emotions.

It is not easy to forecast how markets will behave due to their unpredictable nature. However, observing and understanding the patterns and cycles can help investors make decisions. In this article, we will learn about the crypto market cycle!

Article Summary

- 🔄 The market cycle is a trend repetition that happens in all markets, including the crypto market.

- 🌟 There are four phases of a crypto market cycle: the accumulation, markup, distribution, and markdown phases.

- 🔎 Understanding the crypto market cycle can help investors understand market dynamics over time, spot opportunities, and make more informed investment decisions.

What is Crypto Market Cycle?

Market cycles are specific trends and patterns that occur, driven by the psychology of market participants and the general economic environment. As the name implies, cycles will occur repeatedly. This natural phenomenon occurs in every market, and the crypto market is no exception.

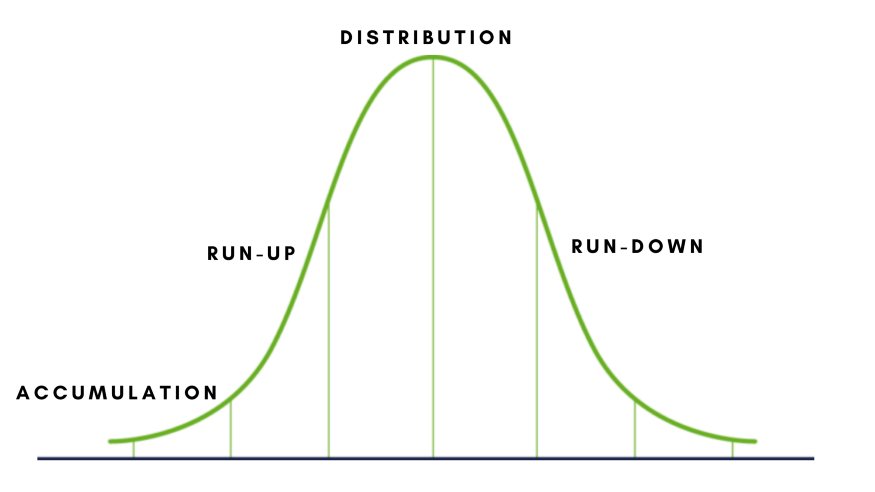

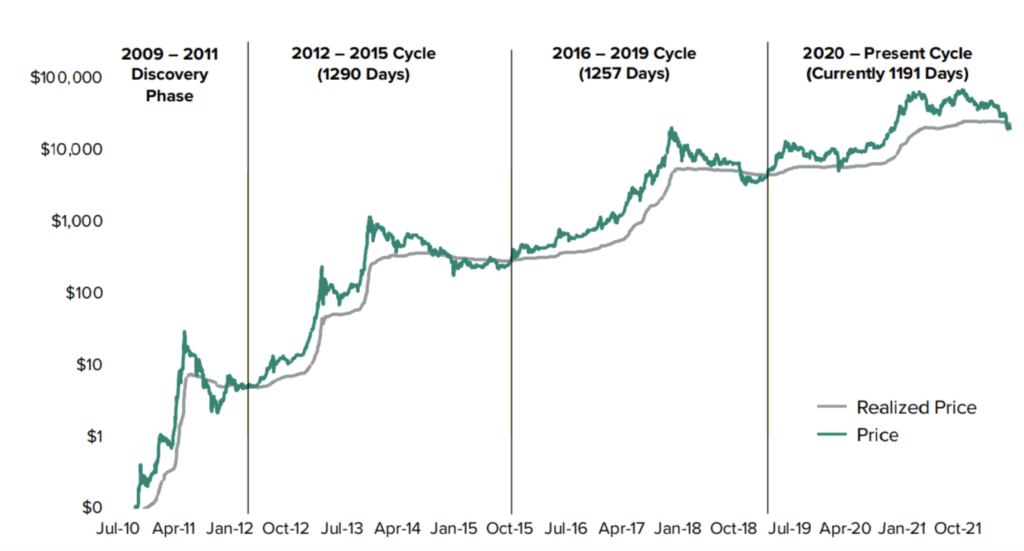

The crypto market cycle has four phases: accumulation, markup, distribution, and markdown. Historically, the crypto market and Bitcoin, as its main asset, have experienced several cycles. In each cycle, the price of an asset will move from an all-time low to an all-time high, and vice versa. Every phase has a different duration and level of intensity.

Remember that crypto market cycles are not perfect and predictable projection models. Moreover, determining a market cycle’s start and end periods is also very difficult. However, crypto market cycles can be used as an analytical tool or as additional information for investors to understand the market dynamics.

Crypto Market Cycle Phase

As mentioned earlier, there are four phases in a crypto market cycle. Each phase can be identified by market activity and the sentiment that drives the behavior of market participants. The following are the phases in a crypto market cycle:

1. Accumulation Phase

The accumulation phase starts when the market has just experienced a significant crash. In this phase, usually, the market tends to be stable, as the market volume is typically lower than average.

The following are some characteristics that can be seen in the accumulation phase:

- A group of investors or whales start buying an asset because they believe the bottom has already been reached.

- Negative sentiment following after the crash are starting change to “the worst is behind us”

- As investor interest remain low, so there is no clear trend emerges with low price volatility.

In the following article, you can learn more about the Bitcoin bull run cycle.

2. Markup Phase

After the accumulation phase, the market moves to the markup phase. In this phase, the price increase of an asset becomes more consistent and long-term. Many people called this phase as bull run period.

BTC has experienced a substantial price surge during the markup phase of the last two cycles. In 2017, the price of BTC rose from US$ 700 to US$ 20,000, nearly three times its initial value. Similarly, in 2020-2021, BTC's price also witnessed a massive increase, skyrocketing from US$ 15,000 to US$ 69,000, an increase of four times.

The following are some characteristics that can be seen in the markup phase:

- Market sentiment changing to positive and excitement tone, boosting investor confidence.

- The Fear and Greed index, will be on the far right of the spectrum, aka Greed. Driving the FOMO (Fear of Missing Out) trend.

- Skyrocketing trading volume and increase in price chart.

3. Distribution Phase

The distribution phase marks the end of the bull run or markup phase. In this phase, imarket participants will be divided into two groups again, those who believe “the best is over”, and those who believe prices will continue to rise.

The following are some characteristics that can be seen in the distribution phase:

- Investors who accumulate assets in the early phase will start selling their assets. Investors who believe prices are still rising, will continue to buy, or at least hold their positions.

- Negative sentiment such as uncertainty starting to emerge, but overconfidence sentiment remain strong.

- As a result of investors being divided into two group of fear and greed, elevated trading volume, but with low price volatility.

Don’t miss out, learn more about the fear and greed indicator and how to read it in the following article.

4. Markdown Phase

In the markdown phase, the bubble finally bursts, triggering a downward price trend.

The following are some characteristics that can be seen in the markdown phase:

- Negative sentiment such as “the worst is happening” is dominating and causing fear and panic.

- Trading volumes were dominated by selling as investors avoided deep losses.

The markdown phase is sometimes a good thing for short sellers. This moment can be used to short the market and reap profits from its decline.

The markdown phase will continue until the market believes that “the worst is over” and prices cannot fall further than their current position. At that point, asset prices will stabilize and move in a more limited range.

Once market conditions stabilize, some investors will re-enter the market and buy assets at “discounted” prices. This is also a sign that the price decline phase is over. The return of investors is also a sign that the accumulation phase has begun. Thus, one crypto market cycle has been completed and is ready to restart the next cycle.

Factors That Affect a Crypto Market Cycle

- Macroeconomics. The conditions of the larger economy, along with various government policies, can greatly influence whether crypto assets are experiencing a bullish or bearish period. If the economy is not doing well, it can cause a correction in crypto assets, and vice versa.

- Bitcoin Halving. Bitcoin halving happens approximately every four years and reduces the rewards that miners receive by half. At the same time, the amount of new Bitcoin that is created is limited. If the demand for Bitcoin stays strong, this limited supply can push the price up. Historically, Bitcoin halving has always led to a new phase of growth, making it an important indicator to watch.

Investment Strategy in Crypto Market Cycle

By understanding each phase of the crypto market cycle, we can strategize our investments to get the most optimal returns. Ideally, the strategy is to buy crypto assets in the accumulation phase and then sell them when they are in the distribution phase. This way, investors can buy crypto assets at the lowest price and sell them at the highest price.

On-chain analysis tools such as IntoTheBlock, Glassnode, Nansen, and Dune can help identify these phases by providing data on supply, demand, market psychology, and whale activity.

It’s important for investors to also track the crypto market sentiment by staying updated on industry news and using the fear and greed index. This index ranges from 0 to 100, with lower scores indicating fear and higher scores indicating greed. The fear and greed index is calculated based on factors such as market momentum, volatility, and social media activity.

In investing in crypto assets, you can also try using the following five investment strategies.

Conclusion

The crypto market cycle is fundamentally quite easy to understand. However, crypto assets are a relatively new investment asset class with technology as their underlying. This makes the movement of the crypto market more dynamic and open to potential evolution in the future. Moreover, the crypto market cycle may not have the same pattern.

Nevertheless, by understanding the crypto market cycle along with the characteristics of each phase and the behavior of market participants within it, investors can make sound decision regarding their investment. The crypto market cycle can serve as an additional analytical tool before making investment decisions.

Buy Crypto Assets in Pintu

Interested in investing in crypto assets? Take it easy, you can buy various crypto assets such as BTC, ETH, SOL, and others safely and easily. Furthermore, Pintu has subjected all its crypto assets to a thorough evaluation process, emphasizing the importance of prudence.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Kirsty Moreland, Crypto Market Cycles – How to Read Them; Why They Matter, The Ledger, accessed on 13 March 2023.

Velvet Capital, Understanding Crypto Market Cycles, Coin Market Cap, accessed on 13 March 2023.

Coinbase, From avoiding FOMO to having a plan, 5 key ways to manage a crypto down cycle, accessed on 13 March 2023.

Share